Commodities are the best hedge this year

Optimism about a peace deal between Russia and Ukraine helped to restrain commodity prices and boost equity prices last week.

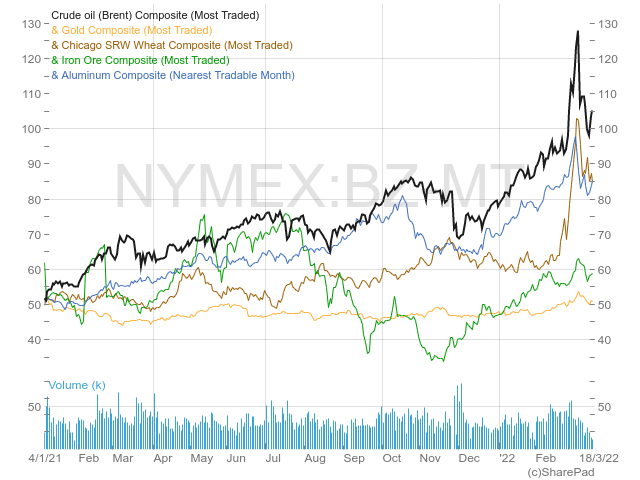

However, the war has not been the main driver for price activity − at least not for the key trends. Many of the factors that led commodity prices higher were already in place before the Russian invasion.

The supply side has been disrupted for many reasons, including the pandemic, which has been creating scarcity, while driving inflation to multi-decade record levels. And inflation is becoming a persistent problem, hitting purchasing power, stocks, bonds and ultimately commodities. No matter what happens in Ukraine, the supply of commodities will continue to be scarce for a while.

Many believe commodities are on a ‘supercycle’. I don’t know if that’s the case, but I do believe we will see further price increases, as geopolitical and economic conditions globally are highly supportive for a continuing commodities bull market.

It’s almost unbelievable that the oil price rose from $18 in April 2020, during the pandemic, to the current $110 level. I thought that it would go down when it hit $70, as the global pursuit of green energy would likely hit demand. But then other geopolitical conditions had an impact, and oil entered an uptrend not seen for many years.

But the uptrend is not only about oil. It is also about gold, silver, sugar, wheat, natural gas, aluminium, iron ore and almost every other raw material we can think of. A mix of conditions, including disruption created by the pandemic, years of monetary easing and the Russian invasion all contributed to the current situation.

While commodities are on a supercycle, the broad equity market is experiencing a heavy correction. The Nasdaq 100 started a downtrend back in November. Back then, the index closed one day at a high of 16,573. But by mid-March it had retreated to 13,046, a 27% decline, indicating a bear market. While it certainly contributed, the Russian invasion is not the key factor driving the Nasdaq down, as on 24 March, when the war started, the index was already down by 16%. It has since recovered 10%. However, a potential mix of high inflation with hawkish monetary policy, is not positive for equities, in particular, for growth stocks.

During the last few days, equities have been recovering, despite Federal Reserve chair Jay Powell’s hawkish comments on a faster-than-anticipated rate hike. In my view, this is more the result of a ‘dead-cat bounce’ than a real inversion in sentiment, as higher interest rates hurt valuations.

Commodities ETFs

With all of this in mind, commodities are the most attractive asset class for the time being. In a world where inflation is looking more than transitory and where a war in Europe may cause continuing supply disruptions, commodities look like the best bet.

Last week’s correction in commodities acts as an incentive to enter the market or to strengthen positions. Gold, iron ore, aluminium, natural gas, wheat and oil prices retreated between 5% and 13%, which is a drop in the ocean compared with the rise so far. With fundamentals on the side of commodities, this correction seems like a second opportunity to enter the market.

In my last article I mentioned a few commodities ETFs that are worth considering this year. The iShares GSCI Commodity Dynamic Roll Strategy ETF (NASDAQ:COMT) offers a broad exposure to commodities, including energy, precious metals, agriculture and livestock products. GSCI has been a clear winner this year, currently up 33%.

But if you prefer a concentrated exposure to just agricultural products, which have seen their supply disrupted by the war, the Invesco DB Agriculture Fund (NYSEARCA:DBA) is a good option, up 12% year to date. For a concentrated investment in metals, the Aberdeen Standard Physical Precious Metals Basket Shares ETF (NYSEARCA:GLTR) is also a good option because it offers exposure not only to gold but also to silver, palladium and platinum. GLTR is up 8.6% year to date.

Comments (0)