Banks to lead the way in the great Brazilian recovery

The focus of this article is to look at the investment potential in Brazilian blue-chip banks. But let´s quickly recap the macro view around Brazil, which as always, is dynamic.

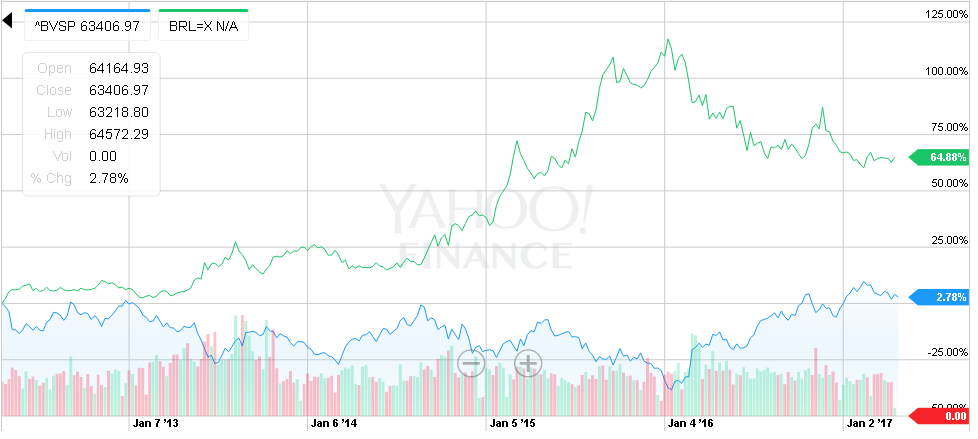

The current market consensus is that even after the strong rally in the Brazilian equities (+20%) and currency during the last 12 months (note the strong inverse correlation over five years), the outlook is still broadly positive for financial assets as the risks shift to the upside after the acute economic contraction and political stress of the last two years. So far, tudo bem. As my previous articles on these pages highlight, the median end of year target for the Bovespa is still 70,000 (up by around 10% from close of play on 19th April).

And whilst a broad based basket of economic indicators – such as GDP, confidence and the Real – have started to turn north over the last few months, contrarian investors have started to think about profit taking. Indeed, after accurately calling the strong asset rally over the last 12 months, the MSCI Brazil index has appreciated by 56% in US dollar terms and 29% in local currency, outperforming the MSCI emerging market benchmark by 33%. Credit Suisse is again moving underweight in Brazilian equities. For Brazil it seems it’s a case of the more things change the more they stay the same, or in this case regression to the mean of bad news.

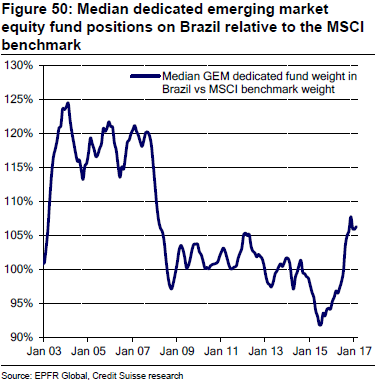

In a report called ‘Taking profits after a year overweight Brazil’, the Swiss bank flags up that when they turned bullish on Brazil, “the median positioning of dedicated EM equity funds was 5% below the benchmark for Brazil. That position has now switched to 6% overweight”.

They also point out that “March 2016 marked the lowest point of analyst sentiment on Brazil, with 18% more sell and hold recommendations than buy calls – the most depressed sell-side view for a decade. In January 2017, the number of buy recommendations increased to the point where they outnumbered holds and sells for the first time since July 2014”.

The bank’s strategists then suggest that the strengthening of the Real has limited further dollar-based gains, and with GDP growth trend potentially impaired, interest rate cuts already priced, and valuations tight, “all that is left is momentum and wishful thinking”. Fair enough. The author could add to that volatility at the political level with continuing discourse and investigations around systemic corruption. But perhaps then there is a disconnect between money on the table in the short term and a slowly, and possibly non-linear, improving macroeconomic picture.

