Gold Miners update: Hummingbird and Aureus

In previous articles I have emphasised the often overlooked and under-estimated, pernicious, effects of dilution on shareholders’ value in the various gold projects I’ve covered. But a higher gold price, depending on each circumstance, might produce a highly geared counterweight. So, how to balance the two?

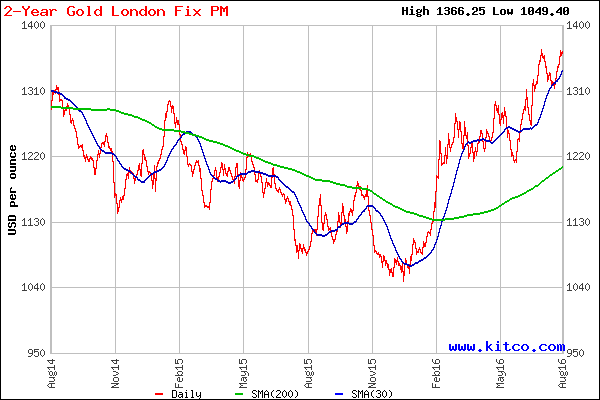

Price of gold up to Aug 5th (USD)

The Gold Fairy vs the Dilution Devil – who is winning?

Hummingbird (HUM) which looked so tempting when I covered it in the December edition of the Master Investor Magazine when 17p, expanded its shares in issue three-fold in June by raising $71m to start construction at Yanfolila instead of financing it – as all had expected – by way of a full project loan. So how does it stack up now – given that the gearing effect of a loan which would have made Yanfolila look especially attractive has gone ?

In the calculation model I used in December I assumed a $65m project loan at 9% over 5 years in addition to the $15m bridging loan from Taurus, who we all assumed would stump it up but which has now been replaced by the $71m equity raise.

Given Yanfolila’s project return of over 60%, the much cheaper project loan would have geared up the return to shareholders markedly. On the 119m shares I expected to be in issue after financing, the NPV8 of earnings per share over the 8 1/2 year life of mine would have been 65.1p, and the NPV of the net cash flow would have been 47.9p – both juicily higher than the then 17p share price.

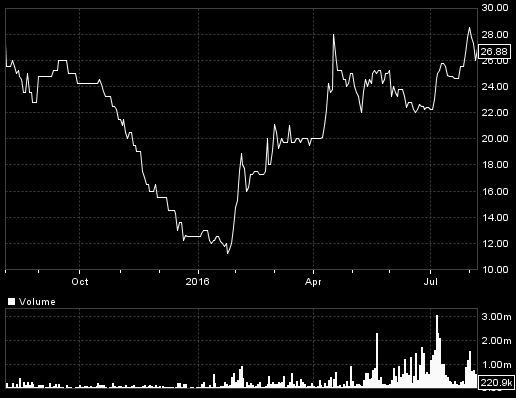

Hummingbird (HUM) – One year to August 5th

But what do we have now?

While the NPV of the project loan and interest repayments replaced by the equity raise would have been $79m, so that the NPV available to shareholders has therefore increased by that amount (52%) to $231m, it now has to be divided by 3 times the number of shares. So not a good deal for shareholders, although judging by the strength of the shares, perhaps they didn’t notice. But maybe, after paying 22p in the June share placing, there was still enough upside to soothe the pain.

On Hummingbird’s expanded 332m shares in issue, my calculation now is for the NPV of earnings per share to be 35.5p – nearly half the value when I though the shares very attractive at 17p. Except that, following Brexit, the £/$ rate is now only 1.3 against 1.52, so that NPV is now worth more in £ terms at 41.5p.

But what about the benefits of a higher gold price ? The Feb 2016 ‘optimised’ technical report on which I based my calculations assumed a $1,250/oz gold price, and stated a $53m NPV increase for each $150/oz increase. So at today’s $1,350/oz the NPV/share would be 10p/share higher at 51.5p.

