Under-performing is Golden

Is it really just the fact that gold doesn’t tarnish that makes it so appealing to us humans? Because, aside from a few industrial uses in more recent times, it’s basically nothing more than a shiny thing with a guarantee of being shiny. Be that as it may, it became a standard for money and whole economies were based on how much of it a country had. People talk about gold standard as if it was some magical commodity based solution. I mean gold is technically a commodity, but it is a rather abstract thing to use.

It still requires a certain amount of confidence. Really it’s no different than Bitcoin there. Limited (at least in the short term) in quantity, it’s of no actual use, unlike most commodities. You can’t eat it. You can’t power things with it. It has a little use in industry which would go no way to giving it the value we attribute to it. For the most part it’s just an intrinsic thing which we find pleasing.

Of course, it doesn’t get consumed by the things we mostly use it for: gold bars, coins and jewellery, which does make it useful as a basis for value. But I’d say there is just as much confidence required as with fiat money. You have to be confident that someone won’t find the alchemist’s formula for making it (more of a worry in bygone times that one), and that no one develops a process to manufacture it in the lab on a grand scale that costs less than its current market value. Or more importantly, that no one already has…

You have to be confident you know how much of it there is. Thanks to Max Keiser’s comments on Germany’s gold, we now know that the Germans don’t really know where it is. Germany’s gold on deposit in other countries’ banks is seemingly not on deposit at all, or at least, by no means all of it. The physical gold may well have been long since sold. And notably, it’s being returned to them very slowly by the US.

The current low price doesn’t really make sense in the physical market. We have low interest rates and inflation fears. China has been trying to get as much of the stuff as possible. And pretty much every individual outside the first world loves to buy it as a store of wealth. Especially Indians and Chinese people, a third of the world’s population right there! The Chinese government holds a lot of US debt ($1.2tr), so they could be hedging there, and they have been divesting themselves of that debt. They may like to usurp the US Dollar with the Chinese Yuan as the global reserve currency at some point, knowing that if they have to crash the dollar to do so China is, well, golden.

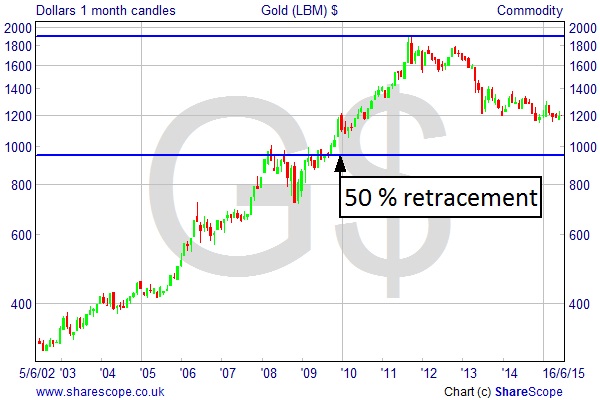

Are the paper gold markets not working properly (or being manipulated) for some reason? I’ve never been a huge fan of Warren Buffett. My favourite hedge fund manager is the man responsible for the biggest trading win ever: John Paulson. He has been buying the stuff for some time now. He’s not afraid of the short term negativity, just like when he was betting against what turned out to be sub-prime. Even Soros is getting some gold on board, and I say “good on them”. As a price floor we’ve got the significant $1,000 level, and the 50% level from the all time high (ATH) (around $950), both not too far below current prices. The 50% retracement level is significant not just to Fibonacci lovers, but also to those of us (me included) who subscribe to the ideas of W.D. Gann.

Seems pretty classic then. With a natural stop below the 50% level, and bed fellows like Soros and Paulson, it’s surely worth a shoofty. In terms of ETFs, there are plenty that are backed by physical gold. And for now gold hasn’t tipped its hat to say it’s ready to rally, so there should be a decent sized buying window.

[notes for the chart: Log chart of Gold (LBM) with the ATH and 50% retracement level shown in blue]

Comments (0)