Checking On Green Energy Seedlings

Firstly, it’s good to see three of my gold ready-to-go reccs are delivering – due of course to gold’s strength and to investors’ hopes it will continue. Who knows whether it will. Even Solgold (now up to 8.5p) has been polishing itself up ready for sale or a beauty parade (possibly already in progress) with a report finding “a significant porphyry target” on Cascabel’s nearby Blanca Neaves project “greater in extent than the Alpala system at Cascabelt” which could significantly increase the whole project’s long term value. But the gloomsters point to owner Solgold itself running out of cash, with the risk it would go bust meanwhile. I don’t think so – and the shares look outstanding value if it doesn’t

Unfortunately Kefi has blotted its copybook once again with a deeply discounted but small capital raise, whose size didn’t warrant the extent of the share’s fall, which looks more to do with the state of the markets. Today it has announced further progress towards starting Tulu Kepi this summer which should see the shares better..

And Hummingbird has fallen out with its mining contractor, delaying gold ore supply from its new Kouroussa mine to HUM’s associated ready to go treatment plant. It still has revenue from Yanfolila, and we have to wait and see how and when the hiatus will end. Fears HUM can’t therefore start repaying the Kouroussa construction loans is what is frightening the shares, which nevertheless still look well undervalued.

In Australia, Barton Gold‘s shares are recovering from last year’s weakness and capital raise before the fruits of its exploration began to show, and are now back to where I recommended them (as looking exceptionally promising). They look poised to break above A25c when, if not before, a useful increase in its two easily accessed gold resources found by its first drilling programme is announced this summer along with, possibly, plans to mine. Small, and valued at less per gold ounce than larger peers it is a buy.

Gold is being bought by the fearful – who think the world is going to Hell in a handcart. But if it isn’t (and humans have a habit of shaking off sloughs of despond) the optimists will look again at humanity’s next big project (it was transport that powered economic growth in the 19th and 20th centuries) – for which four would-be suppliers to the green revolution, who I looked at in 2021-22 are preparing themselves.

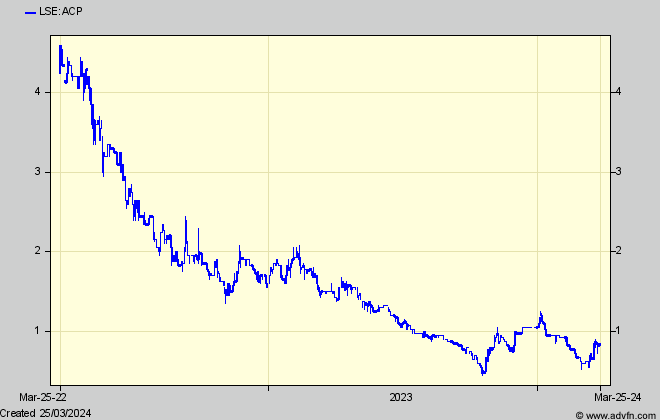

Armadale Capital – ACP Battery grade graphite

Atlantic Lithium – ALL Lithium spodumene ore

Alkemy Capital – AKL Lithium hydroxide toll processing

Pensana – PRE Rare earths concentrate and processing

These were all being trumpeted by brokers as offering eye-watering profits for investors, but since then the green commodity markets have been disastrous. Spodumene (a basic lithium ore) fell by 85% during 2023, and its product, lithium carbonate (a key use in batteries) along with it. Ditto the other commodities and intermediate products.

So all four shares are seriously down, and while some seem to be calling the bottom in the basic commodities, most market observers can’t see it yet, with lithium prices forecast to keep falling well into 2024. Even so, some lithium producers are calling for more investment in supply to meet projected long term demand. But whether it will be there, and when, is dependent on China. Goldman Sachs only three weeks ago said “it is too early to call an end to a battery raw materials plunge and the bank is targeting a 12%, 15% and 25% downside in cobalt, nickel and lithium carbonate, respectively – with all markets generally oversupplied.

And in that vital corner of the market – rare earths – the picture looks almost the same although, to precis a Chinese market analyst last month, “Rare Earth prices have likely bottomed out and could be poised for a rebound in the second half of 2024 on the back of strong demand by the electric vehicle and wind power users”

But prices of rare earths dysprosium, neodymium, and praseodymium oxides are also back almost back to levels in mid 2021 before they all surged, against which that analysts says “further downside for rare earths, particularly for neodymium-praseodymium (NdPr) oxide, used in permanent magnets, which fell 38% last year, is limited with prices near the production cost level.

So perhaps investors should prioritise rare earths over lithium – for the moment – and keep an eye on the others. Because although down, all four companies are still alive, and even kicking vigorously, with some (but fewer) brokers still recommending them.

Which could be because plans for the Gigafactories in Europe and the UK that will need them as feedstock have been pressing on, with early stage funding secured for some. Only this week, Chinese battery giant EVE Energy has announced its plans for Britain’s biggest gig-factory at Coventry are progressing well, with strong Government financial support.

