Is Valeant Worth a Punt?

I’m happy not to be in the skin of Bill Ackman, who will have to explain to investors why his Pershing Square managed to lose $1 billion in less than one one year. That will be particularly challenging because the losses are heavily concentrated in a single asset – Valeant Pharmaceuticals. The Canadian specialty pharmaceutical firm saw its share price decline 90% since August last year on the back of a range of scandals, mis-statements and fraud. But, after the dust has settled, I wonder whether the current share price is just in the middle of a downtrend likely to culminate in bankruptcy, or a bargain price worth a punt.

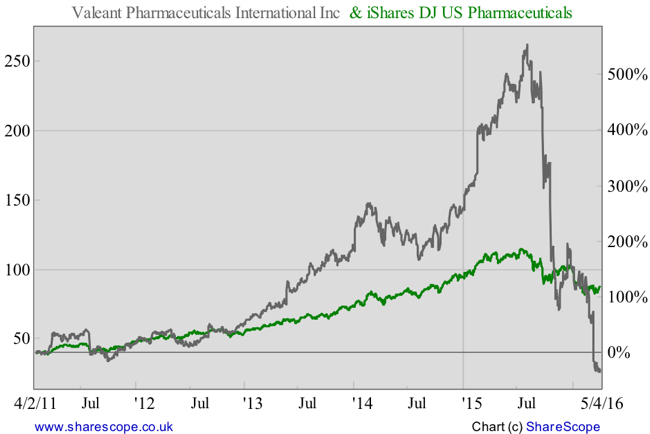

Valeant is a Canadian specialty pharmaceuticals and medical device company, dedicated to developing, manufacturing and marketing a range of drugs and medications. Well, not really! That is the description you would get from any financial website. In fact, Valeant has dedicated little time to the development of drugs of late and has opted instead to purchase what others have developed, to cut their costs, and to prop up their prices as much as possible. In that sense, Valeant has been behaving more like a financial intermediation business rather than as a pharmaceutical company. But, as far as we know, that strategy has in fact worked, as the outgoing CEO Michael Pearson was able to push Valeant’s share price from below $20 in 2008 to more than $260 by mid-2015.

Lately, Valeant has come under intense criticism, which turned into intense scrutiny, due to its M&A strategy. While purchasing a business to resell the products at a higher price is as good a strategy as any other, it doesn’t fit that well in a sensitive sector such as this one. Valeant used to purchase smaller companies, to then incorporate their main drugs and medications into its sales and supply chain, and to finally raise their prices exponentially while firing researchers and cutting other costs. Instead of relying on its own research, the company was relying on others’ research to grow. There’s nothing wrong with that, but in firing the research teams of acquired companies Valeant was squeezing all the short-term juice it could get while destroying the long-term value of the accumulated research. The mix of hiking prices and cutting previous research got the attention of many politicians, who put the company under close scrutiny.

Last year, the company acquired the rights to sell two medications used to treat heart disease – Nitropress and Isuprel – just to raise their prices overnight by 212% and 525% respectively. Another example involves a drug used for AIDS management, for which the company raised the price by 5,500%, also overnight. Analysts at Deutsche Bank reported that, out of a portfolio of 54 medications owned by Valeant, the company raised their average prices by 66% in 2015. The strategy was really simple: let others do the research, develop the medications and market them, then acquire them, cut staffing levels and raise the prices of what they used to sell.

The above behaviour is certainly immoral but not exactly illegal per se. Were it not for the fact the company was using a fake business to propel its sales, the stock might very well have still come under intense scrutiny but probably wouldn’t have suffered a 90% loss in eight months. Last year, Andrew Left, under the umbrella of Citron Research, published a report on Valeant’s business that led to an immediate 40% loss in share price. He accused the company of running a network “of phantom captive pharmacies”, working as the Enron of pharmaceuticals. He claimed that the company was using an affiliated company, Philidor Rx, to store its own inventory and record the transactions as sales. This report was greatly dismissed by Valeant but over time, as the truth was unveiled, Valeant was pushed into restating its financial statements while being heavily punished in the market. As a result of this, the Valeant share price has declined by 90% since peaking at $263.81 on 6 August 2015. Currently the shares are trading at $28.73, up from a bottom at $25.27 on Monday (4 April 2016). Not even the persuasive conference calls conducted by Bill Ackman, who owns 10% of the company’s stock, were enough to stop the bleeding. He appeared several times restating the value behind Valeant but it played like music on deaf ears.

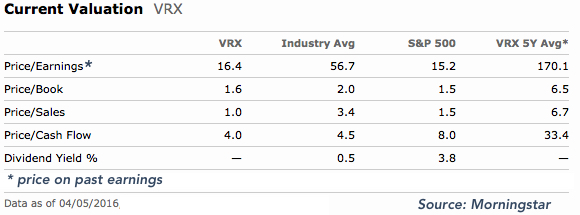

There’s no doubt that many things were wrong with Valeant, but it seems to me that, after experiencing a 90% decline in price, the company is starting to look attractive again. While Ackman tries to recover his money, anyone entering here would be making a profit on the free ride. We can let Ackman do the hard work (and he will for sure), and enjoy a much better entry price than him on a stock that currently trades at depressed price ratios. If behavioural finance is of use here, it seems that Valeant has been exposed to overreaction.

