Unilever’s beautiful future

Andrew Latto, CFA, explains why Unilever’s shift away from food, in favour of beauty and personal care, could mean its share price has a lot further to run.

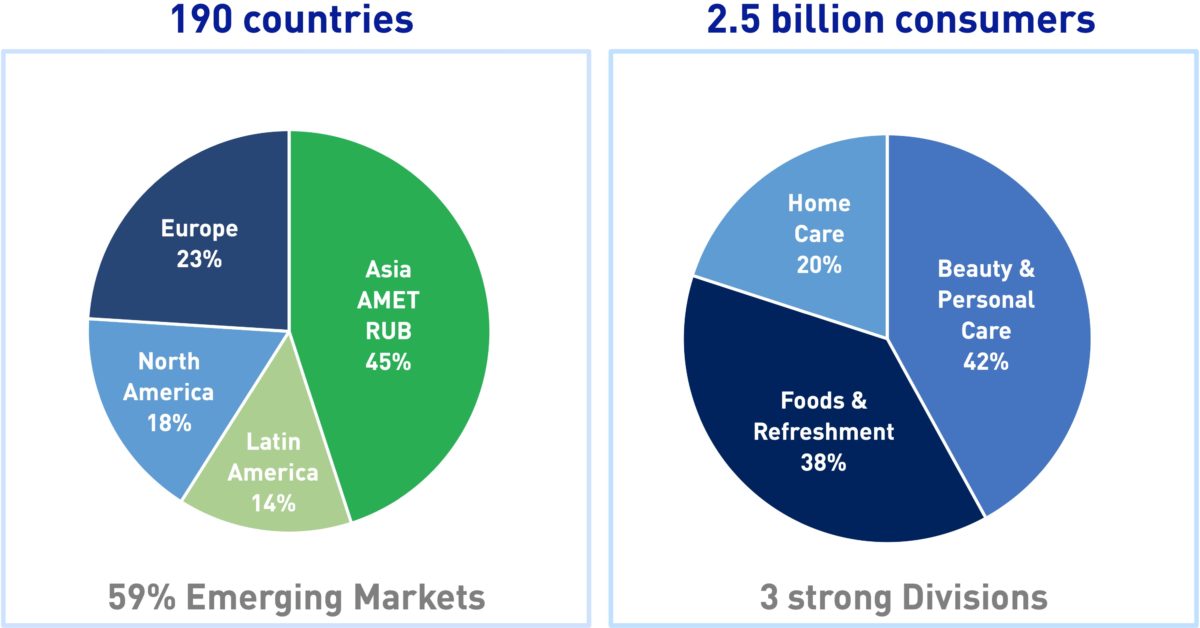

Unilever is a major player in the beauty and personal-care market, which generates 42% of its revenue and is the group’s most profitable division. The ninety-year-old business just wants to make you look and feel good.

According to Women’s Wear Daily (WWD), Unilever is the second-largest player in the beauty market, with $21.5bn revenue in 2017. This puts it behind L’Oréal’s $29.4bn revenue and well ahead of Estee Lauder’s $12.8bn.

