Activision Blizzard fights back

The video-game industry is more profitable than ever before. But free-to-play games may undermine blockbuster gaming franchises. Activision Blizzard is fighting back with free-to-play and mobile versions of its most popular franchise, Call of Duty, writes Andrew Latto.

The video gaming market is no longer just middle-class kids in developed countries. Online and mobile gaming means that the addressable market is in the billions. For instance, video-game company Activision Blizzard used to sell into 40 countries but now targets over 200 countries.

Video-gaming stocks are driven by the strength of their gaming franchises. Popular games can support sequels that are nearly always commercial hits. It is analogous to owning a blockbuster movie franchise like Star Wars.

The profit margins of major gaming companies have increased significantly due to digital game distribution. Mobile gaming is now the largest part of the industry with smartphone and tablet gaming experiencing rapid growth since 2007.

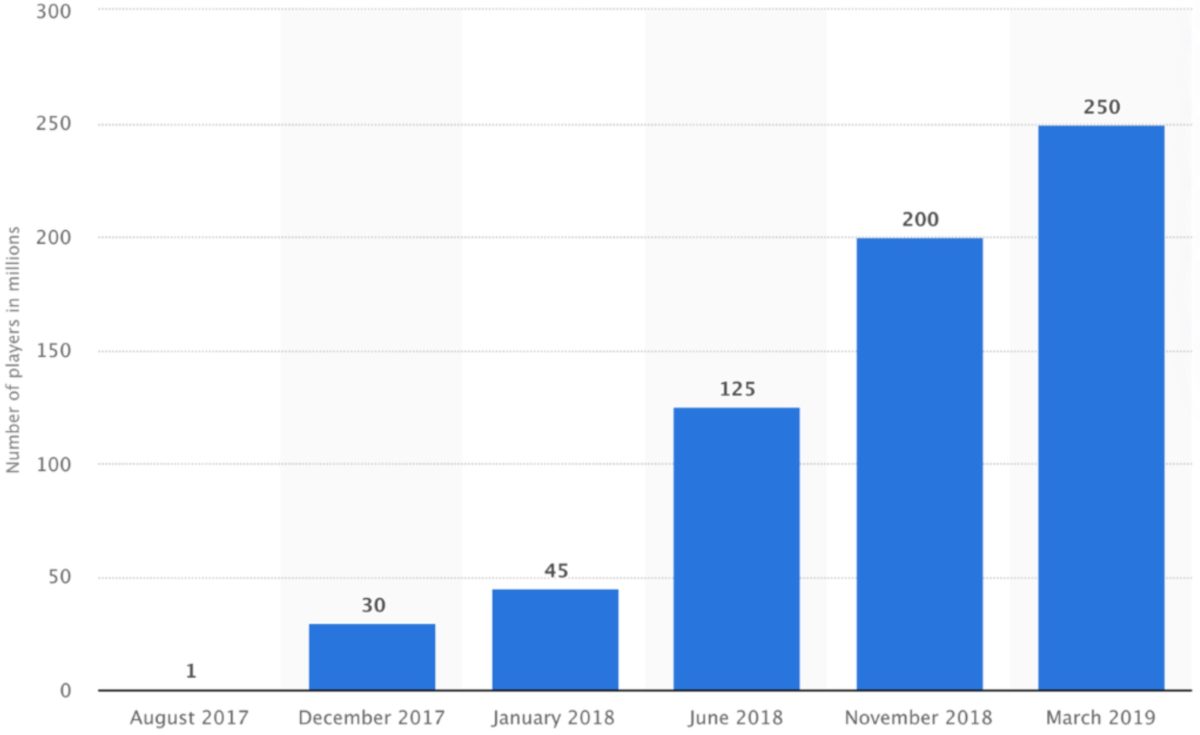

A recent development has been the success of the free-to-play game Fortnite, which was launched in 2017. Fortnite had 250 million players in March 2019 and has generated billions in revenue through in-game purchases.

Activision Blizzard is the largest US-listed video-gaming group and owns the Call of Duty (COD), World of Warcraft and Candy Crush franchises. The company’s challenge is to grow revenue while the free-to-play gaming model becomes more popular.

