UK General Election: Whoever Wins, Britain Loses

The Election Day Is Nearing…

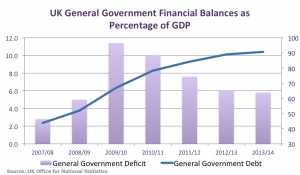

Five years have passed since the last General Election and the UK is preparing for a new one. All parties involved are now aggressively marketing their political plans with each of them greatly amplifying its strengths while trying to cloak its weaknesses. The fight will be fierce and eventually extend past the Election Day, as neither the Conservatives nor the Labour party are likely to grab a majority. Political leaders like Tony Blair, Margaret Thatcher and John Major, who were able to lead their parties to a majority, are part of the past, as the new government will most likely either have to rule with an unstable minority or to seduce an ally. But, with the Liberal Democrats likely to lose a few seats and with the SNP and UKIP not being first choices for either the Conservatives or the Labour party as coalition partners, markets are heading towards turbulent waters, with the pound being the first casualty. But while David Cameron praises the recovery of the British economy from the Great Recession and Ed Miliband promises extra funding for the NHS and a cut in University tuition fees, the UK economic recovery is hiding severe problems that have not been seriously tackled by either party. Time is running out, as Britain has been spending much more than it generates for many, many years. The public sector runs a deficit of 5.8% while the current account deficit amounts to 5.6% and no government, either from left or right, has been able to plug the leak. It is true that the economy is growing, but that is mostly the consequence of an epic central bank intervention and bold fiscal moves, which have been generating present relief but at the cost of mortgaging the future. Growth has been created out of artificial fundamentals and not based on previous savings. Such a strategy is running out of fuel.

…But the Main Problems Persist

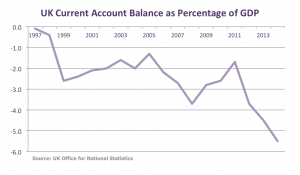

“A ticking time bomb” is the expression the perma-bear Albert Edwards (of Societe Generale) uses when referring to the UK economy’s “twin deficit” of more than 10%. Not only is the current account deficit obscenely large and the government deficit persistently positive but also the household financial position is deteriorating.

Economic growth has been the result of unsustainable fundamentals led by asset price increases, which in turn have been fuelled by uncontrolled credit creation and government spending. Thereby, asset price inflation is neither the consequence of any kind of economic improvement nor of any kind of change in the country’s savings position, but rather a transmission mechanism the central bank uses to boost economic growth. But the Bank of England, being a modern central bank, has lost control over money, which is now in the hands of commercial banks. The problem is that these banks act in their own interests, which are rarely aligned with the country’s long-term sustainability. Banks do tend to add too much credit when there is no need for it, leveraging the economy to unsustainable levels.

The economy is led by a feedback price effect. Higher prices lead to more credit, which in turn leads to more credit and additional price rises. But such Ponzi schemes sometimes break and prices stop increasing. At that point, such is the leverage taken by the economy (government, private sector and households) that no one is able to repay the existing debt. The equity market crashes, the economy shrinks and a large recession sets in.

The Bank of England Is Part of the Problem…

Then comes the central bank again, cutting interest rates, purchasing assets en masse and trying all kinds of tricks to boost asset prices again. In the end, the interest rate will never reflect the underlying economic conditions on which investment and consumption decisions should be based, and will contribute to the growing imbalances.

For households, lower interest rates are an incentive for them to engage in too much credit, which will translate into higher prices (in particular house prices) and at the same time completely erode any incentives to save. It comes as no surprise that the savings rate is negative for households in the UK.

For the government, lower interest rates means paying lower prices for new debt issues no matter how much debt is in the pile. Again, it is no surprise that despite its pledge to balance the public finances, David Cameron completely reversed the idea three years ago, as the incentive to spend was too great to miss.

For businesses (and pushing the Austrian School of Economics thinking into the table), lower interest rates decrease the cost of capital, leading to larger allocations of investment into capital goods instead of consumption goods. For the Austrian School, the lower interest rate is the result of an increase in the savings rate in the economy. Households are willing to consume less in the present to consume more in the future, thereby leading to a decrease in the interest rate. But what about when the decrease in the interest rate is artificial? Then the interest rate no longer reflects an increase in the savings rate and businesses will invest in longer-term projects to produce more capital goods at a time the preference goes in favour of consumption goods. The investment in capital goods is not financed by savings and at the same time there is no decrease in current consumption. The central bank “fools” households and businesses into taking wrong decisions. At a time the economy should be getting rid of past excess capacity, liquidating some of the unprofitable projects and relying more on consumption goods, it will produce capital goods. In the present it looks like the problem is solved but then, when reality sets in, we will have excess capacity and a new recession will take hold. We need consumer wealth to follow economic growth; otherwise what we really have is no more than thin air and leverage, which will create a bubble that always ends with a burst. With all this in mind, I think it is fair to say that the Bank of England would have its fair share of responsibility in the next crisis to come.

