Where Now For The Pound?

Seven days on from the UK election and markets have had ample time to reflect on one of the most dramatic election results in British history.

The British pound started to rally late Thursday evening as the first exit polls trickled through and continued to advance through Friday and Monday.

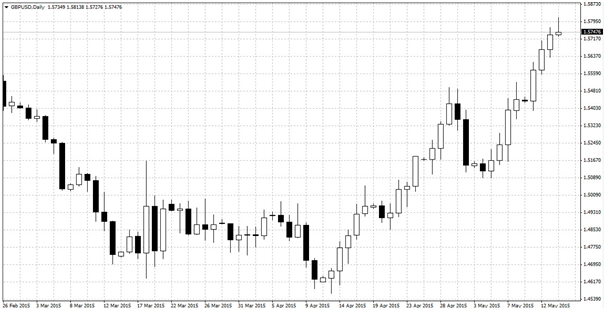

GBP/USD Daily Chart

The GBP/USD is now flirting with the December 2014 highs, though it should be noted a significant proportion of this move is down to the continued collapse in the US dollar.

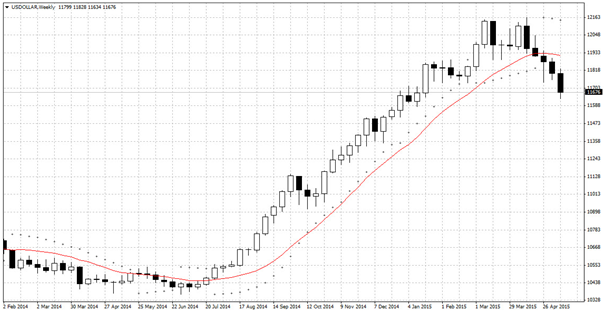

US dollar index weekly chart

The dollar has reversed course with momentum over the last few weeks confirming that the dollar’s Teflon days are over. Friday saw the important US Non-Farm Payrolls come in a fraction below expectations, with average hourly earnings rising just 0.1%. Markets are increasingly expecting a US rate hike to come in 2016 instead of 2015 as the economic recovery stalls.

However, if we assess the pound’s performance versus the euro, we can glean a more accurate depiction of the pound’s progress over the last seven days.

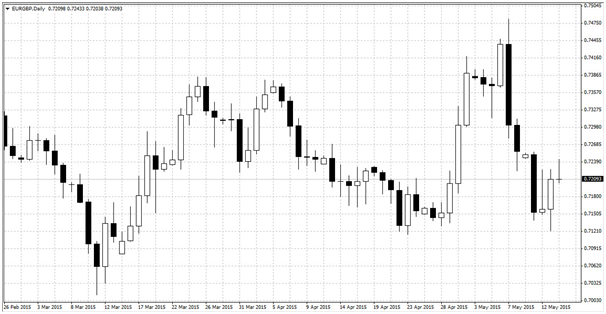

EUR/GBP Daily Chart

Here we can see how the pound’s advance has been slower and indeed has reversed from Tuesday onwards. In fact, all the EUR/GBP’s post election slump appears to have accomplished is to bring the pair back to where it was at the end of April.

The euro’s resilience is all the more remarkable given the ongoing stalemate between Greece and the rest of its creditors. Bookmakers staged their usual PR coup in April by stating that all bets were now off on Greece exiting the euro, with odds of a ‘Grexit’ as low as 1/5. Either financial markets know something the bookmakers don’t or Greece no longer has the perceived potential to drive a wrecking ball through the EU or the euro.

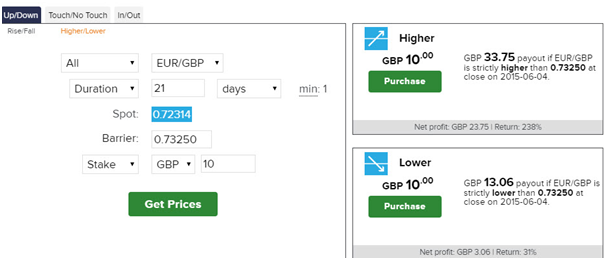

While the British pound is basking in a conservative victory, the bull run could be short lived. It would be unwise to bet against the GBP/USD at the moment given the weakness of the dollar, but the EUR/GBP is a different story. A conservative victory brings with it the uncertainty of an EU referendum. Already BoE governor Mark Carney has called for this referendum to come as fast as possible as the uncertainty is already hurting business investment.

If there’s one thing markets hate more than anything, its uncertainty, which brings with it some potential upside for the EUR/GBP. Sure there is the potential for Greece to implode, but judging by market reactions so far, this is either being priced in or is expected to have minimal impact.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)