Three small caps offering decent and reliable dividends

For those seeking an income from small-cap companies, Richard Gill reveals three firms which he believes should continue to provide a decent and reliable payment for years to come.

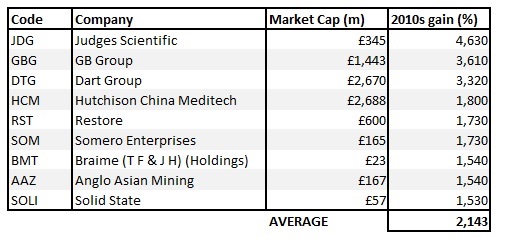

Given the kind of share-price rises seen on the small-cap markets over the past 10 years, it’s no wonder that, when analysing a stock, investors are mainly looking for growth potential. The table below shows that over the decade of the 2010s the top-10 best-performing AIM-listed stocks generated an average gain of 2,143%. That’s a compound annual gain of 36.48% − well ahead of the returns even Warren Buffett has delivered. In other words, if you’d put £100 into each of the 10 shares at the start of 2010, your portfolio would now be worth £22,430.

In contrast, dividends often play second fiddle to growth in the small-cap markets. After all, few investors get can excited by a return which is usually in the low single digits. What’s more, companies at the growth stage of their life cycle usually retain their excess earnings to invest in expansion. According to my analysis, only around 30% of AIM companies currently make a dividend payment, although this rises to 82% of FTSE Small Cap listed firms.

Dividends should not be underestimated however. Not only can they provide a regular source of income, reinvested in shares they can act to compound returns over time. According to analysts at Link Asset Services, UK dividends rose by 6.9% on a headline basis in Q3 2019 to £35.5 billion, with an estimated £110.3 billion expected for the full year. ‘UK plc’ is expected to yield 4.4% over the next 12 months, close to historic highs and well ahead of other asset classes such as bonds.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

For those seeking an income from small-cap companies, here are three firms which I believe should continue to provide a decent and reliable payment for years to come.

APPRECIATE GROUP

Listed companies can change their name for a number of reasons. A quite common reason on the small-cap markets is a change of business strategy, often because the previous strategy failed and management want to disassociate themselves from the previous business name. I note one particular AIM company which has undergone no less than four name changes in the past 10 years! However, Appreciate Group, which recently changed its name, has been performing very well indeed.

Appreciate Group (LON:APP), previously known as Park Group, is a provider of value-added pre-paid gift, reward and savings products to the corporate and consumer markets, with sales coming through a direct sales force, a network of agents and, increasingly, digital channels. This is a market which according to the UK Giftcard & Voucher Association is worth around £6 billion per year. Trading is split between two divisions; consumer and corporate.

In the consumer division, the company has been helping people across the UK to budget for Christmas since 1967, via its savings schemes, with 426,000 customers using its services in the last financial year. In the corporate division, under the brand Love2shop Business Services, the firm is the UK’s largest provider of multi-redemption gift cards, vouchers and digital reward propositions, principally to the incentive and reward markets. It serves around 37,000 business customers, with market-leading incentive, recognition and rewards options for an estimated two million recipients through 189 retail partners with over 25,000 outlets.

Appreciate earns income from service fees paid by partner retailers, leisure and other service providers based on the face value of money spent via its cards and vouchers, as well as from interest on all pre-paid cash until the obligation to the redeemers has been settled.

Gaining pounds at Christmas

With a strong focus on the Christmas savings market, Appreciate Group’s financials have always been weighted heavily to the second half of its financial year, when three quarters of annual revenues come in. As a result, the numbers must be read on a full-year basis to get a full picture of how trading is progressing. Those for the last full year, to March 2019, reported revenues relatively flat at £110.4 million and adjusted pre-tax profits again round about £12.5 million.

More recently, numbers for the six months to September 2019 (the company’s ’quiet’ half) reported a strong performance. Revenues for the period were up by 21.3% to £33.2 million, benefiting from increased demand and the addition of new clients, with the traditional first-half loss down by £0.2 million at £1.3 million. As a result, the interim dividend payment was held flat at 1.05p

The first half saw investment in a new strategic plan, with expenses incurred on new technology, new products and the move to a new head office. Enhancing the investment case, the business is decently cash generative for the full year as a whole, with a debt-free balance sheet. At the interim stage, net cash to the company (it holds customer cash on the balance sheet in trust) was £7.7 million. This was down from £36.9 million six months previously but as usual should improve markedly by the financial year end.

Appreciate the returns

Investors in Appreciate Group had an excellent decade, with the shares rising from 18.75p to 56.5p between 2010 and the end of 2019. That’s a total capital gain of 199%, or an 11.7% compound annual return. But this is a perfect example of how dividends can sharply magnify returns. Over the last decade, Appreciate paid out 23.73p worth of dividends, taking the total 10-year return to 328%. The payment was increased every year, from 1.32p in 2010 to 3.2p in 2019.

