Small caps with potential to double or more

While it has been a turbulent year for the markets so far, small-cap companies have once again demonstrated their potential to make huge returns for investors. At the time of writing, 16 AIM-listed companies have doubled in value or more in the year to date, with another 19 rising by at least 50%. The biggest winner of the year is Falkland Islands oil explorer Borders & Southern Petroleum (BOR). Its shares are up by 636% since the end of 2021, as a Canadian investor has built up a notifiable holding.

In search of further triple-digit returns (but noting that these shares are riskier than usual), here are three small-cap companies which analysts believe could double in value.

4D Pharma

Drug-development companies are highly risky, as many investors in AIM-listed pharma and biotech stocks have seen. In February this year, shares in respiratory company Synairgen (SNG) collapsed by more than 80% after it was announced that its Covid-19 vaccine candidate SNG001 did not meet its primary or key secondary efficacy endpoints in a Phase 3 trial. In contrast, just one piece of good news from a biotech company could send its shares soaring.

One such business in which analysts see significant upside potential is dual-listed AIM and Nasdaq company 4D Pharma (DDDD). The business is developing so-called live biotherapeutic products (LBPs), a novel class of drug derived from the human microbiome. LBPs are defined as biological products that contain a live organism, such as a bacterium, that are applicable to the prevention, treatment or cure of a disease. From its research, 4D has learned that bacteria in the human gastrointestinal tract (gut microbiome) have important functions in many diseases. More importantly, 4D understands how they function and how they can be used as potential new therapies.

A core part of its business is the MicroRx discovery platform. Using over two decades of research, it can rapidly select bacteria that have a therapeutic effect on specific diseases. Using MicroRx, 4D has generated a suite of development programmes in a range of therapeutic areas, including immuno-oncology, respiratory, autoimmune and central-nervous-system disease.

Gut news

There are currently five clinical programmes. The most advanced is the ongoing Phase I/II clinical trials for lead oncology candidate MRx0518. This is the world’s first live biotherapeutic to show positive signals of clinical activity in cancer and 4D is investigating its effects in a range of solid tumour types and treatment settings. Last year, signals of anti-tumour activity were announced for the combination of MRx0518 with prescription skin-cancer medicine Keytruda in bladder cancer. This added to previously reported activity in renal cell carcinoma and non-small-cell lung cancer.

One of the company’s major partners is the science and technology giant Merck. It is collaborating with Merck on several clinical trials. One of these trials, to discover and develop live biotherapeutics for vaccines, has the potential for milestone payments totalling over $1bn to 4D, across up to three undisclosed indications.

For the year to 31 December 2021, 4D made a net loss of £54.7m after spending almost £20m on its research and development activities. A major corporate highlight was a listing on the Nasdaq global market index, following a merger with special-purpose acquisition vehicle Longevity Acquisition Corporation, alongside a fundraise of $39.8m. At the end of the year, cash stood at £15.5m, which is expected to provide a runway into Q4 2022, with another $17.5m of credit available from a facility agreed with Oxford Finance LLC.

There’s been more good news since the period end, with US regulator the Food and Drug Administration (FDA) clearing investigational new drug applications for MRx0005 and MRx0029 for the treatment of Parkinson’s disease. 4D expects to initiate a first-in-human Phase I clinical trial in people with Parkinson’s disease in mid-2022. With a range of ongoing trials and data presentations, there should be a good flow of news to look forward to for the rest of the year.

Punt on a potential world leader

At this point in its development, 4D Pharma is still very early stage, makes no revenues, has no approved drugs and will clearly need more financing in the not-so-distant future. So, the investment case here is betting on the company becoming a market leader in a new area of healthcare innovation. The industry is expected to grow very quickly, with analysts at InsightAce Analytic expecting the global live biotherapeutic products and microbiome contract manufacturing market to reach $635.9m in 2028, up from just $41.8m in 2021, growing at an impressive annual compound rate of 47.54%.

