Michael Taylor’s Chart Navigator: Four charts for the month ahead

As we near the end of summer and people gradually begin to return to something that distantly resembles normality, Michael Taylor reveals four charting picks where the momentum looks to be building.

Another month passes as we enter the beginning of the end of summer. For now, the pandemic seems a thing of the past. Restaurants are buzzing, bars are teaming with punters, and Covid-19 is but a distant memory.

And who knows if that will change? Let’s hope not, but it is something we must be prepared for. As traders, we must ask ourselves what can happen and how we can prepare. By looking at current themes and trends we can get onboard early doors.

One key talking point of the last few weeks has been gold. All of a sudden everyone wants to be long gold and producers, as the commodity has broken free through resistance and powered on to smash $2,000.

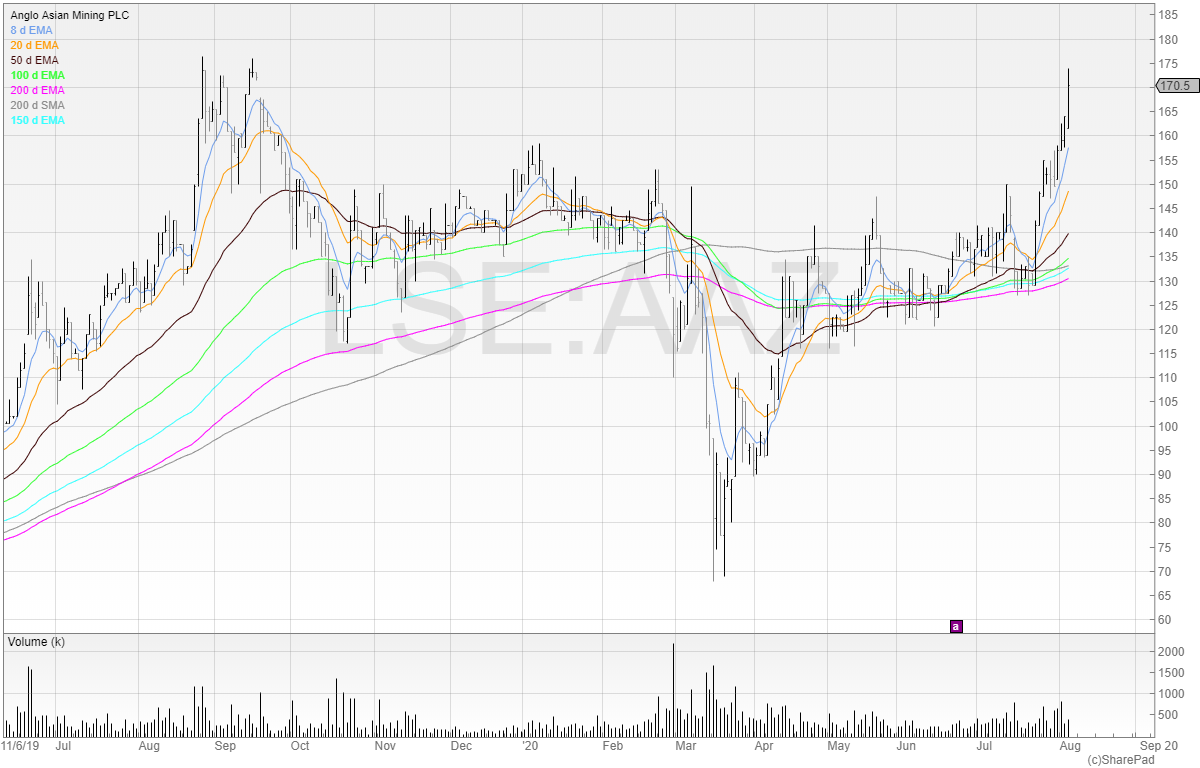

One stock I particularly like in this sector is Anglo Asian Mining (AAZ).

This is a popular stock for several reasons:

- It is clearly uptrending, and appears to be a stage 2 stock

- The company has open pit mining sites and it ranks in the lowest quartile for cost

- At current gold prices, Anglo Asian Mining is highly cash generative

- This cash generation has seen reductions in gearing on the balance sheet from a net debt to a net cash position

All of this sounds positive. But remember: gold is a finite resource. Any gold producer will eventually run out of gold, and a gold producer without gold is like a pub with no drinks.

