Passive strategies to exploit an oil recovery

Filipe R. Costa reveals how to explore an opportunity in the oil market without being exposed to negative prices.

“When there is not enough storage for the oil the world is still producing, then prices can go anywhere to the downside”

~ Pierre Andurand

Last month I had to lock myself inside a very small room to finish this column, such was the hubbub coming from all around! My house has been crowded for the past five weeks and there’s not much room left for those in need of peaceful thought. To some extent, I understand the guys at Cushing, Oklahoma. They also feel crowded, but in their case with oil barrels!

From what we have observed thus far, investors may be willing to pay to get rid of oil in times of storage congestion. The negative-price pandemic, initiated by Mario Draghi a few years ago, has spread from interest rates to the futures market. Contracts for May delivery of West Texas Intermediate (WTI) oil reached minus $37.63 on 20 April, as institutional investors tried to avoid physical delivery of oil. At a time when Cushing is near its capacity, storage costs are rising and investors are willing to pay to close their positions. It’s similar to negative interest rates. People are willing to pay the bank or the government to take care of their savings, as storing them at home is impractical, unsafe and expensive.

The spot oil market has remained positive for now, but we witnessed WTI oil trading at just a few cents on the dollar on 21 April, even though it closed the day near $14. Brent oil was by then trading at $23. We haven’t seen such low closing prices in more than two decades – not even during the financial crisis, when the world entered an ‘epic’ recession, were oil prices so depressed.

Due to the Covid-19 pandemic, most of the developed world is locked down at home. Part of the global economy is closed, planes are grounded and streets are deserted. There just isn’t the need for as much oil as before.

Still, there’s hope for the economy and, in particular, for oil companies and energy conglomerates. The pandemic will eventually go away and oil prices will recover as they always have. This month I propose a few ETFs to take part in the potential recovery of oil and avoid the unlimited liability opened up by negative prices.

