Investing during inflation and war

Against all odds, Vladimir Putin invaded Ukraine. And no matter how the conflict ends, it will change the world for many years to come. Severe consequences are expected for the global economy; the configuration of Europe; the role of NATO as a military power; the degree of globalisation; the role of the US dollar; and cryptocurrencies as global means of exchange and store of value, to mention just a few.

This year had already started with many challenges ahead, including equity prices near multi-year highs, price ratios heavily stretched, inflation at a four-decade high and central banks threatening to continue with monetary tightening.

And now, only two months into the year, we also have a war in Europe, commodities at skyrocketing prices, supply-chain disruptions and even higher consumer prices. This requires action from investors, as a traditional 60/40 allocation between equities and fixed income is not a good fit for these fast-changing conditions. Furthermore, the equity part of the portfolio needs some tweaks, as a broad market exposure may not be the best allocation at this point. Instead, tilting the portfolio towards specific sectors and asset classes may be more effective.

A complex world order

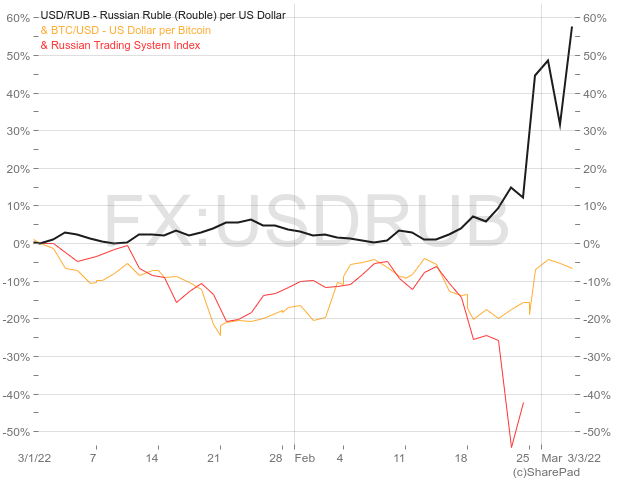

Since the Russia-Ukraine war started on the night of 23 February, the impact on financial markets has been substantial. At the time of writing, the rouble is down by almost 60% against the US dollar year to date. The negative trend for the rouble had been going on for years, but on this occasion the Russian currency was hit so hard that the central bank had to hike its key rate from 9.5% to 20%. With the West imposing severe sanctions on Russia, the country is experiencing financial chaos, with many companies leaving Russia and refusing to sell their items in the country. Russia is also on the brink of defaulting on its financial obligations.

At the same time, the Russian Trading System Index (RTSI) has declined more than 40% year to date, with some big names at risk of liquidation. Russian oligarchs are trying to sell assets held outside Russia and convert their currency holdings into something they can hide. This is where blockchain and digital currencies come in. While at first, bitcoin suffered losses due to a risk-off stance felt on every market, it later rose almost 20% in a period of just 24 hours. While governments may impose restrictions on digital-asset exchanges, they can do nothing about people’s wallets.

Tilting the portfolio

With the above in mind, a few tilts on a portfolio are in order. Let’s start by looking at asset classes, considering cash and cash equivalents, equity, fixed income, commodities and real estate. The prospect of inflation has been with us for a while and now with a European conflict involving a big oil-and-gas producer, fixed income looks unattractive. Central banks will be forced to hike their rates and bond investors will see their purchasing power depleted very quickly.

While the safety of US Treasury bonds is a draw in times of turmoil and war, I would instead look at cash or money-marketfunds in these circumstances. Going down this route, the US dollar is ‘king’ but the Swiss franc and the Japanese yen may also be good options. However, Japan is heavily dependent on oil and the yen may suffer a negative impact deriving from costly oil imports.

Inflation should benefit real estate in general and equities to some extent. But commodities are the best bet here. If the war lasts, we may just be at the beginning of a rising cycle for commodity prices. For now, I would say a war will just bring more volatility to stocks. However, if I were to bet on specific sectors and themes, I would increase holdings in energy and utilities sectors and reduce exposure to the consumer-discretionary sector. Rising energy prices and the potential for a downward business cycle favour these sectors while a loss of purchasing power should hit discretionary expenses badly.

