What You Need to Know about Leveraged ETFs

Exchange-traded funds (ETFs) have grown in popularity over the last few decades, as they offer a few advantages over other investment vehicles. In particular, retail investors can use them to achieve a much higher degree of diversification within their portfolios without incurring prohibitive fees, while also getting exposure to markets they wouldn’t otherwise be able to access.

In general, the idea behind an ETF is relatively simple: it is a marketable security that tracks an index, a commodity, a bond, or a basket of assets, but which trades like a stock. Unlike investment funds, which usually have their net asset value updated once at the end of each trading day, an ETF trades continuously throughout the day while arbitrageurs do their job in not allowing net asset value to deviate from the trading price. Investors can place a bet on any specific market trend due to the large ETF stable which, combined with the high liquidity often found in these markets, provides a low-cost means of playing the markets.

But, among this large offering is a category of ETFs, known as leveraged ETFs, which are difficult to master and may lead an investor’s portfolio to a very different outcome than first anticipated, even when the underlying movement is in the desired direction. A leveraged ETF is a bet on strong short-term trends and as such should be used in a very short time interval (sometimes a single day) when the market is moving quite fast in one direction. The main reason behind this is because a leveraged ETF buys assets when the value of those assets is rising and sells them when their value is decreasing. While the simplicity offered by a leveraged ETF may be great, it is often the case that investors are better off building leveraged positions themselves, through spread betting, margin trading, short selling, or borrowing.

In my past articles, I sometimes mention double (2x) and triple (3x) ETFs as a way of getting exposure to trends. Past examples include the ETF Securities 3x Long AUD Short USD (LAU3), which is a triple long bet on the daily price movements of the AUD/USD pair; and the ETF Securities 3x Daily Short WTI Crude Oil (3CRS), which is a triple short bet on the daily price movements of crude oil. While these bets are great in terms of their simplicity, they may sometimes not work as expected. Under certain conditions, investors may instead opt to purchase three times as much equity through the use of margin.

Understanding Why a Leveraged ETF Behaves Unexpectedly

First of all, let me explain exactly what a 2x or 3x ETF is. Let’s consider an ETF on FTSE 100. Such an ETF tracks the FTSE 100 performance. Apart from the fees involved in the active management of the ETF, its performance should mirror that of the FTSE 100 index in any time interval. However, a 2x or 3x ETF is actually quite different. These ETFs keep their daily leverage constant at a 2:1 or 3.1 ratio, respectively. When you buy a stock on margin, your leverage ratio changes over time instead. The result of this is that a double or a triple ETF tracks daily returns and no longer the returns for any other time period. Thus, if the FTSE 100 changes 3% in a day, the 2x ETF should change 6% while the 3x ETF should change 9%; but if the FTSE 100 changes 3% over a 10-day period, nothing can be said about the 2x and the 3x ETFs. That’s right! We just don’t know, because the constant leverage ratio creates what is sometimes referred as the constant leverage trap.

The exact return achieved on a margin bet on some underlying is predictable with certainty for a simulation of returns over a period of time. If I purchase a volume of stock that is double my equity, I know that I will get double the performance of that stock over any time period (less some potential fees and interest). But, if I purchase a 2x ETF, knowing the final performance of the stock over the time period is not enough, because the final performance for the leveraged ETF will also depend on the price path.

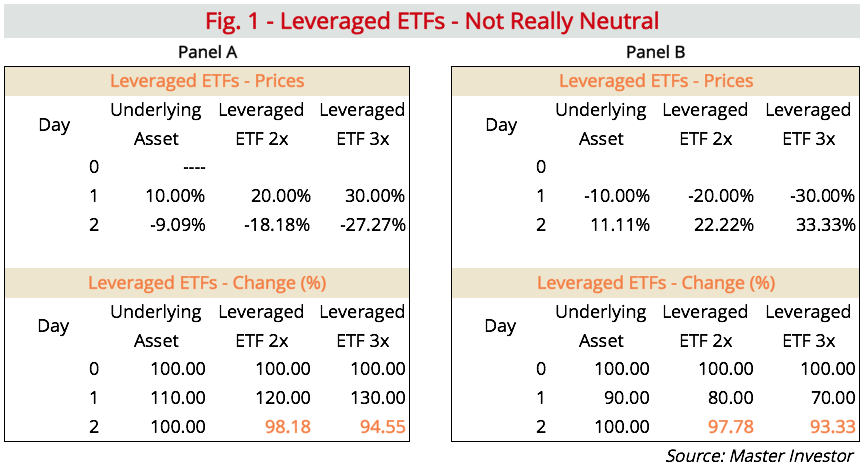

Allow me to start with a very simple example using an ETF on some underlying and its 2x and 3x leveraged versions. Let’s start with an example with a 2-day time period, during which the underlying price moves first in one direction and then reverts to close at its initial price.

