How to diversify your portfolio to survive stagflation

It looks like we may be entering a period of stagflation, with higher inflation and slowing economic growth threatening to undermine the markets, which would be an environment that demands effective diversification.

The broker Investec has recently released a research report highlighting seven investment trusts that offer both strategic and tactical value.They each provide a genuinely differentiated exposure and low correlation with equities that would improve your portfolio diversification, while also providing some inflation protection.

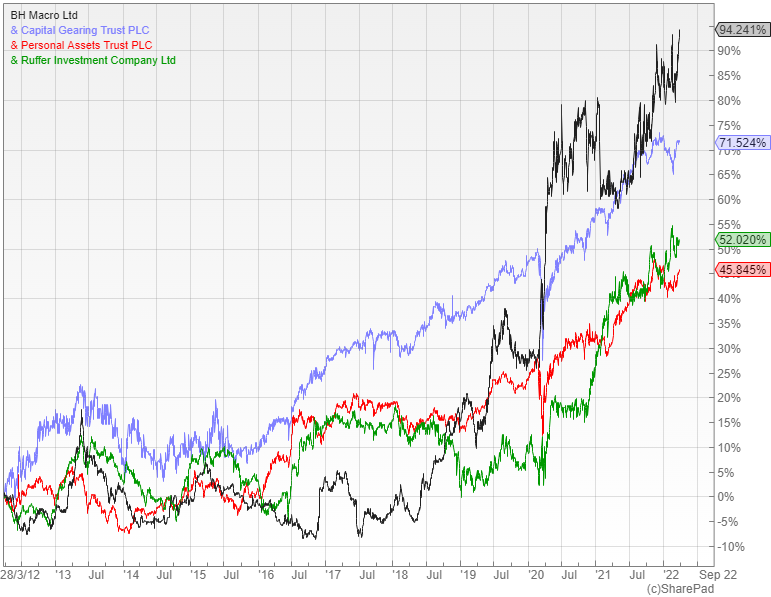

First up is BH Macro (LON: BHMG) that acts a direct feeder into the Brevan Howard Master Fund, a hedge fund that uses macro and relative value trading strategies mainly in the global fixed income and FX markets.It tends to deliver its strongest returns at times of market distress when the correlations of most financial instruments increase, with high double digit returns during the pandemic and the global financial crisis.

Defensive stalwarts

Next is the Capital Gearing Trust (LON: CGT), which aims to preserve shareholders’ real wealth and to achieve absolute total returns over the medium to longer term mainly via its asset allocation. It is defensively positioned with a focus on inflation protectionand has held up well during all the major risk-off events in recent years.

The nearest equivalent is the Personal Assets Trust (LON: PNL) whose objective is toprotect and increase (in that order) the value of shareholders’ funds over the long-term. It has a flexible, long-only multi asset approach that currently consists of quality equities, index-linked bonds, gold and cash equivalents; a strategy that has enabled it to withstand the various market crashes in its long history.

Neither of these funds use derivatives, unlike Ruffer (LON: RICA), another multi-asset trust that is currently positioned to protect investors from what may prove to be a generational event of wealth redistribution. It has just under 14% invested in illiquid strategies and options; a key differentiating feature, which could have significant value as we head into uncharted waters.

Higher risk/reward options

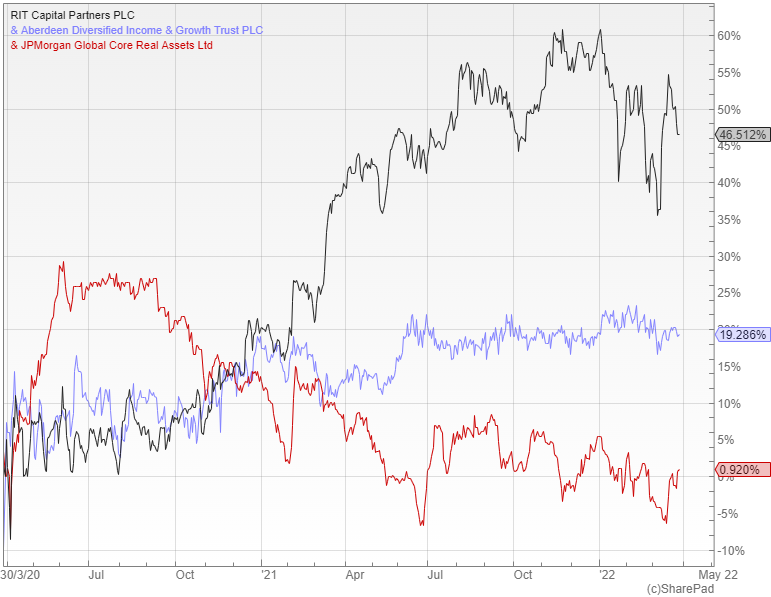

RIT Capital Partners (LON: RCP) aims to protect and enhance shareholders’ wealth over the long term, by enjoying a healthy participation in strong equity markets but with reasonable protection during sell-offs. It is the worst performer out of all of these five funds during the recent corrections, although it has not fallen anywhere near as much as the broader indices and has delivered the highest long-term returns in this peer group.

The manager and mandate of Aberdeen Diversified Income and Growth (LON: ADIG) were changed in 2017 with the new objective being to provide income and capital appreciation over the long-term via a globally diversified multi-asset portfolio. It has struggled to make much headway in recent years − partly due to the pandemic − and has altered its target asset allocation to: private equity 55%, fixed income and credit 20%, listed alternatives 15% and equities 10%.

JPMorgan Global Core Real Assets (LON: JARA) was launched in September 2019 to provide investors with a stable income and capital appreciation from a global portfolio of core real assets, primarily across real estate, infrastructure and transportation. These sorts of holdings tend to do well in times of rising inflation, yet the dull performance to date has left the shares trading at a ten percent discount to the underlying NAV.

CGT & PNL are the only true low volatility wealth preservation funds (which is why I have a lot in them). RICA performed terribly for a decade, then bought Bitcoin (lucky to sell at a profit), and has higher volatility.

RCP is good, but notably higher volatility and risk of loss. BHMG is very expensive on charges.

I bought JARA at 92p and have come back to break even. It needs time to become recognised and grow greater AUM. Just my view; good review by Mr Sudbury.