The appetite for Brazilian stocks and potential for interest rate cuts

In a previous article on these pages, I examined the outlook for the Brazilian Stock Exchange – the Bovespa – and asked the question if it could sustain 2016’s rally, which made it one of the best equity performers last year with an 80% year on year uptick in dollar terms (+39% in local currency terms). One of the key projected drivers of continued upside was the trend for aggressive reductions in the Brazilian Central Banks’ benchmark SELIC (Special Settlement and Custody System) interest rate throughout 2017 as inflation expectations recede. This article will look at the relationship between the Bovespa and the SELIC in more detail and assess the potential investment opportunity.

The importance of central bank guidelines

Economics 101 tells us that lower interest rates make it cheaper to borrow, which tends to encourage consumption and investment as the money supply increases, the incentive to save is reduced and a fall in interest costs enhances discretionary spend capacity for consumers and companies. Ceteris paribus, this leads to higher aggregate demand, economic growth and rising asset prices as the demand curve shifts to the right. The outlook for company’s top and bottom lines also improve. There is then an inverse relationship between bond prices and interest rates: equities therefore become more attractive relative to government and corporate debt securities. It is for these reasons that market expectations around central bank interest rate forward guidelines are some of the most eagerly anticipated economic data points for investors. The correlation between movements in stock prices and bond yields is a key input for portfolio asset allocation decisions.

Brazil’s economy appears to be rebounding

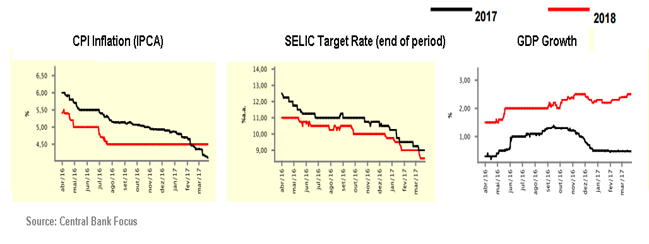

Market analysts are turning bullish on Brazil and forecast a return to growth after depression level activity of the last two years. The economic downturn helped push inflation from over 10% in 2015 to close to the government’s 4.5% target last year, which created space for the central bank to kick-off the first rate-cutting cycle in four years. Economists now expect the SELIC target rate, currently at 12.25%, after a second 0.75% cut this month, the fourth consecutive reduction in total, to end the year at 9%.

Risks therefore seem skewed to the upside as several economic data points, sentiment and industrial output turn positive. The median projection for GDP this year has increased to around 0.5% and 2.5% in 2018. Although it may be wise to not yet bet on a square root shaped recovery, the economic signs are certainly looking better (albeit from a low expectation base).

Median economic forecast expectations (24/03/2017)

The prospect of lower rates, as a function of falling inflation and the improved political and economic macro pictures, are one of the key drivers flagged up by market analysts as justifications for expecting the Bovespa to continue to rally. The consensus estimate is for a year end close of 70000, an uptick of around 8% from the current level (28/Mar). On the surface such rationale makes sense, but let’s dig a bit deeper. Are such expectations based on historic fundamentals?

Back to the past

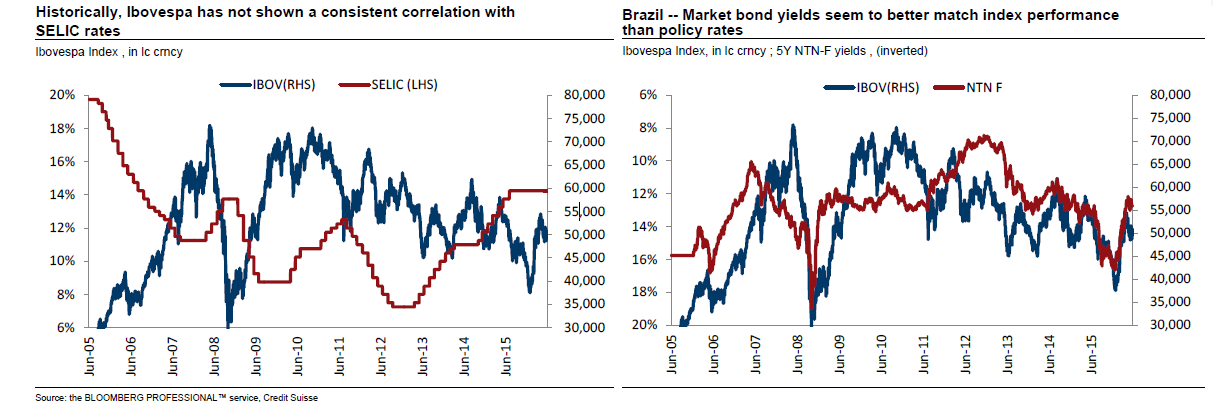

Analysis by Credit Suisse* looked at both the theoretical and empirical arguments behind such a contention and conclude that the relationship between the benchmark rate and stock market performance is weak and that the role of rates cuts as a market catalyst may be overestimated.