In terms of investing themes for stocks, I believe that defence and cybersecurity are solid themes for the year. When it comes to digital currencies, bitcoin, ethereum and other alt coins are risky investments, which usually suffer amplified losses on top of those experienced by the broader market. However, under these current, specific conditions, privacy is in high demand, so keeping a portion of the portfolio in bitcoin is worth it.

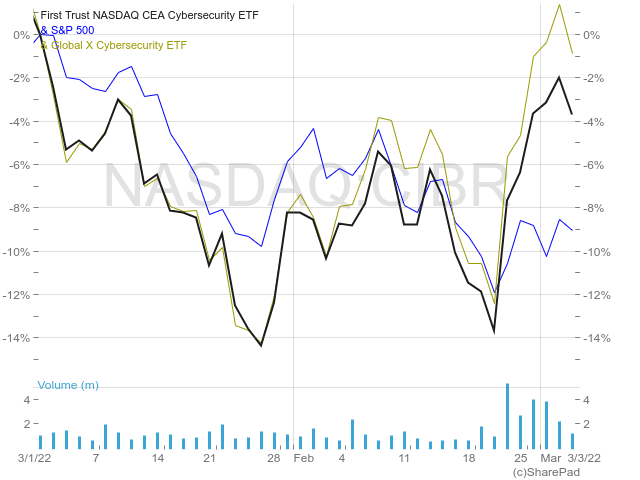

Cybersecurity ETFs

First Trust NASDAQ Cybersecurity ETF (NASDAQ:CIBR)

Let’s start with CIBR, which is the largest fund specialising in cybersecurity, with more than $5bn in net assets. Unlike other funds, which are heavily concentrated in the IT sector, CIBR also provides exposure to other sectors, as it invests in five different industries: software; IT Services; communications equipment; professional services; and aerospace & defence. It provides better diversification than similar ETFs. CIBR weights holdings by liquidity, as a way of balancing its small-cap focus. Additionally, it caps the weighting of the securities of the five most liquid companies at 6% each, and the remaining at 3%. Nevertheless, its top-five holdings still weight 28% on the total portfolio. CIBR invests 95% of its funds in the US.

Ongoing charges: 0.60%

Net assets: $5.94bn

Top holdings: Palo Alto Networks, Cisco Systems, CrowdStrike Holdings, Accenture and Check Point Software (28%)

No. of holdings: 35

Global X Cybersecurity ETF (NASDAQ:BUG)

The Global X Cybersecurity ETF (BUG) invests in companies that are expected to benefit from the increased adoption of cybersecurity technology. These include companies such as those whose principal business is in the development and management of security protocols preventing intrusion and attacks to systems, networks, applications, computers and mobile devices. To be included, a company needs to derive at least 50% of its revenues from cybersecurity activities. Most companies in BUG are from the IT sector and 65% are located in the US. The fund also invests in other countries, including Israel, the UK and Japan.

Ongoing charges: 0.50%

Net assets: $1.17bn

Top holdings: Check Point Software, Palo Alto Networks, Fortinet, NortonLifeLock and Avast (35%)

No. of holdings: 31

Defence

SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR)

XAR provides exposure to the industrials sector, more precisely the aerospace & defence industry. Investors have other options such as the iShares U.S. Aerospace & Defense ETF (BATS:ITA) or the Invesco Aerospace & Defense ETF (NYSEARCA:PPA). However, both are heavily concentrated on top holdings. PPA is more diversified across an increased number of holdings, but XAR tracks a modified, equal-weighted index, which provides an unconcentrated industry exposure. All holdings are in the US.

Ongoing charges: 0.35%

Net assets: $1.4bn

Top holdings: Mercury Systems, Lockheed Martin, Northrop Grumman, Maxar Tech and L3Harris Tech. (24%)

No. of holdings: 31

Utilities

Vanguard Utilities ETF (VPU)

This ETF includes stocks of companies that distribute electricity, water or gas, or operate as independent power producers. It is cheap when compared with its peers. Alternatively, the iShares Global Utilities ETF (NYSEARCA:JXI) gives a global exposure to the utilities sector.

