Chart Navigator: Greggs, Restaurant Group, Bilby and Cambridge Cognition

In this monthly charting column, full-time trader Michael Taylor reveals four stocks that he reckons could see fireworks in the month ahead.

It’s been a long month in the markets. And a great one too! On 2 November 2020 we saw news of a vaccine and the UK market surged, with many stocks closing into double digits. I saw a piece that said it was the biggest blue day for decades – and I can believe it. I’ve never seen so many FTSE 100 stocks trading above 10% and then carrying on rallying like penny stocks over the next few sessions.

With the vaccine we saw a huge amount of sector rotation going on. Fast money came out of Covid testing stocks and into retailers, hospitality, travel… all sectors that had previously been out of bounds for institutional money.

The following Monday, we saw further news on a vaccine – putting Covid-19 and coronavirus firmly on the back foot. Although the vaccination programme will take months to have a serious effect, the first vaccine was rolled out to Coventry’s Margaret Keenan, who is 90.

Make no mistake, Coronavirus will linger, and it is by no means over, but we are now firmly at the beginning of the end.

One potential market gyrator that has been swept under the carpet is Brexit. I realise this topic is a divisive one, but whether you voted remain or leave it is undeniable that the outcome will have an effect on the markets.

There is, at least in my opinion, the potential for a big shock. It seems many people are expecting a deal, and everything to run smoothly. But what if there is no deal? What if – just like in 2016 – everyone is wrong? “But that was the exception” – some will undoubtedly say. And yet Donald Trump was a whisker away from winning the Presidency for a second term, when everyone said he was almost certainly going to lose.

We don’t know what is going to happen. We don’t need to know, either. What we do need to know is 1) what can hurt us, and more importantly 2) what are we going to do about it?

Having a plan for various situations is always a good idea. I’m also a subscriber to the idea of keeping cash ready for opportunities. If you’re fully in the market and you need to deploy capital, this can be frustrating and can weaken your returns.

Having cash is a hedge, as if things go bad the cash will stay the same, but it’s also a call option on being able to take advantage of volatility immediately. Don’t underestimate the psychological factor of having powder dry either.

