Green Seedlings Part 2

To continue my update of hopeful green energy raw materials suppliers.

Alkemy Capital (ALK:LSE) – market cap £7.5m @ 82p) – offers yet another business model, which it says will protect shareholders (once it gets going) from variations in the lithium price – by offering customers a ‘tolling’ service (to treat their own ores or constituent materials) instead of taking lithium, with its price volatility, onto its own books. It is also hoping to finance its plant largely through ‘green bonds’- ie borrowings. Funding project subsidiaries through borrowings is what every project company wants of course, but lenders always want equity shareholders somewhere in the chain to take the risk, so it remains to be seen how far the bonds will go and therefore how much they will take from the top shareholders.

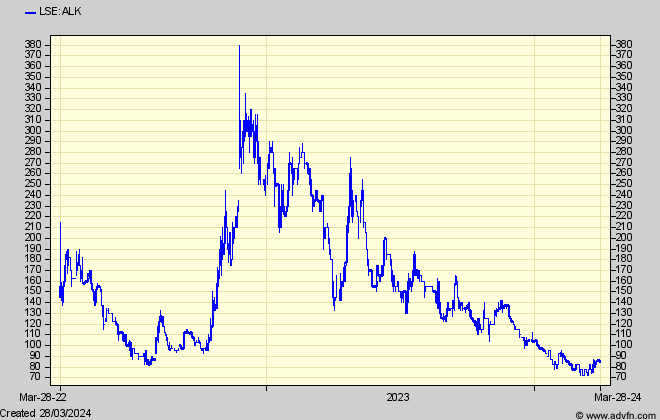

I first mentioned ALK in Dec 2022 – “A newcomer promising even more riches for investors has recently arrived” in the shape of ALK – previously Tees Valley Lithium – which had listed in 2021 at 150p, momentarily reached just over 300p at end 2022 – and is now 80p. (after a fund raise last May when the chairman, Paul Atherley, also chairman of Pensana, subscribed at 140p)

TVL plans to produce 96,000 tonnes of premium, low-carbon lithium hydroxide annually at Teesside and the refinery, which has been granted full planning permission, was recently highlighted by the UK’s Critical Minerals Association as a project of strategic importance in the UK critical minerals midstream processing and refining sector.

Its not jut the tolling which is different, but the quality of lithium produced – higher value lithium hydroxide capable of making longer lasting batteries, and it will be only the second plant of its kind in Europe.(The other is in Germany and not far from production).

But the lithium hydroxide price has also been very weak, and it was those being forecast by brokers when production started in four years from then that induced their eye-wateringly high valuations for the shares (up to 1,200p) and which I cautioned against. A more recent broker report has a markedly lower ‘target’ of 614p per share, based on a 8% NPV of £442m for just the first stage of the project ‘due to commence in late 2024’ (but now at least late 2025).

Needless to say, even without doubts over the method, such ‘exact’ figures (in reality merely ‘estimates’) need to be taken with large pinches of salt, especially because the 2022 estimate of £212m capital cost for just the first stage (of four planned – plus more for a plant in Australia to source and process raw lithium into sulphate) has still to be raised. And although using toll processing is one arm to ‘protecting shareholders’, Alchemy is yet to announce whether it will use those other funding structures to protect their shareholdings.

For the same reasons, discussion of the longer-term, equally eye-watering ‘valuations’ for when the plant is fully up and running with four times the initial output, and with a 30-year life, of a £2,200m NPV would be a waste of time, but again, will probably attract some investors, especially when news comes of the various steps in progress.

Progress has been made however, with MOU’s for some of the lithium sulphate feedstock, and the hydroxide offtakes. And as for funding, the latest announcements (April last and effectively repeated this January after a placing raised £650,000 @ 100p) ) said “Having secured the feedstock for stage 1 (train one) – a vital condition for securing funding – TVL is in discussions with a number of leading financial institutions for the $300m approximate capital cost, which is expected to be financed largely through green bonds, combined with a mix of debt, strategic equity finance and grant funding, all at project level.”

It has also said “Whilst Alkemy’s goal has always been to mimimise dilution in the listed topco, it may also seek to introduce one or more long term strategic partners who share in our vision of building a global leader in lithium downstream processing and refining.”

So that is another investment prospect which might partly protect shareholders from funding ups and downs. And another good step is that a recent report from a new broker calculates the project’s value (although not yet the shares ,whose number we don’t yet know) based not on a NPV but, more sensibly, on the potential dividends for the top company shareholders, which works out at £130m from just stage one. That of course, is still eye-watering compared with the current £7.5m market cap, even though we don’t know yet how many shares it will be divided between.

