Pension Boost as Military Spending Rises

I remember when I was a teenager saying to people “if you get three wishes from a genie don’t ask for world peace.” The reply would come “why ever not?!” “Because”, I would reply, “our economy is based on arms sales”.

If you read my magazine article “War! What Is It Good For? Absolutely Your Pension” last August in my Final Word Column, you’ll know from the title that riding the wave of the military spending cycle is not only following the money, but also to some extent a hedge for other market factors. The Swedish think tank SIPRI (Stockholm International Peace Research Institute) publishes figures on international defence spending. Of course not all of it is technically ‘defence’ spending. Some of it must be ‘aggression’ spending, otherwise the ordnance would just gather dust and eventually there would be no military spending at all. But we don’t live in some naïve notion of a fair world, and realistically we probably never will.

World peace is a paradox anyway, since peace comes about either through force, as in a totalitarian dictatorship; or through exploiting other countries to ensure a happy domestic population; or through enforced peace by subjugation. What it boils down to is that peace is a function of economic growth and stability, which is why there’s less of it about right now.

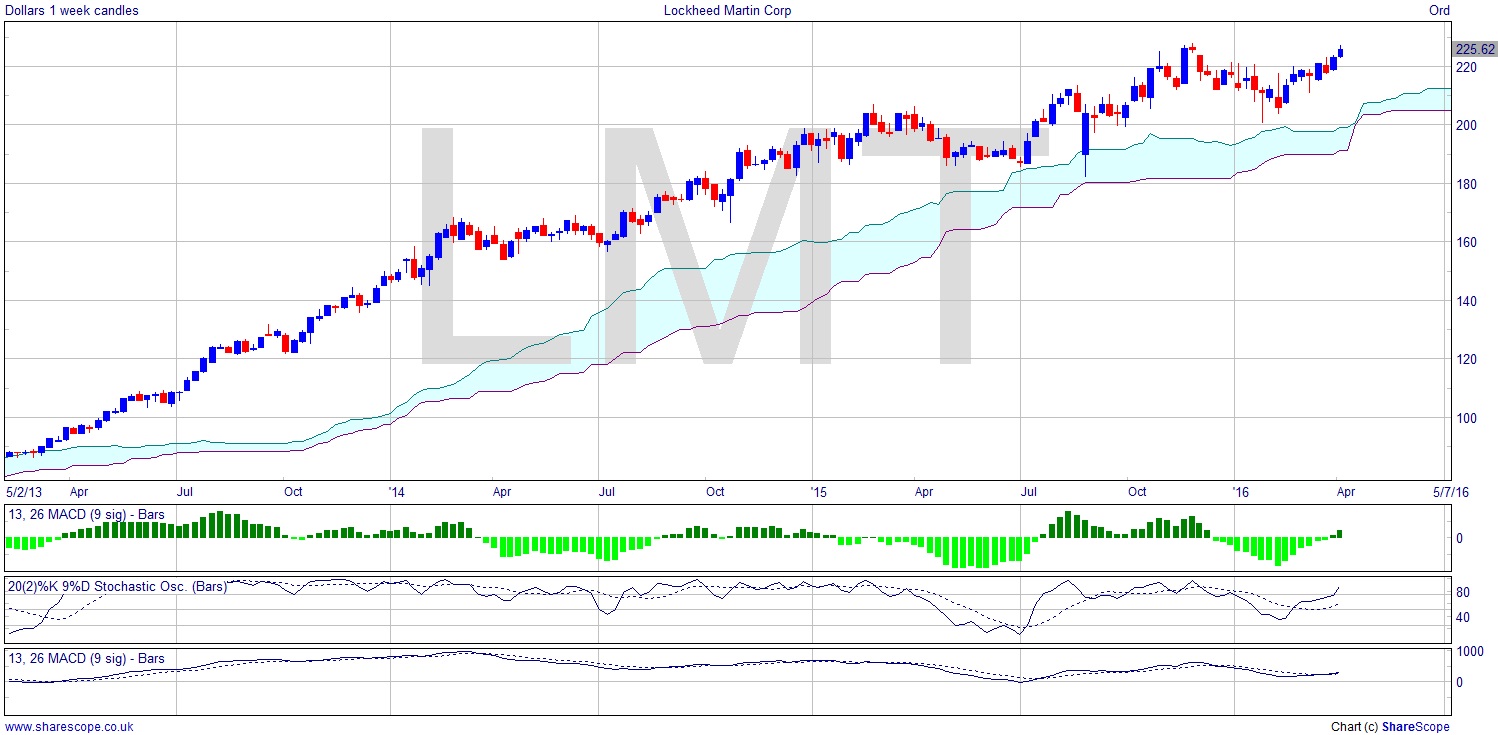

So SIPRI has announced record defence spending (although records are what you expect in number terms over time anyway) of $1.7 trillion in 2015. No wonder Lockheed Martin’s (NYSE:LMT) chart looks so great! They’re picking up more contracts along the way, like being part of the team developing the Gremlin drones. These are really smart and (relatively) cheap disrupter drones that fly ahead of expensive planes and interfere with radar and cause the defending country to waste its expensive defences on these little drones thus clearing the coast for the main onslaught. Clever stuff.

