The Dogs of AIM 2020

Richard Gill, CFA, updates his “Dogs of AIM” portfolio, a selection of ten shares based on the popular “Dogs of the Dow” trading method.

For three years now I have been covering the “Dogs of AIM” portfolio, a selection of ten shares based on the popular “Dogs of the Dow” trading method. As a reminder, this investment strategy was popularised by money manager Michael O’Higgins in his book 1992 Beating the Dow. It sees investors put equal amounts of money into ten individual companies, otherwise known as “dogs”, which are constituents of the blue-chip focussed Dow Jones Industrial Average index. The strategy has had its up and down years but is doing quite well so far this century, beating the index in 11 out of 20 calendar years since 2000.

The term “dogs” refers to the companies with the highest historic dividend yields. Instead of the Dow, my strategy applies the same approach to the Alternative Investment Market, using the FTSE AIM 100 index to ensure that constituents are of a decent size and sufficient quality. However, with such high yields, there is also the risk that the shares are being lowly priced for a very good reason.

Under the original strategy the portfolio is periodically rebalanced, typically annually, with the previous year’s holdings sold and replaced with a revised, but again equally weighted, selection based on the same criteria. I last did this on 23rd July last year, so let’s look at how the portfolio has performed since then, a period which saw the February/March coronavirus inspired sell-off.

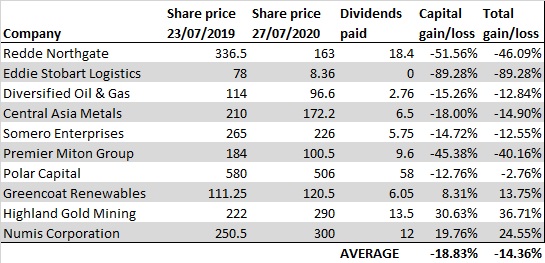

Data source: Sharepad

As the table above shows, the overall portfolio had a difficult 12 months, with only three of the constituents rising in value. Three companes in particular saw substantial falls in their share prices, bringing down the performance significantly. Overall, the portfolio saw an 18.83% fall in capital value over the period, versus a 5.5% fall in the wider AIM 100 Index and a 3.6% fall in the AIM All Share.

The biggest loser was trucking firm Eddie Stobart Logistics (LON:ESL), down almost 90% after the shares were suspended following an accounting review and only returning to the market after a £70 million injection from investor DouglasBay Capital. Meanwhile, accident management support group Redde, now Redde Northgate (LON:REDD), fell by just over 50% following its all share merger with light commercial hire business Northgate and being impacted by Covid-19 in March and April. Shares in fund manager Premier Miton Group (LON:PMI), which saw its own merger last November, are down by 45% after they slumped during the market sell off and have yet to fully recover.

Fortunately, most companies continued to distribute decent dividends over the period, aside from Eddie Stobart which was forced to scrap its payment due to the financial issues experienced. If we add dividends into the valuation then the overall loss is reduced to 14.36%. While the last 12 months have reduced the Dogs of AIM portfolio value, since it was initially formed on 28th March 2017 the portfolio is up by 31.6%. This compares to a 0.13% fall in the AIM 100 Index since that date.

Moving mongrels

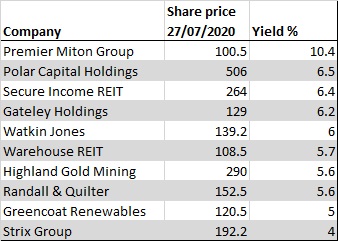

One year on, once again it’s time to rebalance the portfolio, liquidiating the current holdings and replacing them with the current top ten yielding AIM 100 companies. Familiar faces remaining in the portfolio for another year are Premier Miton, Polar Capital, Highland Gold and Greencoat Renewables. Exiting due to falling out of the AIM 100 are Redde, Eddie Stobart, and Somero Enterprises. Numis and Central Asia Metals also leave, just missing out by being the 11th and 12th highest historic yielding firms. Also, Diversified Gas & Oil is removed after moving from AIM to the Main Market. The six new entrants are property investment firms Secure Income REIT (LON:SIR) and Warehouse REIT (LON:WHR), law firm Gateley Holdings (LON:GTLY), student accomodation developer Watkin Jones (LON:WJG), insurance book buyer Randall & Quilter (LON:RQIH) and kettle safety business Strix Group (LON:KETL).