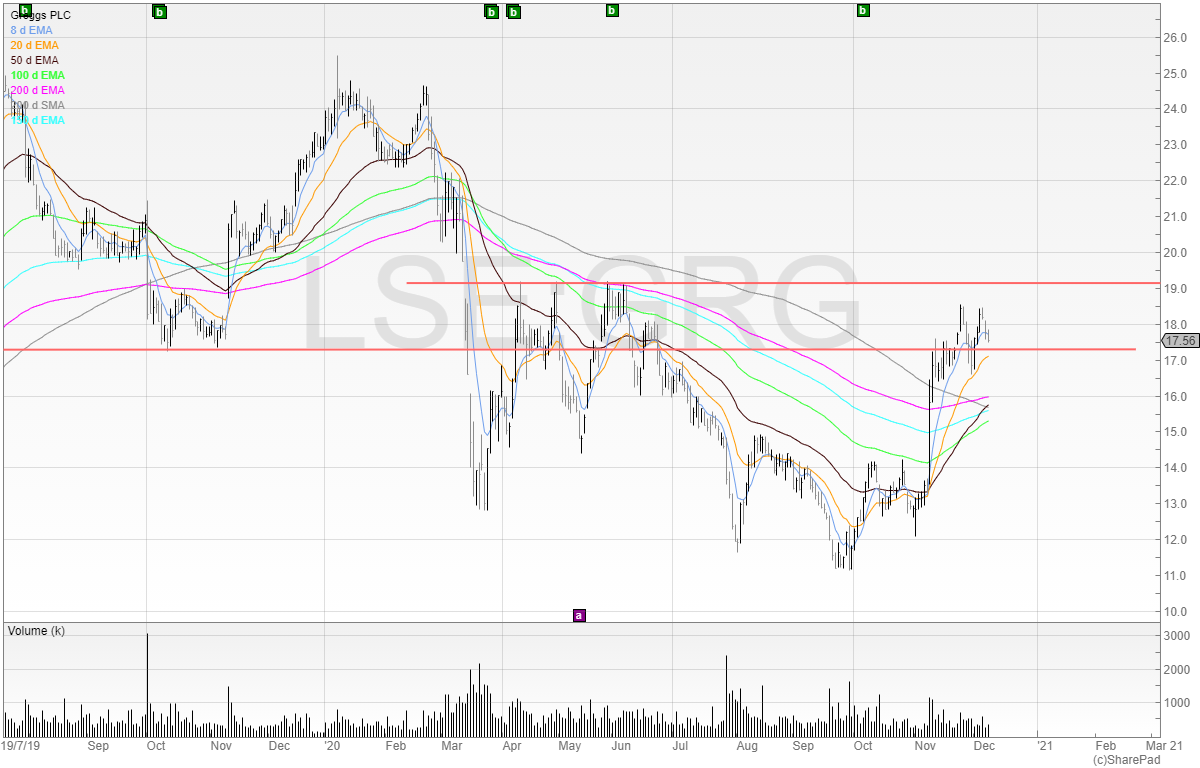

Greggs (LON:GRG)

Greggs has been hard hit due to Covid. Many of its units are in high-footfall areas, which of course have seen reduced footfall as well as no footfall during the first lockdown. Since Vaccine Day the stock has recovered, and there could be a lot of upside left provided we don’t have another lockdown.

The Covid news has tended to change by the day, and who knows what December will bring, but I believe that Greggs may offer a short-term trading opportunity if it takes out the 1,900p resistance.

In the company’s recent trading update, it announced that “September company-managed shop like-for-like sales improved to 76.1% of 2019 level in the four weeks to 26 September 2020”.

Greggs is also restarting its shop opening programme and expects 20 net openings in 2020.

The share price is currently just over 24% off its highs – so one could reasonably ask if there is much upside here.

It’s a fair question, and not one I’ll concern myself with. I’ll let the chart do the talking. It’s a trade only. Whilst I believe Greggs is a quality business that is likely to be a Covid winner, the price is always right and I’ll trade the pattern, not the fundamentals.

Restaurant Group (LON:RTN)

Another stock in a similar group that I like the chart of is Restaurant Group. I think it is a poor-quality business, with fatigued brands, but in crises the small get smaller and the big get bigger.

Many of the weaker competitors have gone bust. The ‘me-too’ competitors have realised that casual dining isn’t the golden goose it once was, and the crisis was already in full swing before Coronavirus came around.

We can see resistance on the chart at 75p, and if the stock breaks this on good volume I’d look to take a long position.

The stock is now trending above all its moving averages which is positive. Volume has increased throughout November which is a sign of institutional money and interest moving back into the stock.

It’s another case of trading the chart and fundamentals here, because even though I feel that Restaurant Group has the potential to do very well out of this recovery, I believe there are better opportunities elsewhere.