Activision Blizzard’s three divisions

| 2019 | Activision | Blizzard | King |

| Segment net revenue | $2.22bn | $1.68bn | $2.03bn |

| Operating income | $850m | $464m | $740m |

| Franchises | Call of Duty, Skylanders, Tony Hawk’s Pro Skater. | World of Warcraft, Diablo, Overwatch, Starcraft, Heroes of the Storm, Hearthstone. | Candy Crush, Farm Heroes, Pet Rescue, Bubble Witch. |

Source: Activision Blizzard

Activision Blizzard’s backdrop

Activision Blizzard was founded by ex-Atari developers in 1979. The business was revitalised in 1991, when new investors led by current chief executive, Bobby Kotick, took control. Kotick is one of the longest-serving corporate leaders in the US

Activision Blizzard’s three divisions are Activision, Blizzard and King. Activision is the most important driver thanks to the COD franchise. The first-person ‘shooter’ was first launched in 2003 and is one of the most successful video games in history.

Activision Blizzard’s gaming franchises

Source: Activision Blizzard

Blizzard owns the World of Warcraft, Diablo, Starcraft and Overwatch franchises. World of Warcraft was launched in 2004 and is a popular multiplayer, online role-playing game. Overwatch is a team-based, first-person shooter that is also popular as an e-sport.

King owns the popular mobile-gaming franchise Candy Crush along with Pet Rescue and Farm Heroes. Candy Crush is one of the biggest mobile-gaming brands in terms of gross daily revenue on Apple’s USA App Store (March 2020).

Activision Blizzard History

| 1979 | Founded by ex-Atari game developers. |

| 1983-88 | Video-gaming crash. |

| 1991 | New investors led by Bobby Kotick . |

| 2003 | Call of Duty franchise launched. |

| 2004 | Blizzard launches World of Warcraft. |

| 2008 | Activision merges with Blizzard. |

| 2016 | Buys King Digital for US$5.9bn |

Activision Blizzard breakdown

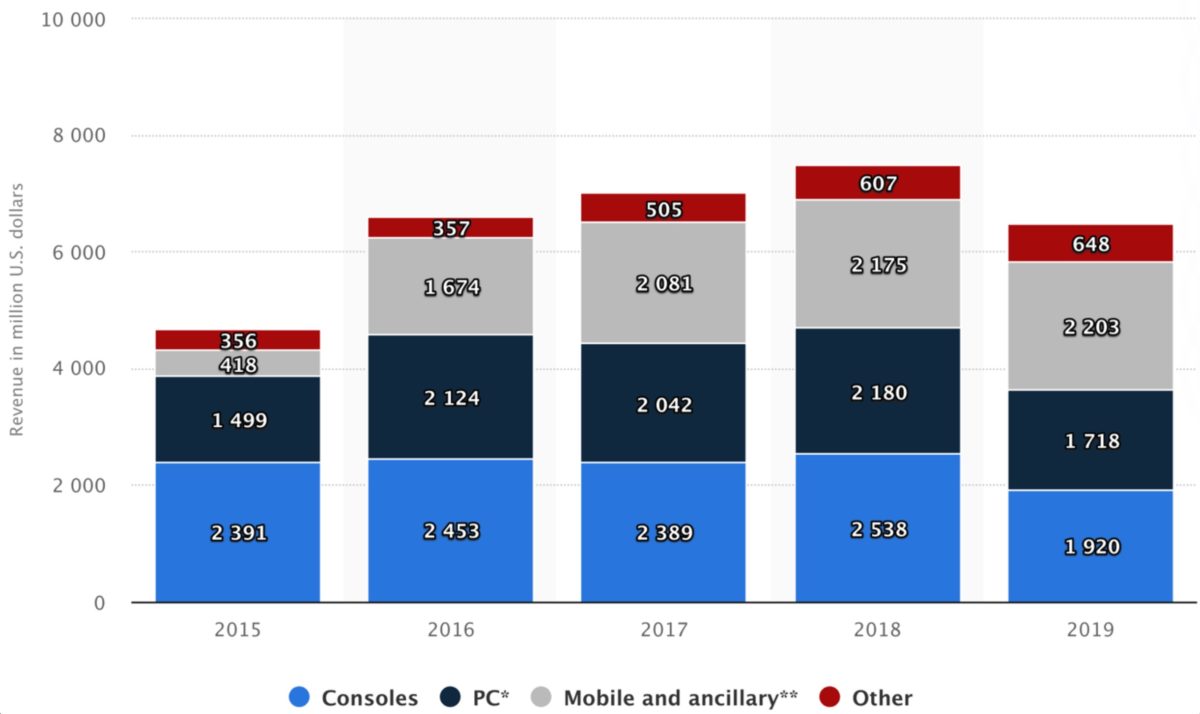

Activision Blizzard has historically been focused on console and PC games, with the two platforms generating 63% of revenue in 2017. But they both accounted for 56% in 2019 as revenue from mobile gaming increased to 34% of the mix.

