Can the Nasdaq Rise More?

I am somewhat pessimistic about the stock market, as I believe current prices are supported by interest rate cuts and a strong US economy. Should something fail, prices would derail. The optimism on AI remains strong, and the Information Technology sector, mega caps and almost the entire Nasdaq market keep rising. However, we have observed increased volatility in recent times, as investors digest the impact of negative surprises from US companies, stubbornly high inflation figures and the Federal Reserve’s apparent reluctance to act. Investors are no longer enthusiastic about all mega caps. Take the example of Tesla and Meta, where once high-flying projections are now being revised downwards, resulting in high volatility for these stocks. Another example is Apple, the giant iPhone maker which has experienced troubled growth figures. This is due to the company failing to increase sales in China and losing leadership to Samsung, but the company announced a repurchase to avoid a stock price decline. The trouble doesn’t end with these stocks. This is about all stocks with very high growth projections and that are reliant on an expected monetary easing that may come later rather than sooner. In my previous blogs, I have expressed some concerns about the outlook for growth. In particular, I have highlighted the vulnerability of mega growth companies, as most of their value comes out of thin air. Adding to the trouble is the fact that the current rally has not been broad-based but instead reliant on a few mega cap companies.

One of the most concerning indicators for the current stock market is the rising yield on bonds. The US 10-year yield currently stands at 4.54%, a slight decline from last week’s peak of 4.69%. However, it has been on an upward trajectory since the beginning of the year. This poses a significant challenge for stocks, for two reasons. Firstly, higher yields reduce the additional returns investors receive from bearing the risk of stocks. Higher risk-free rates make stocks less attractive, unless expected returns rise. However, for that to happen, either stock prices had to decline or profit projections to increase. Secondly, higher yields erode the present value of companies’ future profits. This is problematic, particularly for those high-flying growth stocks. The stock market can survive rising yields to some extent, but not at these levels if they continue increasing. Prior to the beginning of 2024, investors were heavily invested in the possibility of interest rate cuts. However, as the year progressed, this outlook shifted, with the expectation of just one rate cut by the end of the year.