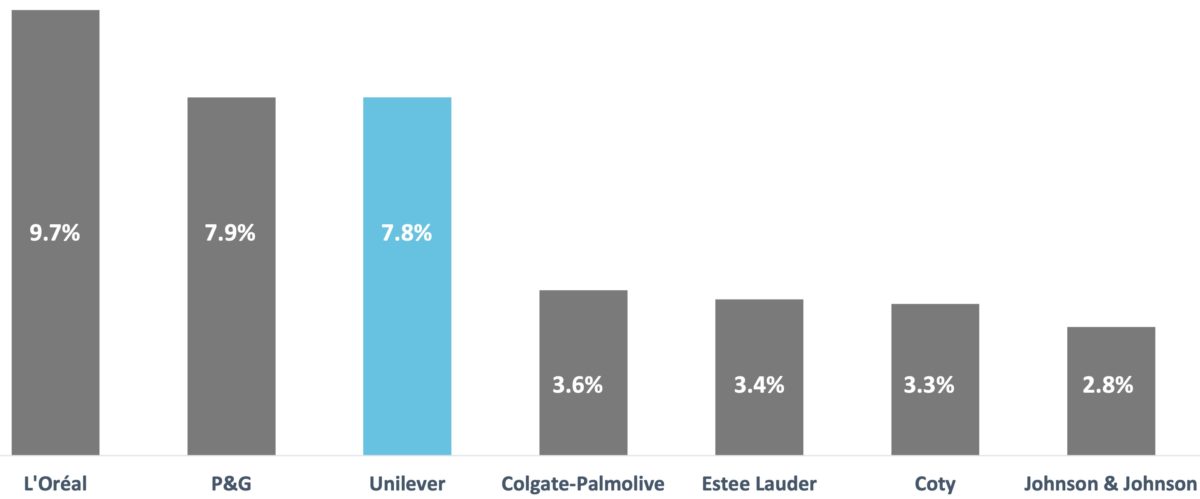

In the broader beauty and personal-care market Unilever is in third place with a 7.8% share of the market. L’Oréal has the leading share at 9.7% and Procter & Gamble is in second place with a 7.9% share.

Unilever’s 2017 market share in beauty and personal care

Source: Unilever

Unilever used to be focused on food and refreshment, but this segment now generates only 38% of revenue. The group’s stock-market subsector changed to personal products in September 2014, having previously been food products.

Unilever’s change of leadership at the start of 2019 also highlighted the change in focus; Alan Jope became chief executive of Unilever, having previously led the beauty and personal-care division.

Quality investors

Unilever was the largest position in the Lindsell Train Global Equity Fund at the end of September 2019, at 8% of assets. The second-largest holding was Diageo at 7.7% of assets and Heineken was in third place at 7.6% of assets.

The main threat to consumer-staple companies is the loss of pricing power. Fund manager Nick Train has stated that, of the stocks held in the Finsbury Growth & Income Trust, Unilever is the:

“… most challenged by changes in consumer tastes because it has the most mass or mid-market brands.”

Train is nevertheless optimistic on Unilever’s shift towards beauty and personal care. Unilever has historically been a sound investment with the shares increasing nineteen-fold since 1988.

Unilever’s brands

Unilever has more than 400 brands, with many of them unique to local markets (eg Suave and Pureit). Three quarters of Unilever’s recent revenue growth has been driven by 28 sustainable-living brands.

The group says it enjoys “number 1 or 2 positions in 85% of the key markets and categories in which we compete.” Twelve key brands generate over €1bn in annual revenue versus Unilever’s total revenue of €51bn in 2018.

They include the beauty and personal care brands Axe, LUX, Rexona (also known as Sure), Dove and Sunsilk. The €1bn food and refreshment brands are Knorr, Hellman’s, Magnum, Lipton and Wall’s.

Unilever’s 12 €1bn revenue brands

| Beauty and personal care | Food and refreshments | Home care | |

| €1bn revenue brands | Axe, Dove, Lux, Rexona, Sunsilk | Knorr, Hellman’s, Magnum, Lipton and Wall’s | Dirt is Good (eg Omo and Persil), Surf |