While identifying these companies is an easy administrative task, the investment challenge here comes from the fact that many companies have reduced or even cancelled their dividend payments to preserve cash during the coronavirus pandemic. That means historic yields may not be a useful guide towards current year or future payments. Reflecting this, the recent UK Dividend Monitor report from Link Asset Services revealed that dividend payments to shareholders were cut by 57% in Q2 of this year. So for those investors who don’t want to risk following the Dogs of AIM strategy to the letter, here are two of the constituents which I believe look most attractive.

WAREHOUSE REIT

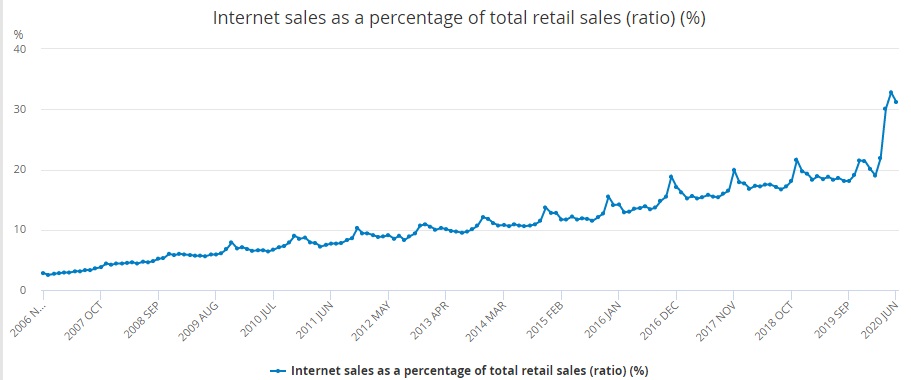

Warehouses may seem like a dull investment but current market trends mean that demand has been increasing markedly in recent years. One of the main trends driving this growth is the move from high street shopping to online shopping, with online sellers needed warehousing operations to store their stock and administer deliveries.

Data from the Office for National Statistics show that just 2.6% of total retail sales were made online in November 2006. However, this stood at 31.2% in June this year, with a sharp rise (almost ten percentage points) being seen following the coronavirus inspired lockdown. So called urban warehouses, smaller local hubs which typically handle good in the “last mile”, immediately prior to them being delivered to the customer, are currently especially sought after.

Taking advantage of this growth is Warehouse REIT (LON:WHR), a company which listed on AIM in September 2017, raising £150 million to invest into a diversified portfolio of UK warehouse assets located in urban areas. One deal had already been queued up on admission, with the company buying the Tilstone Property Portfolio, a portfolio of 27 warehouse assets, for £108.85 million. Another big deal was completed in February 2018, the firm buying the Industrial Multi Property Trust portfolio from main market listed Hansteen Holdings for £116 million, bringing with it 51 assets, the majority being multi-let UK urban warehouses.

At the end of the last financial year the portfolio covered a total of 6.2 million sq ft of space across 95 assets in the UK, with 560 clients spread across a range of sectors and industries. As well as expansion by acquisition, the overall strategy is focussed on growing contracted rent, increasing the portfolio occupancy rate and capturing additional reversionary potential.

Source: Office for National Statistics

Store of value

Numbers for the year to March 2020 reported on another year of progress, with Warehouse REIT posting record revenues despite the COVID-19 pandemic affecting the final few weeks of the period. At the top line, the company brought in £30.1 million of revenues, up from £22 million. However, statutory pre-tax profits slipped from £22.8 million to £20.7 million due to higher admin and interest costs and lower increases in property values and gains on disposals.

Numerous operating highlights of the period include the raising of £76.5 million via an equity issue in April, with a strong take up from the firm’s directors. This helped to fund acquisitions worth almost £150 million during the year, adding 1.8 million sq ft to the portfolio at a net initial yield of 6.6%. At the period end the portfolio was valued at £450.5 million, up by 2.5% over 12 months and equating to an EPRA net asset value of 109.5p per share.

Being a property investor, Warehouse REIT has sizeable levels of debt, with borrowings of £186.5 million at the period end resulting in a loan to value ratio of 40.2%. This looks comfortable, and while at the upper end of the company’s target range will be managed below 40% through the disposal of non-core assets. Also, during the period a new five-year £220 million loan facility was agreed with a group of banks, reducing the cost of debt and extending maturity to January 2025.

In terms of the expansion strategy, the acquisition pipeline amounted to a total of £350 million as at the date of the results, with an increased focus on e-commerce. Encouragingly, a proportion of these were said to be priced at potentially more attractive values following the impact of the coronavirus pandemic. Deals worth £100 million were said to be in exclusive or final negotiations, with £250 million in detailed negotiations.