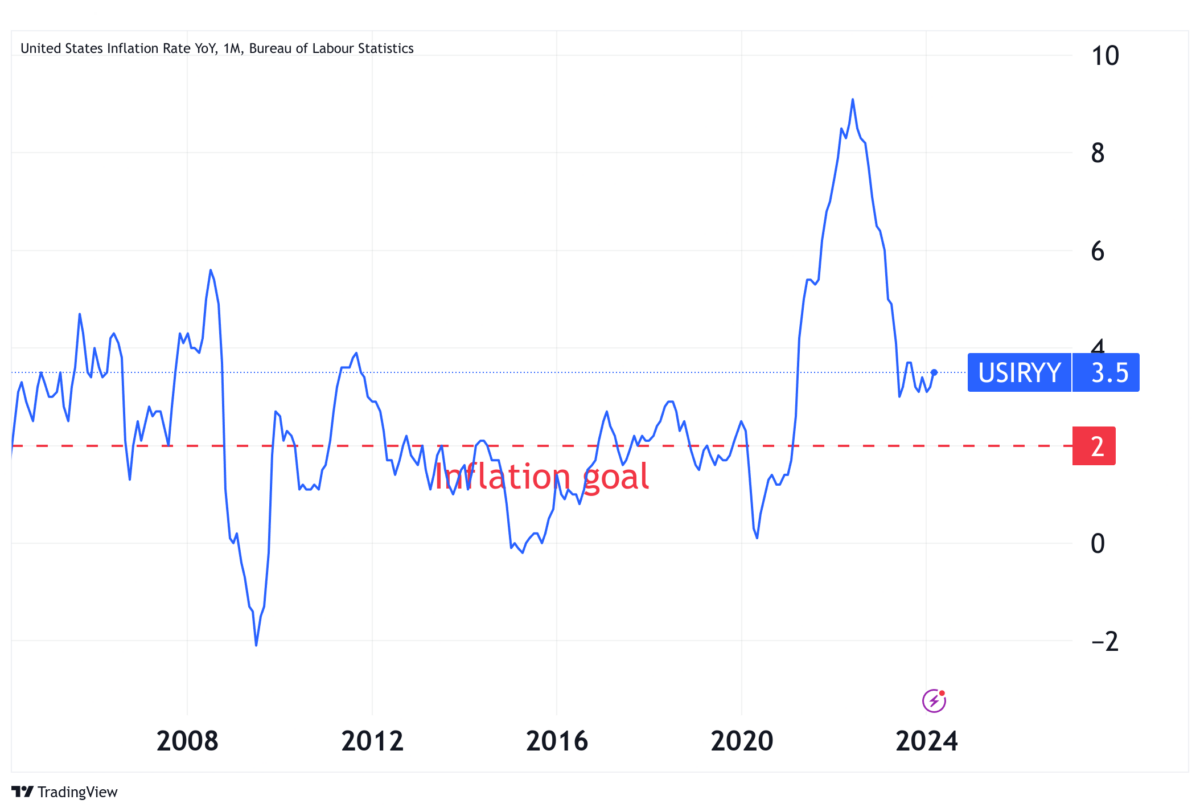

Despite the market adjusting the projected rate path, I believe the current stock prices do not reflect such a significant adjustment. Investors are still betting on aggressive rate cuts that have just been delayed but (they believe) will occur. Historically, a 4% interest rate has been considered a neutral nominal rate, resulting from a 2% real rate and a 2% inflation target. However, during the deflationary period following the Global Economic Crisis and the European sovereign debt crisis, many economists were predicting a lower real interest rate to justify a lower neutral rate. Using very simplistic calculations, taking the current inflation levels and output gaps, the current interest rate level would appear to be appropriate for a real interest rate of 2%. While the exact number for the real interest rate is the object of much discussion, there is still little room for interest rate cuts. Given that the US economy is close to full employment, it is unlikely that Jerome Powell would initiate a rate cut just to see it reversed in the near future. Furthermore, inflation has been persistently high since February 2021, significantly above the Federal Reserve’s target. While the figure is no longer near the two-digit level seen in June 2022, it is still hovering around 3.5%. Only during the 1980s did we find inflation at the same level as two years ago.

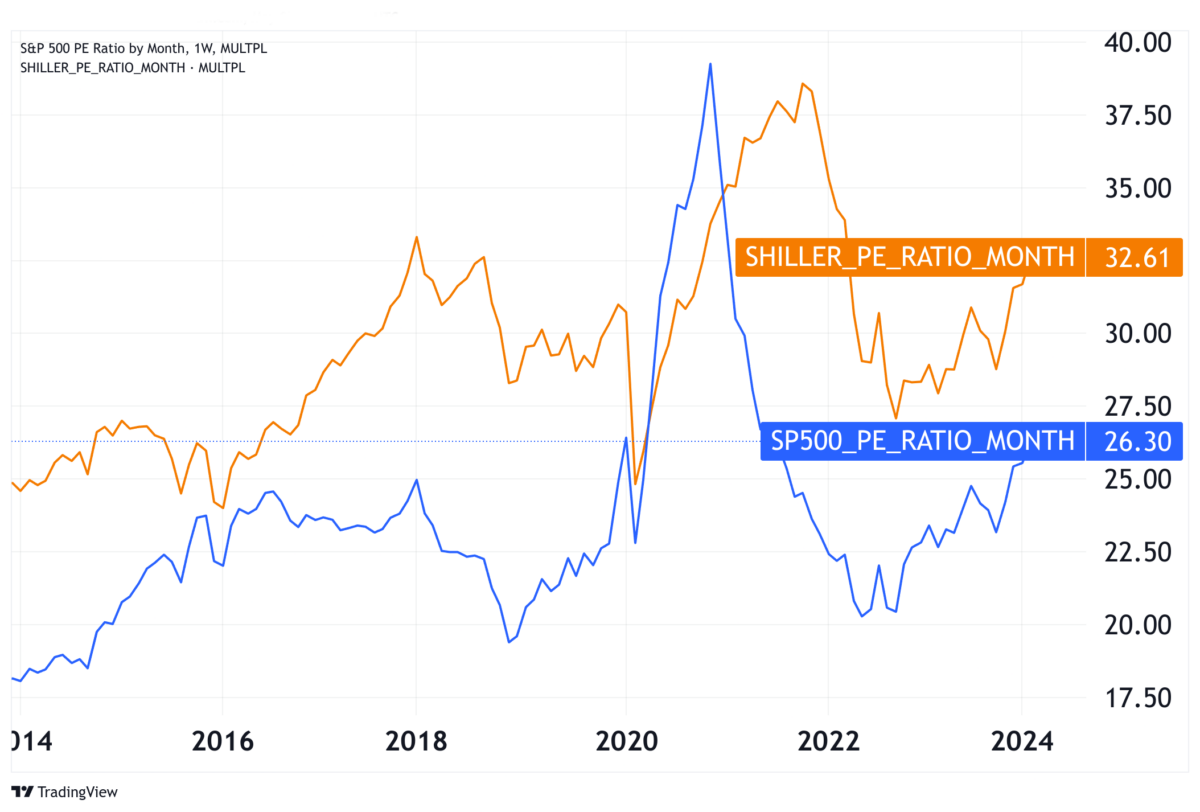

Another negative point to make about the current stock prices relates to price earnings-ratios. Historically, PE ratios for the S&P 500 have been around 20. However, they currently stand at 26.3.

To sum up everything, I believe we may enter a turbulent period, opening space for a retreat in stocks, as investors realise the scope for rate cuts and profit growth is meagre. The US economy has been resilient so far. But this resilience is not enough to justify the high growth projected for some companies and, at the same time, goes against the rate cut prospects. The last job report came below expectations leading the Nasdaq 2% higher. But again, such economic “deterioration” may not been enough to lead to any aggressive rate cut path, while at the same time not contributing for supporting any high profit growth prospects seen in stock prices. One way or the other, I think the stock market will retreat, even if there’s no strong negative surprise coming from economic data.

Comments (0)