The oil pandemic

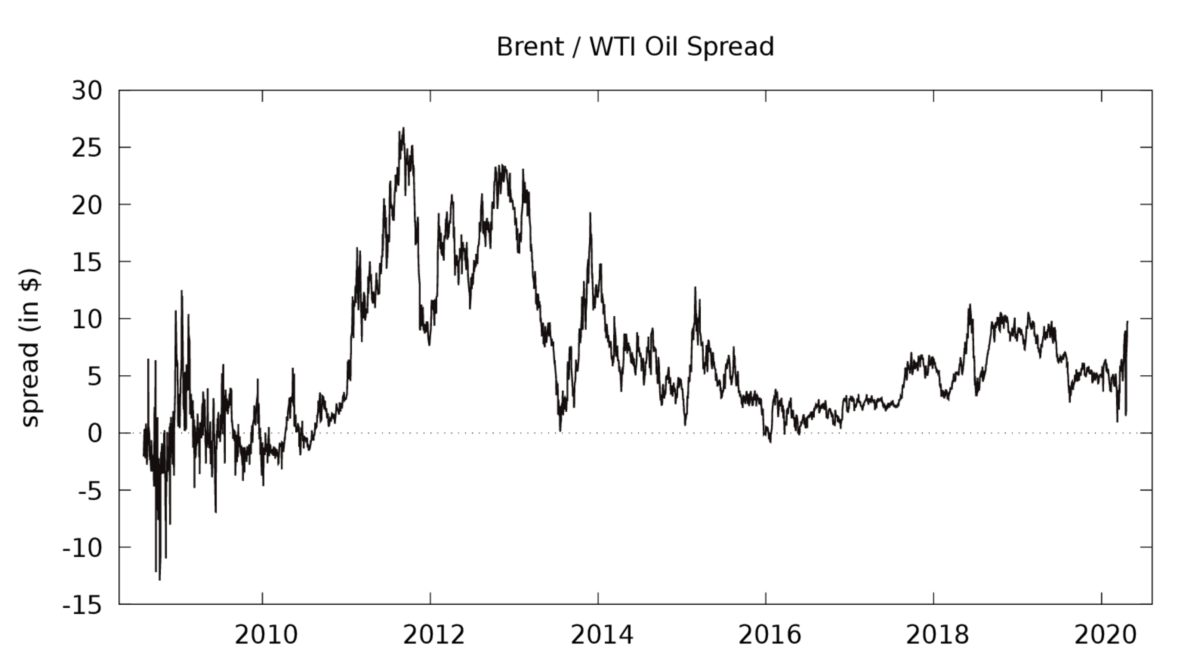

When I wrote this column a month ago, there were 335,000 cases of Covid-19, spread around 213 countries, and 14,500 lives lost. One month later, at the time of writing, there are 2,860,000 cases, hitting 213 countries and which have thus far resulted in the deaths of 196,000 people. The numbers are ugly, as they show an exponential growth of cases and casualties induced by an unknown enemy that we cannot see or kill. Lockdowns and travel restrictions across the world aimed at containing the spread of Covid-19 have been effective but have closed parts of countries, thus contributing to the oil glut. But the global lockdown isn’t solely to blame for low oil prices. Saudi Arabia has committed to break every other oil producer, particularly Russia. Instead of reaching an agreement to cut production, Saudi Arabia and Russia entered into a price war, pumping ever more oil into an overflowing market. With the global economy at a standstill, it took just a few weeks before Cushing was stuffed with unneeded oil barrels, raising storage concerns for the near future. This pushed the price of WTI oil to unprecedented low levels. The case for Brent oil is less dramatic because it is stored in vessels that make their way across the world. As a consequence, the Brent – WTI spread is rising quickly.

In the meantime, there are some positive developments for the oil market: a retreat of Covid-19, the agreement to cut oil production and the approval of several packages of financial aid for the economy across the globe.

The number of new cases of Covid-19 is declining in Europe and in the US. Confinement measures are being relaxed, allowing people to return to their business, even if only slowly and gradually. Pressed by a collapsing energy industry, Donald Trump turned into the de facto OPEC president, as he effectively guided Saudi Arabia and Russia towards reaching an agreement to cut oil production. OPEC agreed to cut 9.7 million barrels a day in May and June, which roughly corresponds to 10% of global supply. Other non-OPEC countries, including the US, are also cutting production. In terms of government intervention, the US has approved several packages to boost the economy and the EU has the support of Germany to agree on a substantial economic-aid package. A return to normality, a substantial cut in oil production and wide agreement to approve economic-revival packages in Europe and the US are positive points for the oil market.

At the time of writing, Brent and WTI oil are trading near $23.80 and $19.35 respectively. I don’t expect oil prices to recover overnight, as global demand will stay low for some time. The pandemic is not over yet and there’s a risk of a false restart of the economy leading to a second wave of contagion. Still, there’s not much room for lower oil prices. At the current levels most oil businesses are unprofitable. Even the likes of Saudi Arabia have already needed to tap debt markets to balance their budgets. If prices stay low, further production cuts are expected.

My investment thesis

The key points that guide me to choose the best energy/oil ETFs can be summarised as follows:

- Oil prices are at very low levels by historical standards. If oil prices were to remain at these levels for long, they would make every oil business and every producer unprofitable. OPEC would likely cut production again and again until prices returned to a reasonable level, which certainly isn’t between $10 and $30. Historically, prices have soon reverted their trajectory when hitting these low levels. For these reasons, I believe it is worth tilting a portfolio towards oil and energy at this point.

- The Covid-19 pandemic is weakening but may last for longer than expected or lead to a second wave of contagion. We should be careful. While prices may have reached a low, global oil demand may remain subdued for quite some time, thus eroding the prospects for an easy rebalancing of the oil market. For this reason, and to remain on the safe side, I see the oil opportunity as a medium-to-long-term opportunity and not a short-term speculation.

- The stock of oil at Cushing is large and will take time to normalise. Unlike contracts for Brent which are settled in cash, contracts for WTI require that its holders take delivery of barrels when the contract expires, which usually occurs at Cushing. Some ETFs invest large amounts in these contracts and are willing to pay any price to get rid of contracts near their expiry date. This is a good reason to avoid all oil ETFs trading WTI futures contracts. It’s likely that next month will see another round of ‘madness’ in the futures market, which increases risk to investors unnecessarily. There are other ways to profit from an oil-price rise.

- Equity prices cannot decline below zero. Investing in the stock of oil/energy companies offers limited liability to investors and is much less exposed to the physical delivery madness.

