Whom Should I Follow on Twitter?

“You are what you share.”

― C.W. Leadbeater, We Think: The Power Of Mass Creativity

In a world where people share their most important moments in life before even living them, social media assumes the highest relevance. We frame the important moments of our life and share them on Facebook; companies market their products through their Facebook pages; bloggers send their latest updates to their followers on Twitter; Prime Ministers comment on important political issues by tweeting to the population; and institutions let people know about important events through social media websites. Social media aggregates a large quantity of information in one single source, thereby allowing the user to choose what interests him the most, all without the need to exit the platform. Because of its reach in terms of number of users and its immediacy, many professionals use social media to disseminate information. Almost every internet user uses at least one social media service during his daily internet experience, being it Twitter, Facebook, Linkedin, Pinterest, or another. A simple statistic gives an idea of the growth social media has been experiencing and the importance it now has. Take Twitter for example: it had 30 million monthly average users in 1Q 2010. Five years later, it shows a tenfold increase to 300 million. One way or another everything in our life passes through social media.

If everything in life is somewhat connected to a Facebook or a Twitter account, then one should expect that financial markets, monetary issues and economic matters will all be extensively discussed in social media. Take now the case of Master Investor. It publishes the texts from its contributors in the website and magazine but at the same time it disseminates these through its Facebook and Twitter accounts, to let its users know that fresh content is just waiting to be read. Like it or not, there’s no business with an Internet presence that can opt out of this. It would be like opening a restaurant in the middle of nowhere without telling anyone.

Many other financial websites, the whole financial press, online brokers and dealers, traders, financial consultants and all other individuals and companies that have a professional link or a passion related to financial markets, express their opinions and thoughts through Twitter accounts. Millions of opinions are tweeted every day and many of them are about investments. If one searches on Twitter for a specific publicly traded company, one will find hundreds if not thousands of tweets expressing a feeling about it. Being that true, one could then ask: How much can be extracted from these discussions and how could that be translated into trading strategies?

Sul, Dennis and Yuan from the University of Indiana discuss this idea in a paper presented in the 47th Hawaii International Conference on System Science entitled Trading on Twitter: The Financial Information Content of Emotion in Social Media, 2014. The main question they ask is the following: Can the emotion expressed in tweets related to a specific firm be used to predict the future price of that firm’s shares?

With most companies accumulating so many tweets, where feelings are expressed about their share prices, one could very well expect that the average mood expressed on such tweets is somewhat connected with that share price. Isn’t Twitter made up of many traders and professionals trading in the markets? If so, some relationship must exist. One could argue that these people only tweet after trading. That is very well a possibility, and past prices would then explain the future mood on Twitter.

The idea of prices being explained by tweets’ moods challenges the assumption that markets are rational and efficient (sorry Eugene Fama!). The human being is unable to collect all fundamental information available on public traded companies and thus many times relies on partial information, on anchors like the proximity to the 52-week high or low. It has been often empirically shown that high sentiment is related with high contemporaneous returns and low future returns. Investors overreact and underreact systematically. That is, prices generally take time to adjust to new information, instead of reflecting it instantaneously. If that wasn’t the case, technical trading would be a waste of time. But in fact it isn’t, as share prices can be predicted and some strategies are able to deliver above average returns (the so called alpha) repeatedly and consistently over time.

In their study, Sul, Dennis and Yuan collected data from a Twitter developer account for the period running between March and October 2011 on all S&P 500 firms. In total there were more than 3 million posts to be analysed. The idea was to group tweets per company and per day and then to analyse what the prevalent mood was on a specific day and for a specific company. Twitter users usually use a dollar sign ($) before a company’s ticker symbol, so it is easier to identify tweets on that specific company (even though some may be missed). For example, when talking about Netflix, an user usually mentions $NFLX in his post. A typical comment would be like:

$Nflx Reid Hastings can kiss my trailer…I will not pay anymore than I already do to watch commercials! #FREEDOMfromTYRANNY

Another more positive example would be:

$Fb Its time for the next run and Instagram monetization will be the catalyst. Im adding at 80, pt 95 eoy imho

