Trinity Mirror – Yesterday’s news or scoop up the shares?

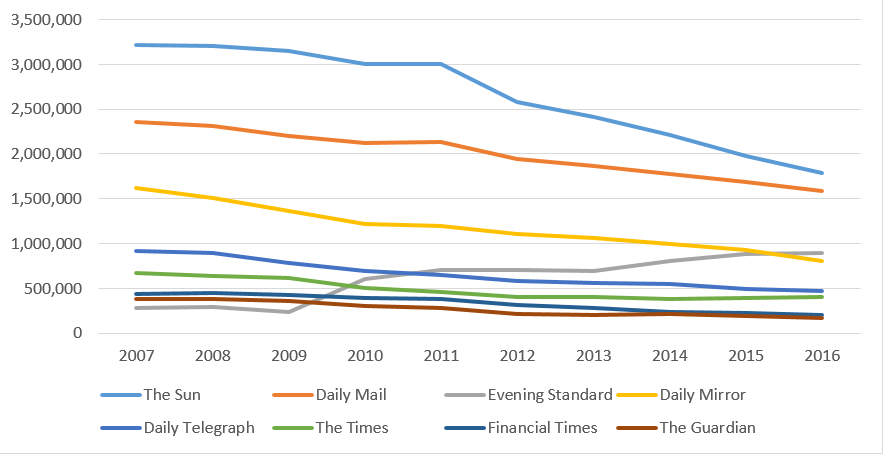

Over the past decade or so the internet has transformed the way in which we consume news, with readers moving away from the traditional “deadwood” press towards digital media. The chart below shows how the circulations of some major newspapers have been hit, with only the Evening Standard seeing a rise in circulation over the past ten years after it became free in October 2009. Overall, according to figures from the National Readership Survey, the reach of national newspapers amongst adults slumped from 72.4% to 45.4% over the ten years to March 2015.

Data source: Audit Bureau of Circulations for January each year

In contrast, growth in internet news consumption has boomed in recent years. To quote one source, Ofcom’s News Consumption in the UK report suggests that 41% of adults used the internet for news in 2015, up from 32% in 2013. This has created a major headache for newspaper owners as they have been forced to adapt to the changing consumer habits in order to maximise income from their publications. One such business is FTSE Small Cap listed Trinity Mirror (TNI).

The Business

Perhaps best known for publishing left wing tabloid the Daily Mirror (and perhaps for its historic association with bouncing Czech, Bob Maxwell) Trinity Mirror is now the largest national and regional multi-media content publisher in the UK.

As well as its flagship title, Trinity publishes over 150 newspapers across the UK & Ireland, including nationals the Daily Record, the Sunday People and the Sunday Mirror, along with popular regional papers the Liverpool Echo, Nottingham Post and Manchester Evening News. These are complimented by a network of 80 websites which are currently attracting average monthly page views of 770 million. The company also earns modest revenues from its printing business, which provides printing services internally and to third parties, as well as from the Specialist Digital division, which includes a digital classified recruitment operation and digital marketing services businesses.

In November last year the company’s operations were significantly expanded after it purchased the 80% of the shares it did not already own in regional publishing business Local World for an effective £187.4 million. The deal brought with it 83 print publications, including 7 of the top 20 regional paid daily titles by circulation in England and Wales, and a range of websites with a combined 167 million monthly page views.

Local World made revenues of £221 million in 2014 with adjusted operating profits growing from £36 million to £39 million as a result of cost cuts. Cost synergies of £10 million-£12 million are expected to be delivered in the second full year of ownership and the deal, which made Trinity the UK’s largest regional news publisher, is forecast to be earnings enhancing in the first full year.

Mirror reveals smashing interims

Trinity released the first set of results which included a full contribution from Local World at the beginning of this month, and they were well received by the market. For the 27 weeks to 3rd July 2016 group revenues grew by 30% to £374.7 million, with adjusted pre-tax profits up by 47% at £66.9 million. However, reflecting continuing challenges in the operating environment, like-for-like revenues, which assumes Local World was owned in the comparative period, fell by 7.8%.

Operating highlights of the period included average monthly page views on the company’s websites growing by 19% and like-for-like publishing digital revenues growing by 14.4% to £39.7 million. The integration of Local World is said to be progressing well, with at least £12 million of annualised savings on track for 2017.

Perhaps the highlight of the results was the strong cash generation performance, with a net cash inflow from operations of £61.1 million. This helped net debt to fall from £92.9 million to £48 million by the period end and encouraged Trinity to increase the interim dividend by 5% to 2.1p per share. Along with the results the company also announced a share buyback programme worth a maximum of £10 million, which as I write has started to be implemented.