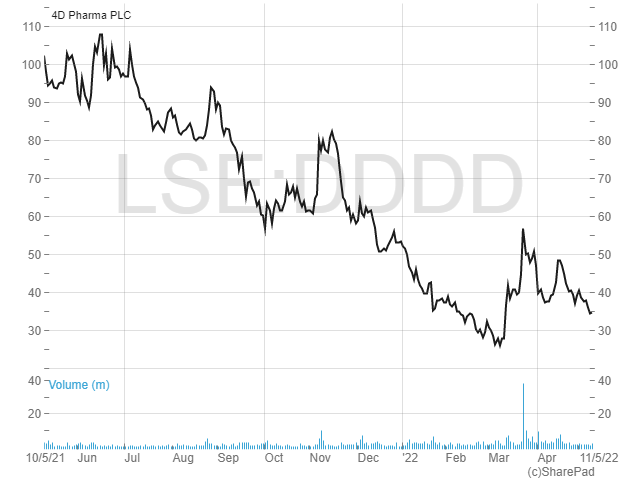

Investors in the company haven’t been too happy recently, with the shares down from over £10 in 2016 to just 35p at the time of writing. However, they will be overjoyed if analysts at Ladenburg Thalmann are correct; the US investment bankers have a substantial $37 (£29.94) target price on 4D Pharma shares. With the Nasdaq shares equivalent to 8 AIM shares, that’s a target of £3.74 and potentially over ten times upside should the target price be met. However, the risks are clear with 4D Pharma shares and in my opinion represent a highly speculative opportunity.

Water Intelligence

According to the World Health Organization, more than 45 million cubic metres of water are lost through leakage every day. That equates to the volume of water in 18,000 Olympic-size swimming pools. What’s more, the World Bank estimates that the cost to utility companies of water lost before reaching the consumer is around $14bn per annum.

Helping to solve these problems is AIM-listed Water Intelligence (WATR), a multinational provider of precision, minimally invasive leak detection and remediation solutions for both potable (safe to drink) and non-potable water. Its strategy is focused on building a world-class growth company that provides solutions to water loss from deteriorating infrastructure including residential, commercial and municipal buildings.

The company operates through two subsidiaries. The main subsidiary is American Leak Detection (ALD), which currently makes up around 90% of revenues. The business unit operates in over 150 locations across 46 states of the US, along with a few in Canada and Australia. It is the only nationwide provider in the US for pinpoint leak detection and repair solutions. Its offerings include minimally invasive water and wastewater solutions for small and medium diameter pipes, both residential and commercial. Business also comes from a range of partners, including insurance companies, property management companies and homebuilders. ALD operates largely through both franchise and corporate locations. Meanwhile, the other subsidiary, Water Intelligence International (WII) operates largely in the UK, Canada and Australia through corporate locations, focusing primarily on municipal leak detection and repair.

Growth by ‘aqua-sition’

Given the size of the addressable market for water infrastructure solutions in the US and elsewhere, Water Intelligence sees plenty of upside ahead and market share to capture. To give some industry statistics, some five million people in the US experience a water-damage emergency every year. Also notable is that last year, the Biden administration’s American Jobs Plan outlined a target of spending $100bn on water infrastructure.

Part of the company’s current growth strategy is to expand via acquisition and also to reacquire select franchises, adding revenue to the accounts that is currently is recorded as royalty income. Recent months have been positive. In early April, Water Intelligence obtained a significant expansion of its credit facilities with M&T Bank. An additional $15m has been agreed for further acquisitions of its American Leak Detection franchises, along with a two-year extension of a $2m credit line for working capital. These funds added to £12.5m raised from an equity placing during November 2021, with net cash standing at $15.3m at the December year end.

A recent Q1 trading update revealed that the funds had already been put to use. The company has accelerated its strategic growth plan with its recently increased ‘war chest’, by hiring and training more than 60 new staff members to meet increasing market demand; establishing a new training centre for technicians in Seattle; and continuing to reacquire its American Leak Detection franchises. The financials are also growing, with revenues up by 44% to $16.5m in the three months to March and adjusted EBITDA rising by 26% to $3m. The update came after the company previously announced that it performed strongly in the 2021 financial year, exceeding expectations for revenue and profits.

