Brazilian stocks to shine in 2018?

In 2017 global emerging markets stocks and currencies posted their best return since 2009. And even after this robust performance emerging markets continue to offer attractive investment opportunities as economic growth outpaces the developed world in 2018 (4.9% vs 3.3% forecast growth this year (Shroders)), current account deficits improve, political volatility moderates and structural reforms get back on the agenda in many key markets. This supportive macro milieu should allow for further gains in corporate earnings (margins are currently below historical levels), return on equity and upside pressure in stock markets.

Emerging markets equity valuations, although not as cheap as before last year’s bull market, are broadly competitive versus developed markets and their historical levels. The rally has reduced the valuation discount for emerging markets relative to developed markets from 35% to 25% further gains could reduce this to around 20% in 2018 (Bulltick).

This emerging market thesis neatly sums up the Brazilian equity environment as well, as the country continues its recovery from one of its largest ever recessions. (With a 9% fall in GDP, that’s close to depression level economics.)

Brazil seems to have gotten back on a positive trajectory in 2017. According to Angela Bouzanis Senior Economist at FocusEconomics, recently released data “indicates that GDP grew for the first time in over three years in Q2, confirming that the [Brazilian] economy has turned a corner”, led by falling inflation and export growth. Indeed these factors, together with historic lows in the benchmark SELIC interest rate (currently at 7%), emerging discourse over political and fiscal reform and positive economic growth, have fuelled investor optimism and capital flows into Brazilian equities.

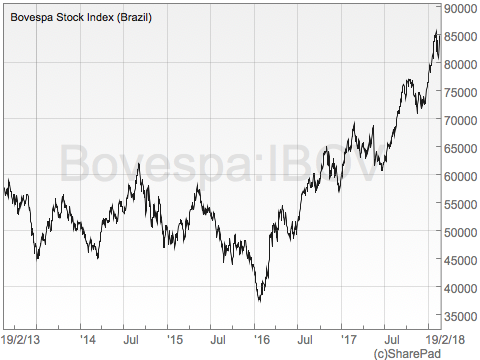

Cyclical stocks have led the pack with consumer discretionary stocks up nearly 60% since December 2016. The benchmark Ibovespa index of leading Brazilian listed companies was up by 26.8% over 2017 in local currency, outperforming both developed markets and broader emerging indexes. The index has more than doubled since hitting a seven-year low in early 2016.

According to Bulltick, the Latin America focused Asset Manager, valuations may be slightly extended but “earnings will pick up amid stronger growth, justifying current multiples. It should also be noted that the current P/E ratio for the Bovespa is 14% higher than the trailing 60 month average, which is still less than in US markets, where the S&P 500 multiple is trading 19% above its 60 month historical average.”

A “Major upside trigger”

Since the impeachment of President Dilma Rousseff in August 2016, political stress – closely related to corruption investigations – has been a constant theme. One of the biggest discussion points for the markets has been the potential candidacy of Lula, Dilma’s predecessor and a central figure in the Car Wash corruption scandal that has captivated the nation. Fears over the return of the left-wing Workers’ Party in October’s presidential election have kept markets on egg shells over the last few months.

This uncertainty however, which was potentially holding back further upside pressure both in financial markets and the real economy, was cleared up in an appeals courtroom on 24th January, where Lula was condemned to 12 years in prison on corruption and money laundering related charges, therefore ruling him out as a presidential candidate. This eventuality, although widely expected, was greeted warmly by the markets. The Bovespa rose to a record high (almost 4% on the day the decision was announced), pushing year-to-date gains to more than 9% and taking the index to a historic high (see below).

The trial will be a “major upside trigger” for Brazilian assets, said James Gulbrandsen, a Rio de Janeiro-based money manager at NCH Capital, which oversees $3.5 billion. “The Brazilian economy is already in major recovery mode. The first movement will be flows into Bovespa futures, but domestic economy-related companies will roar past the market once dedicated small and mid-cap flows overtake large cap flows.”

XP Investimentos, the largest security broker in the country, projects the index to reach close to 90,000 points by year end 2018 (and 95,000 points in the upside scenario), a positive but less impressive uptick than that seen last year. Furthermore, on the operational side, XP expect to see “consistent revenue growth, which with the dilution of fixed costs and controlled inflation will result in higher operating margins, further intensified on the bottom line because of lower financial expenses.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

Bulltick expect GDP growth to be 2.2% this year with investment mood set to risk-on. They recommend long positions that would benefit from a not-priced-in collapse in the SELIC rate such as Discretionary, Materials and Financials. Looking at GDP to total market cap – one of Warren Buffett’s favourite metrics – also suggests upside potential. The current ratio is 47%. The historical high is 106%, the historical low is 26% and the average is 53%.

The extent of secular upside in Brazil depends on GDP and other metrics continuing to strengthen, the progress of economic reforms and a market friendly “win” in the presidential elections later in the year. Domestic politics has always loomed large in Brazil’s market performance, even by emerging market standards. “The campaign looks set to bring bouts of increased market volatility”, according to Marcelo Carvalho, head of emerging market research at BNP Paribas. Jeffrey Lamoureux, senior country risk analyst with BMI Research adds that “it is far from clear that a strong, pro-reform candidate capable of building a broad electoral coalition will emerge”. Investors will therefore keep elections in the spotlight.

A “festa” in Brazilian equities

There is the possibility that a virtuous cycle on the economic front could result in higher growth, low inflation, low interest rate and debt sustainability et al. But equally, harmful economic policy post-elections could have a binary outcome. Recent history suggests Brazilian assets are either suffering acute downside or upside swings.

In any case, good earnings growth and an above average (but correcting) valuation discount compared to developed world equities should continue to support Brazilian equities. The Brazilian central bank’s aggressive rate cuts have not only supported aggregate demand but also anticipated expected monetary policy normalisation from developed market central banks. The Car Wash corruption investigations are also having a positive impact on corporate governance and compliance.

As a result of the improved outlook, country risk (as measured by JPM EMBI Brazil) is also seeing downward pressure. The relative bond spread of a basket of emerging market sovereigns is down 30% year-on-year, positively impacting equity valuations and supporting the consensus bullish view on Brazilian assets. There is a significant relationship between Brazil risk and Bovespa strength (historic R2 of 0.68 between 2015 and 2017).

In a recent FT article on the current “festa” in Brazilian equities, Geoff Dennis, head of global emerging markets equity strategy at UBS, argues that “Brazil is still a market that investors love to love. When markets move, they tend to buy Brazil.” How long the rally can last, and the acuteness of future gains is harder to quantify though. For now, valuations are more attractive than India, China and broad Latin American markets based on forward PEs.

Looking at the EM universe as a whole, analysts at TM Rowe believe that the future path for EM equities is likely to be less homogenous and more divergent than it was in an era when commodity prices were rising, global trade was strong, and China’s economy was growing at over 10% annually. “This suggests that rigorous analysis of company fundamentals will be more important than ever in 2018. Being proactive will be essential to identify and invest in the most attractive opportunities within these highly diversified markets.” As always, fundamentals are key to long term valuations.

Comments (0)