- While the pandemic is improving, an economic recession is unavoidable. The recession may be V-shaped but is unavoidable. Smaller energy companies will find it difficult to find the necessary financing to weather these hard times. The larger, more established companies have the financial strength to surpass this difficult period and regain market share after the market rebalances.

- Hard assets are less exposed to volatility than paper assets. That’s the case with gold, money and other commodities. The futures market allows trading of more oil than there is available for delivery. This leads to wild swings in prices. At the same time, most ETFs that invest in oil do so through the futures market. They don’t own the hard asset, just on paper, and then they have to roll the contracts several times per year. When the market is in contango (futures contracts a few months out trade at a higher price than those expiring in the near term) it is expensive to roll these contracts. That’s why these ETFs are poor long-term investments.

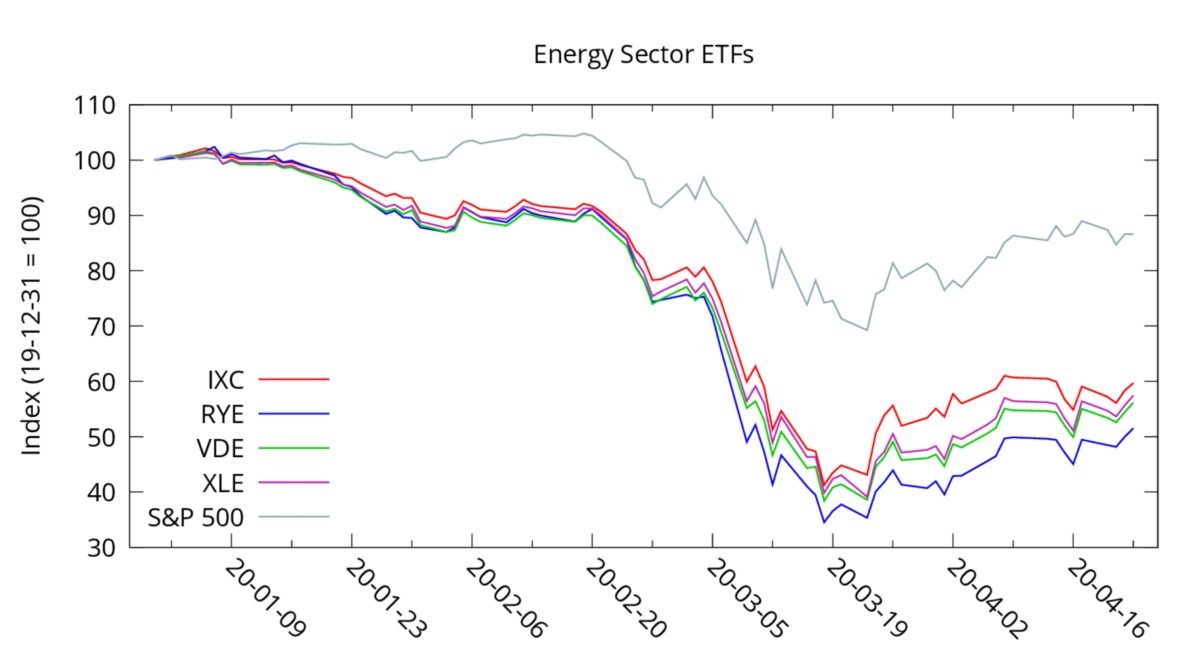

Four energy ETFs to cover all angles

There are several ways of getting exposure to oil using an ETF. Following my investment thesis described above, I avoid all ETFs investing in ‘paper’ oil through the futures market and look only at the ETFs investing in the companies that produce the hard asset. From that pack I prefer those investing in larger caps for the reasons described. Even so, that’s not enough to shrink the offer to just a handful of ETFs. I suggest four ETFs, which are well established, have reasonably low expenses, are highly liquid and cover different parts of the market. Other options may be sound as well.

Energy Select Sector SPDR ETF (NYSEARCA:XLE)

Created in 1998 and with $8,512m of assets under management, the Energy Select Sector SPDR (XLE) is the oldest and largest energy/oil ETF. XLE offers exposure to the largest energy/oil companies from the US, which are among the world’s largest oil producers. Its largest holdings include Chevron (24%), Exxon Mobil (22%), EOG Resources (5%) and ConocoPhillips (5%). In total, the fund invests in 28 companies.

