Is the Avocet Spike All That It Seems?

Avocet Mining

AIM:AVM

209m shares in issue

Back in 2011 when I was contributing to a mining broker’s newsletter – the only one still publishing as the sector set itself up for the second mother of all slumps in only three years – I twice recommended selling Avocet Mining at over 200p. That was when that particular broker had been enthusing about its expansion prospects, and so when, as a result immediately afterwards, my services were deemed superfluous to requirements, I forgot about it.

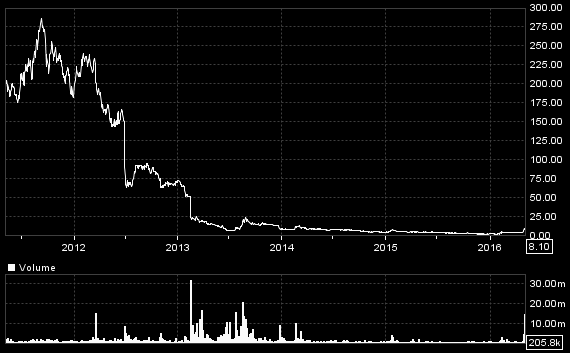

Avocet – 5 years to May 2016

I wish I had remembered that Avocet’s problems (obvious then but not apparently of concern to anyone else) were: 1) cash costs rising and production falling at its Inata gold mine in Burkina Faso; 2) a need to spend to replace the latter’s short remaining life; and 3) a lot of debt – so much so, that the 2012 accounts reported, in mid 2013, “Discussions ongoing with regard to financial restructuring”.

Since 2012, Avocet has seen production at Inata steadily fall (which was anticipated) but cash costs increase (which wasn’t), and with gold sinking has been sitting on, and developing more and more slowly as its finances deteriorated, the one or two new potential mines that it had planned would follow on from Inata.

With its continuing existence dependent on new funding from its one key shareholder, Elliott International, it thus transpired that, along with gold, AVM’s shares over the next four years gently but inexorably descended to only 1% of my 2012 selling price. And that was without any downward hammering from any share issues – which obviously were not possible even through Avocet’s top notch broker JP Morgan Cazenove.

Until, in January this year, someone (not, unfortunately, me) remembered that Avocet’s resources across its three potential mines had originally totalled over 8M gold ounces.

Not that the realisation immediately helped, whoever it was. But, last week, a day after the latest, dire, results for 2015 showed a continuation of Inata’s again reduced gold production, at a cash cost of $1,058/oz, just scraping along below the $1,167/oz price received for its gold, Avocet published operational results for the first quarter of 2016. Cash costs had reduced to $925/oz, so that a back-of-the-envelope calculation – at exactly the time gold had suddenly broken above its three-month old trading range, almost to $1,300/oz – showed AVM’s ‘gross profit’ per ounce at a stroke maybe nearer to $375/oz, rather than 2015’s $99/oz.

So, on the year’s forecast production around 75,000 oz, Avocet might make an extra $19m. And how it needed to!

Not only that, but a quick look at that gold resource (no longer an 8M oz resource, because a lower gold price meanwhile had forced higher the cut-off grade used to calculate it, but maybe 6Moz) showed that its ‘in-ground’ value, even at only 1% of a $1,300/oz gold price, would be worth around 25p per share, when that share in January had sunk below 2.3p.

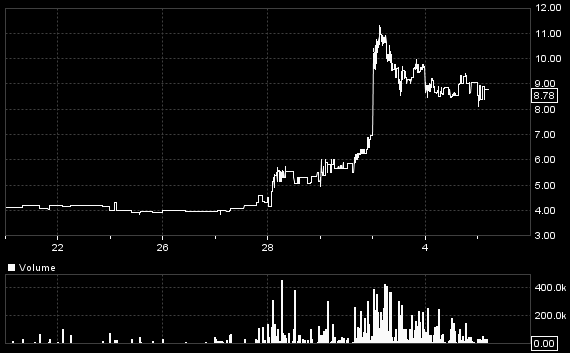

So there you had it. A shaft of light. And a sudden spike when in sank that news – and in rushed investors.

