The Best Investment Companies for Income Drawdown

As seen in the latest issue of Master Investor Magazine.

The new pension freedoms that were introduced in April 2015 have been widely welcomed with one of the most popular features being income drawdown. According to data from the Association of British Insurers, 43,800 people invested a total of £2.85bn in these plans in the first six months after the change in the rules came into effect. This is equivalent to an average fund value of almost £65,000.

Those who opt for income drawdown can leave their pension fund invested and take out whatever income they want as and when they need it. Unlike an annuity they keep full control of their assets and can pass on the residual value to their beneficiaries, but they need to be comfortable with the ongoing risk to their capital.

A recent report by pension specialist Retirement Advantage calculated that drawdown investors could have experienced an 8% average loss in the value of their pension fund. They worked out that a drawdown plan of £100,000 invested in a mixed portfolio of assets on April 7th 2015 would have fallen to £86,522 by the end of January after taking out income equivalent to the prevailing annuity rate of £5,571.

Drawdown would only be suitable for those who are comfortable with this sort of risk to their capital. In most cases it would be people with other reliable sources of retirement income such as a company pension, or those who have used part of their fund to buy an annuity that would fall into this category.

The problem is that it is harder to make up for any losses when you need to continue to take an income from the same investments, although there are several safeguards that you can put in place to minimise the potential risk. The most obvious of these is that you need to make sure that you have a sufficiently diversified portfolio. Normally this would include different asset classes such as shares, bonds and cash so as to limit the impact of market falls and to provide more consistent returns.

Another important consideration is not to take out too high a level of income that it depletes the remaining value of your fund. The safest way to do this is to limit the withdrawals to the natural yield of your portfolio, which means that you will only take out the income and not the capital. This would leave the underlying investments intact thereby improving the chances of long-term capital growth and a gradually increasing stream of interest and dividends.

Smooth operators

Most of those who opt for drawdown will want to invest their portfolio in a number of different funds, as these provide a professionally managed exposure to the markets and a much greater level of diversification than would otherwise be possible.

The problem with open-ended funds is that they have to distribute all of the income they receive during their financial year. This means that the annual dividends will tend to fluctuate and could be higher one year than the next, which could be quite a challenge for retirees who are dependent on the distributions to maintain their standard of living.

UK domiciled investment companies have more flexibility as they can transfer up to 15% of their annual income to their revenue reserves. They can then use the money to smooth the dividends so that investors are able to enjoy a steadily increasing level of income. Investment companies domiciled offshore can transfer as much as they want as they are not subject to the 15% upper limit.

The Association of Investment Companies (AIC) has identified 19 funds that have successfully increased their dividends each year for at least 20 years. A further 18 have done so for between 10 and 20 years.

It’s easier for investment companies to do this because the managers can set aside some of the income in the reserves, which they can draw on whenever their underlying holdings unexpectedly cut their dividends. Open-ended funds have no such protection.

Many people think that 2016 will be a difficult year for dividends, with some of the biggest companies on the London Stock Exchange having to reduce their distributions to reflect the fall in their earnings as a result of the slowdown in the global economy. The likes of Tesco, Glencore, Antofagasta, Standard Chartered and Rolls Royce have already cut their pay-outs and others are expected to follow suit.

If all goes according to plan, an investment company should be able to generate an increasing stream of income that outpaces inflation, while also growing their capital over time. They are helped by the fact that they can gear their returns (borrow to invest) and in many cases have lower ongoing costs that their open-ended equivalents.

Research by the AIC using data from Morningstar reveals that a £100,000 investment made on 31st December 1995 in the average UK Equity Income investment company would have grown to £215,874 by the end of 2015. This represents an increase of 116% over 20 years. The annual income would have risen from £3,826 to £8,993, which was way ahead of inflation, with total dividends over the period amounting to £124,548.

A shortlist of suitable candidates

There are more than 400 investment companies listed on the London Stock Exchange, although not all of them would be suitable for drawdown investors. The best way to narrow it down is to identify those that have the necessary characteristics and you can then pick and choose which ones you want to include as your core portfolio holdings.