XLE is in line with my investment thesis described above. It invests in hard assets instead of paper oil. It is concentrated in the major players in the industry, ie those which are unlikely to go out of business with the current low oil prices and which can eventually improve their market share as smaller companies go out of business. XLE has an additional favourable point, which is its low expense ratio of just 0.13%. There are cheaper funds but none with the liquidity of this one.

However, there are three important points to consider before investing. First, this fund is a regional play, which only invests in US-based companies. There are major oil players in the UK, France, the Netherlands and other countries that may be worth considering at this point. Second, the fund has only 28 holdings in total, which means it is not overly diversified. Third, and still on the diversification front, the two top holdings account for 46% of the portfolio holdings, which is a huge concentration. Notwithstanding all this, XLE should be at the top of investors’ preferences.

Vanguard Energy ETF (NYSEARCA:VDE)

For those concerned with the diversification issues of XLE, the Vanguard Energy ETF (VDE) may offer some relief, as it offers a broader exposure to the US market, investing in the stocks of 131 companies. At the same time, the fund is still concentrated around large caps, has a respectable $2,526m of assets under management and was established long ago, in 2004.

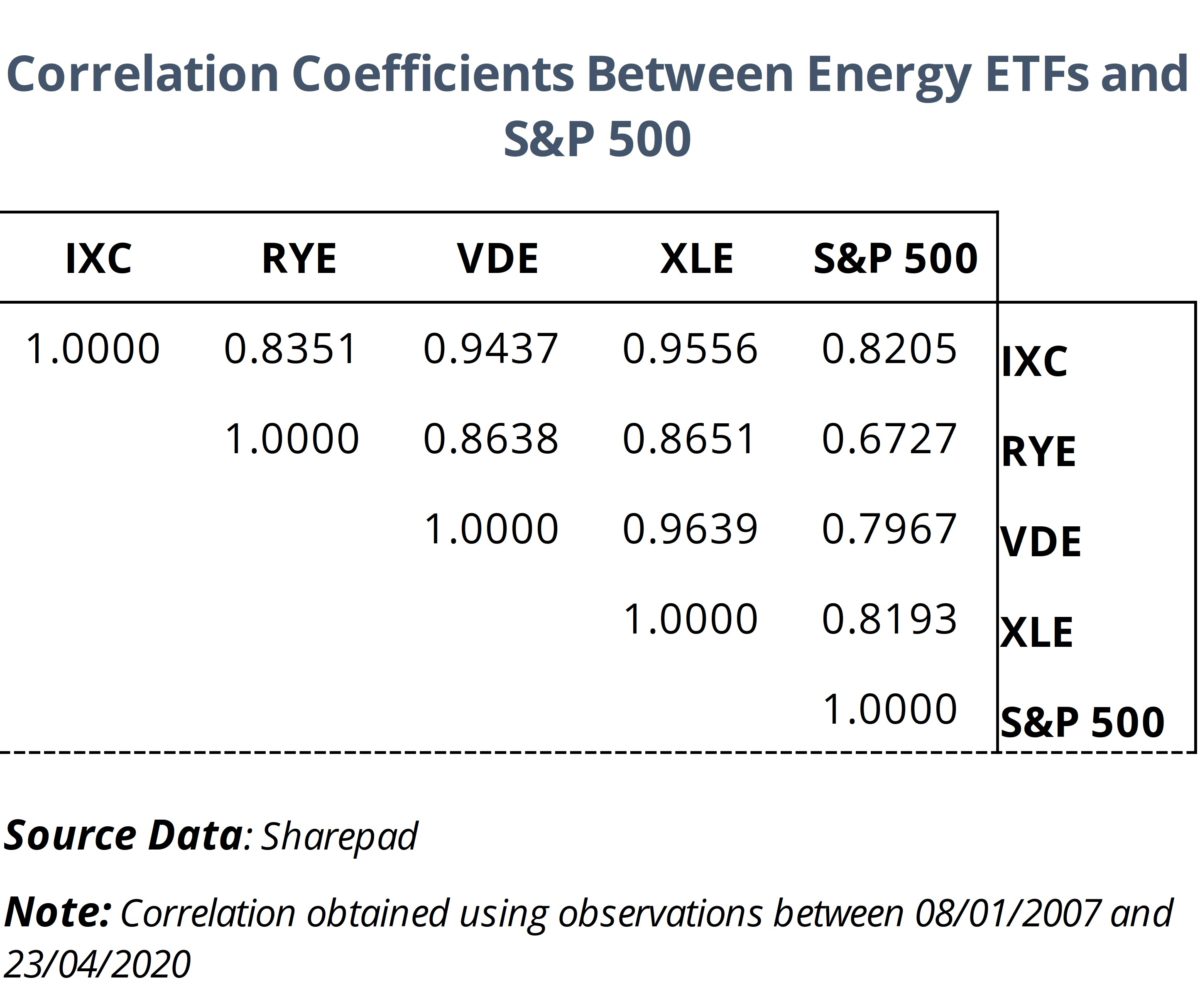

Nevertheless, while more diversified than XLE, the fund is still concentrated in Chevron and Exxon Mobil, which represent 47% of the fund’s holdings. This concentration leads us to ask one question: how much does it really depart from XLE? VDE invests almost 90% of its funds in the same companies that XLE does. There’s only 10% of the funds left to invest in the remaining companies. It doesn’t come as a surprise that the correlation between XLE and VDE is 0.964 over the long term.