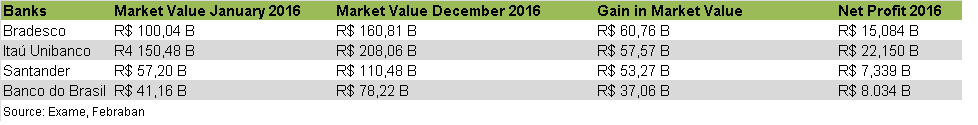

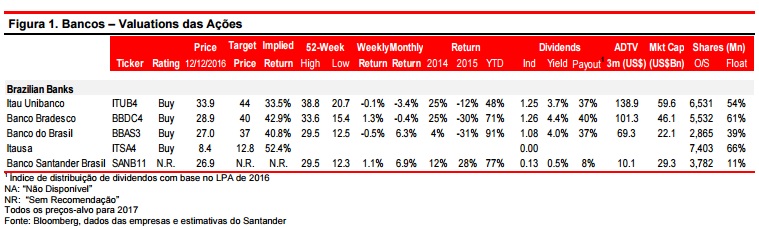

So where does that leave the Brazilian banking sector? Let´s recap on the recent performance of the largest banks, who together with Caixa Econômica (a type of state building society) make up around 80% of total loans. According to estimates, the average gain last year in market value for the big four publicly traded banks was around 140 billion BRL. The stocks increased on average by 71% over 2016.

Year-to-date they have mirrored the broader decline in the Bovespa from March (when Credit Suisse called peak rally) but are still outperforming the index on average by around 6% (by 19th April).

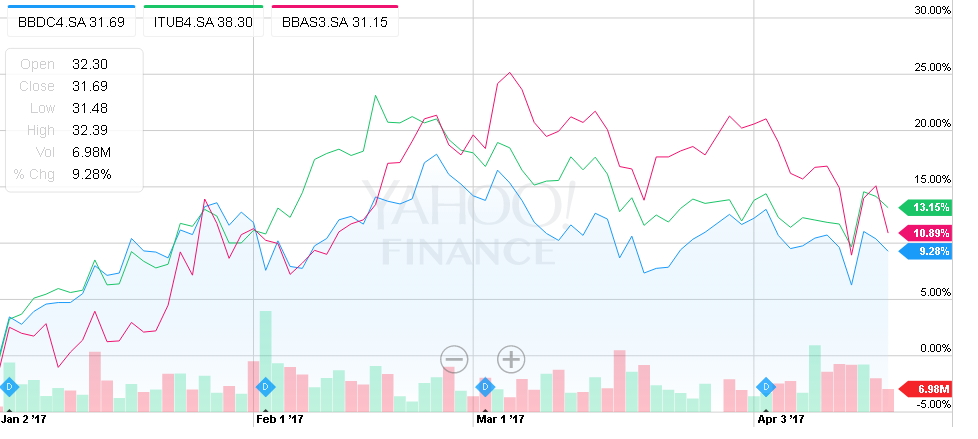

Based on Santander´s projected target prices for the stocks in an end of year study, average returns for Itau (^ITUB4) and Bradesco (^BBDC4), the largest private banks in Latin America, could be in double figures by the end of 2017, with 30% and 38% gains respectively (19th April). The bank added that “we have been optimistic about Brazilian banks since the beginning of 2016, and new events (such as the impeachment process, improvement in confidence levels, a cycle of monetary easing and favourable results in 3Q16) have strengthened our position”. On the other hand, Goldman Sachs is more conservative, projecting end-of-year target prices for Itaú at R$35.5 and Bradesco at R$31.3.

According to analysts, Itaú is seen as hungry for further acquisitions (after having just recently snapped up Citibank for 710M BRL) and with a strong capital structure to support earnings growth. Banco do Brasil (^BBAS3) however, is more sensitive to falls in loss provision expenses and should therefore benefit throughout the household recovery this year. The bank´s chief executive is also expected to boost efficiency savings, asset quality and capital position. Default rates are also expected to fall from the second half of 2017. And despite an expected year-end SELIC rate of 9%, analysts from Citi project an overall increase in average loan yields as a majority (52%) of the loan portfolio originated before 2015. What´s more, Santander project EPS to grow almost 50% this year. Bradesco´s upside, however, is seen as potentially being limited in the near term by increased cost structures as it continues to incorporate HSBC’s Brazilian operations and seek future synergies.

