Small-cap bounce back – pharma stocks fighting COVID-19

Richard Gill, CFA, looks at three companies which are leading the fight against Covid-19 and look to have good growth prospects.

In the midst of the February/March stock-market plunge, I wrote in last month’s Master Investor Magazine that, “… market corrections like this can provide great opportunities for investors with a long-term focus”. As luck would have it, those brave enough to buy during the coronavirus-driven panic have already seen decent returns from small caps. Since bottoming out at around 591 points on 19 March, the AIM All-Share index has recovered to 813 − a gain of 38% in six weeks. We are, however, still short of last September’s 12-year high of around 1,108.

The three companies I covered last month have also performed well. Drinks seller Nichols (LON:NCHL) is up from 1,168p to 1,250p after announcing that trading in the first two months of the financial year was in line with management expectations. However, to preserve cash it has cancelled its final dividend payment, saving £10.4m over the seasonally critical spring and summer period. The star performer was video-advertising technology firm Tremor International (LON:TRMR). Its shares surged from 114p to 144.5p after announcing a strong set of numbers for 2019 and revealing a share buy-back of $10m. Finally, property developer Conygar (LON:CIC) rose from 108.5p to 114p after implementing its own share-buyback programme, looking to take advantage of the current substantial discount to net assets.

In the wider market, no less than 33 AIM listed companies have doubled in value since 1 April. Interestingly, but perhaps not surprisingly, a third of these companies operate in the pharma, biotech and medical equipment and services sectors. This month, I take look at three of these companies, all of which are leading the fight against Covid-19 and look to have good growth prospects. As with all early-stage health care companies however, investors should be aware that they remain highly speculative and primarily focused on long-term outcomes.

4D Pharma

Founded in February 2014, AIM-listed 4D Pharma (LON:DDDD), is a company focused on the development of live biotherapeutics. These are a novel and emerging class of drugs, defined by the US Food & Drug Administration (FDA) as biological products that contain a live organism, such as a bacterium, that is applicable to the prevention, treatment or cure of a disease. This offers a new way to create safe and effective treatments for patients and the opportunity to treat diseases that existing therapies are unable to effectively address.

The company’s live biotherapeutic products are strains of gut bacteria which have been isolated from healthy human donors. A proprietary library of several thousand strains has been built up over the years. These are grown in the company’s 1,500 m2 CGMP-certified manufacturing facility, then encapsulated, administered orally and delivered selectively to the gut, where they exert their therapeutic effects.

To speed up the development process, 4D Pharma has developed a proprietary platform called MicroRx® that identifies live biotherapeutics in the company’s library that have therapeutically relevant effects, based on their efficacy and ability to be rapidly translated into a drug. Using the platform, the company has generated development programmes in a number of therapeutic areas including immuno-oncology, gastro-intestinal, respiratory, autoimmune and CNS disease. A number of clinical trials on various candidates have been completed or are currently ongoing.

Gut news

On 20 April, shares in 4D Pharma surged by over 60% after the company announced it had received expedited acceptance from the UK Medicines and Healthcare products Regulatory Agency (MHRA) to commence a Phase II study of its candidate MRx-4DP0004 in patients with Covid-19. The drug is an orally administered, single-strain live biotherapeutic, which is currently in a Phase I/II clinical trial for the treatment of patients with partly-controlled asthma.

The new trial will be a randomised, double-blind, placebo-controlled study looking to evaluate the efficacy and safety of MRx-4DP0004 in up to 90 patients in the UK hospitalised with symptoms indicative of Covid-19. Eligible participants will be randomised 2:1 to receive 14 days of treatment with either MRx-4DP0004 or a placebo and be monitored daily for improvement or progression of Covid-19 symptoms and adverse events.

The company’s key focus over the coming weeks will be initiating the trial as soon as possible, with its chief scientific officer, Alex Stevenson commenting: “If MRx-4DP0004 is successful in this study it would represent a highly significant breakthrough in the global fight against the novel coronavirus pandemic.”

MRx-4DP0004 is seen as a particularly attractive candidate for Covid-19 patients as it may potentially prevent or delay their progression to requiring ventilation and intensive care. While it is very early days, encouraging results have already been seen in the asthma trial, where 20 patients have been dosed to date, with no drug-related, serious adverse events. In pre-clinical studies MRx-4DP0004 has shown it can significantly reduce lung inflammation and impact particular immune cell types and pathways which have more recently been implicated in the hyperinflammatory response to Covid-19.

Healthy newsflow

Shares in 4D Pharma have surged from 23.5p in March (an all-time low) to a current 72p, capitalising the company at £79m − yet the shares remain well down on recent levels, having reached more than 100p as recently as early February.