Thus, in the end, investors shouldn’t expect a significant improvement in diversification by replacing XLE with VDE. However, there’s some minor improvement and the lower expense ratio may favour this ETF. Liquidity is still very good for VDE.

Invesco S&P 500 Equal Weight Energy ETF (NYSEARCA:RYE)

The Invesco S&P 500 Equal Weight Energy ETF holds exactly the same stocks as XLE but in different proportions. The aim here is to keep an equal weighting in order to give proper weighting to smaller capitalisations. In comparison to XLE, RYE has an underweight exposure to the giant energy stocks, tilting the portfolio average towards midcaps. Academic research has shown that smaller firms tend to outperform larger ones over the longer term. This way investors can benefit from the size factor while playing the energy/oil market. Investors concerned with the fact Chevron plus Exxon Mobil account for almost half of the holding of XLE (and also VDE) get some relief with RYE, as the sum of the holdings for the two is just 9%. Equal weighting comes at a cost though. There’s a need to rebalance the portfolio from time to time. Rebalancing means higher expenses, which come in the form of an expense ratio of 0.40%.

One favourable point to consider is that RYE is the ETF least correlated with all others considered here and the least correlated with the S&P 500. This is interesting, in particular for investors looking to invest in a new layer tilted towards energy/oil while still keeping a broad market exposure.

iShares S&P Global Energy Sector ETF (NYSEARCA:IXC)

The iShares S&P Global Energy Sector ETF (IXC) is my fourth option, which departs from the previous three in terms of its broader global exposure instead of a regional US exposure. IXC still shows a large exposure of 26% to Chevron and Exxon Mobil, but this is a much lower exposure than that of XLE or VDE. Investors looking for global diversity can get an exposure to energy giants like Total, BP and Royal Dutch Shell that are not present in any of the above three ETFs. IXC was created in 2001, invests in largecaps and comes with an expense ratio of 0.46%.

