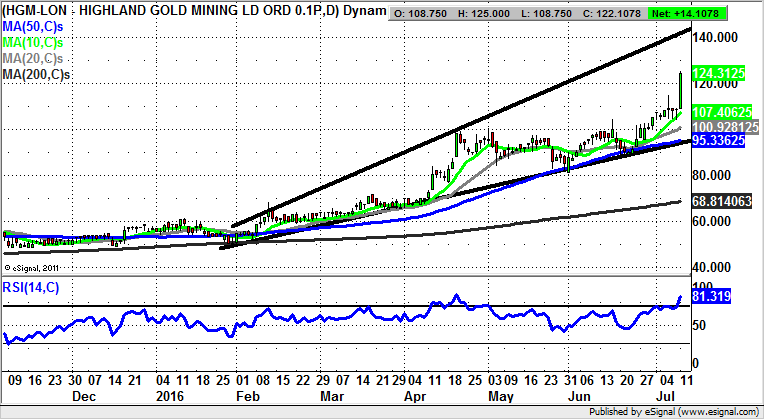

Chart of the Day: Highland Gold Mining

While the price of precious metals, including Gold, has come off the boil slightly, it can be seen how the great revival in Gold stocks of all shapes and sizes continues. As many observers will be aware, in most instances it is a case of small is beautiful in terms of proxies to the mining sector rebound.

Highland Gold Mining (HGM): 140p Technical Target

It was the case not too long ago that shares of Highland Gold Mining did not make for a very attractive proxy to the Gold price rise due to the stock being curiously slow moving. However, it would appear that the rise and rise of precious metals so far this year has meant that buyers and volumes have rebounded, and this means we have a play which is really starting to swing around. The point is clearly underlined by the latest sharp intraday move to the upside, which has been so sharp that you might be forgiven for thinking there was some kind of M&A move involved. But at least from a technical perspective we have a situation where the shares appear to be accelerating towards a line of resistance from February currently pointing up to 140p. The timeframe on such a move is regarded as being as soon as the next 4-6 weeks. In the meantime any dips towards the former initial June peak at 114.75p are regarded as buying opportunities. Only well below 110p really questions the ongoing bull argument, especially given the spring in the price action we have seen since this number has been cleared.

Comments (0)