The Force is Strong with this One

When Disney met Star Wars

Being a huge Star Wars fan, I confess to having felt a pang of child-like excitement upon hearing that Disney had released a new trailer for the first instalment of the third trilogy in the franchise. Although it certainly piqued my interest, I had been somewhat underwhelmed by the first ‘teaser’ trailer, which was painfully laconic in terms of what it revealed. But perhaps that was always the best way to play it: keep the fans guessing and wanting more.

If the last trailer underdelivered, the latest one did the opposite. We were treated to screenshots of key characters in what was an altogether more fluid and cogent appetiser for the film. I challenge any Star Wars fan not to admit to having felt the hair stand up on the back of their neck upon witnessing the Millennium Falcon fly into the engine shaft of a star destroyer; or at the reappearance of a geriatric Han Solo and Chewbacca after an absence of more than three decades from the silver screen.

But apart from the fans, the people who can also look forward to many an exciting year ahead are Walt Disney Co. shareholders. Disney stock jumped 1% on the back of the release of the new trailer – a move that was enough to add $2 billion to the company’s market capitalisation. To put that into context, Disney bought Lucasfilm for $4.05 billion back in 2012. If the Star Wars franchise can add that much value on the back of one trailer, what might it add over the next decade of films and merchandising? If I were being cynical, I’d say that George Lucas has been short-changed by this deal.

The deal follows Disney’s acquisitions of Pixar studios for $7.4 billion in 2006 and Marvel comics for $4.2 billion in 2009, and is part of a strategy to grow its stable of entertainment franchises from the core Disney portfolio. Examining the Disney Co. accounts, we find that the $4.1 billion price tag for Lucasfilm was allocated as follows: $2.6 billion to identifiable intangible assets, $2.3 billion to goodwill, and ($0.8 billion) for a deferred income tax liability. The 2014 annual report states that “The goodwill reflects the value to Disney from leveraging Lucasfilm intellectual property across our distribution channels, taking advantage of Disney’s established global reach.” It strikes me that $2.3 billion is a seriously conservative estimate for this potential. It therefore seems that rather than purely extracting the highest price tag for Lucasfilm, Lucas himself was primarily motivated by stewardship considerations. Put simply, Lucas wanted Disney as much as Disney wanted Lucasfilm.

So how much is the Star Wars franchise really worth to Disney?

Disney has allocated a ‘useful life’ of 40 years to its Lucasfilm intangible assets, so that gives us a clear indication that Disney expects a lot of mileage out of the franchise. After all, Star Wars has been around for almost 40 years already, so why shouldn’t it be around for another 40 years? With the last film in the franchise, The Revenge of the Sith, having been released ‘a long, long time ago’ in 2005, Disney, believes that there is “substantial pent-up demand” for new material. As a Star Wars fan myself, I can confirm that they’re right in that assumption.

But the real opportunity surely lies in bringing Star Wars to a new generation of fans, along with opening up new markets and geographies to the franchise. Since the last film was released in 2005, hundreds of millions of people have joined the ranks of the middle classes of the emerging economies. What’s more, the global middle classes are set to more than double by 2030 (according to analysis from Reuters), thus bringing a whole new potential market of budding Star Wars enthusiasts.

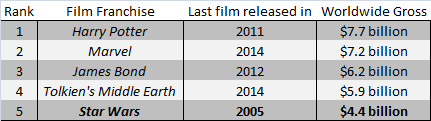

With this in mind – and considering the fact that there hasn’t been a Star Wars move released for ten years – the new batch of Star Wars films could easily become the highest grossing films of all time. Star Wars is currently the fifth most successful film franchise of all time, with total worldwide box office receipts of $4.4 billion. But consider that the top four franchises – Harry Potter, Marvel, James Bond and Tolkien’s Middle Earth – have all had films out much more recently, in a market where ticket prices are now much higher and global audiences much larger! Given that Avatar made $2.8 billion in 2009, I don’t think it would be outrageous to suggest that Disney could conceivably recoup the entire price tag for Lucasfilm in a single film.

In addition to the films themselves, there is also the whole consumer phenomenon emanating from them. An article from Forbes in 2011 noted, “Star Wars’ initial release was followed by another five blockbuster films and a mini-industry of tapes and DVDs, toys, video games and books. Taken together over its 30 years of cultural dominance, the Star Wars franchise has earned more than $22 billion.” Sales have now surpassed $30 billion, according to more recent estimates. With its extensive distribution and creative infrastructure, Disney should easily be able to move the Star Wars money-making machine up a few gears, especially as it seeks to capitalise on the release of the new films from the end of 2015 onwards.

In the new world where Content is King, Disney holds the crown jewels

With Star Wars being but the latest jewel in the crown, Disney is in a supremely strong position in today’s digital world. The market is beginning to understand that entities that have a strong creative and distribution presence are highly valuable assets – and Disney’s portfolio is arguably the best out there. Moreover, Disney has shown itself to be a masterful creator, acquirer and reformulator of content – something which is showcased perfectly in its success with Pirates of the Caribbean, a franchise that was created entirely out of a theme park ride!

Although Disney stock trades on a trailing 12-month P/E of around 24x, this rating looks well-deserved in light of its position within the industry and its prospects for future growth. The shares are, in my opinion, a long-term strategic hold.

May the force be with you… always!

Comments (0)