Console and PC gaming is more expensive for gamers and less accessible than mobile gaming. But it does offer a more immersive gaming experience. Mobile gaming has helped to attract casual gamers through titles like Angry Birds and Candy Crush.

Activision Blizzard revenue by platform

| 2019 | 2018 | 2017 | |

| Console | 30% | 34% | 34% |

| PC | 26% | 29% | 29% |

| Mobile | 34% | 29% | 30% |

| Other | 10% | 8% | 7% |

Source: Activision Blizzard

Activision Blizzard’s ‘other’ revenue category accounted for 10% of total revenue in 2019, in comparison with 7% in 2017. It includes revenue from the group’s studios and distribution business as well as revenue from major league gaming and the Overwatch League.

E-sports involves organised competitions between gamers and has grown rapidly since 2012 to US$1bn in global revenue for the industry last year. Activision Blizzard is hopeful that esports will “help solidify the enduring appeal of our franchises.”

Activision Blizzard revenue by platform: 2015 – 2019

Source: https://www.statista.com/statistics/269667/activision-blizzards-revenue-by-platform/

On a regional basis, the Americas generated 51% of Activision’s revenue in 2019, while the Asia Pacific region accounted for 14% of revenue. It is notable that in the fourth quarter of 2019, Asia Pacific generated 17% of Activision Blizzard’s revenue.

The release of COD Mobile on 1 October 2019 may have been responsible for the increased importance of the Asia-Pacific region. China is the world’s largest gaming market and has historically been driven by mobile gaming.

Activision Blizzard revenue by geography

| Q4 2019 | 2019 | 2018 | 2017 | |

| Americas | 47% | 51% | 52% | 51% |

| EMEA | 36% | 35% | 35% | 35% |

| Asia Pacific | 17% | 14% | 13% | 13% |

Source: Activision Blizzard

The way we buy games has changed, with traditional high-street gaming retailers, like Gamestop, in decline. Activision Blizzard generates over three quarters of revenue from the digital online channel, with retail only 16% of revenue in 2019.

