Are These the Cheapest Stocks in London (Part 2)?

Potentially looking even cheaper than my first selection on Monday but with many more risks, is Tandem Group (TND), a designer, developer and distributor of a range of leisure goods. Core products include the bicycle brands Claud Butler, Dawes and Falcon, as well as table sport business Pot Black, and golf equipment company Ben Sayers. These are complemented by a range of wheeled toys which are branded (under licence) with popular cartoon characters, including Batman, Postman Pat and Peppa Pig.

For many years the company was focussed on the two core divisions of bicycles & accessories and sports, leisure & toys. However, it significantly expanded its operations in August 2014 when it finalised the £2.5 million acquisition of Pro Rider Mobility, an online retailer of mobility scooters, associated mobility products, electric bicycles and electric golf trolleys. The business was bought so that Tandem could further expand its direct to consumer online operations, as well widen the distribution network and customer base, and improve buying power.

Then in September last year Tandem further expanded its direct to consumer online product range by buying leisure products business ESC for an initial £2.4 million. ESC is an online retailer of gazebos, party tents, household, kitchen and fishing products. The business made revenues of £6.3 million and a net profit of £0.8 million in the 10 months to 1st September 2015, so looks to have been bought very cheaply. The deal is expected to be earnings in its first full year of ownership (2016), will further strengthen distribution channels and the Tandem customer base.

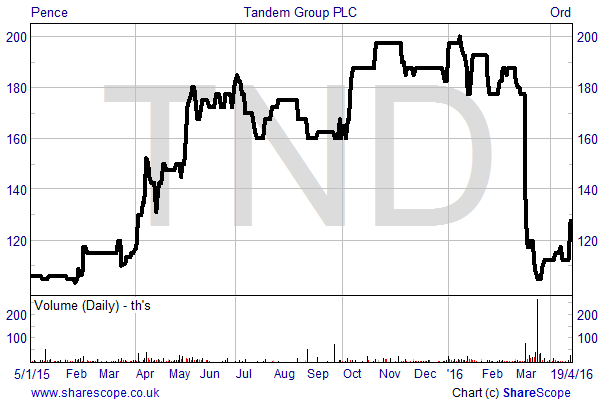

Shares plunge on trading warning

Trading has been inconsistent over the past five years, but 2014 was a much better year for Tandem. Boosted by the acquisition of Pro Rider and 6% like-for-like growth, adjusted pre-tax profits for the year grew by 56% to £1.28 million. However, things have taken a turn for the worse since then. Shares in the company plunged from 177.5p to 130p on 9th March this year after the markets picked up on a number of points in a badly received trading statement.

Firstly, 2016 is expected to remain highly competitive in the mid-tier section of the bicycle market in which Tandem operates. As such, a challenging year is expected, especially as 2015 also had a large one off promotional contract with a large supermarket.

Secondly, the company flagged up its exposure to forex risk. With a significant amount of expenses being denominated in US dollars a strengthening of the currency against sterling has a detrimental effect on margins. While certain forward contracts are used to mitigate risk, Tandem said that if the dollar remained at current levels (c.£1:$1.42 at the time) it would have a negative effect on the second half.

Finally, in a rather vaguely worded statement Tandem flagged that it might have underpaid duty on certain Pro Rider and ESC products. The issue is being discussed with HMRC and while nothing has been quantified as yet the company will seek to recover any losses from the Pro Rider and ESC vendors should any arise. This issue could become messy as the vendors of both acquired businesses agreed to stay on as directors after their purchase.

Sentiment improves on results

Subsequently released results for full year 2015 (announced yesterday) injected a certain amount of confidence back into the markets. They showed that revenues in the year to December 2015 were up by 10% at £34.4 million. ESC contributed £1.59 million of revenues for the final four months of the year, with Tandem like-for-like revenues up by 5%. Operating profits before non-underlying items were marginally down, by £38,000 at £1.42 million due to additional costs from the ESC acquisition and underlying pre-tax profits were £1.21 million, down from £1.28 million after being hit by higher finance and tax charges.

Encouragingly, the outlook statement in the results wasn’t quite so bleak as previously mentioned. Despite the challenging conditions in the bicycle market (flagged in the March trading update) Tandem said that the order books have improved in recent weeks. Also, investment made into order processing and fulfilment systems, along with the redevelopment of all websites and personnel, is expected to drive growth in the direct to consumer operations.

Ride on the share price recovery?

Despite bouncing back after the results Tandem shares continue to trade at well below the pre-profit-warning levels. The current price of 127.5p capitalises the company at £6.05 million and puts the shares on a historic multiple of just 5.8 times underlying earnings for 2015. This looks very low, especially given that 2016 will enjoy the first full year contribution from ESC. With a dividend of 3.75p for 2015 the historic yield is a reasonable 2.94%, with the company having a progressive policy.

I believe that the markets value Tandem so lowly due to the issues flagged in the recent trading update and also a number of other factors, including its inconsistent trading history, saturated markets, high levels of competition and acquisition integration risk.

There are also risks related to the balance sheet. Firstly, as at 31st December last year net debt stood at £5.65 million – not far off the current market cap. Net borrowings, a mix of bank overdrafts, invoice discounting finance, hire purchase and bank loans, have risen by 5.3 times since the end of 2011, mainly due to the two recent acquisitions and the purchase of property freehold in 2013. In addition, Tandem had a combined deficit of £3.6 million in its two pension schemes at the end of 2015, with deficit contributions amounting to £256,000 on top of £147,000 of admin expenses.

But the over-riding factor here is that Tandem’s operations deliver excellent cash flow.

In 2015 net cash from operations amounted to £1.48 million, up by 11% from 2014. The pension contributions are incorporated in admin expenses and finance costs in 2015 were comfortably covered, almost 7 times by operating profits. With underlying capex averaging around £0.2 million over the past 5 years we are looking at free cash flow of roughly £1.3 million per annum, which equates to a superb free cash flow yield of 21%. This cash can be put towards reducing debt and paying further dividends, and thus increasing value for equity shareholders.

Overall, Tandem is a risky value and income play which I believe could double on a three year view if management successfully deliver on their strategy.

Comments (0)