So there you have it. Quite a bit more work is necessary both to develop the project and to calculate what’s in it for current shareholders, but so far it looks good for an early stage speculation and share ‘spikes’ on any positive funding news.

Alkemy Capital

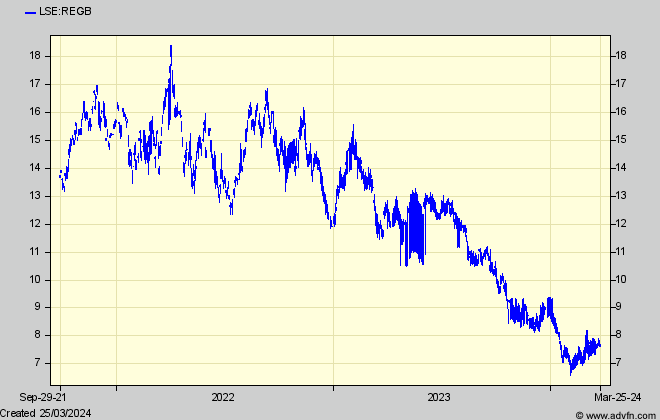

Pensana (LSE:PRE) market cap £76m @ 26p) has also been perking up, following recent news and presentations – although from a very depressed base and not very persuasively. I first mentioned it in April 2022 in a review of the rare earths industry “Two footholds in a fledgling sector.” (along with a small Canadian trading hopeful Auxico, now almost sunk without trace – I was cautious !).

Although Pensana has been long in the making and has attracted scepticism over the time it has taken to secure funding, if rare earths recover determinedly the brakes on the shares might come off.

Van Eck Rare Earths ETF

Pensana has two arms – At Longonjo in Angola “one of the world’s three largest undeveloped deposits of magnet metal rare earths” (Neodymium and Praseodymium (NdPr) – essential for efficient magnets) – whose NdPr-rich mixed rare earth carbonate (MREC) product will be able to supply Pensana’s downstream rare earth separation facility (RESF) at Saltend in the UK, or other customers depending how the markets develop.

The Longonjo mine is almost in sight of the $217m needed to develop it (pending due diligence and agreements to take its production), which will comprise up to $80m equity from the Angolan sovereign wealth fund, and a $156m loan which South African ABSA Bank has been mandated to raise. That removes most of the risk from PRE shareholders for that arm of the company, at the cost, of course, of whatever the lenders or other equity shareholders will take from profits. It also means that profits above those predicted at prices assumed for the product will be geared up considerably for them.

A recent company report said “financial support from our major shareholders (in Angola), have rapidly repositioned our Longonjo Rare Earth Project into a staged development programme targeting first production in early2026.” But while an updated technical report has detailed cost estimates, the economic result in terms of profitability has not been published. Some independent estimates for annual profits before interest and tax however have been around $125m from stage one, and $250-$300m from stage two three years later. Until full funding details are known however we can’t know how much will flow through to top company shareholders and to each share.

While Longonjo has been more easily financed (because Angola and locals obviously want the mine), funding the Saltend processing facility has had a somewhat more erratic journey, with a proposed package of funding ‘from a major strategic mining house’ for both Saltend and Longonjo last year, which envisaged a US$220 million equity investment alongside debt/bond financing, ‘stalled due to operational challenges faced by the potential strategic investor.’ – which is not very reassuring.

Meanwhile the ‘top’ company, PRE which holds both projects, has continued to be supported by M&G group who has invested £19m so far, including last May at 27.5p. But it won’t be surprising to see another such capital raise soon (probably why the shares haven’t bounced much following recent fairly reassuring statements about Longonjo)

So, again, we have a prospect for the moment, from Longonjo (of which PRE has a 84% share) – although the estimated initial profits from the project don’t look particularly eye-watering compared with the top company’s current £76m market cap, bearing in mind the funders will take their share first. (I haven’t done the sums at this stage) and that the bigger task at Saltend has still to be faced. Not to be chased yet.