Activision Blizzard revenue by channel

| 2019 | 2018 | 2017 | |

| Digital online | 76% | 77% | 78% |

| Retail | 14% | 15% | 15% |

| Other | 10% | 8% | 7% |

Source: Activision Blizzard

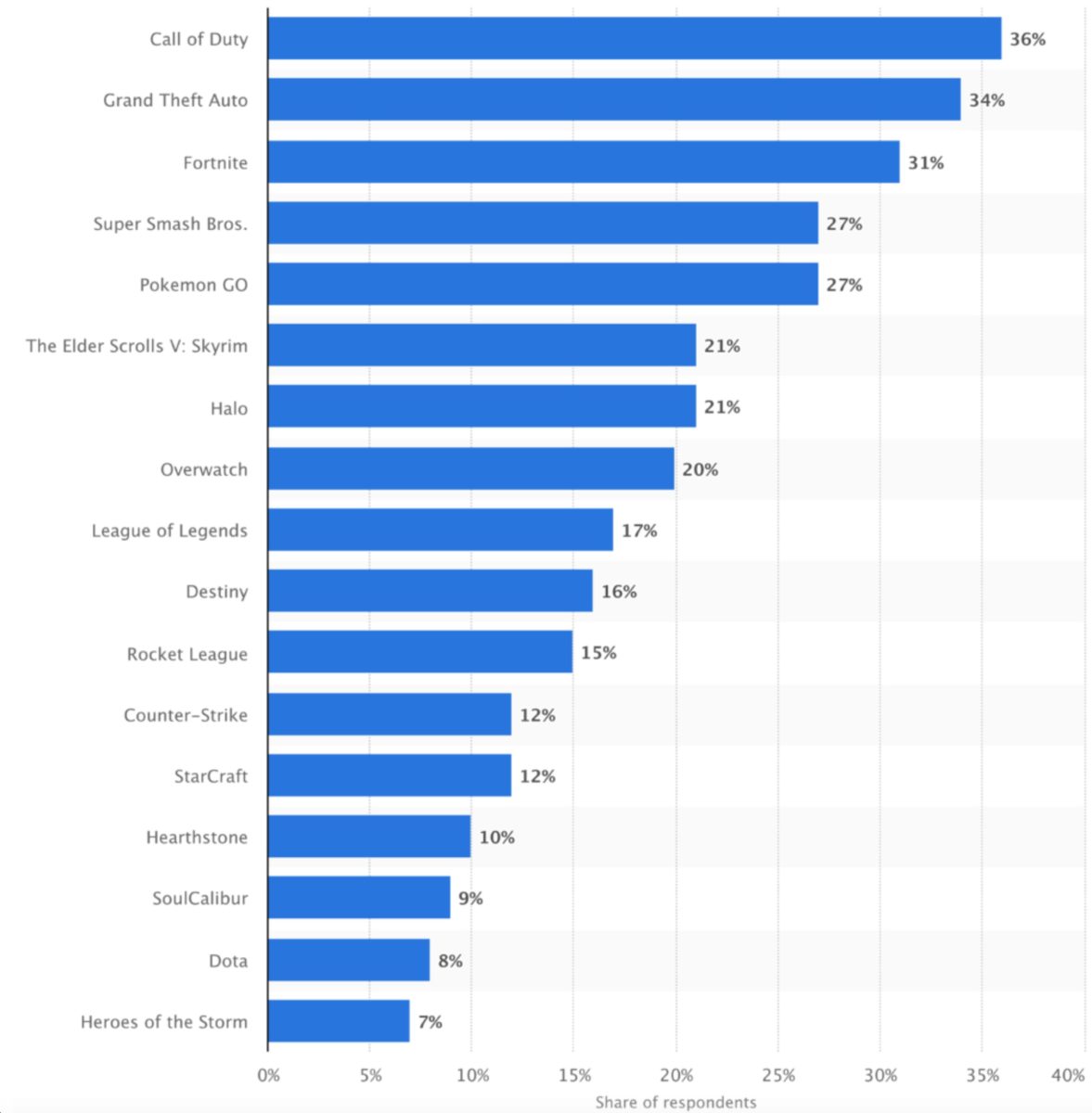

USA gamers: most popular games

In a 2019 survey of 994 US gamers, COD came out on top, with 36% of gamers playing it. The second most popular game was Grand Theft Auto (34% of gamers) and Fortnite was in third place, with 31% of gamers.

Fortnite has overtaken established franchises to become one of the top three games in just a few years. Popular Blizzard titles were Overwatch (20% of gamers), StarCraft (12%), Hearthstone (10%) and Heroes of the Storm (7%).

In terms of mobile games, Candy Crush Saga was in the lead in terms of revenue generation from Apple’s App Store in March 2020. Fortnite was in seventh place, with the game more popular to play on a console or PC.