Source: Unilever

Beauty and personal-care brands

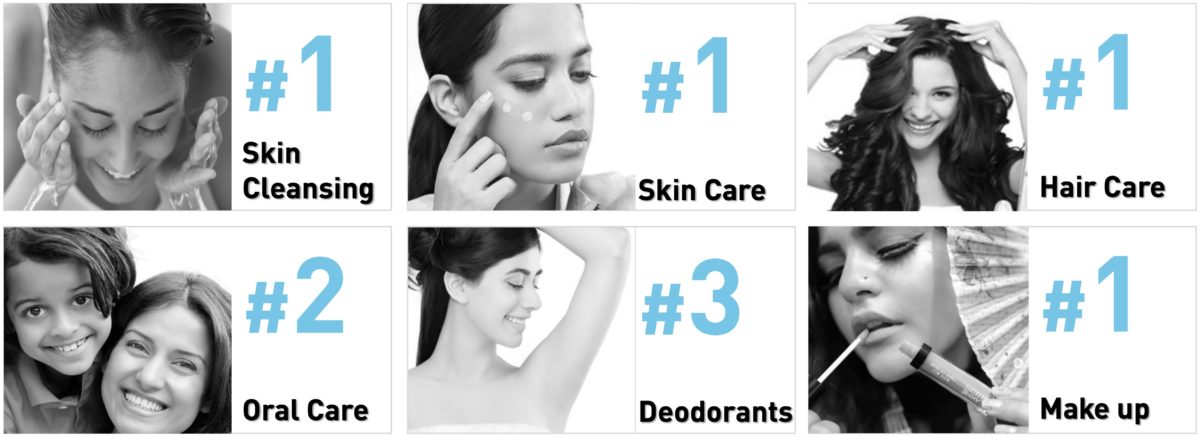

Unilever’s beauty and personal-care division enjoys the leading global position in hair care, skin cleansing and deodorants. Prestige brands, such as Dermalogica and Hourglass, generated 2.4% of the division’s revenue in 2018.

Unilever is the leader in Indian beauty and personal-care market with top positions in hair care, make-up, skin care and skin cleansing. The group is in second-place position in the oral-care market and third place in deodorants.

Unilever in India: the beauty and personal-care leader

Source: Unilever

Unilever’s investment case

Companies that can stand the test of time like Unilever are few and far between. The business is also resilient, with demand for fast-moving consumer goods (FMCG) holding up during downturns.

The shift towards beauty and personal care has helped to improve group profitability. The ongoing premiumisation of Unilever’s brand portfolio will improve brand loyalty.

Emerging markets generate 59% of Unilever’s revenue and underpin the long-term growth outlook. Unilever may be one of the most attractive ways to buy into the emerging-market consumer class.

The stock is an attractive holding for investors seeking a reliable and growing dividend income. The company pays quarterly dividends and has a long track record of increasing the payout.

Unilever’s revenue in 2018: a diversified business

Source: Unilever

Unilever since 2009

Unilever was primarily a food and refreshment business in 2009, with this division generating the majority of revenue and operating profit. It is unsurprising that we continue to associate Unilever with Marmite and Magnum ice cream.

The beauty and personal-care division has seen its share of group profit increase from 37% in 2009 to 46% in 2017. This has helped improve Unilever’s underlying operating profit margin from 14.8% in 2009 to 18.4% in 2018.

