Are These the Three Cheapest Stocks in London (Part 1)?

Value investing is a famous investment style often religiously followed by both professional and amateur share pickers alike. Its core focus is upon buying shares which are trading below their so called “intrinsic” value. Trumpeted for almost 90 years now, initially by the father of value investing Benjamin Graham, the technique can help identify some real investment gems.

But shares are often valued below their theoretical intrinsic worth by the markets for a reason. While a brief scan of the figures may suggest that a share is cheap, there may be wider issues which affect its valuation, such as an incompetent management team, a declining industry, poor liquidity and so on.

In the vein of Graham et al I have identified what I believe are three of the cheapest stocks currently trading in London. The first is covered below and the other two will be released later in the week. While all three clearly have some issues which are depressing their share prices, to me they look like good value risk/reward plays.

NORTHERN BEAR

Looking dirt cheap is Northern Bear (NTBR), a company which has been listed on the markets for a while but never really seems to be very active in terms of corporate actions or share price movement. The business is a Northern England based owner of a group of companies which provide a range of specialist building and related support services, including roofing, solar panel installations, asbestos management and even drone surveys.

Looking dirt cheap is Northern Bear (NTBR), a company which has been listed on the markets for a while but never really seems to be very active in terms of corporate actions or share price movement. The business is a Northern England based owner of a group of companies which provide a range of specialist building and related support services, including roofing, solar panel installations, asbestos management and even drone surveys.

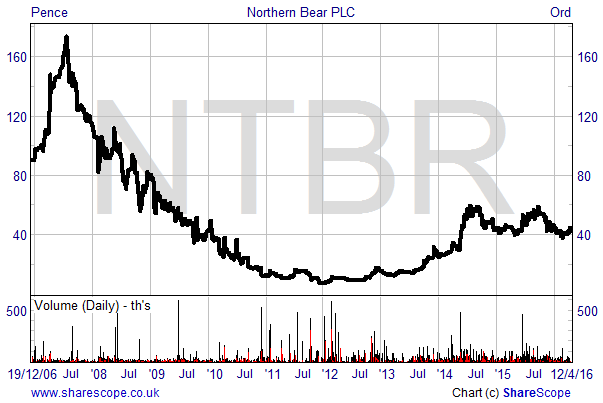

Prior to the financial crisis of 2007/8 Northern Bear had a rather aggressive buy and build growth strategy, acquiring 12 businesses within 16 months of joining AIM in December 2006. This strategy came to an abrupt end in 2009 after the building sector experienced trading conditions which the then CEO called, “the worst experienced in recent memory”. With profits falling and net debt having risen to over £10 million, the company began to focus on repairing the balance sheet by disposing of underperforming businesses, paying off debt and cancelling the dividend.

Good progress was made and in the 2014 financial year Northern Bear reported a marked turnaround in its fortunes after the building sector began to see a strong upturn in activity. Pre-tax profits for the year soared by 157%, and, as a clear sign of a turning point being reached, the company returned to the dividend list.

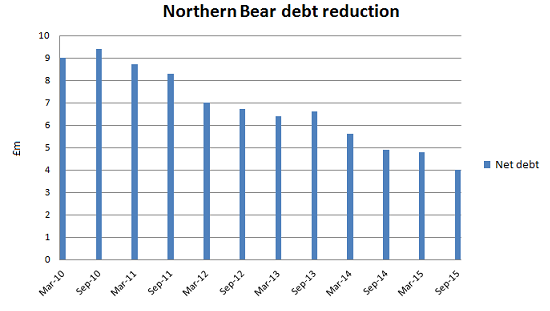

Perhaps most impressively of all Northern Bear has made excellent progress in reducing its borrowings over the past six years. Since peaking at £10.1 million in 2009 net debt has more than halved, to stand at just £4 million as at 30th September last year. Importantly, debt has been reduced solely from operational cash flow – the company has not had to resort to tapping shareholders for cash.

The company’s most recent results, covering the six months to September last year, showed a resolute performance. While revenues slipped by 2.5% to £20.1 million, a fall in admin expenses, finance costs and tax helped to push net profits up by 2.9% to £749,000. It’s worth mentioning that had a major roofing contract not been delayed revenues would have been ahead of the previous year.

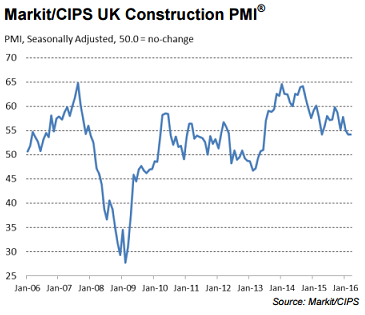

The outlook was encouraging, with the order book being “significantly” stronger and an “encouraging” level of tender activity being reported. We can have some confidence in this statement given that the Markit Construction PMI (a barometer of industry strength), while being on a downward trend, remains well above the 50 level which separates growth from contraction. In fact, the index has been above 50 for 35 months in a row now, with the most recent figure being 54.2 for March.

Northern Bull?

Northern Bear currently has no analyst coverage but the interim results and subsequent guidance suggest to me that net profits of at least £1.5 million (and earnings of c.8.5p per share) are on the cards for the full year to March 2016. At the current share price of 44.5p, that equates to an earnings multiple of just 5.2 times. With the company stating that it expects to continue with its policy of paying a final dividend I see a payment of at least 1.5p for 2016, which equates to a yield of 3.37%.

Those figures certainly look good value. But Northern Bear does have a few niggling issues, including its lack of communication the market. The last set of numbers are now six months old and trading updates are few and far between, which does not inspire confidence amongst investors. We should also remember that this is a cyclical stock, with the shares having fallen significantly following the economic crash of 2008/09. In addition, the previous Chairman Jon Pither has been selling down his stake recently and the low valuation could tempt management to take the business private.

If the past two years are anything to go by, then we can expect a year end trading statement in May/June. If that update confirms trading is in line with expectations, I believe there could be a sharp move upwards in the share price. A price of 68p, which equates to 8 times my expected earnings for 2016, seems like a fair value target.

Comments (0)