If we start with a price of £100 for each ETF, we end with different prices for the three different ETFs, despite the underlying asset price closing at its initial price. In a margined bet on this asset, an investor would expect his portfolio to revert to its original value (excluding any potential fees and interest). But that isn’t the case with the leveraged ETFs. It doesn’t matter whether the asset started rising to later reverse gains or vice versa. In both cases the leveraged ETFs have lost value. So, a first lesson to learn here is that leveraged ETFs are not really neutral and they don’t work well when the market is moving sideways. Let’s just accept the facts for now and leave the interpretation of them until later.

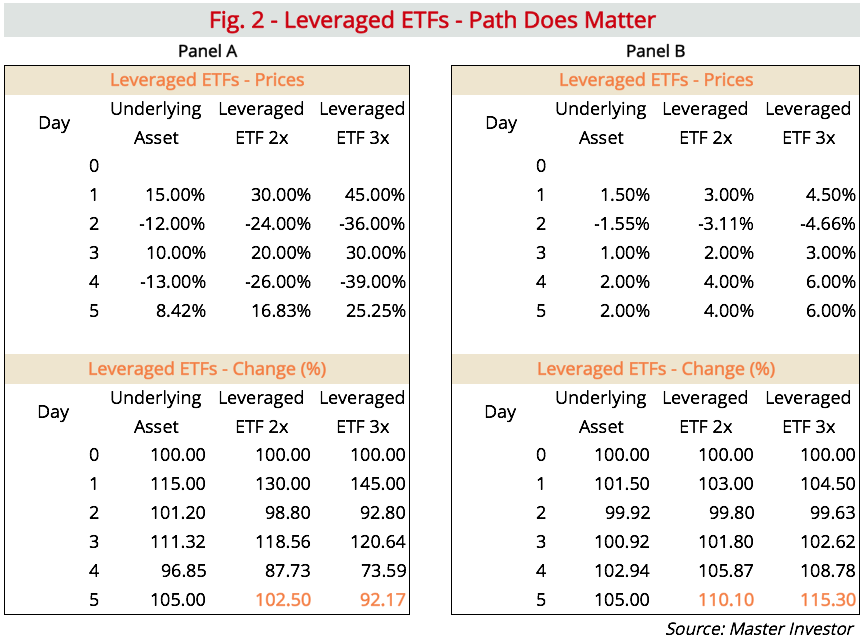

Now, let’s work a little bit on the example to consider a five-day time period during which the underlying rises 5%, even while following two different paths (as depicted in panels A and B).

Volatility is much larger for the underlying in panel A than in panel B. The standard deviation is 13.2% in the first case, but just 1.5% in the second. But, while the risk is higher in panel A, returns for the underlying are equal in both cases. Now look at what happens to the 2x and 3x ETFs. In panel B, the performance of the 2x ETF is roughly 2x that of the underlying asset and the performance of the 3x ETF is roughly 3x of the same. That is as most investors would expect it to be! But that is just one potential outcome. Panel A ends with a much different outcome and clearly shows how unpredictable leveraged ETFs may be. While the underlying rose 5%, the 2x ETF rose just 2.5% and the 3x ETF shows a loss, returning negative 7.83%. How can that be?

The second lesson to learn is that price path does matter and that leveraged ETFs are unpredictable in flat markets with high volatility. Let’s again accept the facts and leave the interpretation of them until later.