Divisional share of operating profit

| 2009 | 2017 | |

| Beauty and personal care | 37% | 46% |

| Food and refreshment | 51% | 41% |

| Home care | 12% | 13% |

Source: Unilever

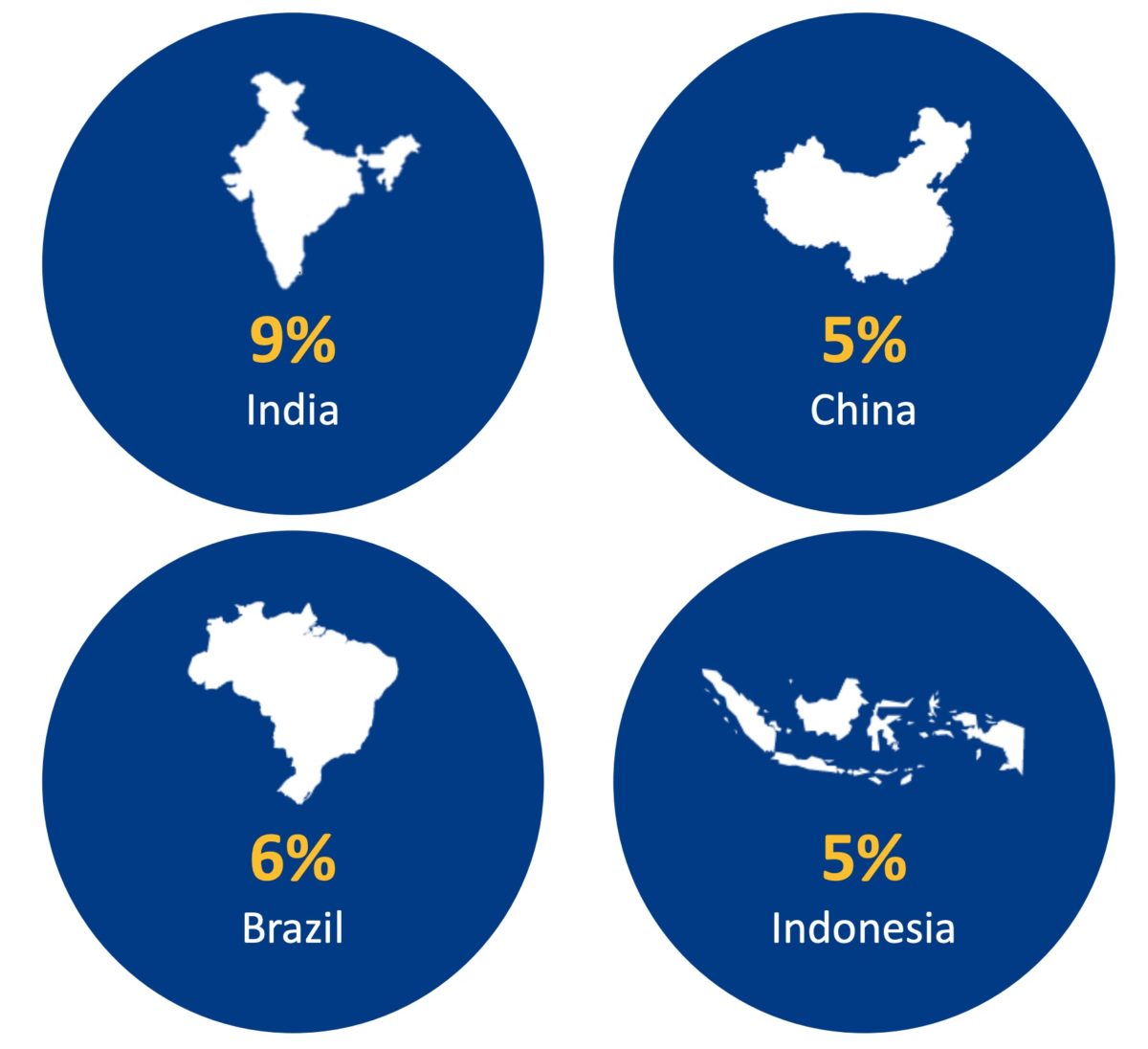

Emerging markets have become a larger share of revenue at 59% in Q3 2019 versus 57% in 2013. The key emerging markets in 2018 were India at 9% of revenue, Brazil at 6%, China at 5% and Indonesia at 5% of revenue.

India, Brazil, China and Indonesia collectively account for a quarter of Unilever’s turnover. There are not many Western companies with both long-established and profitable footholds in these countries.

Share of Unilever’s 2018 revenue

Source: Unilever

Acquisitions

Unilever has shunned mega deals of the type favoured by Reckitt Benckiser. It has instead acquired successful brands that can improve revenue growth, innovation and group know-how.

Large consumer-goods companies often fail to spot new-product opportunities, but they are good at rolling them out and marketing them. Much of the recent acquisition activity has focused on premium brands and on-trend product categories.