Headline grabbing figures but problems remain

Unfortunately, Trinity Mirror has a number of issues which are currently depressing the share price.

Decline in print industry

As the introduction to this article discussed, the trading environment for print newspapers is becoming increasingly difficult given the migration from paper to digital platforms. Paid for newspaper sales are declining (further evidenced by Trinity’s attempt to launch a new national, the New Day, which was closed after just nine weeks due to poor circulation figures) and the share of advertising spend being allocated towards print is also falling. In the first half of this financial year Trinity made 82% of its revenues from print circulation and advertising, while deriving just 11% from digital publishing, so it has further work to do to ensure that print revenue falls are offset by growth in digital.

Pension Deficit

Bringing back memories of Cap’n Bob, Trinity Mirror currently has problems with its pensions. As at 3rd July the deficit stood at £426 million, increasing by £120.8 million over 12 months largely as a result of a fall in long-term interest rates pushing up the value of the liabilities.

Under current funding plans designed to plug the gap, £17.9 million was pumped in during the first half of the year, with a similar sized payment due in the second half. Also, alongside the share buyback, a minimum of £5 million or up to a maximum of 75% of the share buyback is expected to be used as additional funding. While this situation is affecting the group’s cashflows I note that the strong cashflow performance in the first half was delivered despite the sizeable deficit funding payment.

Phone Hacking Scandal

As if those issues were not enough, CEO Simon Fox also has a significant legacy issue to deal with.

To summarise a complicated situation, following initial allegations against the company’s journalists in 2011 it wasn’t until September 2014 that Trinity admitted some previous employees had been involved in the hacking of certain celebrities’ phones. The company agreed to pay compensation to four individuals who had sued subsidiary MGN (Mirror Group Newspapers) and in February published an open apology to its victims in the Daily Mirror, Sunday Mirror and Sunday People.

The next key date in this saga came in May 2015 when the courts awarded damages totalling £1.2 million to eight further individuals as a result of phone hacking. These awards were substantially higher than any given previously, with Trinity subsequently appealing to the Court of Appeal regarding the damages being “excessive and disproportionate.” The appeal was unsuccessful and in March the Supreme Court refused permission to appeal for the final time. All criminal investigations against journalists and MGN Limited have now ended.

So far Trinity has made a provision in its balance sheet of £41 million to deal with the claims and legal costs, with £31 million remaining as at the last balance sheet date. Management’s line on the issue is that the exposure remains manageable but that there is the potential for further liabilities to arise.

Yesterday’s news or scoop up the shares?

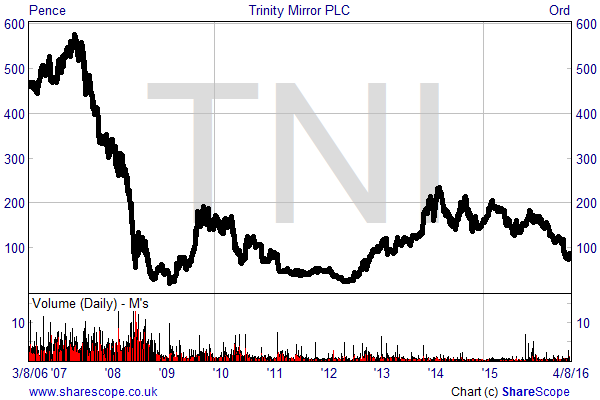

Following the interims, Trinity Mirror shares have bounced back slightly to the current 90.25p, capitalising the company at £255 million. However, they remain at circa four year lows, primarily due to the issues described above. Despite the raft of challenges facing the company I believe that the shares do offer an opportunity for the brave investor.

The current valuation, based on market consensus earnings of 33.9p for the current year to December, is just 2.7 times. In 2017, as the company benefits from the synergies associated with Local World, the multiple falls to just 2.5 times. There is also a chunky income on offer, with a 5.7% yield if last’s year dividend of 5.15p per share is at least maintained.

While there are many issues hanging over Trinity Mirror it is good to see that management are reacting to them, with the Local World acquisition providing growth and synergy opportunities and the pension deficit being attended to out of the strong operational cashflow. The phone hacking liabilities however are largely out of its hands.

The key thing for me is that revenue declines are managed and that the current excellent cashflow performance is maintained. Should this be achieved then I see for the potential for the shares to double over the next two years. Broker Numis has a similar view, currently having a 210p target price, which implies 133% upside.

Comments (0)