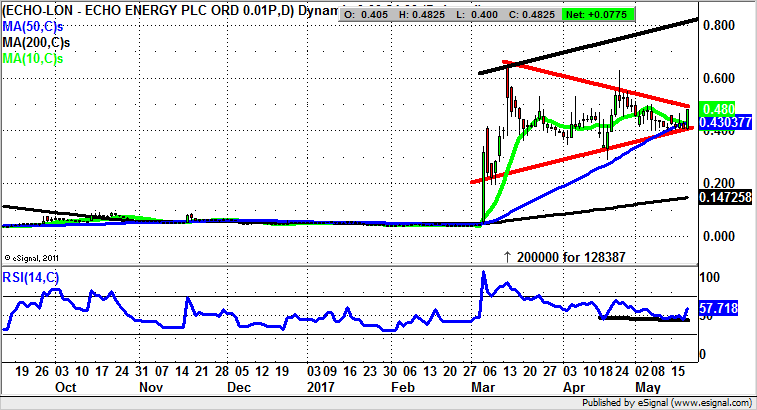

Echo Energy: Imminent triangle breakout towards 0.8p

Echo Energy (LON:ECHO), formerly Independent Resources, has already been one of the micro cap stocks of the year to date. It would appear from the daily chart configuration that a new leg to the upside should be with us within days.

What was interesting about the break higher for Echo Energy, on news that Sound Energy supremo James Parsons would be transferring his skillset to the company, was the way that the vertical spike saw no meaningful retracement. What can be seen here currently is that following the share move higher a consolidation phase began, with the price action so far contained within a triangle formation which can be dated from the early part of March.

Another thing to note is the way that the 50 day moving average, currently at 0.43p, has acted as a dynamic support feature, something which one would expect to back the latest attempt by the shares to break out of the triangle with its resistance line at 0.5p.

All that bulls are waiting for here is an end of day close above 0.5p to unleash what could be a quite powerful move. This is said on the basis that above the triangle the stock could head as high as the top of the rising trend channel from March at 0.8p. The time frame on such a move would be regarded as within a month of 0.5p being cleared. That said, aggressive traders would already be going long, given the way that the RSI indicator has bounced on the neutral 50 level, and the triangle itself is almost certainly a continuation feature.

Comments (0)