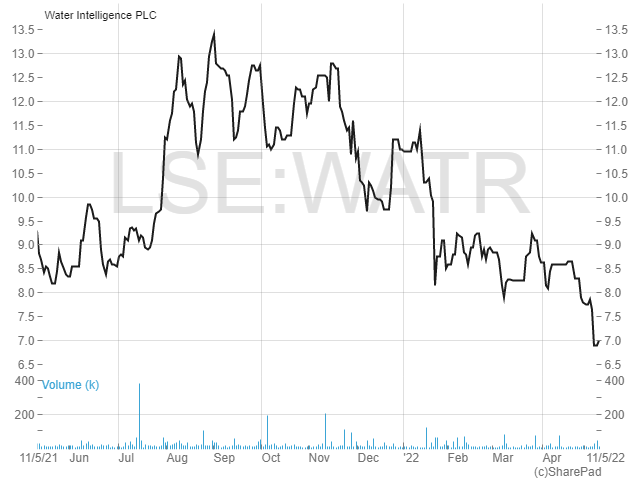

Following the recent trading statement, analysts at broker WH Ireland updated on Water Intelligence shares, noting that their price has fallen recently despite earnings upgrades earlier in the year. As a result, they see a good buying opportunity, stating that their fair value assessment of the shares gives a price of 1,450p. That represents upside of 108% from the current price of 695p. Ahead of the 2021 results release in late May, I believe that Water Intelligence looks like an attractive investment at current levels.

CentralNic

According to the recently released IAB Internet Advertising Revenue Report, digital advertising revenues in the US soared by 35% to $189bn in 2021. Taking advantage of this growth was AIM-listed CentralNic (CNIC) an online marketing-services company which is also growing quickly by acquisition.

The company was founded in 2004 as a specialist domain industry registry but today it is a developer and operator of software platforms which provide web-presence services to customers worldwide. Operating through the online presence and online marketing segments, it provides the tools required to create websites, use email and secure business online. Clients include domain-name resellers such as GoDaddy and corporate customers who have large portfolios of domain names, as well as small businesses which typically hold a few domains and use email and hosting services.

CentralNic listed on AIM in 2013 and has doubled in size in six out of the last seven years through a combination of organic growth, winning new clients, introducing new services and its acquisition strategy. The company’s market cap has gone from £32.5m at IPO to £381m today, with annual revenues up from around $4m to $410.5m over the last nine years. This is also a highly cash-generative and predictable business, with the company earning recurring revenue from the sale of internet domain names and hosting on an annual subscription basis, with cash paid upfront. In the last financial year only 1% of total sales came from non-recurring revenue products, providing great visibility of revenues.

INSERT CENTRALNIC LOGO

Great host

It’s been a great year for the company so far, including the main highlight of completing its largest acquisition to date. In March, CentralNic finalised the purchase of German online marketing business VGL Verlagsgesellschaft for an initial €67m in cash. This was financed by £45m of new equity and a €21m bond issue. VGL (for short) is used by the world’s leading German e-commerce companies to acquire customers via high-quality content websites and for using media-buying technology. It made revenues of $55.3m in 2021 and the deal is expected to be double-digit earnings enhancing in 2022 even before any synergies are realised. Despite the size of the deal, the market-consolidation strategy continues, with acquisition opportunities continually evaluated in what is a large, global and fragmented market.

CentralNic further impressed the markets in late April when it said it expects to report revenues of around $156m and adjusted EBITDA of around $18m for the three months to March 2022. This came on the back of organic growth of about 51%, driven by increased demand for privacy-safe, online customer-acquisition services. On the balance sheet, cash increased to $86.9m at the quarter’s end with net debt down by $10m over three months to $65m. At the same time, cash conversion continued at over 100% of profits. This performance meant that management expected to materially exceed market expectations at the time.

Growth and value

Shares in CentralNic currently trade at 130p, up by 136% on the company’s IPO price of 55p but off all-time highs of 150p seen in November last year. Analysts at research house Edison are looking for revenues to grow by 40% for the full 2022 financial year to $573.5m, with normalised pre-tax profits expected to be up by 60% at $51.1m. On Edison’s earnings forecasts for the year the shares currently trade on a multiple of just over 10 times, a figure which looks very cheap for a business with such a strong track record. The more relevant price-to-earnings growth multiple is very low at 0.33 times, with a figure of one often considered to be fair value for a growth company. On that basis the shares could treble.

Comments (0)