Beauty and personal care

Unilever acquired Dermalogica, Murad, Kate Somerville and REN in 2015 with the combined price tag estimated at €1.2bn. Dollar Shave Club was bought for an estimated €0.9bn in 2016 along with Living Proof for €0.2bn.

Dollar Shave Club grew in the US on the back of low pricing with the business loss-making from 2011 to 2016. US market share has remained static since Unilever’s takeover, calling into question the merits of the deal.

In 2017, the group bought the skin-care brand Carver Korea for €2.3bn, Sundial Brands for €0.6bn and the cosmetics brand Hourglass. The following year saw the purchase of the personal care brands Quala and Equilibra.

In 2019, the French derma-cosmetic brand Garancia was purchased alongside the Japanese inspired skincare brand Tatcha. The beauty and personal-care division has clearly been the main focus of acquisition activity.

Beauty and personal-care acquisitions 2015-2017

Source: Unilever

Food and refreshments

Acquisitions in this segment include the Italian gelato business GROM in 2015, which at that time had 60 Gelato shops. The Pukka Herbs tea business was bought in 2017 and is benefiting from growing demand for herbal teas.

The Sir Kensington condiments brand was bought in the same year and its products include vegan mayonnaise. Brazilian natural and organic-food business Mae Terra was also bought in 2017.

Home care

Acquisition activity has been relatively light in the home care division. The Seventh Generation natural home-care brand was bought in 2017 and the Blueair purification brand was bought in 2016.

Blueair is a Swedish group that develops air-purification products for the home and business market. It appears odd for an FMCG company to buy an electronic-goods business.

Unilever buys Horlicks

Unilever’s most recently announced deal is to acquire the health-food drinks portfolio of GlaxoSmithKline (GSK HFD) in India for €3.3bn. Horlicks is one of GSK HFD’s key brands and was first introduced into India in the 1930s.

India accounts for 90% of GSK HFD’s revenue with the rest generated from countries in southeast Asia. GSK HFD generated €550m revenue in 2018, which equates to 1% of Unilever’s turnover in 2018.

When the transaction completes, it will mean that revenue from India will contribute approximately 10% of Unilever’s total revenue. The deal is in line with Unilever’s objectives to increase its exposure to health-food categories and high-growth markets.

Business disposals

Corporate activity highlights the direction of travel for a business. Unilever’s most significant disposal in recent years was the €6.8bn sale of the spreads business on 2 July 2018.

Spreads generated 5.7% of group revenue in 2016 and included the brands Flora, Becel, ProActiv, Bertolli and I Can’t Believe It’s Not Butter. Western consumers have shifted from toast for breakfast to yogurt and porridge.

Other exits include the AdeS soy beverage sale to Coca-Cola in 2016 for US$575m. The Slim-Fast diet brand was sold in mid-2014 and the Ragu and Bertolli brands were sold in the same year for $2.15bn in cash.

Skippy peanut butter was sold in 2013 for $700m and the North American frozen- meals business was sold in 2012 for US$267m. Unilever has been transitioning away from mature food and beverage brands.

Unilever’s growth backdrop

Consumer staple groups like Unilever are finding it harder to deliver organic growth (excluding acquisitions and disposals). This is due to the emergence of new competitors and weak demand in developed markets.