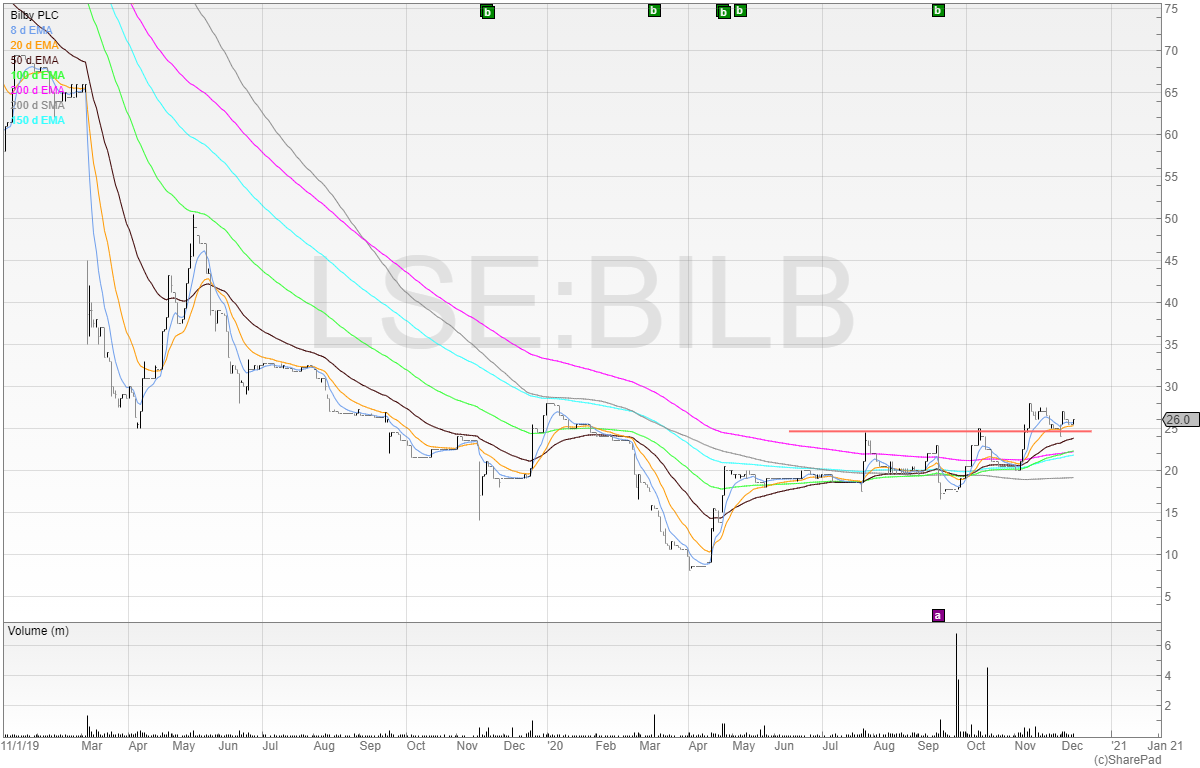

Bilby

Bilby is one of those stocks with more opportunity. Again, this is never going to be a high-flyer, but the trade here is that the stock has been hammered down and the business is trading well.

It’s also broken out of a nice range and is on the uptrend.

Here’s the chart.

Notice the volume ramping up in September and October. It’s a sign that people were wanting in, and now the stock has taken out the resistance zone.

The directors were heavy buyers – which is always a good sign. Nobody puts a gun to their head and forces them to buy, and most small cap directors pay themselves well enough already.

I would like to average up with this position if it takes out the recent high at 27p.

Cambridge Cognition

An interesting stock to put on your watchlist is Cambridge Cognition. It has a new commercially focused chief executive, and placed equity last year to raise more capital. It’s now on the cusp of cash flow breakeven, a significant de-risking factor of the business.

The chart is nicely uptrending too and it’s a stage 2 stock. Look at the chart.

It’s understandable that after such a rise in 2020 from the lows that the stock is pausing for breath. From the lows of sub 20p the stock is closing in on a 200% rise but with a market cap of £17 million I feel there is upside here if management can execute. Revenues and the order book are both growing, so we will see in the next update.

The coming month

Equities have been on a storming run over the past few weeks, but that’s because the investing landscape has changed significantly. However, it’s only natural prices will pull back at some point, because it’s part and parcel of any market.

Brexit could significantly derail the market if we see a no deal, but who really wants that? It’s likely to be in nobody’s best interests, so I’m confident a deal will be done. Currently, the suits seem to be arguing over fish, which if we’re all really honest, I doubt many people are going to lose sleep over. Therefore, I take that as a sign that the major things are sorted. Unless of course you’re in the fishing industry, in which case you might beg to differ, and so the fish is a very major bone of contention (pun intended).

As always, manage your risk, and keep on your toes. Next year is going to bring about a lot of opportunity, as I feel we’re coming into a raging bull market. But whatever next year brings, I’d like to take this opportunity to wish you and your family a lovely Christmas and a healthy and prosperous 2021.

- Michael has released his UK Online Stock Trading Course. Master Investor readers can download Michael’s book and learn more about the course by visiting www.shiftingshares.com/online-stock-trading-course

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael

Comments (0)