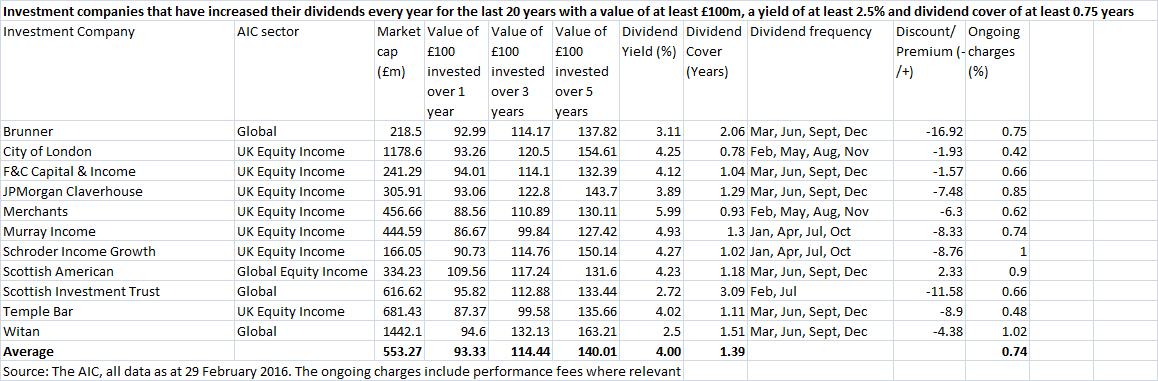

The most important quality for drawdown is the reliability of the income, so a good starting point would be the 19 investment companies that have successfully increased their dividends each year for the last 20 years or more. One or two of these are quite small, so it is worth cutting it down to those with a market value of at least £100m as an added safeguard.

Retirees also need a decent starting level of income, but some of these funds pay less than 2%. It would be better to limit it to those that pay at least 2.5%, which is more than you can get from most savings accounts. This may sound low but two of the funds – Witan and JPMorgan Claverhouse – have recently increased their annual dividends by 10.4% and 7.5% respectively.

Another key point is to look at the level of dividend cover that measures the number of years that the reserves could be used to maintain the current dividend. Some funds are more prudently managed than others, but a figure of at least 0.75 should ensure that there is no sudden cut in your income.

Once you have taken all of this into account you get a shortlist of 11 investment companies that could make decent core portfolio holdings. They are listed in the table and all have fund managers that have been in place at least four years. The one exception is the Scottish Investment Trust where Alasdair McKinnon took over in July 2014.

The key points to look for

The first thing to note from the table is that the majority of the investment companies operate in the UK Equity Income sector with just four global funds out of the 11. This is not as much of a problem as you might think as most UK-based investors will want the lion’s share of their portfolio exposed to their home market. They can then use the international funds to add the required level of diversification.

You can see the benefit of this from the performance data. Over the 12 months to the end of February the two funds with the best returns were Scottish American and the Scottish Investment Trust, both of which have a global mandate. On average the 11 funds lost almost 7% over the last year, but over three and five years they have produced total returns of 14% and 40% respectively.

The dividend yields of the 11 investment companies range from the 2.5% on offer from Witan to the 5.99% paid by Merchants and between them they average 4%. It is also worth noting that other than the Scottish Investment Trust they all pay quarterly. There are several different combinations that will ensure that you receive a dividend each month and by choosing the right allocation you should be able to get a relatively consistent monthly income.

Another welcome feature is that all but one of the funds have ongoing charges of 1% or less, which will have a major beneficial impact on the long-term returns. The exception is Witan where the annual cost is 1.02%. It is different to the others because it invests most of its portfolio in other funds, which is a more expensive process but delivers additional diversification.

Investment companies, unlike their open-ended counterparts, can trade at a premium or discount to the underlying net asset value (NAV) of their holdings. If you buy the shares at a discount that subsequently narrows it will improve your returns, although there is always a risk that the discount could widen. At the end of February 10 of the 11 funds were trading at less than their NAV, giving the potential for additional outperformance.

The investment companies listed in the table would all potentially make decent long-term core portfolio holdings for those in income drawdown. Investors would need to decide for themselves how many they invest in and how much they allocate to each based on the size of their portfolio, their risk tolerance and income objectives. They may also want to hold additional funds on a tactical basis to increase the diversification or bolster the potential capital growth.

Comments (0)