The “Bolsonaro effect” and the outlook for Brazilian equities

Never miss an issue of Master Investor Magazine – sign-up now for free! |

After winning 55% of the votes and taking 4 out of 5 Brazilian electoral regions in the second-round runoff on 28th October, Jair Bolsonaro will assume office for his four-year term as president on 1st January 2019. First things first, caveat lector, don´t believe everything you read about Bolsonaro in (some of) the foreign press. As the old saying goes, democracy is when your team wins the election and dictatorship is when the other guy wins (think Trump and Brexit as other collective shocks to the consensus).

Bolsonaro is an extremely popular, old school conservative with a pro-market and “Chicago Boy” economics advisor – soon to be finance minister – in Paulo Gueddes, founder of BTG the large Brazilian investment bank. Markets reacted positively to the news, with the Bovespa stock index hitting a record high and the real strengthening the day after the election. This isn´t surprising considering that Bolsonaro’s presidential opponent was a federal minister in a Workers Party government which was heavily blamed for the country´s worst recession in history (with a 9% drop in nominal GDP, that’s almost depression territory), a world record corruption scandal and his choice for VP being the head of the Brazilian communist party. Markets work in mysterious ways.

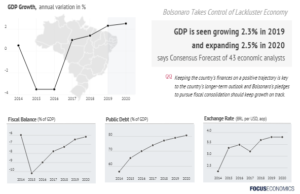

With new political visibility and uncertainty clearing from Latin America´s largest economy, a basket of economic indicators and market expectations are starting to point north. GDP growth is projected at 2.5%, inflation is meeting its 4% target, and the benchmark interest rate is heading up slightly to 8% due to an uptick in economic activity and investment.

Nonetheless, extensive structural challenges remain and the incoming President´s inbox will be overflowing. Key priorities will be addressing the fiscal crisis and government debt by focusing on the much heralded – but as yet not implemented – pension reform (around 50% of the federal budget), privatisations, increase trade liberalisation and roll back the size of federal government.

Some key facts. The UK and the US have around 16 state run companies, Brazil has over 400. It also has 39 federal ministries, often replicated at the state level, whilst the US has 15 executive departments. Brazil’s budget deficit is creeping up to 8% of GDP and the national debt is increasing significantly. According the Heritage Foundation’s Index of Economic Freedom, Brazil ranks a 153 out of 180 countries.

The biggest question mark then is not the need for reform per se but the political support and will in the new Congress to drive forward the reform agenda and get Brazil back on the economic track. It won´t be easy and the direction will not necessarily linear. But as we know, no significant achievements are meant to be easy.

What does all this mean for Brazilian equities? The index is up 23% (15th Nov) since its YTD low point in June. And despite a lot of the “Bolsonaro effect” being already priced in, since he led

the polls over the last few months, market analysts expect a sustained rally in 2019. Equity volatility, as measured by the CBOE Brazil Etf Volatility is also down from its pre-election peak.

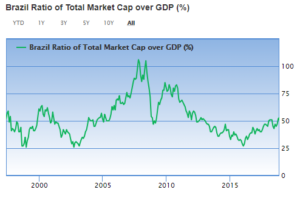

Karel Lukatic, Chief Analyst at XP, one of Brazil’s biggest brokers, thinks the index could reach up to 125K points by the end of next year. That may be overtly optimistic. But money managers are still broadly defensive, with only around 5% of Brazilian funds allocated in the stock market, against an average of 8% and previous peak of 14% during BRIC mania. Looking at the total equity universe as a percentage of GDP – one of Warren Buffet´s favourite metrics – the index has been ramping up to its historical average. Further upside is possible and probable. Long term international investors (as opposed to “fast money”) will likely be in “wait and see” mode on the new administration and the velocity of coming reforms.

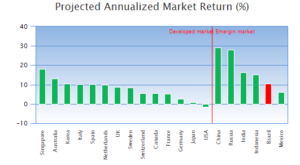

According to Guru Focus, the Brazilian stock market is expected to return 10.4% a year via growth and yield for the coming years, way ahead of developed markets and just behind other key emerging economies.

As a result of the improved outlook, country risk (as measured by JPM EMBI Brazil) is also seeing downward pressure. The relative bond spread of a basket of emerging market sovereigns is down 20% since June, positively impacting equity valuations and supporting a consensus bullish view on Brazilian assets. There is a significant relationship between Brazil risk and Bovespa strength (historic R2 of 0.68 between 2015 and 2017).

According to Lazard, emerging markets equities have the lowest valuations of any major asset class, and this year’s underperformance has pushed the valuation discount to developed markets back to the 30% range. They go on to argue that “the asset class offers the highest real growth globally”. This investment thesis is supported by analysis from Blackrock, who state that “EM earnings momentum is solid and increasingly broad-based. The median earnings growth for stocks in the MSCI EM Index for 2018 and 2019 is forecast to be 10.1% and 13.6%, respectively.”

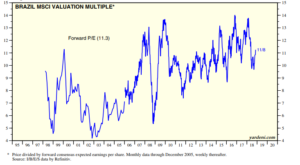

In Brazil, valuations continue to see positive pressure. The forward P/E, currently at 11.3x, is trending upwards.

Wallet Advisors forecast a long-term increase in momentum in Brazilian equities. The “EWZ” fund price prognosis for 2023-11-12 is 56.230 USD. With a 5-year investment, the revenue is expected to be around +44.63%”. The “Bolsonaro Kit”, which involves state-owned companies, major exporting companies stronger real and banks, are expected to lead the positive momentum.

The positive outlook is also expected to be reflected in M&A and private equity. The President of the Brazilian stock exchange expects up to 30 IPOS in 2019. Brazilian M&A has rebounded over the last year with strong momentum poised to continue through 2019, as the author has previously written on. All in all, investment bankers expect a new refreshingly positive cycle in corporate and investment activity in the Brazilian market. And a key factor is the “Bolsonaro effect”.

Comments (0)