Overall, Santander forecast a better than expected performance from the leading banks. They base this optimism on greater operational cost reductions and bad loan provisions (especially in 2018) and stable “net financial intermediation due a persistent credit repricing cycle and lower funding costs”.

Indeed, analysis by UBS suggests an “inflexion point” for emerging-market banks as the long cyclical decline in ROEs seen across the board seems to have bottomed-out. Thus, the analysts expect EM equities to outperform due to structural improvements in COE and the potential to start to generate economic value added.

“We think the importance of COE in determining the fair value is especially true for banks in LatAm where greater macro volatility can quickly change the risk-free rates and risk premium” contends Phillip Finch, UBS banking strategist. Based on the bank´s proprietary CAPM, the implied COE for EM banks is now 12.3%, down from 14.2% in March 2016. A regional analysis shows that during the past year Latin American banks’ COE fell 110bps to 13.1%. The downtick in cost of capital is in part a function of an improved political outlook, lower inflation expectations (together with monetary loosening) and strengthening currencies. UBS state that Brazilian banks have the highest implied COE in Latam at 14.0%. In summary, “the bottoming out of ROE after five years of continuous decline indicates that the sector could be approaching a new earnings cycle while the crossing of EM banks’ implied ROE [over] their implied COE suggests that EM banks’ valuation multiples could rise further”. Citibank project long term ROE for Itau at 18%, 17% for Bradesco and 16.5% for Banco do Brasil. This could drive upticks in valuations going forward. Nonetheless, as Fidelity point out, it is worth comparing to other EM banks for perspective where ROE´s are also high but with much more attractive price-to-book multiples.

Looking at historic 5-year P/E ratios, we can certainly see a pick up from Q216 and a slight moderation over the last month in the case of Bradesco and Banco do Brasil. The macro direction seems clear though, hence the current outperform calls of market analysts.

Source: Bloomberg

UBS points out that “we have seen a major valuation re-rating in Brazilian banks, from 6.0x PE to 10.0 PE”*. Close to historic average levels of 9.5. However, despite the recent valuation rally, banks on the Bovespa are still trading at around 11% discount to the MSCI Brazil and – bar a few exceptions – a feature of the market has been that the banks tend to trade above the overall market.

There are reasons for caution though. Expectations are certainly for gradual improvements in Brazilian bank asset quality and lower ECLs as the economy rebounds but this could already be priced into asset prices. The medium term outlook is for limited credit expansion and for households to repair finances thus limiting upside potential. According to UBS, “there is limited scope for multiples to expand further and we now need to see positive earnings revision to support share prices or risk seeing a reversal in sector performance”*. Established banks could also be impacted by the Central Bank’s attempts to lower the very high credit spreads charged by financial institutions in the country and enhance competition in the sector through better credit pricing and less regulation. Fintechs such as Banco Original and NuBank could benefit from such endeavours. Another potential threat on the horizon is the need, according to the International Institute of Finance, for local banks to raise around US$347 billion in additional capital by the end of 2017 to support economic growth (Valor Econômico). The rating agency Moody´s, although flagging up the improved economic conditions and reduced ECLs, has adopted a neutral outlook for the Brazilian banking sector.

Banks, and the Bovespa as a whole, are essentially path dependent on macro factors such as pension and labour reform, political stability and the de-indexation of the economy. Indeed, the economic growth trajectory of the country depends on it. A tide of economic recovery should lift all banking boats but 2017 is still a year of transition with real loan growth limited. Recovery will not be V-shaped. An uptick in SME activity will also lag corporate growth. We should, however, start to see the start of a more positive macro cycle for the sector. For BTG, the Brazilian investment bank, “the high degree of banking concentration in Brazil means that all current players are experts in the business and have the “know-how” to price credit risks correctly. This represents a healthy environment, and one that should continue over the next few years, as spreads are set to remain high and companies will continue their deleveraging. Going forward, profitability should increase”.

* Is it time to sell Brazilian banks? UBS (March 2017).

Comments (0)