Avocet – 10 days to 5 May 2016

But maybe they should have hesitated. Because, in a recent report the company had said “It is indisputable that the ability of the Company to continue as a Going Concern for a 12 month period, let alone any longer term, is, and has for some time, been a serious concern.” And only a week before, Avocet had reported asking its supporting, major (27.7%), shareholder, Elliott Management, for yet another ‘short term’ loan, bringing the latter’s total lending to $24.8m.

Other debts take Avocet’s total to $66m (against negative net assets) – secured on both the Inata mine and the newer, but unfunded and unbuilt, prospect at Tri-K in Guinea. That debt doesn’t include another $34m of trade creditors at Inata, who have been clamouring for their cash all throughout 2015.

So how long would it take to pay of those loans and creditors, and at what gold price? If all went well the loans would, in practice, be rolled over or re-financed. But let’s work it out. At the latest cash cost ‘margin’ and its resulting ‘extra’ $19m per year revenue, obviously nearly five years. It’s a very crude figure and there are many other costs that Avocet would have to meet, not least to invest to prolong those revenues.

While Avocet’s current production at Inata is around 75,000 oz per year, it only has two years left. To keep Inata going after 2018, it needs ore from a satellite pit 15 miles away at Souma, where it will cost $5-7M just to conduct a study before Avocet can even apply for a mining permit. And then it needs to raise the funds to get it going. Souma’s gold ‘resource’ is just under 500,000 oz, and so the mineable ‘reserve’ will probably be around 300,000, which would add about four years to Inata’s life, although we don’t know the full economics.

Beyond that, Avocet will have to spend what it takes to get the larger Tri-K – with a 3 Moz resource – up and running. All we have to go on is a pre-feasibility study in 2013 which estimated its cost at $88m, now reduced to $60m after refinement of the plan, in order to start on the initial 480,000 oz mineable reserve there, which would last 7 years at 55,000 oz extracted each year. And, presumably, considerably more will be needed to exploit the remaining 2.5Moz resource which is a different type of gold ore.

But Avocet hasn’t published the full economics for either phase of the Tri-K project, so we outsiders can’t predict what funding for it might be possible, or at what cost.

And it seems obvious that Avocet hasn’t been able to raise any funds from ordinary shareholders. In its latest report it said “It is indisputable that the ability of the Company to continue as a Going Concern for a 12 month period, let alone any longer term, is, and has for some time, been a serious concern.”

So in effect we are looking at a company already heavily indebted, depending on completely new projects whose economics haven’t yet been worked out, and for which funding must therefore be an impossible dream at this stage. As Avocet also says in its 2015 Annual Report, “Provided Elliott remain confident that discussions regarding Tri-K remain positive and are likely to lead to a favourable outcome with regard to their loan, the Board believes that Elliott have every reason to remain supportive.”

And it also says: “the Company is in discussions with a number of parties who are interested in investing in the (Tri-K) project, and bringing it into production.”

Well you can believe that if you like. I think Avocet’s situation is very precarious. Not the least risk is that further delays to funding and starting Tri-K, which actually now has a mining permit, might spur the Guinea Government to withdraw it, which in turn will trigger repayment of the outstanding $23m Elliott loan, and that would be that.

I, personally, don’t think a $1,300/oz gold price will be enough to save Avocet (or, at least, make it sensible to invest in it before the inevitably highly dilutive further equity funding or restructuring comes along). Obviously if gold continues on upwards, the chances will improve. But I would say a gold price well above $1,500/oz would be necessary before anyone connected can breathe a sigh of relief, and even before anyone else would come in with a rescue plan. While that person would be attracted by the gold ‘in-the-ground’, its value won’t necessarily flow through to the present Avocet shareholders.

Comments (0)