Proving up more reserves is in the group’s plan – but it is a risk.

Looking at the chart, we can see that the price took a hammering during the Covid fear. Both the baby and the bathwater were unceremoniously dumped during this phase, with little regard and pure emotion.

How much a gold producer can be affected in times of a pandemic I’m not entirely sure, but the market deemed this warranted a more than 50% drop in the merchandise and so it was marked down. Stocks are one of the only things that everyone loves to buy when the price rises, and that appears to be the case now as the stock is now in vogue again.

The stock is now punching new 52 week highs and closing in on the all-time high.

I hold a position and intend to add to this should the stock break out. I often average up because I am rewarding well-behaved stocks with more responsibility for the account. They have earned it. Why would I reward bad stocks with more capital when the very thing they are supposed to be doing – earning capital – is the exact opposite of what they’re doing?

Would you reward your dog with a treat every time he fails to do a trick you’re trying to get him to do? Didn’t think so!

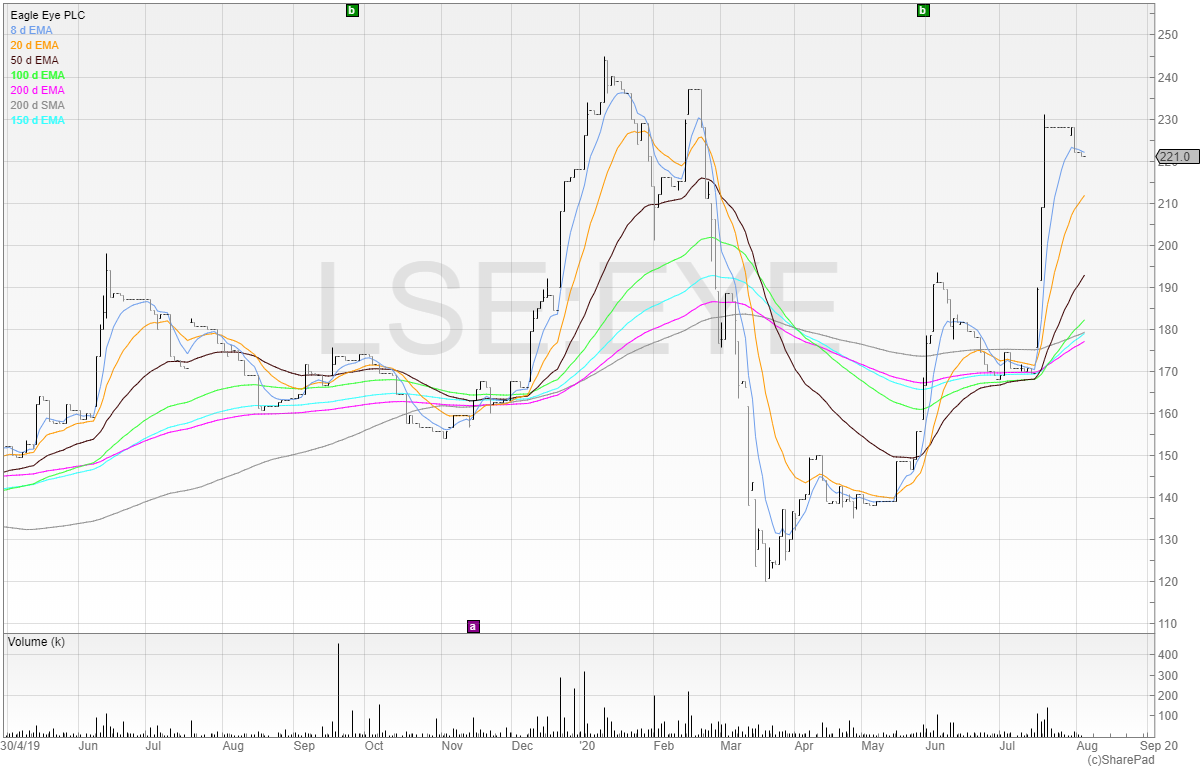

Eagle Eye

We looked at Eagle Eye last month, and I mentioned that as the stock was trading ahead of expectations it didn’t seem unreasonable to assume that due to supermarkets remaining busy Eagle Eye’s AIR platform had been seeing a lot of business.

