China Loses Its Shine

Wednesday saw the Shanghai Composite plunge by as much as 8% on its open, with trading in almost half of Chinese shares halted to stem the volatility. By midweek, the main Chinese index was down by around a third from the highs, having given back all of its gains from the March rally.

There haven’t been any crystal clear catalysts behind this sell off other than the literal ‘Chinese whispers’ of panic. There’s no doubt that European turmoil has had some sort of impact on the Shanghai Composite, particularly in the context of the leverage and overheated nature of this market.

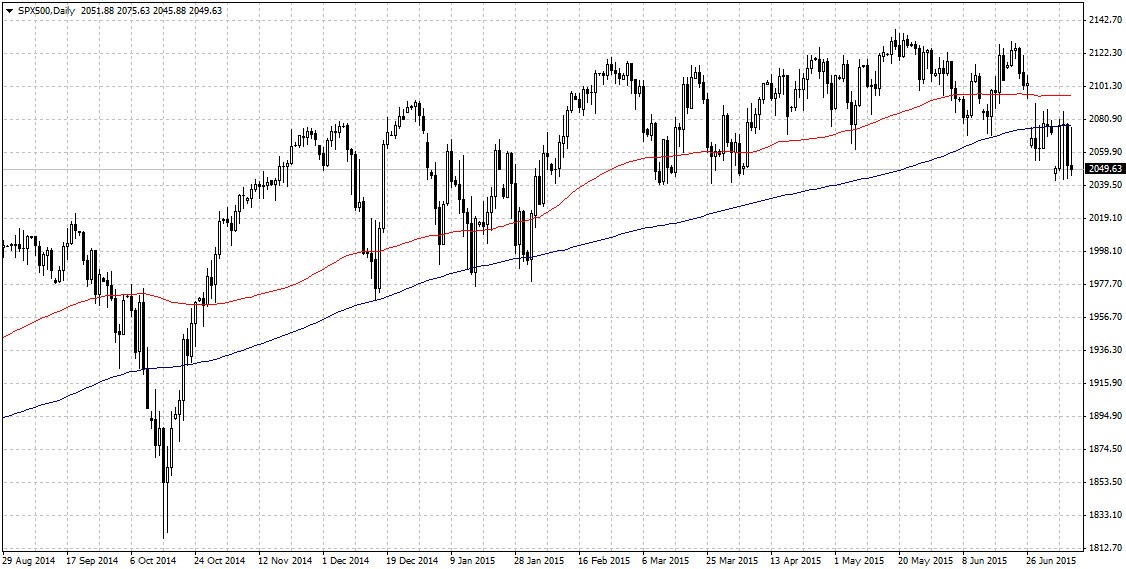

Markets recovered on Thursday as a combination of structural trading initiatives and bargain hunters stepped in to stem the tide. China’s sell-off has coincided with the S&P 500 finally ceding the 200 period moving average, an event that could have significant repercussions.

The chart above shows the S&P 500 with its 100 and 200 period moving average. Both averages have acted as bullish support throughout the recent rally.

For the first time since October 2014, the S&P 500 has closed below its 200 period moving average. This drop has occurred in two sharp waves, both times following negative news from Greece over the weekend.