“On a theoretic level, we believe the case is weak for using SELIC rates as a key determinant of equity valuations. Equities are long duration assets. They should be valued considering the lifetime of a company’s free cash flows. It would be inappropriate to discount these cash flows (which often extend to perpetuity) based on the SELIC rate, which is a short-term and ‘artificial’ rate set by policy makers, rather than a market derived, long-term rate.”

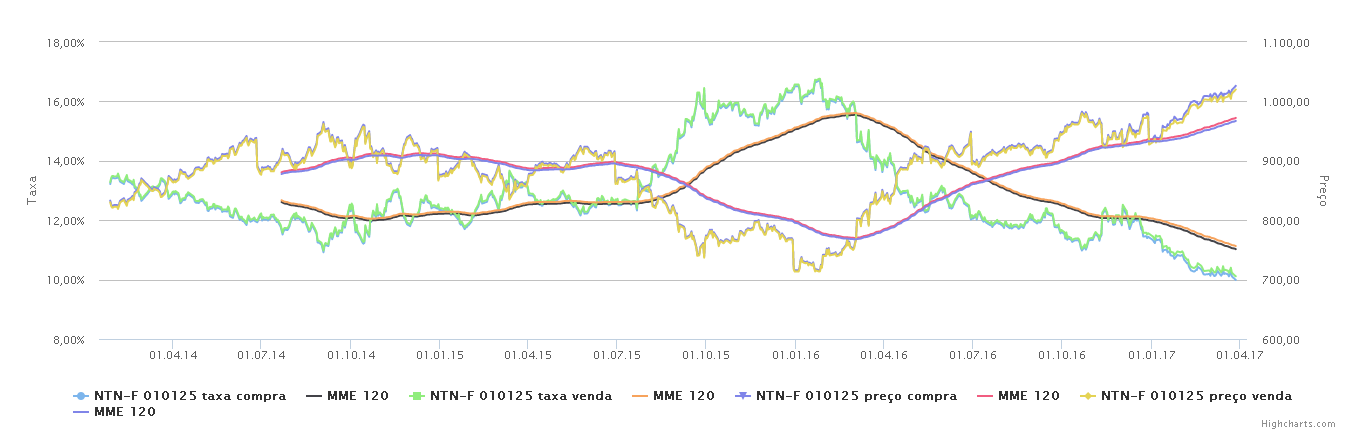

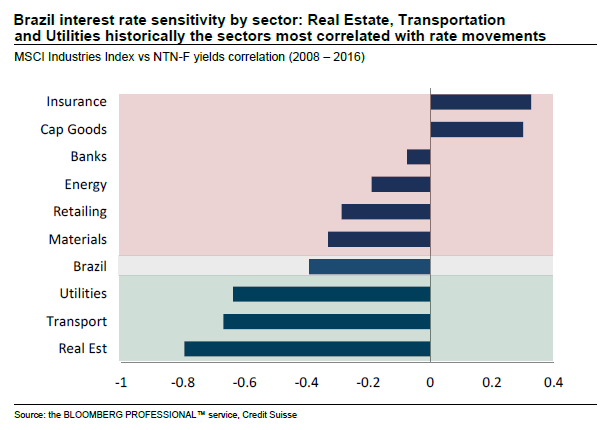

In other words the historic correlation between the SELIC and Bovespa is low. They argue that risk-free rates for the estimation valuation should instead be based on 10-year government bonds for cash flows in Brazilian Reais or 10 year CDS spreads over US treasury bills for dollar cash flows. The correct use of such market-based interest rates discount rates are essential to avoid potentially significant over and under estimates of value. Indeed, they suggest that the pre-fixed Treasuries (NTN-F), which are currently offering a medium term yield of around 10% a year, offer a better guide for future movements. It is worth pointing out though that such market based instruments are also seeing a downward trend.