Ongoing charges: 0.10%

Net assets: $7.3bn

Top holdings: NextEra Energy, Duke Energy, Southern Co, Dominion Energy and Exelon (28%)

No. of holdings: 64

Real estate

Vanguard Real Estate Index Fund (NYSEARCA:VNQ)

VNQ invests in stocks issued by real estate investment trusts (REITs), companies that purchase office buildings, hotels and other real property. It generates income in addition to any capital appreciation and is a very good hedge against inflation. It provides access to some of the biggest residential, commercial and industrial real- estate companies in the US, including mall operator Simon Property Group, apartment developer AvalonBay Communities and telecom giant American Tower Corp.

Ongoing charges: 0.12%

Net assets: $84.7bn

Top holdings: Vanguard Real Estate II Index Fund, Prologis Inc, American Tower Corp, Crown Castle International Corp and Equinix (32%)

No. of holdings: 168

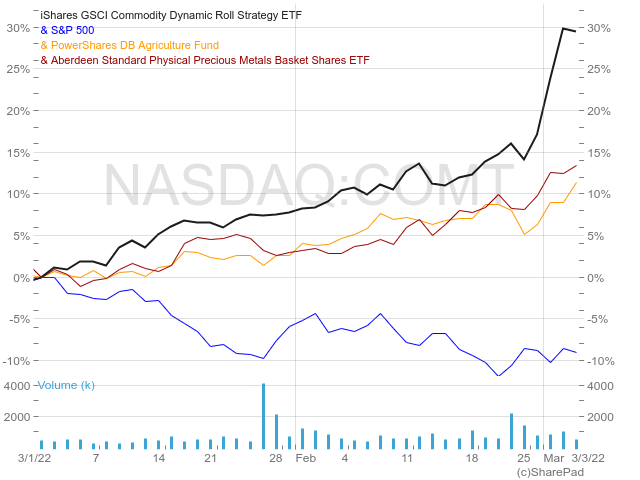

Commodities

iShares GSCI Commodity Dynamic Roll Strategy ETF (NASDAQ:COMT)

This ETF offers a broad exposure to commodities for reasonable ongoing charges. GSCI gives access to commodities, across the energy, metals, agriculture and livestock sectors, through a rules-based futures strategy designed to minimise costs associated with futures investing. It is not a holding for the long term but good for the months ahead. Alternatives to this broad-based ETF are the Invesco DB Agriculture Fund (NYSEARCA:DBA), for exposure to agriculture products and the Aberdeen Standard Physical Precious Metals Basket Shares ETF (NYSEARCA:GLTR) for exposure across the precious-metals segment.

Ongoing charges: 0.48%

Net assets: $3.4bn

Multi-asset exposure

SPDR SSgA Multi-Asset Real Return ETF (RLY)

RLY seems like a perfect fit for the current economic and geopolitical conditions. It is like an ETF of ETFS, which targets several asset classes tailored to provide a real positive return in times of rising inflation. The key goal is to get an edge over the inflation rate, such that the portfolio doesn’t decline in value in real terms. RLY uses quantitative models and fundamental views on qualitative factors to allocate exposure across asset classes via ETFs. The current exposure includes a broad range of commodities and precious metals, infrastructure-related stocks, TIPS, government bonds and real estate. In my view this is a very good ETF to keep on the radar for the times to come, in particular for investors willing to simplify the investment process.

Ongoing charges: 0.50%

Net assets: $243m

Top holdings: Invesco Optimum Yield Diversified Commodity Strategy ETF, SPDR S&P Global Natural Resources ETF, SPDR S&P Global Infrastructure ETF, SPDR Bloomberg 1-10 Year TIPS ETF and SPDR Dow Jones REIT ETF (64%)

No. of holdings: 11

Digital currencies/cash

Considering digital money as cash may seem a step too far, but it may at least serve as a cash alternative in certain conditions, like a war in Europe and accelerating inflation. In these circumstances, government-backed money has often failed to provide a means of exchange, let alone a store of value. Due to their privacy-focused nature and ease of transfer, digital assets like bitcoin and ethereum are an excellent alternative to conventional money. Unfortunately, these are nascent and volatile assets, with prices that can move widely in a single day. Nevertheless, they are a great addition to a portfolio.

Comments (0)