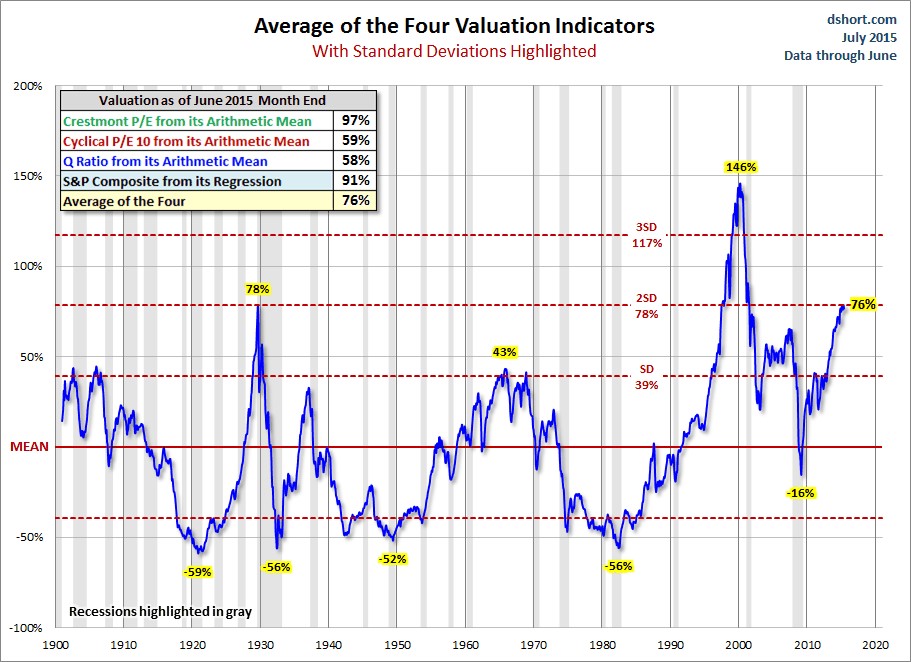

The S&P 500 has been in ‘overvalued’ territory for some time as the following chart from advisorperspectives.com indicates:

This chart takes the average of four respected valuation metrics including the P/E 10 ratio. The average of these metrics is currently at 76%, or nearly two standard deviations above historical averages. To put things into perspective, apart from 2000, the last time valuations were in this region were just before the great crash of the 1930s.

We still have the thorny issue of the situation in Greece to contend with however. At the time of writing, the ebb and flow of confidence is finely poised with a creeping sense of confidence. Many analysts have pointed out that Greece and its official sector creditors weren’t actually that far apart in negotiations before the Sunday referendum.

Yet, even should the worst case scenario be avoided, there is still ample room for downside for markets. Markets often climb a wall of worry and it is possible that devoid of the hope of a Greek resolution, traders could once again focus on the fundamentals of a dangerously overcooked market.

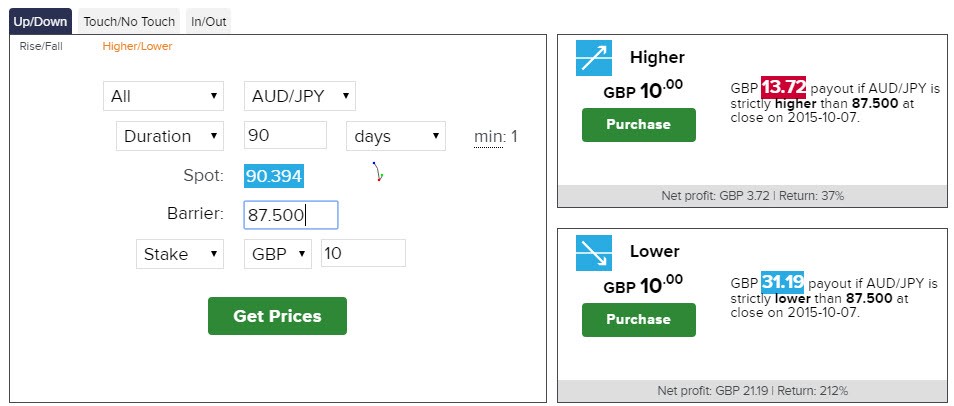

There are many vehicles to play this situation including the S&P 500, but of particular interest is the AUD/ JPY. With its close links to China, the Australian dollar is a Shanghai Composite proxy, while the Japanese yen has rebuilt its reputation as a global safe harbour. In short, should global confidence slip back, the AUD/ JPY could see an extension of its mid year slump.

A good way to play this is a LOWER trade predicting that the AUD/ JPY will close below 87.50 in 90 days’ time for a potential return of 212%. Or put another day, betting that the AUD/ JPY will close below 87.50 on October 7th could return £31.19 from every £10 put at risk.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)