No Cause For Hope

Apparently people used to hedge against inflation with Pork Bellies futures. They’re no longer traded, some may say as a part of some imagined Zionist banking conspiracy, but that seems doubtful! If you believe the government then there is no inflation any more. Perhaps that’s why – there are no pork bellies futures any more, ergo, no inflation. On the other hand, there’s no money to be made by depositing cash in the bank either. Commodities are falling and we have a record number of profit warnings, at least here in the UK. Oh, and there’s now one person sitting on the Bank of England’s Monetary Policy Committee (PMC) who thinks that interest rates should rise, which they definitely should. Not a great backdrop I would say.

A good litmus test for the global economy is the Baltic Dry Index. How busy Wickes car park is would be a good one for the UK, along with skip and crane counts. The BDI is actually not looking that great, recovering from a drop after a peak in 2014. The BDI basically shows the demand for shipping container capacity and earlier this year it was around 500, the lowest level since it began in 1985. I used to live opposite Wickes but not any more so I can’t tell you how their car park looks.

Inflation, which I have long said is artificially depressed by the constantly moving goalposts in official figures, and should have been (and was for you and me) 8%-10% in the last few years, is apparently close to zero. Given how much oil prices have fallen it begs the question: if rates are still close to zero, and commodity prices have fallen, then where’s all the inflation making that number up to around zero coming from? The average of +10 and -10 is 0, but it’s not a realistic or helpful data point. Hardly surprising when interest rates have been over-used in monetary policy, like a last line of defence antibiotic, and are now useless until we develop a new one. Let’s hope there’s not an economic epidemic. Oops! Too late.

Ignore the US as they are able to print money with no consequences, being the reserve currency. While the rest of the world accepts the status quo then we will all keep underwriting US growth. Meanwhile, traditional stores of wealth – gold in particular – are not performing. The paper gold market is somewhat divorced from the physical gold market, there being a lot more paper gold than the real stuff. Diamonds are becoming attractive as a rainy day solution, being conveniently small and relatively high in value. Expect to get ripped off in a real emergency though, as you will likely get cubic zirconia prices in an apocalyptic future, unless you can confidently identify a real diamond from a fake without any special equipment.

And the commodities that are doing really well aren’t possible to invest in on the world’s financial markets. Not directly anyway. Drugs would be one market that is being denied us, although watch the US companies that are springing up around the liberalised states in the US, and maybe drug-decriminalised Portugal. I would guess the biggest growth commodity market right now is people, as in trafficking and/or slavery. It’s estimated there are as many 10s of millions of slaves globally. It’s worth considering that slavery wasn’t abolished because we suddenly became ever so ‘evolved’, but rather it was a technological advance taking place in tandem with the Industrial Revolution. I don’t think that is a coincidence.

It’s hardly a surprise that illegal markets are the ones doing well in a poor global economic climate. A stable society relies upon a growing middle class and certainly at least in the developed world the middle class is not growing. Increased regulation in an economic downturn gives rise to criminal opportunities and a lack of funds for authorities to do much about it.

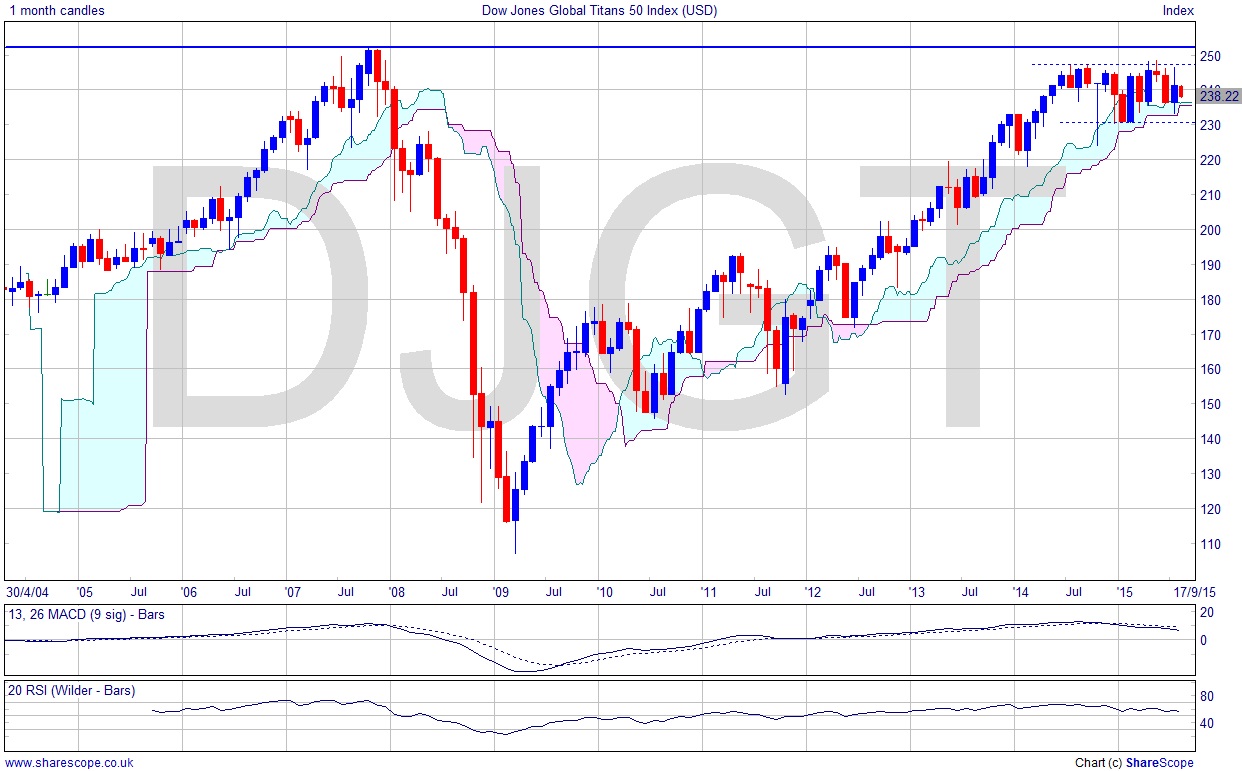

The Dow Jones Global Titans 50 Index is struggling to reach the ATH from 2007. In fact it’s reached congestion below it. If it breaks upwards it will immediately run into resistance, which is a good recipe for a failed breakout (or fakeout), which I’ll be talking about in my next blog post. The question is, if we do see a downturn from here where is the support? Either way, a major rally, right here, right now, seems the least likely outcome. We’re staring down either a fairly boring sideways struggle or a correction. As David Bowie once said: “there is no cause for hope”.

Comments (0)