A few ETFs to avoid

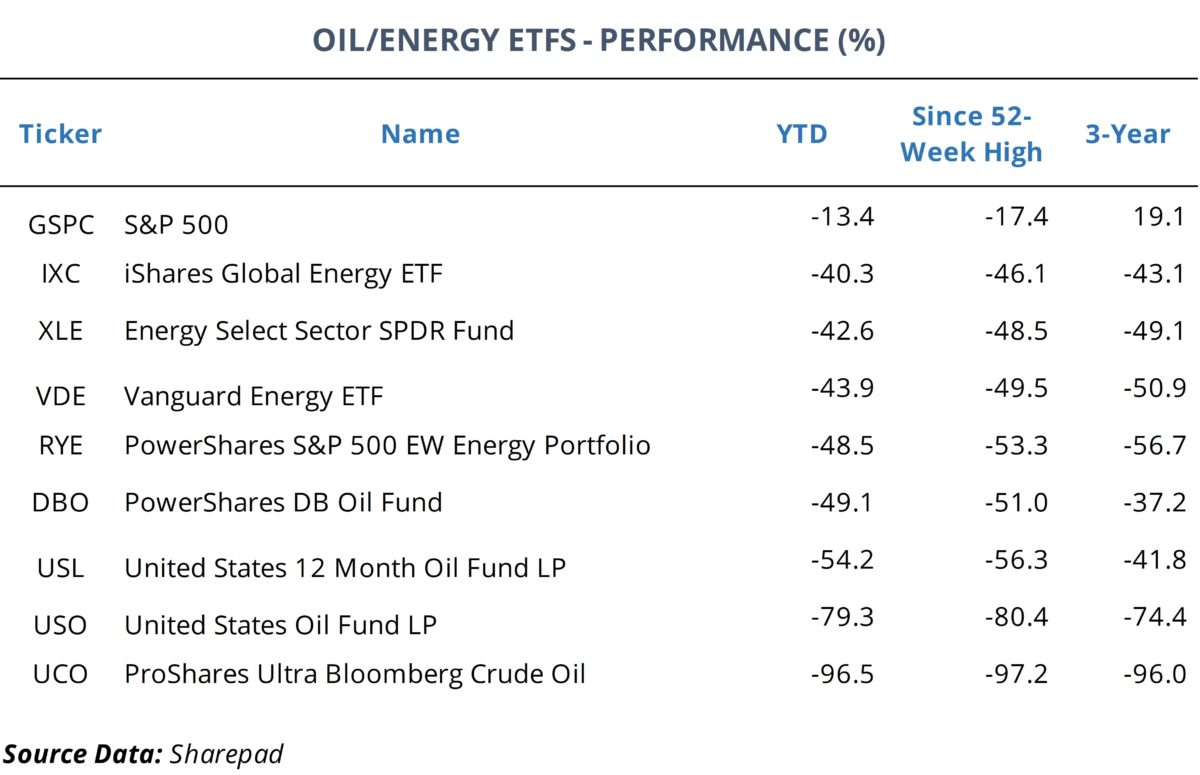

With an average volume above 125 million, the United States Oil Fund (NYSEARCA:USO) is the most traded energy/oil ETF. USO is designed to track the daily price movements of WTI oil. For that purpose, USO invests primarily in crude oil futures contracts and other oil-related futures contracts. USO invests in paper oil and does everything to get rid of any contract near its expiry date, including closing oil positions at negative prices. This raises the spectre of unlimited losses for investors. Between 8 April and 21 April (when the market hit negative values), the fund saw its price drop from 538c to 280c, a 48% decline. Upon the event of negative pricing, the fund managers said they were replacing short-term contracts with longer-dated contracts. Still, given USO holds a substantial part of the total outstanding futures contracts, I would prefer to stay clear. The same applies to the United States 12 Month Oil Fund (NYSEARCA:USL). While USL invests in longer-term future contracts, it is still exposed to the ups and downs of a market that is far from stabilised. At the same time, the WTI benchmark that these funds track has been more volatile than the Brent benchmark.

Final words

Low oil prices, in particular below $20 as is the case for WTI oil, are unlikely to remain with us for a long period of time. However, we’re not sure about how deep the recession created by Covid-19 will be and therefore any bet placed in the oil market should not target the shortterm. With this in mind, it’s better to avoid ETFs heavily relying on the futures market, as they face higher volatility and steep costs to roll positions. Following in the footsteps of last month’s take, I don’t think it’s time to ‘bet the house’ but rather to just tilt our portfolio towards the nascent opportunities. I strongly believe that the world will replace oil by cleaner energies over time. However, we shouldn’t discard oil for now. At the same time, the four ETFs I suggest above are not pure oil plays, as they invest in energy conglomerates, which are giant companies dedicated to everything energy-related, not just oil. These companies will weather the current crisis much better than smaller companies and will adapt to a cleaner future.

GAS……you have forgotten this………….

What happens to natural gas when most of the shale drillers stop and shut wells?

Think about a 5 – 20 BCF gas deficit by the end of winter 2020/21………………………..

That will shake up the UK prices and the EU.

Worth thinking about and also keep an eye on the Baker Huges oil rig count in the US,