Well, not long after last month’s piece was published, the company issued another ahead-of-expectations RNS.

The company also made the swing from net debt to net cash, which now confirms that the group is self-sustaining. This is a huge derisking of the business model because it now means that the company is no longer reliant on cash placings to survive and so it removes the need for a begging bowl style equity raise.

Eagle Eye is also in the process of applying for an extension and increase of its debt facility, so this will mean further liquidity available for the group. This means that potential acquisitions could be on the cards but I think also relatively unlikely. It makes sense to get liquidity if it’s there, but Eagle Eye’s model should now be to scale up and deepen its customer relationships.

Looking at the chart we can see the spike up, and a potential bull flag forming. I intend to add to my position here. As far as I’m concerned, Eagle Eye is now a serious business rather than just a loss-making idea. It still is loss-making but able to sustain itself – and that is the difference.

AO World

AO World has been a shorting favourite for several years, but recent trading for the business has been good. It’s also become cash generative and as a result of Coronavirus more people are doing their shopping online.

I haven’t looked much into the business – and neither do I intend to – because what matters here is the price action. Let’s look at the chart.

We can see that the stock has been threatening to break out of that 175p range. It’s been on a storming rally, and now all of the moving averages are turning upwards. If this is the start of a new trend, then I want to be in on it and that means I want to buy the breakout of 175p.

If we look at the bottom of the chart, we can see that the volume has ramped up significantly. This is a clear sign of accumulation and buying. To me, that’s a bullish signal and something I want to try to capitalise on.

EKF Diagnostics

EKF Diagnostics is a company that has continually put out good news, and continually been sold off on the back of it. It is clear that there is a seller in abundance there, but how much longer can it last?

On May 15th, the company announced that: “In these circumstances, the Board expects the second half of the year will see continued momentum and the full year results will exceed, perhaps considerably, its recently upgraded expectations.”

A month later almost, on July 14th, the company again iterated: “Due to the continued demand for PrimeStore MTM, full year performance is likely to exceed and possibly significantly exceed previously revised management expectations.”

Yet the price did not shift due to the seller. And on August 5th the company announced: “Due to the continued demand for PrimeStore MTM, full year performance is likely to further exceed, and possibly significantly exceed, previously revised management expectations.”

Here is a company that keeps upgrading its expectations, as it is clearly trading its socks off, yet the price is being pegged back by a seller.

Here is the chart:

We can see that the business has traded in a range from around 50p to 44p since around May. There has been plenty of volume and several spikes in volume, but each time a seller has stepped in to stem the rise. Once the seller stops choking the price – and assuming demand for the stock remains at a similar level – then one could expect the price to rise. I hold a long position at 54p and I am bidding for stock lower should the price offer an opportunity.

In trading I like momentum plays, and stocks that have a catalyst. A catalyst provides the reason for the move and is something I like to identify before buying. If there is no catalyst, then why buy the stock?

The stock is now at all-time highs, and so I am hopeful it will go on a run. That remains to be seen – but one thing I am sure of is that if the stock reverses I’ll be quick to cut my losses.

In this market, it pays to be nimble. If you get stopped out, you can always get back in. But if you lose all your capital, you go out of business.

And with that in mind, one firm did exactly that this month. They were short a microcap called Eurasia Mining, which is no longer a microcap after multibagging. It put the firm out of business.

Shorting illogical moves is silly because 1) prices can become even more illogical, and 2) the assumption that prices are logical is illogical in itself. You are therefore illogically betting that prices would return to logical levels. Whatever you do, always make sure you are protective of your capital, because if you have to leave the dealing table it may not be so easy to reclaim your space.

- Michael has released his UK Online Stock Trading Course sharing his knowledge and how he trades the stock market. Investors Chronicle readers can take advantage of an introductory offer by visiting shiftingshares.com/online-stock-trading-course

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael

Please look at TESLA’s chart in the next issue. It strikes me as an excellent example of technical analysis in action.