…But It Is Not Alone

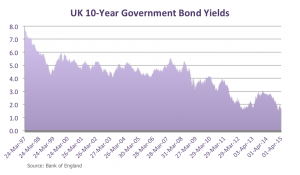

While the Austrian School may be right, sometimes it is costly to allow the economy to liquidate excess capacity, as it would certainly generate unemployment and could lead to serious recession. For the sake of long-term stability and sustainability, allowing a recession to take place may be a small and necessary price to pay for past excesses; but for the sake of a political party being re-elected that is certainly too large a price to pay. So, no government will weigh long-term risks as they weigh short-term ones. And that is the main reason why the UK is heading towards disaster. A two-digit twin deficit is a huge problem, but not today or tomorrow. Today the sun will continue to shine, as the global easing has been contributing to a decrease in the issuing costs for gilts while sterling has been trading within an acceptable margin. Only when it is too late, will the British government do something. When that time comes, the adjustment will be much more painful, as Southern Europe knows all too well. No one can sustain deficits for an unlimited period, as these annual deficits add to a growing debt pile.

Smoothing the business cycle as advocated by Keynes is a justifiable policy option. Government reduces taxes and increases spending when the economy is sluggish but then reverses the policy when the economy is fast growing. But has that really been the case so far with Britain?

Just suppose you earn £10,000 in even months but just £2,000 in odd ones. On average, you earn £6,000, even though there is a cycle behind it. That is not much different from the business cycle. Think about it as the boom-bust cycle, with the even months representing the peaks and the odd ones representing the troughs. Keynes would advise you to proceed as follows: borrow £4,000 in odd months to keep a spending level of £6,000 and save £4,000 in the other months. This procedure allows you to smooth your spending while keeping your finances in shape.

Now suppose you spend the same £6,000 in odd months but that you save nothing in even months. You will then end the year with a deficit of £24,000. Now add years of deficits and you have the situation of the British government. That is obviously unsustainable. Unless at least part of the extra “spending” is in the form of “investment” to expand your potential to generate a higher future income, you will become ever more indebted until everybody realises you are bankrupt. Therefore, the question we should ask is this: Is the British Government “investing” to generate future income?

To quote The Economist: “Britain is on a consumption binge. The household savings rate is negative, according to one estimate, and household debt is forecast to balloon in the next five years. If that happens, Britain will grow as forecast, but at the cost of running down its wealth. It will be heading for a crisis”. The government is spending rather than investing and has been doing that for years, by consuming the country’s present wealth. So rather than creating a future the government is destroying it just for sake of the present looking better than it really is. With the Bank of England helping the government with a 0.5% interest rate and with the ECB just having approved a large-scale asset purchase; the yields on the British government debt are improving overnight, as investors are angrily seeking anything with returns above zero. The 1.57% currently offered by the 10-year gilt is a massive premium over the negative Swiss rates or over the zero-yielding German bunds, in particular at a time the pound looks robust against the euro. Thus, the British Government is issuing debt at ever lower rates, despite the debt as a percentage of GDP having risen from 43.7% in 2007/08 to 90.6% in 2013/14 (see chart above).

Whoever Wins, Britain Loses

Overall, the British economy now seems better than at the peak of the Great Recession, but such observation hides the real value of the improvement. Investing after saving is very different from investing before saving. Without saving, the cost to finance the extra growth in the present will be too high to pay in the future. No matter who wins the General Election, the next government will have the difficult task of tackling the growing imbalances. If not, the pound will be vulnerable to what happened in 1992 when George Soros “broke the Bank of England”. The current account deficit cannot continue to grow, as the pound would face a quick depreciation at some point. Until now the fact that all major central banks have been competing for currency devaluations has prevented the pound from being hit, but if the first rate hike in the country continues to be pushed into the distant future, the pound may be pressed in the second half when the first rate hike from the Fed is likely to occur. At the same time, even though the large-scale asset purchase programme is not beneficial for the euro and thus supports the pound at current levels, we should not forget that the Eurozone still has a positive current account, which helps the euro in the long-term. When we sum all this, it makes us worried about the future and we believe that a currency crisis may occur in the UK and interest rates may start rising faster than first thought, which would lead the vulnerable economy into recession once again.

It is time to look at the past and recognise that we can no longer finance growth with credit and debt, which has only been possible due to an artificially low interest rate level, but that, at the same time, has been leading to huge investment mistakes that drive the economy from boom to bust. Households and the government are consuming more than they generate and thus eroding wealth. Productivity gains have been modest over the last few years when compared with other countries. Money is flowing out of the country with the current account just hitting the worst annual deficit since records began in 1948 and “the largest peace-time deficit since at least 1830, based on the Bank of England’s historical dataset”, the Office of Budget Responsibility reports. This is the real challenge facing Britain today, yet sadly it is one that will be overlooked by the politicians and the public until it is too late.

Comments (0)