NTN-F Yield Curve – Maturity 2024

Source: TD Charts

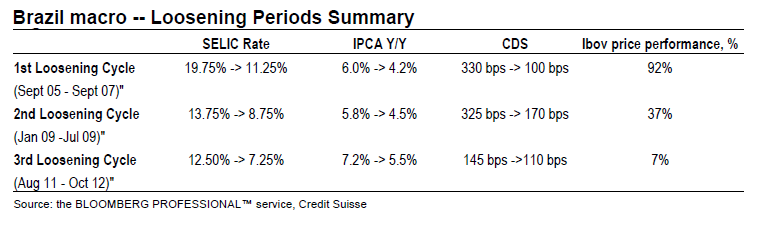

The Credit Suisse study goes on to argue that that “In addition to the theoretical flaws in using SELIC rate to value equities, we believe the empirical evidence of equities outperforming during monetary loosening cycles in Brazil is mixed”. Their analysis suggests that different historical scenarios and stock market performance can be explained based on not only the SELIC but broader market conditions. The table below maps out these relationships.

Thus, the loosening cycle that commenced in 2005 was extremely positive for Bovespa performance whilst the equity uptick during the third cycle (Q311-Q412) was much less pronounced. The data indicates that secondary economic variables such as the inflation rate and CDS spreads also have a key role to play.

Credit Suisse conclude that: “With many investors anticipating a new loosening cycle in the coming months, a key question is whether this cycle will be like 2005 (bullish for stocks) or 2011 (weak for stocks). The 2005 loosening cycle had two elements that we believe are critical for determining whether the next loosening cycle will be bullish.

- First, it was accompanied by a sharp reduction in country risk of about 200 bps, as measured by falling CDS spreads over this period.

- Second, it corresponded to a period when inflation figures were supportive and actually fell below the Central Bank’s target rate of 4.5%, reinforcing policymakers’ credibility.

In contrast, during the 2011 cycle, the decline in country risk was modest (only 35bps) and the entirety of the rate reductions took place when inflation was still above the target of 4.5%.”

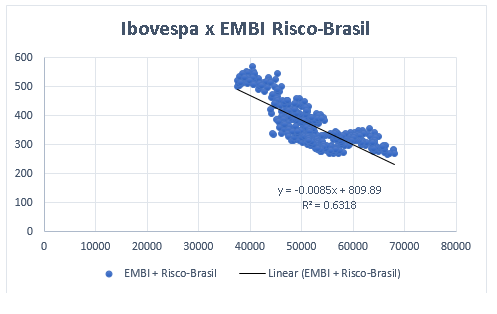

Updating this scenario to the present, due to the improved outlook, country risk, as measured by JPM EMBI, is also seeing downward pressure. The relative bond spread of a basket of emerging market sovereigns is down 47% y-o-y and 14% YTD (by Feb/17). The graph below suggests a significant relationship between Brazil risk and Bovespa strength (correlation of -0.79, and R2 of 0.68 over the last 24 months). Country risk is at lowest level since 2015 which positively impacts equity valuations.

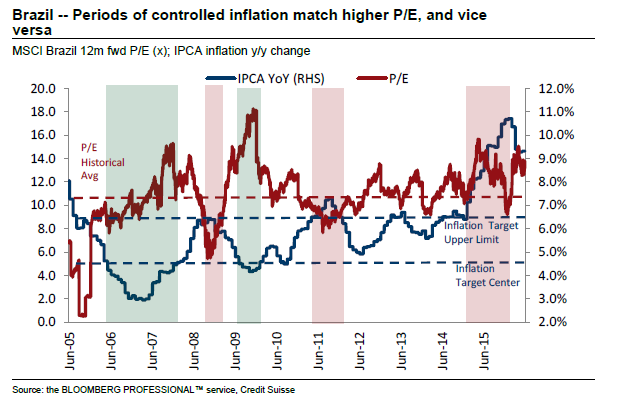

Inflation expectations (e.g IPCA) are also expected to close the year below the central bank target of 4.5%, similar to the 2005 loosening scenario and Bovespa rally. The loosening cycle would also be expected to positively impact equity valuations as historically periods of low inflation in Brazil go hand in hand with higher multiples (see graph below). Thus, both key economic variables of inflation and Brazil risk are on favourable trends to support the thesis of interest rate cuts as Bovespa catalysts.