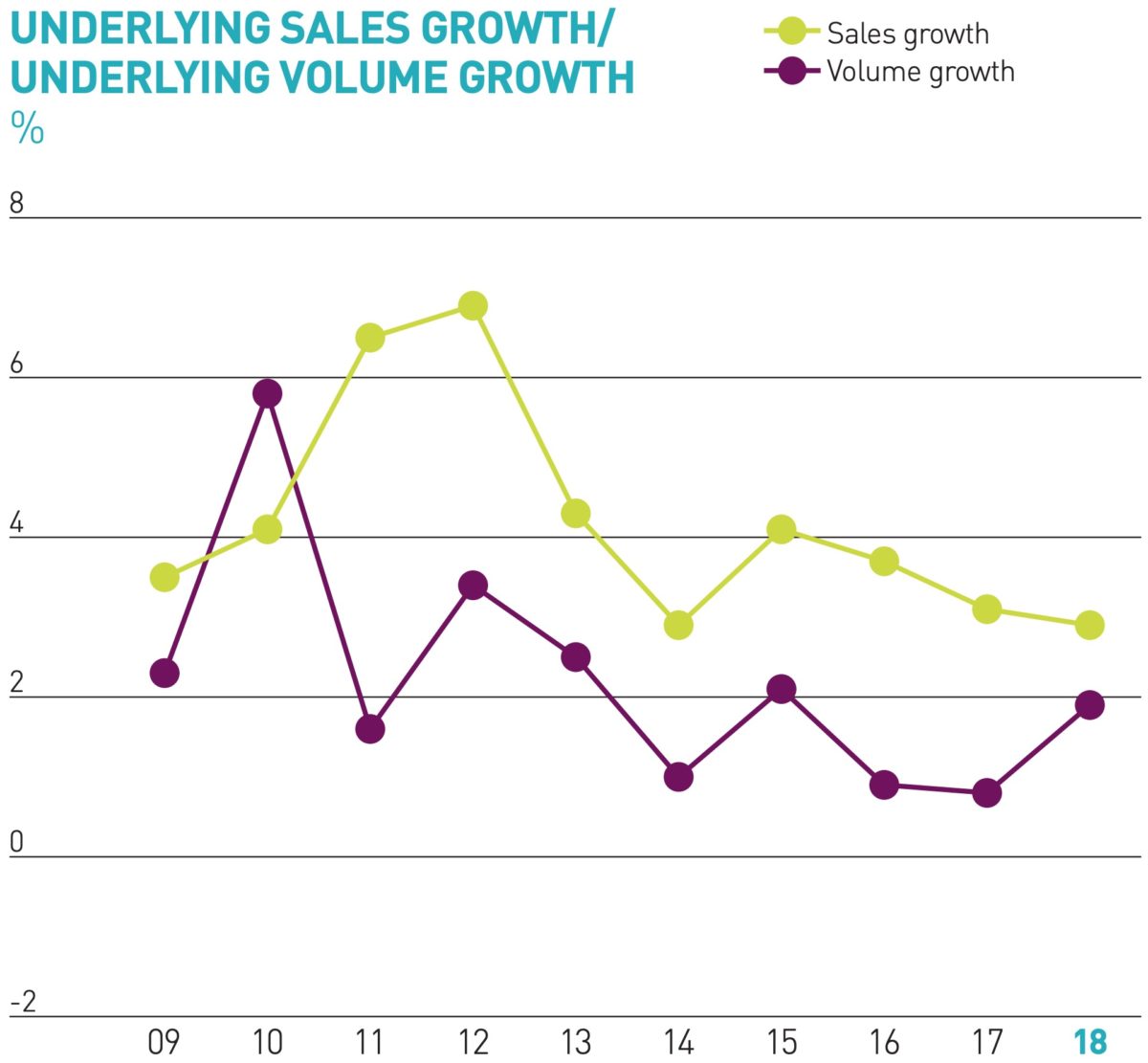

Unilever’s underlying sales growth hit a high of 6.9% in 2012 but has declined since then. Underlying sales growth was 2.9% in 2018 and improved to 3.4% in the first nine months of 2019.

Underlying volume growth hit a high of 5.8% in 2010 but fell to only 0.8% in 2017. Volumes improved by 1.8% in 2018 and in the first nine months of 2019 increased by 1.3%.