Lockheed’s chart is pushing the ATH, and that’s an incredibly intact upward trend on the chart. It’s been above the Ichimoku cloud on the weekly now for years.

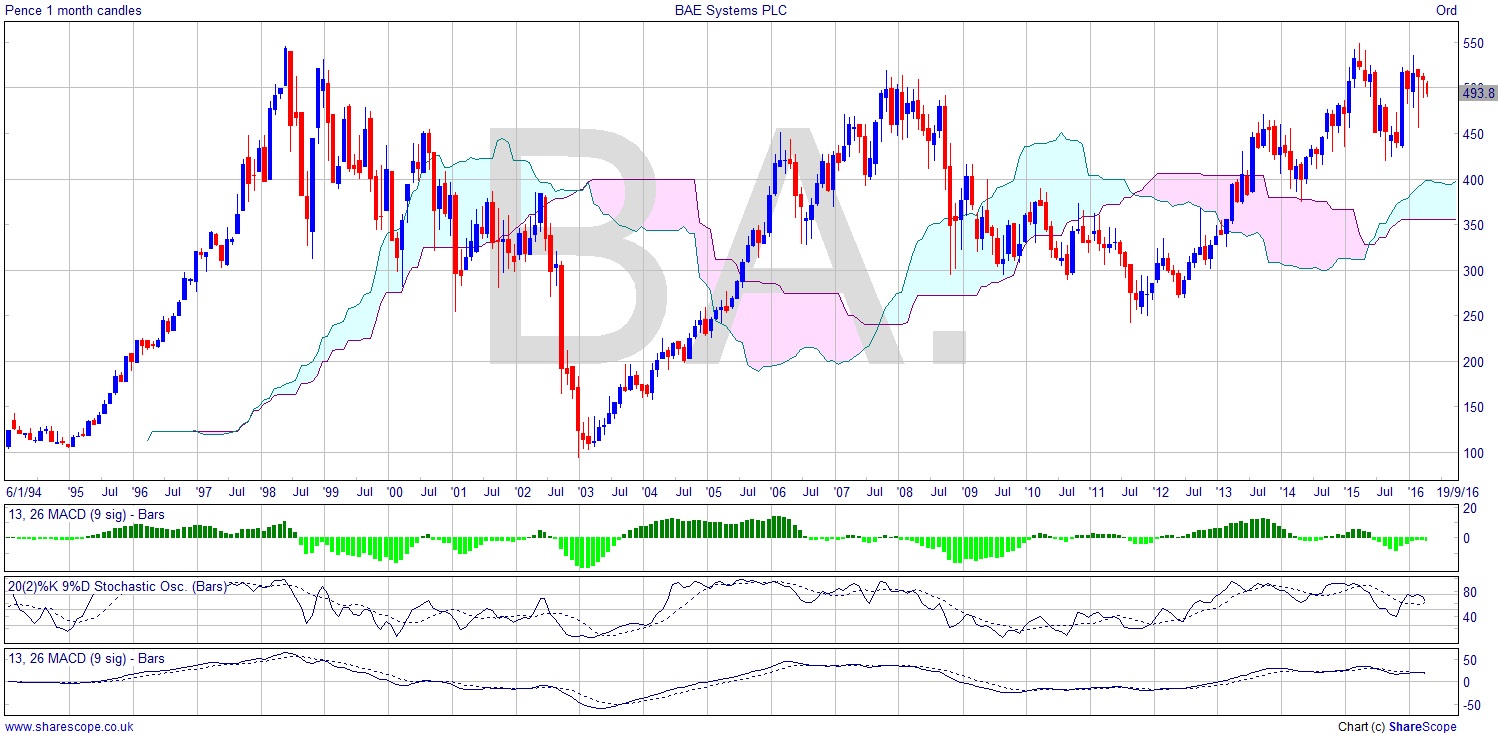

I’m not a big fan of British stocks where US ones will do, but we are still fifth in the world for arms exports and have a thriving defence industry, in spite of the pro-peace extremist lobby. BAE Systems (LON:BA.) is still doing reasonably well. Do I really need to make the case though? Look at the chart. What is substandard about it compared to the Lockheed Martin one? Well, loads. It’s not thundering through ATH after ATH. It’s only barely reached the level it was at in 1998. It’s not in a thoroughly convincing upward trend, although it is technically in an uptrend. There’s also risk here, because if the do-gooders get their way then BAE will lose a number of really big hitters, like Saudi. Don’t get me wrong. I think the Saudi regime is one of the most unhelpful on Earth, to put it in understated fashion worthy of Fred Perry commentating on a napalm attack at an international tennis tournament. However, if we don’t sell arms to them then someone else definitely will. We can’t sanction them remember ‘cos of the oil.

Either way, get into defence, or don’t get into defence, that’s up to you. But it’s one of the biggest growth industries globally, and it’s recession proof. It’s obviously even war proof.

Comments (0)