Most popular video games with US gamers in 2019 survey

Source: https://www.statista.com/statistics/1079072/most-popular-video-games/

Fortnite’s success

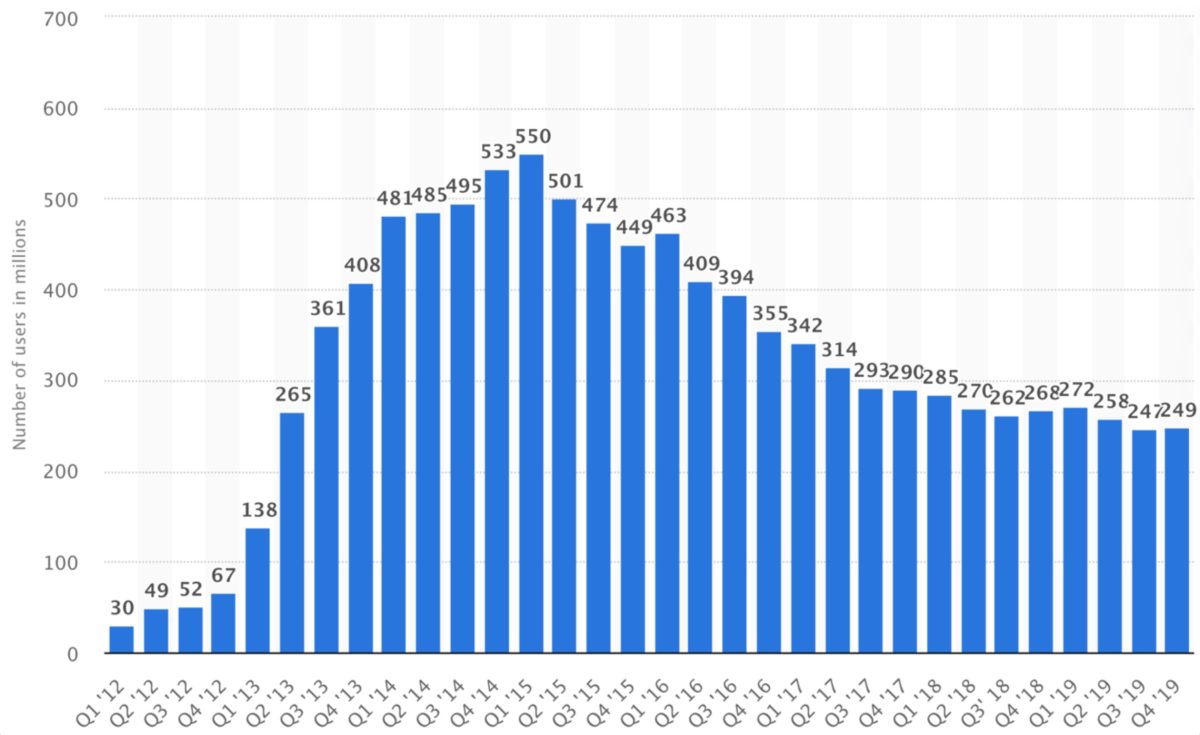

Fortnite was launched by EPIC Games in 2017 and has been described as a ‘cultural phenomenon.’ It had 30m registered users at the end of 2017 and this had increased to 250m registered users in March 2019.

The most popular version of Fortnite is Battle Royale, which attracted 100m users in less than a year. The Battle Royale format sees players battle it out with the winner the last one left alive.

Fortnite is popular with younger players, and in particular schoolchildren, who like the social side of the game. There are lots of opportunities within the game to spend money and it is estimated to have generated US$2.4bn revenue in 2018.

Seventy percent of Fortnite players make in-game purchases and spend an average of US$85. For many gamers, free-to-play games may end up being more expensive than games that are purchased outright.

Number of Fortnite players (millions)

Source: https://www.statista.com/statistics/746230/fortnite-players/

Call of Duty fights back

Fortnite may pose the greatest threat to the COD franchise, with both of the games first-person shooters. A free-to-play version, Call of Duty: Warzone, was released on 10 March and includes the popular Battle Royale format.

COD Warzone achieved 50 million downloads in the first month of release and the scope for revenue generation will be closely watched. The risk is that the free-to-play version of COD cannibalises the pay-up-front version of the game.

Activision Blizzard released its first mobile version of COD for iOS and Android on 1 October 2019. The free-to-play game saw 148 million downloads in the first month and US$54m in revenue.

If the free-to-play gaming model is the way forward, the challenge is to make it as profitable as the current model. Fortnite may be the exception rather than the norm in terms of making free-to-play games generate revenue.

| Release date | Type | Format | |

| Call of Duty Mobile | 1 October 2019 | Free-to-Play | Mobile |

| Call of Duty: Modern Warfare | 25 October 2019 | Upfront payment | PC/Console |

| Call of Duty: Warzone | 10 March 2020 | Free-to-Play with Battle Royale | PC/Console |

Source: Activision

Call of Duty Warzone

Source: Activision

Call of Duty Modern Warfare

The mainstay of the COD franchise is the pay upfront console and PC version of the game. The latest sequel, Call of Duty Modern Warfare, has performed well since it was launched on 25 October 2019.

In the first three days of release the game earned over US$600m, making it the best digital opening in Activision’s history. On 18 December 2019, Activision confirmed that it had earned over US$1bn in revenue.

Modern Warfare scored well with reviewers; it was awarded 8.75/10 by Game Informer and 7/10 by GameSpot. But the risk with any long-established game is that franchise fatigue sets in and players move on to the next big thing.

