Stay With Broad ETFs

The value of assets of exchange-traded funds (ETFs) worldwide has grown markedly over the last 20 years, from $200m to more than $10trn. ETFs are growing in popularity due to their simplicity, cost-effective approach to investing and the diversity that they provide.

Stiff competition between issuers has extended the range of passive-investment approaches from the broad market to particular niches, including clean energy, artificial intelligence, robotics, cybersecurity and disruptive technologies. There are many investment themes for investors to choose from. However, only a few ETFs survive over the long term, so the issuers create new themes and funds to attract new clients and to compensate for the lack of momentum in the older versions.

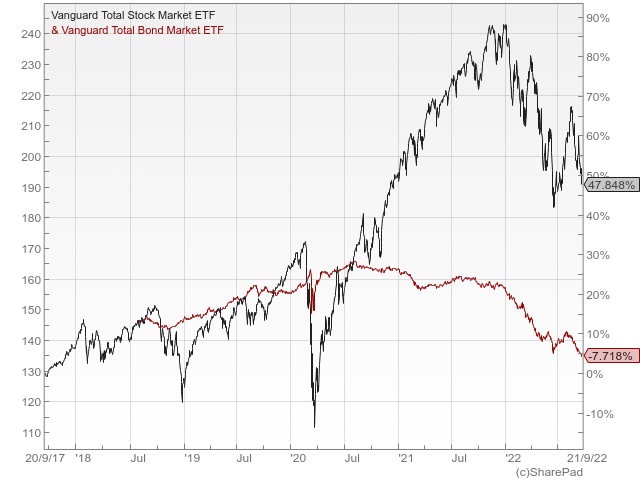

While ETFs are the most cost-effective way for an individual investor to build a diversified portfolio, most new ETFs are uninteresting and do not offer much. If I were to choose just a few ETFs, I would start with the Vanguard Total Stock Market ETF (NYSEARCA:VTI) and the Vanguard Total Bond Market ETF (NASDAQ:BND), adding extra ‘layers’ as desired. Such a portfolio would offer almost perfect diversification, eliminating idiosyncratic risks. The exact proportions of each ETF would ultimately depend on risk preferences.

ETF themes

With research showing that over the long term, the returns from passive investing are not inferior to the returns from active investment strategies, broad ETFs like the VTI and BND are all an investor needs to succeed. The portfolio can be fine-tuned with more specific ETFs targeting world and regional equities and small and large-cap stocks, capturing the returns of a wide market.

These ETFs offer good investment alternatives for different investors. But, when we look at particular themes like cybersecurity, clean energy or the ageing population, and at investment strategies targeting themes like disruptive technology or ‘conscious’ companies, the added value may be more difficult to discern. I’m not saying that there is no value in these ETFs, just that the value may be much less than you might think, and that these strategies work better for shorter periods.

In the chart below, we can compare the performance of the broad-based VTI ETF (which includes more than 4,000 stocks) with three different themed ETFs: ARK Innovation (NYSEARCA:ARKK), GlobalX Artificial Intelligence & Technology (NASDAQ:AIQ) and ALPS Disruptive Technologies (NYSEARCA:DTEC).

The Vanguard’s VTI outperformed all others over five years, even though it was itself outperformed during some sub-periods. The performance of ARKK was spectacular during 2020, just after the pandemic’s peak, as was its downfall in 2021-2022. What an investor was buying there was volatility. In the end, VTI proved better than all others. ARKK, AIQ and DTEC are great ETFs for their categories but still not good enough for a long-term investor to keep as primary holdings.

Strategies

The best possible strategy for an individual investor is to purchase a low-cost index fund targeting a broad selection of equities, such as VTI. This Vanguard ETF has an expense ratio of 0.03%, which is unbeatable, no matter what investment strategy an investor adopts. The bond equivalent BND has the same expense ratio. Having both in the portfolio minimises risks over the long term, and it certainly is one of the best, simplest and most cost-effective strategies. It also allows you to add some thematic layers by purchasing ETFs like ARKK or AIQ. However, the wording used by these funds usually appeals to sentiment and emotions, pushing their prices above and below their intrinsic values and generating unnecessary volatility. These ETFs increase the risk of a portfolio and do not appear to add much to returns over longer periods.

To sum up, it is sometimes best for an investor to start with a well-diversified portfolio built on top of VTI and BND and then follow simple screeners to add extra layers. Some examples of these DIY strategies include DIY – Building a Portfolio of ‘Cash Cows’ and Quality Shares for a Bumpy Market.

Comments (0)