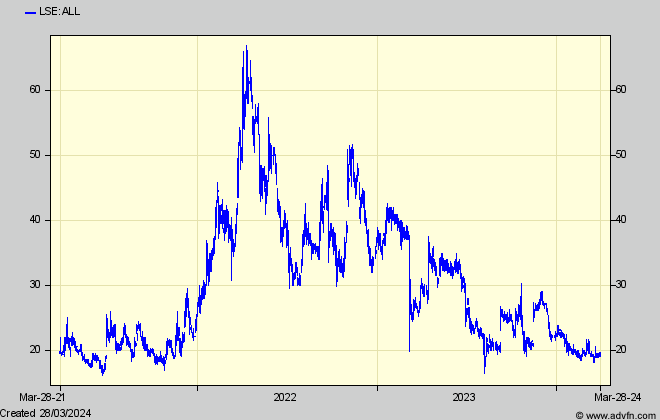

Atlantic Lithium (ALL – market cap £125m @ 19.2p)) is the last of the four, and I think the first I covered (at end 2021) and is planning to produce Spodumene, the raw lithium ingredient with the biggest price fall and no bottom yet. ALL seemed one of the most promising three years ago when (previously IronRidge Resources) it restructured and renamed itself as Atlantic Lithium, having secured an agreement from Nasdaq listed Piedmont Lithium to fund the first $70m of ALL’s Ewoyaa, Ghana, lithium mine’s capex to start production, in return for 50% of its lifetime output.

At that time, the mine’s economics, stated as a $345m NPV in return for $70m initial capex, didn’t look too startling for IRR’s (ALL’s) then £100m market cap. Its 50% of Ewoyaa’s NPV would have been ‘worth’ only £129m. But when spodumene concentrate soared soon afterwards to $1,900/tonne (it’s now $1,200) the NPV became $789m for the same cost, with an exceptional 194% IRR.

I calculated that to translate into EBIT per share of 44p, which in four years from then I didn’t think looked particularly compelling against a 27p share price. And even when the shares reached over 60p over the next few months when lithium spiked, I remained cautious about the volatility. And so, over the next two years, the shares drifted erratically down to 20p along with the lithium price.

But now, while little has changed in ALL’s plans, they are much further on, with an updated definitive feasibility study paid for by Piedmont showing a Post-tax Net Present Value (“NPV8”) of US$1.5bn, and an IRR of 105%, with free cash flow of US$2.4bn and an average annual EBITDA over 12 years of US$316m – 77% higher than in 2021’s feasibility study – although based on a higher $1,587 spodumene price which ALL says is ‘conservative long term’.

Investors however might disagree, given today’s $1,076 price quoted from China (not necessarily the same as from Ghana), and in the US which is $1,200. Against that, Ewoyaa, according to the company ought to remain competitive with ‘one of the lowest global costs

However, despite the current lithium weakness (or because of it) ALL in November received two non-binding offers at 33p per share from its largest shareholder (Assore International who had long backed IRR) – which it rejected.

So all looks good for Ewoyaa itself, with other backing, and government support promising that all permits will allow construction to start by the end of this year.

Which is why management is exuding optimism, because it has secured funding for 79.5% of Ewoyaa’s $185m capital cost – from outside backers of one stripe or another.

But, as ever, that is at the project level, and those outsiders will therefore take 79.5% of the profits, after they have suffered the Ghana government’s 13% free carry (which reduces the IRR as seen by all backers and shareholders from 105% to 74%).- although the exact terms of these funds have not been disclosed and could be different.

But there has not been so much as a beep from the company or from its promoters or brokers, or commentators, as to the eventual value for the top company shareholders. To raise its remaining share of the $38m (which would normally be via a share issue which would further dilute them) the company is negotiating forward off-take deals with potential customers for payment up front – i.e. via an offtake or streaming deal, and these are always much more expensive to shareholders than borrowings would be.

At present, therefore, before the cost of such a deal and very crudely, ALL’s 650m shareholders are due 20.5% of a $200m annual cash flow (if the 2023 DFS numbers are achieved) less 13% to Ghana, which I make to be $36m (£30m) per annum – which equates to 4.5p per share. Bearing in mind that is before the unknown but likely to be heavy cost of an offtake deal, and depends, in two years time on a lithium price which might not be much higher than now, it is not surprising the shares, at 19p, are still bumping along the bottom. (Another lesson in how a juicy looking NPV for a ‘project’ – as always touted by its owning company and its PR henchmen – is not nearly the same as the NPV as eventually seen by its shareholders).

Optimists however are pointing to the stream of news due this year as Ewoyaa completes the steps necessary before, as the company hopes, its construction starts. So you might see the shares spiking up to Assoya’s 33p level. If they do, I would take profits.

Atlantic Lithium

ALL are retaining 40.5% of the profits, not 20.5% as suggested in this article.