So were HUM’s shareholders in the 22p placing screwed? Maybe not totally – but certainly partially! However, remember my explanations of why a share price will never get to its theoretical NPV (unless investors lose their heads of course – not unknown!)

Aureus Mining

I was just about to publish an update advocating caution here – where some investors might have been regarding AUE as a recovery play now that gold is higher; the previous CEO has departed (been pushed); and a new source of finance has arrived in the shape of Turkish gold-mining entrepreneur Mehmet Gűnaland and his MNG vehicle – when an update arrived today which reinforced my view.

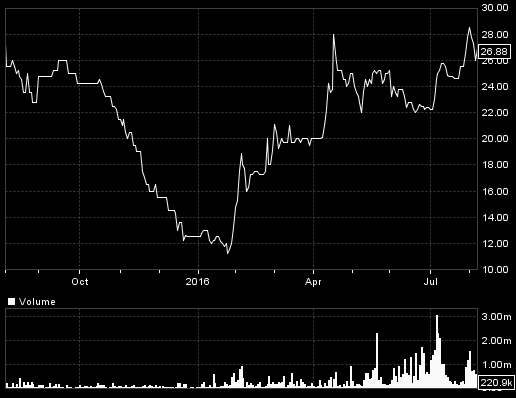

While a quick look at the MNG deal should have caused investors to hesitate, the share chart shows heavy trading volume recently at the current low price. So was the interest justified and will any be from now on?

In what was a ‘rescue’ deal, MNG coughed up a much needed $30m towards the debts AUE has incurred due to delays in getting its New Liberty gold project fully up and running, in return for a 55% controlling stake. But it was at a distressed 3.21p/share, diluting shareholders by a further 45% and adding to the eye-watering previous dilutions I described in February.

At that time, with ‘only’ 542m shares in issue after previous dilutions, I estimated that shareholders’ value once the mine breaks out of its current ‘fits & starts’ phase, was 14.7p/share (based on the 8% NPV – to which I had adjusted the 5% used in the technical report, to accord with how I think the market actually rates such projects) after deducting repayments of the hefty $88m project loan.

But now, still based on SRK’s 2015 costings and the same NPV, but on the expanded 1.2bn present shares in issue (and after allowing for the Sierra Leone government’s 10% stake) that shareholder 14.7p value becomes only 6.8p, even after a 17% boost from the lower £/$ rate. No wonder the shares, despite the trading volume, have been going nowhere even before today’s news.

Aureus Mining (AUE) – 2 yrs to Aug’16

Of course, Aureus has other interests than New Liberty’s 924,000 oz mineable reserve and 8 year life, with the 900koz Ndablama project in Liberia, and two other exploration projects. But they are a long way from being financed.

But could an even better gold price have helped? The NPVs I’ve used are for $1,300/oz gold, while SRK calculates that every $100 increase adds $50m to New Liberty’s 5% post-tax NPV. After the government stake therefore, an extra 3p would be added to the share value at an 8% discount rate, which might be beginning to look worth having if gold gets to $1,400/oz.

Except that there are still uncertainties about New Liberty’s production performance and the extent of its other debts, now highlighted today. While New Liberty has been producing some gold, which it sold in the first quarter this year for $14.7m, (at an average $1,253/oz) it has been incurring much higher costs due to continuing delays and equipment problems, so much so that current assets had fallen to $25m at end June (before receipt of the full $30m) against current and trade debts of $58m and the outstanding project loan (whose repayment timings are being re-negotiated) of $85m.

So it is not surprising that “management believes that the Company remains undercapitalised to deliver to its full potential and is likely to require further funding for capital investment activities to deliver improvements in operational performance. MNG Gold intends to be a long-term supportive shareholder of the Company and fully expects to support the Company in any future funding endeavours that may arise from the conclusions of the on-going performance reviews.”

Until these are complete only a very brave investor will stay with the shares.

Comments (0)