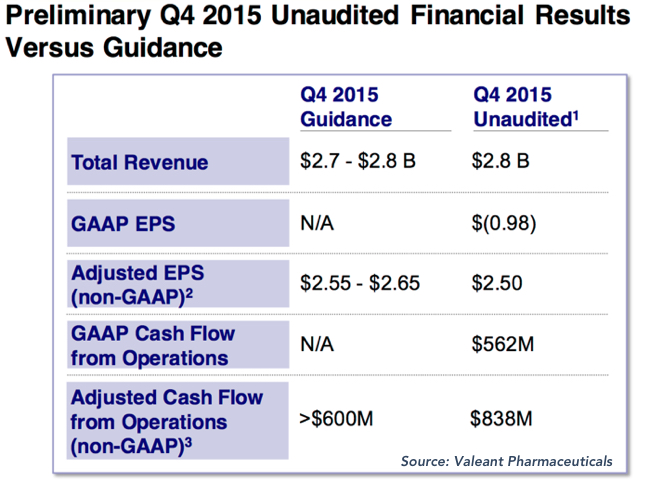

Many would argue that, given the fact that the company has been restating several of its previous financial statements, we no longer know the real figures to assess its financial situation. That is a fair observation. But, still, with CEO Michael Pearson now leaving the company and the latest accounting figures having been issued under intense scrutiny from the Board and investors, I believe that the worst is already behind it. The Ad Hoc committee created to find irregularities in regard to the Philidor Rx case has just announced that it “believes that its review of various Philidor and related accounting matters is complete, and that it has not identified any additional items that would require restatements beyond those required by matters previously disclosed.” That may put an end to the rout.

Unfortunately, on top of the restatement issue, there is another matter for concern. Valeant holds $31 billion in long-term debt on its balance sheet. This debt is a concern not only because of its amortisation over time but because it is dragging profits down. In Q3 2015, the company was paying around $420 million in interest from an operating income of $450 million and it still expects to pay more than $1.6 billion over the next year. With intangible assets worth near $22 billion and just $1.2 billion in cash and equivalents, the risks deriving from this company are high. Additionally, Moody has just cut Valeant’s debt ratings from B1 to B2, which may make things even more difficult for the company. Managing cash flow and reducing debt will be the key points for the near future and will dictate the success of the stock. But I trust that with Ackman now elected to the Board and a replacement CEO on the way, the company will experience a turnaround.

At the last investors’ presentation (in March), Valeant conducted a liquidity update. Its current holdings in cash amount to $1.2 billion. The company has already repaid $405 million in term loans in Q1 and expects to pay $517 million in mandatory amortisations across the year. The minimal amortisation has been estimated in $631 million for 2017 and $2,923 million for 2018. The company still has cash for the near term and it expects to improve its cash position through a few divestitures of non-core assets. Using its mid-point estimates, Valeant expects to generate $2,200 million in cash during 2016, which would be available for debt repayment (and other purposes). I believe that for now the company is relatively safe regarding its debt commitments.

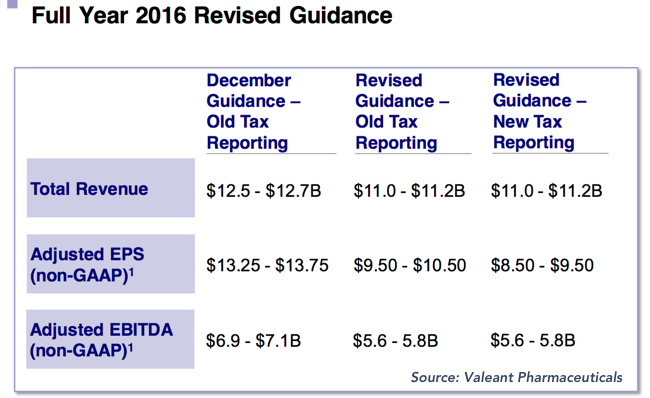

In terms of expected profits for 2016, the current EPS guidance points to $8.50 to $9.50 per share. If they deliver at the midpoint of this, and taking the current market price of $28.73 into consideration, shares trade on a P/E ratio of 3.2x, which is a very conservative value for the sector. The price-to-book is less than 1.6x.

The future of the company will depend on the ability of the new management to keep at least the same level of revenues as before (but this time without recording inventory as a sale) while reducing the company’s huge debt load. With debt having increased so greatly over the years, it won’t be an easy task to put an end to this trend. But, with restatements done, a new Board elected, and a reasonable financial position to keep the business going, I believe the company is worth a punt at this point. But, of course, in stark contrast to Bill Ackman, such a stake should be part of a well-diversified portfolio, as it is speculative in nature.

Comments (0)