Investors will be keenly awaiting news on the Covid-19 trial. But elsewhere there should be a healthy flow of news from five other clinical studies in progress, along with a number of pre-clinical stage programmes. The main study is a Phase II clinical trial evaluating the safety and efficacy of repeated oral doses of drug Blautix in irritable bowel syndrome (IBS) patients. Interim analysis of the data revealed in mid-April showed that Blautix has a safety profile comparable to placebo, with a report on the full data expected in Q3 this year.

It is also noteworthy that US pharma giant MSD, the tradename of Merck & Co, is a large shareholder in 4D Pharma (with a 7% stake) and the two companies have a research collaboration agreement to discover and develop live biotherapeutics for vaccines.

To finance its activities, 4D Pharma raised £22m via a placing back in February at 50p per share. Encouragingly, certain directors put in a total of £2m. The net proceeds along with existing cash are expected to support ongoing clinical studies in IBS and oncology and to fund operations to at least two clinical study readouts.

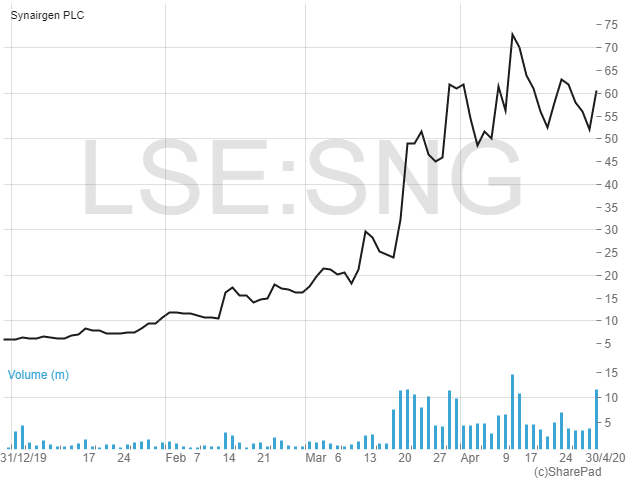

SYNAIRGEN

One of the first companies whose share price benefited from news that it was fighting Covid-19 was respiratory-drug discovery and development firm Synairgen (LON:SNG). Given its focus on respiratory conditions, investors started marking up the shares in February. However, in mid-March the shares really took off after the company confirmed it would be starting a trial of its drug SNG001 in Covid-19 patients.

Synairgen’s SNG001 is a formulation of the protein known as interferon beta (IFN-β). This is a naturally occurring protein which orchestrates the body’s antiviral responses. There is evidence that deficiency in IFN-β production by the lung could explain the enhanced susceptibility of at-risk patient groups to developing severe lower lung disease during respiratory viral infections. In addition, viruses, including Covid-19, have evolved mechanisms which suppress production of the protein in the body, thereby helping the virus evade the innate immune system. In the lab, IFN-β has been shown to protect cells from infection with a broad range of respiratory viruses.

SNG001 has been designed for direct delivery to the lungs via nebulisation, to treat and/or prevent lower respiratory-tract illness caused by respiratory viruses. In clinical trials in asthma and chronic obstructive pulmonary disease (COPD), inhaled SNG001 has been well tolerated and shown to upregulate lung antiviral defences. In two Phase II asthma trials, inhaled SNG001 improved lung function in patients with a cold or flu infection. Synairgen also has a COPD trial ongoing, with early data showing that the drug is well tolerated and upregulates lung antiviral defences in COPD.

Patients needed

Synairgen’s Phase II study in Covid-19 patients, known as SG016, is a double-blind, placebo-controlled trial. The pilot phase will see 100 Covid-19 patients recruited across a number of NHS hospitals, with the first patient having been dosed at the end of March at University Hospital Southampton NHS Foundation Trust. The study has also been adopted by the NIHR Respiratory Translational Research Collaboration, a body comprised of leading centres in respiratory medicine in the UK whose internationally recognised experts are working together to accelerate development and discovery for Covid-19.

The latest news, announced on 30 April, is that Synairgen has received approvals to extend the trial to patients with Covid-19 in the home environment. The objective is to initiate dosing with SNG001 (or placebo) earlier in the infection cycle, before severe lower respiratory-tract symptoms have developed. Details of the design, implementation and timing of this extension to the study will be disclosed more fully in due course.

Meanwhile, treatment of patients in the hospital setting was said to be progressing well, with more than 75 patients out of the target 100 now dosed with drug or placebo. Results from this part of the study are still expected in June 2020, giving investors a near-term potential catalyst to the share price.

Breath of fresh air

Shares in Synairgen have risen more than tenfold so far in 2020, starting the year at just below 6p to currently trade at 60.5p. At that price investors are valuing the business at just over £90m.

In terms of finances, Synairgen had cash of £2.54m as at 31 December last year. Then in March this year, £14m was raised at a price of 35p per share, with the equity placing, unsurprisingly, being heavily oversubscribed. The company will spend £7m of this on Covid-19 clinical trial activity, £4m on the manufacture of the SNG001 drug product and other supplies, with the remainder being set aside for working capital and other matters.