Further into 2020 and Warehouse REIT announced a positive trading update on 16th June, stating that since the year end it has completed, or is under offer on, 43 lettings and lease renewals, across 277,000 sq ft of space, which will generate contracted rent of £1.9 million per annum. Some of these have been completed with a significant uplift to previous agreements, for example a 10-year lease renewal with storage and information management firm Iron Mountain reflected a 26% uplift to the previous rent paid, with a headline rent of £615,000 per annum.

In early July the company significantly strengthened its balance sheet by raising £153 million in a placing priced at 110p per share. Encouragingly, this was ahead of the original minimum £100 million target set in March, showing strong investor interest in the business. The funds will be used to execute on the near-term pipeline of acquisitions, with funds supporting this said to be well in excess of £200 million. Encouragingly, the company commented that,“Demand for warehouse space in strong locations across the UK shows little sign of slowing down”.

REIT good investment

One of the most attractive aspects of the Warehouse REIT investment case is the company’s dividend policy. Being a REIT (real estate investment trust) it is required to distribute 90% of its net income to shareholders in return for paying no corporation tax. At IPO, the intention was to pay dividends on a quarterly basis, with a 5.5p per share payment targeted for 2019, rising to 6p beyond that. For 2020 the company paid out a total of 6.2p per share, in line with increased targets and the intention is to match this for 2021. At the current price of 108.5p, that equates to a yield of 5.7%.

Investors who bought the shares at just over 70p in March following the market sell off look to have bagged an absolute bargain. But demand for the shares has returned, with the current discount to NAV being only 1p per share. Investors can however still buy the shares at a lower price than the recent placing. The asset backing here adds to the strength of the investment case, with further positives being the long-term visibility provided by contracted annual rents standing at just under £30 million at the end of March and the weighted average unexpired lease term being 5.2 years. Meanwhile, occupancy rates of 93.4% are high while providing opportunities for further rental deals to be completed.

PREMIER MITON GROUP

Fund managers had a tough time in Q2 this year as valuations fell across most asset classes and investors withdrew funds from the market. This had an inevitable impact on the fees which managers make from their assets under management. But one manager which seems to be performing resiliently, and has recently been strengthened by a merger with a peer, is Premier Miton Group (LON:PMI).

Premier Miton is an AIM quoted fund management group which currently has over £10 billion of assets under management across a range of equity, multi-asset and fixed income funds and investment trusts. In November last year the firm was brought together via the all share merger of Premier Asset Management and Miton Group. This created a business with a wider product range and scale, complementary investment capabilities, enhanced distribution relationships and expected cost synergies of £7 million per annum within three years.

Premier assets

Results for the six months to March 2020 showed the first benefits of the deal coming through, with assets under management 35% higher over 12 months at £9.145 billion. It was a tough period however, with investment performance wiping £1.72 billion from the value of the funds, with a net £389 million outflow of funds also reducing AuM. Nevertheless, the merger of the firms helped revenues grow by 39% to £33.4 million and adjusted pre-tax profits rise by 31% to £12.2 million. At the time, the integration of the two companies was said to be ahead of target.

The most recent update from the firm reported on trading in the three months to June 2020, with the headline news being that assets under management rose from £9.1 billion to £10.25 billion over the quarter. This was driven by a notable recovery in the firm’s equity and multi-asset funds and a slowdown in outflows. What’s more, the fixed income team has been strengthened with a number of new hires and the launch of two new fixed income products is planned before the end of the calendar year, subject to regulatory approval.

Income and value

As mentioned above, shares in Premier Miton fell in the market sell off of February/March but are yet to see anywhere close to their previous level. At the current 100.5p they are down by half compared to a year ago but up on their recent nadir of 69.5p. At the current price investors have the opportunity of buying into a business trading on less than 9 times forecast earnings for the current financial year. Supporting the valuation, net cash as at 31stMarch 2020 covers 19% of the current market cap.

In terms of the dividend, during the first half Premier Miton adopted a policy that targets a pay-out of c.50% to 65% of profit after tax, adjusted for exceptional and certain non-cash costs. With earnings of 11.26p being forecast for the current year that implies a dividend in the range of 5.63p to 7.32p and a yield in the range of 5.6% to 7.28%. This compares to the last financial year when the 10.5p payment amounted to 97% of reported earnings. Also, payments, previously made quarterly will now be made twice yearly.

Following the recent June update analysts at Liberum Capital increased their target price on the shares from 152p to 157p, implying upside of 56% from the current price.

Do you have a view on INFASTRATA,(infa)

Thankyou.