Source: https://www.statista.com/chart/19774/all-time-unit-sales-of-titles-in-the-call-of-duty-franchise/

COD Modern Warfare used a new development engine that allows for more detailed environments. The COD pay upfront franchise follows a two-to-three-year development cycle to support quality and innovation.

Different sequels of COD have achieved different levels of success. COD Black Ops saw 30.72 million units sold while World at War saw only 15.94 million units sold. The next sequel in the franchise is set to be launched later this year.

World of Warcraft and King

World of Warcraft requires a subscription for continuous play and had earned US$9.23 bn in revenue by 2017. The last expansion for World of Warcraft was released in 2018 and a new expansion should be released this year.

The King division sells mobile games that are popular with casual gamers and generates revenue from microtransactions and in-game advertising. The US$5.9bn that Activision Blizzard paid for King in 2016 appears to have been a good investment.

World of Warcraft: Battle for Azeroth

Source: Blizzard

Gamer engagement

Activision Blizzard tracks monthly active users for each of its three divisions. Monthly active users for King declined from 449 million in Q4 2015 to 249 million in Q4 2019. This raises questions on the resilience of the Candy Crush gaming franchise.

Monthly active users for Blizzard are down from 41 million in Q4 2016 to 32 million in Q4 2019. Blizzard was impacted by the release of World of Warcraft: Battle for Azeroth in August 2018 with no comparable release in 2019.

Activision has seen an improvement on the back of COD Mobile and COD Modern Warfare. Monthly active users were 128 million in Q4 2019 versus 55 million in Q4 2015. But mobile gamers are likely to be less profitable for COD.

Monthly active users (millions)

| Q4 2019 | Q4 2018 | Q4 2017 | Q4 2016 | Q4 2015 | |

| Activision | 128 | 53 | 55 | 51 | 55 |

| Blizzard | 32 | 35 | 40 | 41 | 26 |

| King | 249 | 268 | 290 | 355 | 449 |

| Total | 409 | 356 | 385 | 447 | 530 |

Source: Activision Blizzard

King monthly active users (millions)

Source: https://www.statista.com/statistics/281595/king-digital-entertainment-quarterly-mau/

Activision Blizzard in 2019

Activision Blizzard’s three divisions all experienced weakness in 2019. Blizzard experienced a 25% decline in revenue and King experienced a 3% decline. Activision saw revenue decline 10% despite the success of COD Modern Warfare in Q4 2019.

This backdrop reflects a mixed year for new game releases, but it may also be indicative of longer-term challenges. Activision Blizzard stated that: “…our 2019 results were impacted by poor execution managing our content pipeline.”

Divisional drivers in 2019

| Net revenue | % change | Operating income | % change | |

| Activision | US$2.22bn | -10% | US$850m | -16% |

| Blizzard | US$1.68bn | -25% | US$464m | -32% |

| King | US$2.03bn | -3% | US$740m | -1% |

| Group total* | US$6.49bn | -13% | US$1.61bn | -19% |

Source: Activision Blizzard *Includes revenue from non-reportable segments.