Unilever’s underlying sales growth (USG)

| 2015 | 2016 | 2017 | 2018 | 9m 2019 | |

| Emerging markets | 7.1% | 6.5% | 5.9% | 4.6% | 6.1% |

| Developed markets | 0% | (0.2%) | (0.6%) | 0.5% | (0.5%) |

| Group result | 4.1% | 3.7% | 3.1% | 2.9% | 3.4% |

Unilever’s underlying volume growth (UVG)

| 2015 | 2016 | 2017 | 2018 | 9m 2019 | |

| Emerging markets | 2.7% | 6.5% | 1.1% | 2.8% | 3.6% |

| Developed markets | 1.2% | 0.6% | (0.2%) | 0.7% | (0.3%) |

| Group result | 2.1% | 0.9% | 0.8% | 1.9% | 1.3% |

Developed market headwinds

Developed markets have been a headwind, with underlying sales growth negative from 2016 to 2017 and the first nine months of 2019. Sales volumes in developed markets fell in 2017 and in the first nine months of 2019.

In the four years and nine months to September 2019 we have seen only a 2% increase in sales volumes in developed markets. Unilever is struggling to sell more of its products in Europe and North America.

Unilever’s pace of growth has slowed

Source: Unilever

20% margin by 2020

Alan Jupe has left in place the targets set by his predecessor, Paul Polman, in April 2017. This was in large part a response to the failed $143bn takeover attempt from Kraft Heinz.

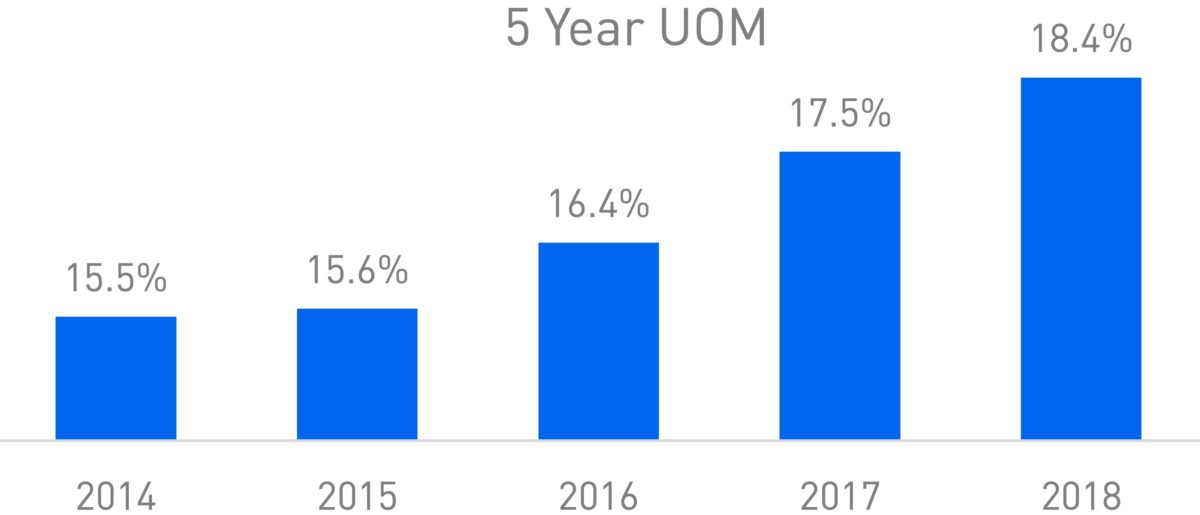

Unilever aims to hit an underlying operating profit margin of 20% in 2020, up from 15.5% in 2014. This has in part been driven by cumulative cost savings, which are on track to hit €6bn this year.

The targeted net debt to EBITDA ratio for the business is 2x, which leaves scope for further acquisitions and/or share buybacks. The 2020 target for underlying sales growth is 3-5% in comparison with the average over the last five years of 3-3.5%.

Unilever’s underlying operating margin (UOM)

Source: Unilever

Risks

Supermarket own brands products continue to make inroads, with Tesco even offering a version of Marmite. Consumers are willing to switch when it comes to staple products like margarine and bread.