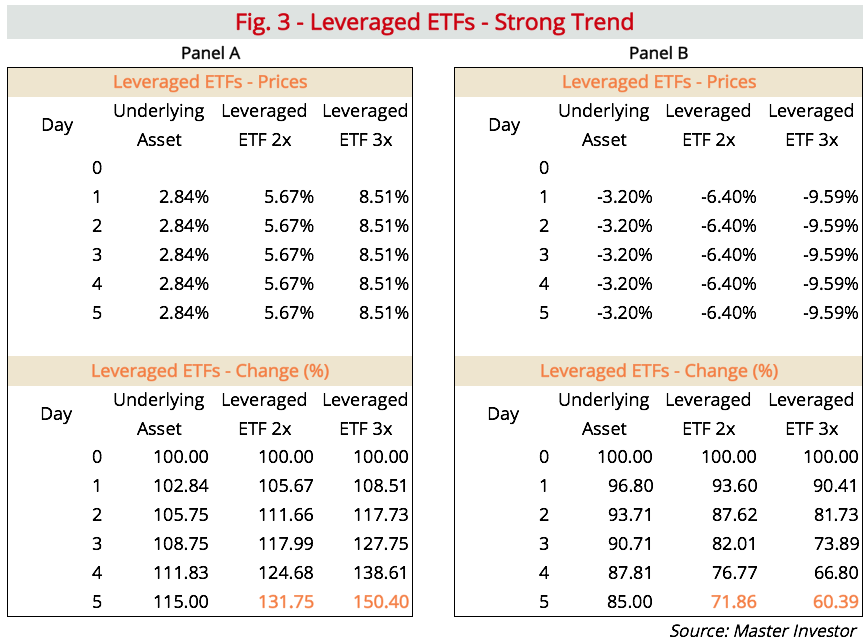

If a flat market with high volatility is not good for a leveraged ETF, let’s consider a strong linear trend as our next example, as depicted in fig. 3.

In the above case the underlying asset rises 15% in panel A and declines 15% in panel B. There is a strong upside (panel A) and downside (panel B) movement in a linear fashion in this case. In panel A, the 2x ETF rose 31.75% and the 3x ETF rose 50.40%. Notice that, unlike what happened in the previous examples, these leveraged ETFs now surpass their original leverage ratios in terms of accumulated performance. In panel B, the 2x ETF declined 28.14% and the 3x ETF declined 39.61%, which is a greater decline than original leverage ratios imply. The third lesson to learn is that leveraged ETFs are better tailored for stronger favourable movements with less volatility.

Explaining Why a Leveraged ETF Behaves Unexpectedly

As I already mentioned, the problem with a leveraged ETF is its constant leverage trap. These funds need to keep leverage unchanged from day to day. When the underlying asset rises, the ETF needs to increase its exposure to that asset; when the underlying asset declines, the ETF needs to reduce its exposure to the asset. This means the ETF buys when prices increase and sells when prices decrease. This is a strong trend-following strategy that explains why these funds behave more predictably and favourably when markets show strong trends with low volatility.

Consider a simple balance sheet for an investor. You buy £2,000 worth of stock A with £1,000 of your own money while borrowing £1,000. Your assets are then equal to £2,000, liabilities equal £1,000 and equity equals £1,000. Leverage is equal to 2x. Over the day, the stock rises 10%. Your assets end the day worth £2,200, while liabilities are unchanged at £1,000 and equity increases to £1,200. Your gain is 2x the gain obtained in stock A, as your leverage was 2x. But look at the balance sheet now. Your leverage is no longer 2x, but rather 1.83x. If stock A declines 9.09% tomorrow, your assets will return to £2,000, liabilities will be kept unchanged at £1,000 and equity would shrink back to £1,000. This kind of behaviour is in line with what happens in panel A of fig. 1.

But, a 2x ETF would have to readjust leverage at the end of the 10% rise. At that time, the fund would have to increase exposure to stock A. Assets would then rise to £2,400, liabilities to £1,200 and equity would remain at £1,200. Leverage is kept at 2x. The problem here is that the ETF is increasing its exposure to stock A after its price has increased. This means that when the stock declines 9.09%, the loss in equity is greater. In this case assets retreat to £2,181.8, liabilities remain at £1,200 and equity retreats to £981.80. This is the main reason why in fig. 1 the leveraged ETFs end up losing money while the price of the underlying asset (and the simple ETF) remains unchanged.

Why Volatility Is Enemy Number One of leveraged ETFs

When prices change rapidly in one direction, or when they just don’t move at all, volatility is low. When that happens, particularly in the first scenario, the leveraged ETF comes into its own. This explains why in fig. 3 a strong favourable movement leads to more than 2x or 3x returns in the leveraged ETFs and why a strong unfavourable movement gives some cushion in the 2x and 3x leveraged ETFs. But when volatility is high, movements alternate from positive to negative. The leveraged ETF must sell assets after a decline in price (reducing the impact on equity of the subsequent recovery in price) and buy assets after a price increase (amplifying the negative impact of the subsequent decline). That is the case depicted in panel A in fig. 2.

Final Words

A leveraged ETF is an excellent instrument to get short-term exposure to a strong market trend, in particular when volatility is low, but it behaves unpredictably when volatility is higher, when used over a longer time period and when markets move sideways. The constant leverage trap makes it difficult to manage risk, and thus increases the appeal of borrowing as an alternate way of increasing exposure. Over a long period of time, it may be better and wiser to increase leverage through more traditional ways than through the use of a leveraged ETF. But their simplicity makes them attractive in the situations depicted above.

Comments (0)