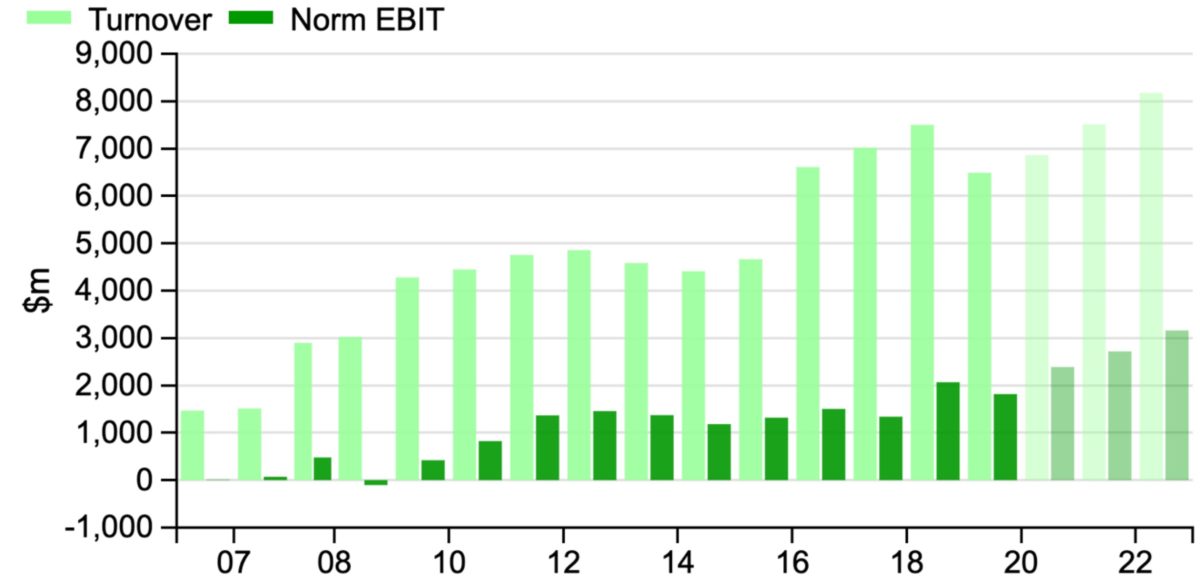

Financial backdrop

Activision Blizzard’s overall revenue declined by 13% in 2019 to US$6.49bn and operating income fell 19% to US$1.61bn. This follows a record year in 2018 when revenue hit US$7.5bn and operating income came in at US$2bn.

Activision Blizzard’s 2020 guidance is for a marginal decline in revenue but analyst forecasts are for 5.8% growth. Much depends on how the slate of new games are received and whether the free-to-play model proves to be lucrative.

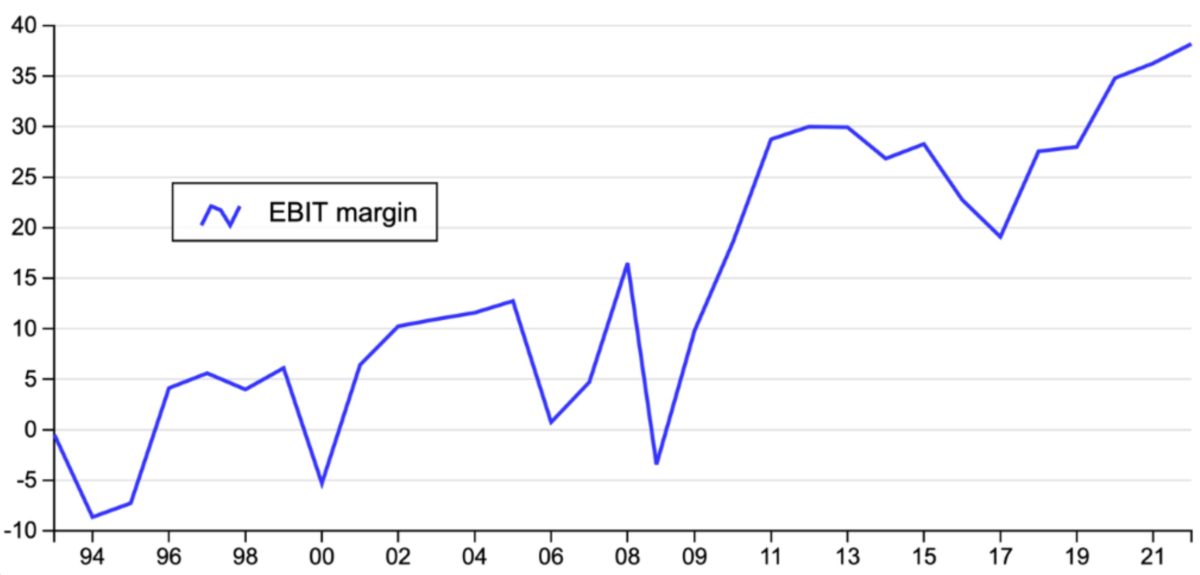

Activision Blizzard’s EBIT profit margin hit 28% in 2019 and is expected to increase to 38.2% in 2022. The dramatic improvement is the result of digital distribution and the related ability to generate new revenue streams from customers.

Activision Blizzard becomes more profitable

Source: SharePad

Activision Blizzard’s financial track record

Source: SharePad

Summary

The video-game industry is more profitable than ever before. But free-to-play games may undermine blockbuster gaming franchises. Activision Blizzard is fighting back with free-to-play and mobile versions of its most popular franchise, Call of Duty.

Activision Blizzard stated in its 2019 results: “We see a clear path to unlock the vast potential within our portfolio of fully owned intellectual property, delivering the growth and superior financial performance that our stakeholders rightly expect.”

Comments (0)