Discount supermarkets are growing rapidly and have been aggressively taking on established brands (eg Aldi has its own version of Pimms). Unilever also has to contend with the emerging-market brands that it is not able to acquire.

Online retailers are able to offer a range of brand substitutes and can use their data to target consumers. Low-cost online marketing has also allowed new brands to emerge, such as Halo Top in the US ice-cream market.

Valuation

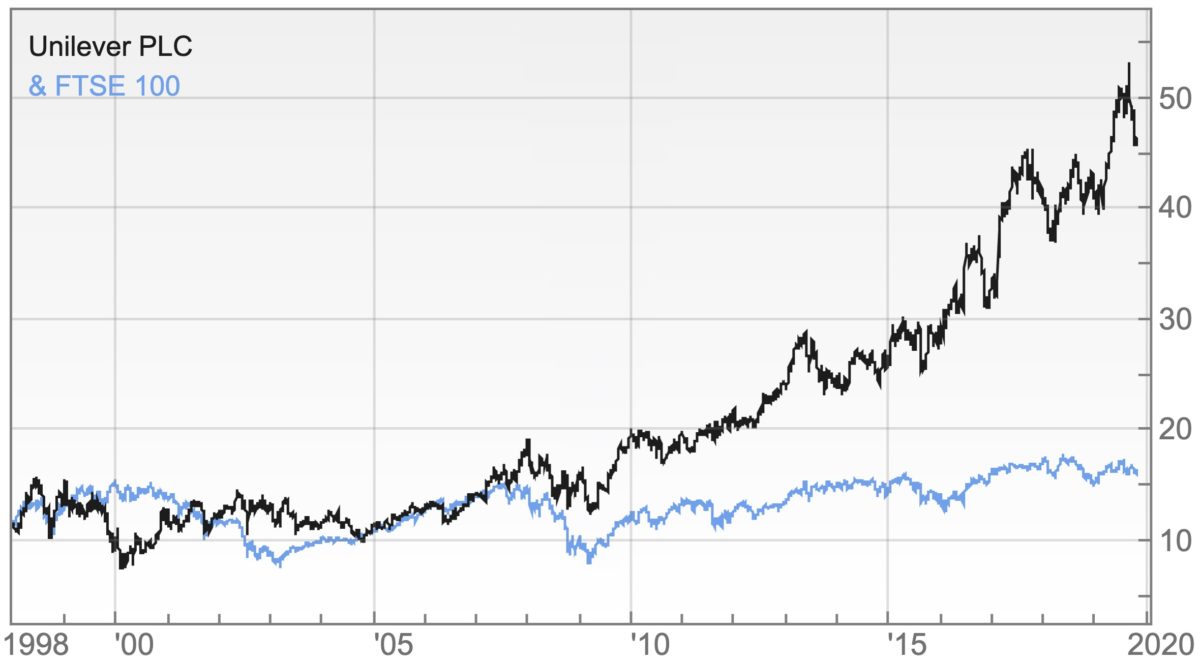

The P/E multiple of Unilever, based on the last 12 months’ reported earnings, has been increasing since 2011. Investors appear to be putting slowing sales growth to one side and instead focusing on improving margins.

The forecast P/E for 2019 is 21x but this falls to 19x in 2020 and 18x in 2021 (based on a share price of £46.3 on 25 October). The forecast dividend yield in each year is 3.2%, 3.4% and 3.7% (1.5x covered).

Unilever has seen its share price increase by almost 200% from the high of £15.7 that it reached in 1998, before the dotcom crash. This resulted in significant outperformance against the FTSE 100.

Unilever versus the FTSE 100

Source: SharePad

Summary

Unilever is on track to increase its operating profit margin from 15.5% in 2014 to 20% in 2020. This reflects the shift from the low-margin food division towards beauty and personal care.

However, the pace of underlying sales growth has declined since hitting a high of 6.9% in 2012. Investors will continue to focus on underlying sales to gauge whether Unilever is delivering on its growth potential.

Comments (0)