De-Construction at Balfour Beatty plc

Here’s a picture of a very casual bloke on a roof opposite my house on the ‘mobi’ to his ‘Bezzie Mate’.

Climb up your roof too, and have a look around.

What do you see?

He’ll be seeing a lot of cranes. There’s plenty of building going on. So you wouldn’t expect the Construction sector to be doing too badly. After all, interest rates are low, so getting finance to construct assets shouldn’t be too difficult. And we have to build lots of offices for the Chinese businesses that have taken advantage of the AIM shell companies they’ve bought to circumvent due diligence, locating their EHQs in London, and using finance from the less stringently regulated Chinese banks that we encouraged over here recently on that ticket.

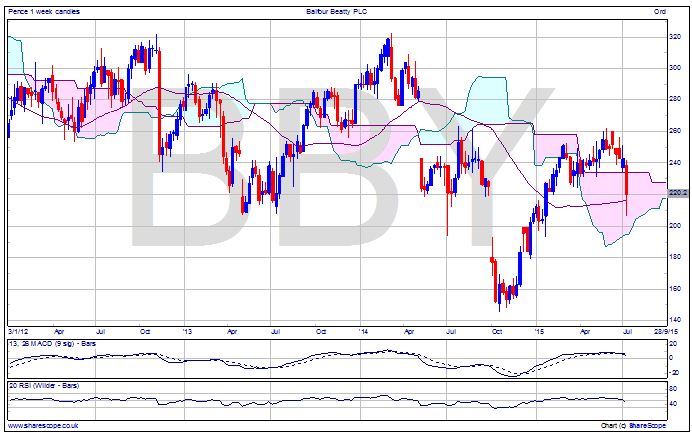

We know it’s not Boom Town out there, but it’s obviously not Ghost Town either. And the FTSE 350 Construction and Materials Sector looks reasonably healthy. After 2008 we see a general upwards trend, so the industry isn’t exactly suffering, although it may have been doing little more than surviving until 2013. By and large, it’s performing quite well now, although the word is that there are very tight margins in the construction industry, which they accepted out of desperation at the bottom of the market.

So what about a company in such a sector that is still really under-performing? A company that has paid less and less CT each year for the last few years, and at the last count a negative amount, which is apparently only going to get worse? I would imagine that’s a zombie company. I’ve been considering whether amount of CT paid is a good indicator of company health. I’d say in general that paying large amounts of it is probably a good sign, but smaller amounts might not signal anything other than good housekeeping. For Balfour Beatty plc it looks like carelessness to have one profit warning, but seven of them? There are many what the current CEO calls “legacy challenges” still to deal with. Legacy challenges? WTF! What is this? Twenty Twelve? W1A? They used to be called problems. Anyway, I don’t need telling twice, this company has bad news probably because this company is bad news. The question is: are they too toxic for takeover? Because if they are, then they’re dead meat for the foreseeable.

A construction company must have systemic problems to be failing in the current climate, and construction is the lion’s share of Balfour’s business. A comparison of the Sector with Balfour’s share price for the same period reveals that whereas BBY initially outperformed the sector it’s certainly normalised now. The stock itself looks rather volatile, so I’d prefer a hedge position myself to take advantage of more weakening. If we see a move down from here then the ideal trade would have been short BBY and long Sector ETF but, being the UK, there isn’t such an ETF. Thankfully the spread bet is available. Watch out doing the Beta trade sizing on spread bets when placing hedge trades, it can be tricky.

Comments (0)