Analysts at finnCap have a net present value-based target price of 120p on the shares, almost double the current share price. Around 80p per share of this value relates to the use of SNG001 in Covid-19 patients. However, should the Phase II study be successfully completed, the broker anticipates that its valuation rising to as much as 360p, providing significant ‘blue-sky’ upside.

NOVACYT

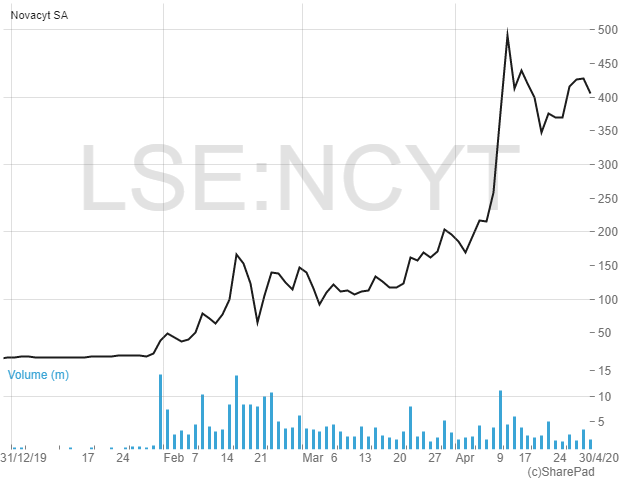

An article on small-cap pharma stocks which have done well from the current situation wouldn’t be complete without this next company. The best-performing share in London in 2020 to date, rising by a stonking 2,790% in just four months, is Novacyt SA (NCYT), an international specialist in clinical diagnostics.

From joining AIM in November 2017 up until the end of last year the share-price performance was moribund. But in late January, investor interest was piqued after the company announced that its molecular diagnostics division, Primerdesign, had launched a new research-use only molecular test for Covid-19 (which at the time didn’t have a name) as a direct response to the initial outbreak in China.

The polymerase chain reaction (PCR) based test has the ability to detect the 2019 strain of the virus only, a feature which differentiates it from other tests which are less specific and may also react to other viruses, thus giving a false diagnosis. The Primerdesign test is also stable at ambient temperatures, which eliminates the need for cold-chain shipping in tropical climates, improving efficiency and reducing transport costs. The test can generate a result in less than two hours meaning that all samples can be screened quickly, helping to stop the spread of the virus.

Soaring sales

A number of breakthroughs were quickly achieved following the launch of the test. Mid-February saw the launch of a CE-Mark molecular test, meaning that it has been manufactured to European Economic Area (EEA) standards. As a result, it can be used directly by laboratories and hospitals for the testing of patients without the need for validation by clinicians. Further, on 23 March, the FDA issued an emergency use authorization for the test, enabling hospitals and laboratories in the US to use it for clinical diagnosis of Covid-19. Following approval by the regulatory bodies of several countries, the test was then listed as eligible for World Health Organization (WHO) procurement under the WHO Emergency Use Listing (EUL) process, which helps to expedite the availability of products to people affected by a public-health emergency

Back in the UK, in late April it was revealed that a supply deal had been signed with the UK Department of Health and Social Care (DHSC), starting from 4 May and lasting for an initial term of six months, with Novacyt initially committing to supply 288,000 tests per week for use in the NHS. There is also the option to expand the agreement.

The latest update from the company revealed that as at 28 April, Primerdesign had sold, received orders for or was contracted to deliver over £90m worth of its Covid-19 test. Reflecting the rapid rise in orders, this was up from £2.3m just seven weeks earlier. Novacyt is now supplying its test to more than 100 countries and approvals have recently been received from Malaysia and Ecuador. The company is also increasing its sales into the US market and looking at further expansion in the country.

To keep up with demand, in mid-April, Primerdesign ramped up to a manufacturing rate of four million tests per month but is planning to increase capacity to around eight million tests per month during June. To further fulfil demand, partnership agreements have been signed with a number of contract manufacturers.

Testing times

There is no doubt that Novacyt’s performance over the past few months has been remarkable. The company as a whole made revenues of €13.7m in its last reported financial year, a figure which has been surpassed almost eight times over in a matter of weeks from one product alone. Investors should also be excited about the high profitability of the product, with the Primerdesign division having a gross margin of 85% in FY2018.

However, there are many questions to consider from an investment point of view, not least regarding the company’s current valuation. Novacyt is now valued at a chunky £275m, driven by momentum and excitement as well as operational growth. Unless the company can cope with meeting the soaring demand for its products, and unless that demand is sustained for some time to come, then it looks to me that the shares may have got ahead of themselves. With increasing competitive pressures to supply Covid-19 tests, I think new investors should exhibit caution, or at least wait for a pullback in the price, before getting involved at current levels.

Comments (0)