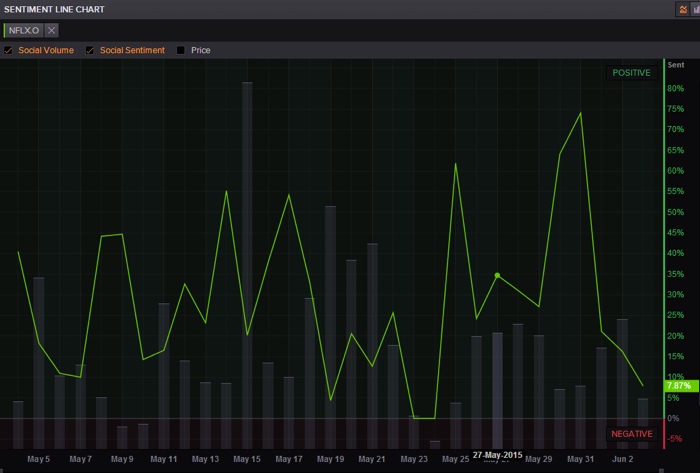

Both posts definitely express an emotion that is easily matched as negative in the first case and positive in the second. But matching tweets by hand is a tedious work. Fortunately, there are some other ways to do it. I was pleased when I was presented the Thomson/Reuters Eikon database. It has an internal app called Social Monitor that is able to track a sentiment index based on a matching they do on tweets to either being positive or negative. Here is a screenshot of what can be found:

You can find more about social sentiment on websites like Stocktwits. You can even check a heat map to know what is hot and what is not.

But looking at the prevalent sentiment or odd isn’t enough as the study I’m referring to shows.

Sul, Dennis and Yuan match tweets against a special dictionary with word classification that allows classifying each tweet as either positive or negative. Tweets for a company are then grouped by day to compute what they call as “cumulative emotional valence”, which assumes a positive or a negative valence. It’s a kind of sentiment degree, which increases with the proportion of positive words about a company’s shares. At the same time they compute share returns for a few intervals, with the most significant being a “same-day” period accounting for returns on the same day as the cumulative emotional valence is computed and a “10-day” period, which involves the returns obtained in the period that starts the day after and ends 10 days later.

The researchers found strong results suggesting that positive (negative) valences are correlated with a 10 day positive (negative) return. So, when the overall valence for an equity is positive in a certain day, the expected return for the following 10 days is positive. This has several implications: first of all, it suggests that the market is not efficient, as information takes time to be reflected in prices; second, tweets can be used to beat the market and gain above average returns. It is interesting that the returns on this [1,10] bracket are more significant than on the same-day. In fact the researchers were not able to understand whether it was the positive valence that pushed the same-day return or the return that pushed the positive valence. But one thing is undeniable: there is a feedback effect over the next few days, with positive valence attracting more buyers. For a trader it just doesn’t matter if the higher price comes from a positive feedback loop or not; What matters is that it just comes.

Additionally there is a very interesting result regarding who a trader should follow on Twitter. The median Twitter account in their sample had 177 followers. They split the results for each company in two different groups: tweets coming from people with more than 177 followers, and tweets coming from people with fewer (they had also tried with a 1,000 and a 100,000 cut-offs which show similar results) What do you think about it? Would this improve the results? What are the most informative tweets?

In fact this separation proved to be significant but eventually not in the direction many readers may think. The most informative tweets may very well be from the larger accounts, but those are also the less tradeable. The largest part of the positive effects deriving from positive valences coming from tweets from users who have a large number of followers occur during the same day of the tweets. No upside (or downside) is left for the following days. Why? Because these Twitter accounts are owned by large hedge funds and traders, by the largest financial news outlets, and other “material” Twitters like the ECB, the BoE or the Fed. One should expect the dissemination of information coming from these sources to be quite fast and prices to adjust almost instantaneously.

But when the cumulative emotional valence is positive and comes from less “material” Twitter accounts, the profits to be made over the 10-day bracket are much more significant. This is because the information takes more time to be disseminated in the latter case, allowing traders to still have an advantage after the information is disseminated. Traditional news media have a strong immediate impact, while those smaller networks provide much more insight for traders. This finding is in line with the empirical evidence that traders can profit the most from assuming positions in smaller companies with an unproven track record and that are more difficult to value and followed by fewer analysts. This scenario allows for much more over- and under-reaction than for other companies. If you mix everything, it is possible to follow the social sentiment and use it in particular to trade in less liquid equities than those that are part of the S&P 500. So, don’t expect to use social information to trade successfully on Apple or Microsoft. Neither should one wait for any Fed announcement to be published through Twitter to trade on it. At the time you perceive the cumulative emotional valence to be positive it would be too late to profit from it. But some interesting results can be derived if you depart from those heavy weights to some lighter equities and when you follow alternative accounts on Twitter. So, don’t forget to add @masterinvestormag to your Twitter account. We do have more than the 177 median followers but can still give you some insights on the less obvious equities – those that are more difficult to value and more exposed to over- and under-reaction.

Comments (0)