When I first looked at the sector, I was cautious about the methods the brokers were using to breathlessly trumpet their staggering share price ‘targets’, and maybe it is not just the weaker product prices than assumed at the time that has sunk the shares, but a realisation that those valuation techniques might not be as they seemed.

So here, before looking at the companies, I revisit valuation methods, which many less experienced investors (not to mention their various public relations promoters) don’t want, or seem, to understand, although many recognise the risks.

Which of course is that investors in these ‘project based’ companies face the dilution (or value erosion) which diminishes their shares’ value, as extra capital is raised to support long drawn out planning processes and then costs to build.

To counter this perception, some would-be producers are beginning to contemplate business and financing structures which – they say – will better protect ordinary shareholders.

Here again however, cautious me says – ‘Well Yes – but only up to a point’ – because the inescapable fact is, that however a project is funded, if outside investors or banks come in to help shoulder the cost, they will want their pound of flesh. Which can only come from the project’s underlying profit (ie the large ‘NPV’ the less scrupulous brokers highlight) before the remaining shareholders (ie those, you and me, invested in the ‘top’ companies who own the project and are listed on stockmarkets – as opposed to the ‘projects’ themselves which usually are not) get what is left over. But brokers (and the companies – let alone public relations puffers) will never tell you how many pounds of flesh those outsiders will take and therefore how much will be left for you, the ‘top’ shareholders.

Some brokers pretend to get around this by ‘risking’ the project NPV that they trumpet. – through saying ‘shareholder value will be some % of it’. By so doing they are admitting they haven’t a clue, and that they haven’t bothered to spend time (and expertise) doing the necessary detailed sums, while also giving them flexibility to choose any flattering %-age they like.

To sidestep that vagueness, and aware of investors avoiding a risk by not investing at all, some companies are now highlighting methods whereby it will ‘seem’ that the listed company shareholders will be protected, ie they will maintain their original share of the issued shares, and won’t be called on to stump up any more cash as the project develops.

That is achieved by the top company investing only indirectly in the project, instead of being directly responsible for funding it. Instead the project will be owned by a subsidiary unlisted company (usually a ‘special purpose vehicle’ – SPV) which may well be funded originally by the ‘top’ company, but subsequently as further cash is needed, will be funded by outsiders – either different shareholders or loan providers.

Even though this arrangement is really a smoked mirror to obscure what is actually happening the (top company investors’ shares value is still being eroded by those pounds of flesh, but further down the line) the listed company investors should feel more reassured, and the price of their shares will probably be more stable.. And for those who do realise what is happening, they will hope the residual profit left for them will be geared up (or down) faster than under the directly owned case. So that, too, might add to such shares’ attractions.

Against the general commodities gloom, the market for graphite, both natural and the much more expensive synthetic variety, which constitutes much more of a battery than lithium, while also down, is not so to the same extent as the other minerals. That seems to be because market analysts think future graphite supply is not at all assured. One says “OEMs and cell makers now rank graphite as their top sourcing concern for battery materials”

So could Armadale Capital (ACP) ((the smallest company with perhaps the biggest risk-reward) with its Tanzanian Liandu Mahenge graphite project, be an early candidate, even though it hasn’t gone for the indirect funding structure.

The company (which has a somewhat chequered history) claims a JORC compliant resource establishing Liandu ‘as one of the largest high-grade graphite projects’ in Tanzania’ with a DFS in 2020 showing a 4-year first stage costing just under $40m, exploiting the initial easiest to mine graphite. That stage ‘could completely fund a $32m 2nd stage’ and overall would deliver a cash return over 17.5 years of $620m after tax (at a $1,179 graphite price, slightly below current) equating to a 10% NPV of $240m.

Compared with ACP’s £5m current market cap that will attract a lot of investors, even though funding will be via the ‘traditional’ top company and will dilute their shareholdings. But the published DFS doesn’t separate out the first stage numbers, which will be the ones investors will want to see to confirm the second stage will be as promised. In addition of course, mining costs have rocketed since 2020, against which according to the company the graphite price is currently ‘materially above the level used in the company’s feasibility study’ (not much so in my view)

To paraphrase ACP’s report three weeks ago, “The Group is continuing discussions with several potential financing partners, while significantly improved market fundamentals and strong ongoing demand from the EV sector has seen increased interest in providing long-term project finance. So the Board has commenced re-engaging with prospective end-users located in Europe and China.” (Somewhat ambiguous wording methinks!)

Meanwhile, Australian Black Rock Mining’s 4 times larger Epanko graphite project, also at Mahenge, has just obtained approval from African banks and development corporations for the loans it will need for first production in 2026, and also a promise of equity funding from a potential partner, South Korea’s POSCO – the largest battery anode producer outside China.

How helpful this is to Armadale’s plans is difficult to judge, since it is scale that funders look for, as well as the offtakes which Black Rock has secured, and while ACP has its mining licence, it still needs an environmental permit. More disturbingly it “continues to actively review other investment opportunities for mineral exploration in Africa” – which along with a last June balance sheet showing little working capital – doesn’t reassure. One to watch but maybe to buy only as a speculation just now.

I will update the other three hopefuls in a few days (and might take a look at Black Rock (ASX:BKT) at some time.

Comments (0)