Why I bought this cash-cow for my portfolio

Enbridge shares currently offer a prospective yield of around 8%. That would normally be indicative of a dividend cut around the corner but James Faulkner doesn’t think that’s the case for Enbridge.

As I discussed in my recent piece on Diversified Gas & Oil (LON:DGO), the conventional energy sector is not the flavour of the month – make that year, decade etc – right now, and although the long-term outlook is certainly challenging given the shift to renewables, there are plenty of babies that have been thrown out with the bathwater.

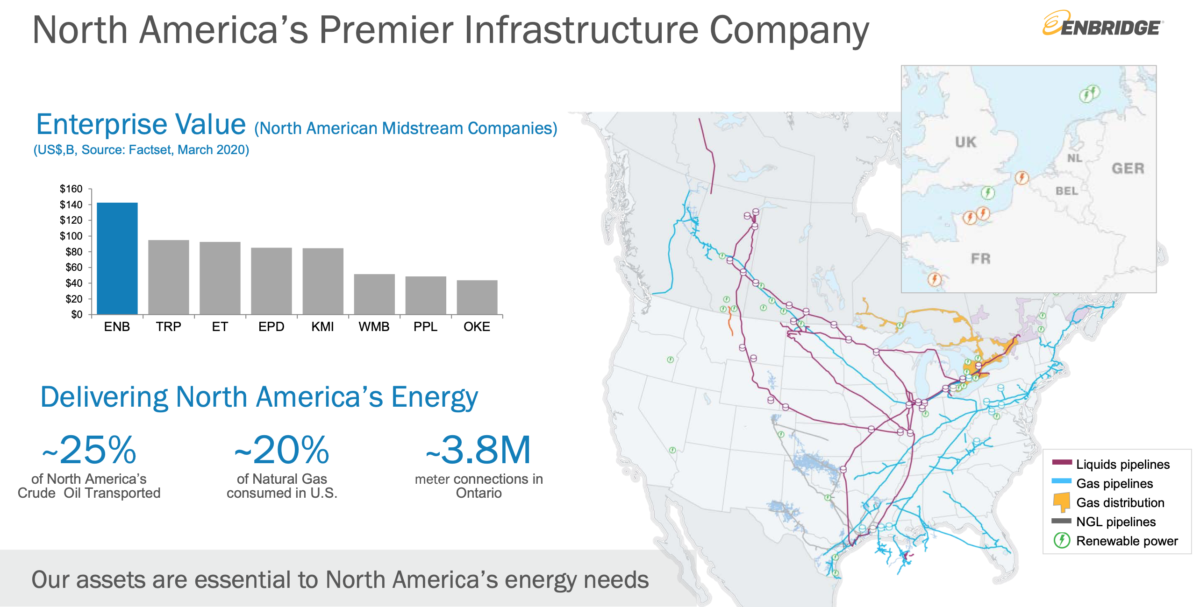

One of them might very well be Enbridge (TSE:ENB), one of the largest midstream operators in North America (see image below).

Source: Enbridge corporate presentation

Enbridge owns and operates a huge network of energy pipelines and transmission systems, transporting oil and gas from where it is produced to where it is needed. It is part of the essential infrastructure that keeps America going.

Like much of the oil and gas sector, Enbridge has seen its share price rocked by the Coronavirus sell-off, falling from highs of around CAD57 before the crisis to lows of around CAD33. They currently trade at around CAD40.

However, the interesting thing about Enbridge and other midstream operators is that they have no direct exposure to energy prices; they simply take a fee for the energy transported. While this does mean earnings can suffer as the volume of energy produced falls during a recession, earnings are much less volatile than they are for the producers who bear the brunt of lower prices.

The next thing to bear in mind about Enbridge is that it generates a large portion of its earnings (>40%) from Natural gas distribution. As I pointed out in my DGO piece, Natural gas’s share of the energy mix is set to rise as it takes share from coal. In addition, it also has a small portfolio of renewable energy assets that it intends to grow over time.

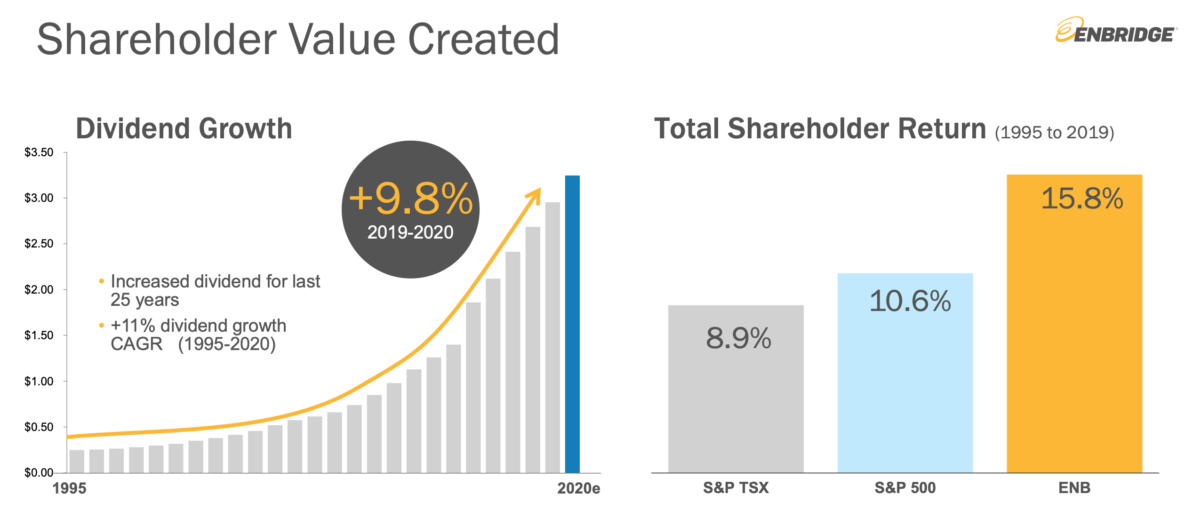

A strong track record of shareholder returns

For an ostensibly ‘boring’ company, Enbridge has a very strong record of growing returns to shareholders. The dividend has grown by a compound annual rate of 11% over the past 25 years (see chart below), and this year’s increase of 9.8% does not suggest this is a company that is pessimistic regarding its future prospects.

Source: Enbridge corporate presentation

And yet Enbridge shares currently offer a prospective yield of around 8%. That would normally be indicative of a dividend cut around the corner but with Enbridge it is hard to point to any underlying problems that would force management to cut the pay-out any time soon.

In fact, Enbridge’s financial position has been improving of late as it has reduced its gearing since taking on debt to fund the acquisition of Spectra Energy a couple of years ago. Since then, net debt to EBITDA has fallen from c. 7x to c. 4.5x, which is at the lower end of management’s targeted range of 4.5-5x. Furthermore, with the dividend pay-out ratio of c. 65% of distributable free cashflow, this suggests ample room to continue the progressive dividend policy.

Of course, Enbridge is not without its risks. Should the transition to electric vehicles and renewables happen quicker than expected, it may find volumes in its distribution business under pressure over the long term. However, for now at least, hydrocarbons remain an integral part of the world economy, and this is a company with a very good long-term track record of navigating the vagaries of the energy markets.

For income-hungry investors, Enbridge is worthy of consideration.

James Faulkner owns shares in Enbridge.

Comments (0)