Sector outlook

Sector outlook

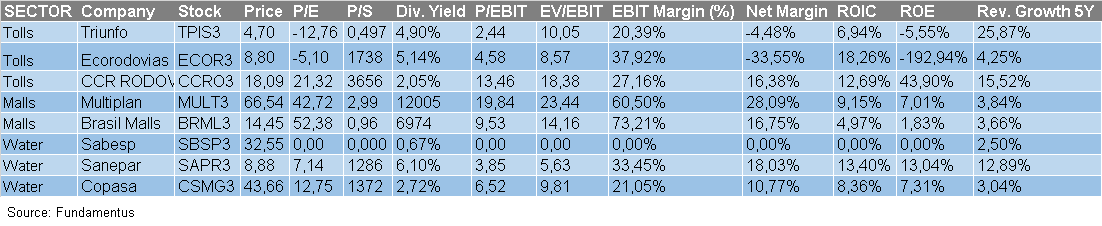

Certain sectors could benefit more from a downward trending interest rate scenarios such as shopping malls and commercial retail, utilities and transport concessions. These sectors have historically had a greater outperformance to the index than other sectors such as Insurance, Banks and Energy.

In the table below we look at the key components of these sectors in the Bovespa:

Moreover, in a study last year analysts at BTG Pactual, a leading Brazilian investment bank, looked at the relationship between a reduction in interest rates and the potential for companies to lower financial expenses (thus increasing earnings), optimising capital structures and increasing cash flow for investments. By last year financial leverage of leading Brazilian companies was at record levels. Indeed, for 14 companies listed on the Bovespa, more than half of enterprise value was debt based.

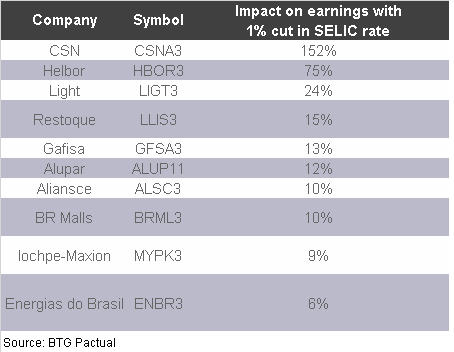

BTG also concluded that potential plays on downward SELIC could encompass heavily leveraged companies, retail and transport concessions sectors and solid dividend paying stocks. They conducted sensitivity analysis showing what would be the impact of a 100 basis point cut in the base rate on projected 2017 earnings figures. They estimated that the below 10 stocks would most benefit from a 1pc fall in the SELIC.

Based on this analysis, the steel company CSN was forecast to see a profit uptick of 152% and energy company Light 24%. Retail companies should also see top line benefits from both the improved macro outlook and the impact of lower interest rates on discretionary spending power. BTG highlight Magazine Luiza (MGLU3), Marisa (AMAR3) and Lojas Renner (LREN3) in this category.

Furthermore, in line with CS findings, they point to transport concession stocks – with pre-fixed cash flows – such as CCR (^CCRO3) and EcoRodovias (^ECOR3) seeing implied IRR improvements.

They added that stocks in the above sectors – commercial real estate, tolls and utilities could also be considered by investors as “yield plays” due to their high dividends.

The final word

Correlations can be misleading. The cause-and-effect chains that exist between the economy, interest rates, and the stock market are complex. They are also dynamic. A new cycle of SELIC rate cuts could certainly benefit certain stocks and sectors. But interest rate costs do not happen in isolation but as a function of broader improvements in the economic scenario. Inflation and country risk are also falling, which is exactly the propitious milieu that the CS study suggested would boost stocks. Currently, appetite for Brazilian equities is in risk-on mode following the emergence of positive economic data points and the potential for business friendly structural reforms. The outlook however remains path dependent.

As always with valuations we need to look at the fundamentals. Over the long term, a company’s share price is determined by the present value of expected future dividend payments, with future payments discounted by an appropriate discount rate that reflects expected paths of inflation, growth and uncertainty. Reductions in risk free rates could certainly impact discounted cash flows (think of the CAPM formula) but cannot by themselves sustain value creation. After all, for complex questions there is rarely a single answer.

* Credit Suisse, Brazil Equity Strategy – Equity investors too focused on SELIC rates? (2016)

Comments (0)