At the current price of 60.25p, shares in Appreciate Group trade on a historic earnings multiple of 11 times, which looks good value in my view, given the company’s strong trading history. With a progressive dividend policy, linked to business performance, I think we can be reasonably confident that the previous year’s payment will at least be maintained for 2020. The debt-free balance sheet and reasonable earnings cover reinforce that confidence. On this basis, we are looking at an attractive yield of 5.3% at the current share price. What’s more, analysts at Edison have an 87p valuation for the shares, which implies capital upside of 44%.

REAL ESTATE INVESTORS

Investors looking for income often flock to the property sector as companies managing property portfolios are generally stable businesses, enjoying regular and predictable earnings streams through rental agreements. Indeed, a certain part of the property sector has been created with a legal obligation to pay dividends to investors.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

A REIT (real estate investment trust), is a property-owning entity which is exempt from corporation tax on profits and gains from property-rental businesses, as long as it distributes at least 90% of taxable income to investors. Technically, income is treated as property-rental income rather than dividends. The structure provides an attractive way for investors to access the risks and rewards of holding property assets without having to buy them directly.

One such company is the appropriately named Real Estate Investors (LON:RLE), the UK’s only Midlands-focused REIT, with a portfolio of 1.59m square feet of commercial property including offices, retail outlets and restaurants. The company’s strategy is to invest in well-located real-estate assets in the established and proven markets of central Birmingham and the Midlands, realising value through rental agreements and opportunities for capital appreciation. Overall, the total £221m portfolio is well-balanced, with no major reliance on any one tenant or industry, with the top 10 tenants representing only 22% of contracted income.

Birmingham and the surrounding areas are vibrant places for business (especially manufacturing and engineering, education and tourism), with the region set to benefit from numerous infrastructure investments over the coming years, maybe including HS2. In the nearer-term horizon, last year the government announced its intention to invest £778 million in Birmingham and the West Midlands in advance of staging the 2022 Commonwealth Games.

Brummie Money

The six-month period to June 2019 was a good one for the company, with the all-important contracted rental income growing by 7.6% to an annualised £17 million. That helped underlying pre-tax profits grow by 18% to £4 million, with earnings up by 19% at 2.15p per share. At the period end, the portfolio had 268 tenants across 51 assets, with a weighted average unexpired lease term of 4.04 years, providing good earnings visibility. However, the EPRA NAV per share (an industry measure of net worth) slipped by 0.7% to 68.8p, mainly as a result of a £2.8 million reduction in the value of retail assets.

Real Estate Investors kicked off 2020 with a positive update covering trading in the previous 12 months. Contracted rents rose further, to £17.66 million by the end of December, up 3.85% over the year, following 44 new lettings and nine lease renewals. The company now has 280 occupiers across 53 assets and retains no material reliance on any single occupier, asset or sector. Occupancy levels are said to be excess of 96% and the overall cost of debt has reduced to 3.4%, with 72% of the debt now fixed. The outlook for the current year was positive, with chief executive, Paul Bassi expecting pent-up demand to stimulate trading potential in the markets, with £15 million of cash and bank facilities available to take advantage of any opportunities.

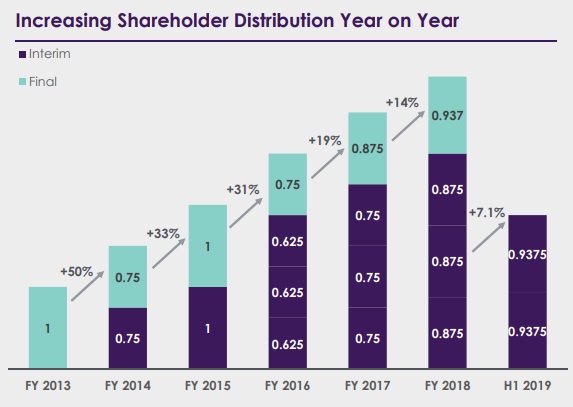

Source: Company presentation

REIT good investment

Shares in Real Estate Investors currently trade at 55p, capitalising the company at £102.5 million. For starters, that is a 20% discount to the EPRA NAV per share as at 30 June last year. Looking at recent acquisition activity in the listed property sector that discount looks attractive, with A&J Mucklow acquired by LondonMetric last summer at an 11% premium to NAV and Hansteen Holdings recently agreeing a cash deal at around a 12% premium.

Acquisition potential aside, the long-term attraction here is income. Real Estate Investors’ dividend has now grown for seven consecutive years, with total dividends paid to date of £27.3 million. Providing a more frequent income stream than many other companies, the payment is made every three months. During 2019, the total pro rata dividend amounted to 3.75p per share, which equates to a yield of 6.8% if maintained. But with the recent trading statement pointing towards an increase this year, I don’t think that a 1p per quarter payment would be too much of a stretch for 2020, meaning that a yield of 7.3% looks to be on the cards.

WYNNSTAY

Finally, we look at a company which has had some troubles of late but still provides a decent, steady income and looks to be significantly oversold in my view. Founded in 1918 as a farmers’ cooperative, Wynnstay Group (LON:WYN) today is a well-established manufacturer and supplier of agricultural products to farmers and the wider rural community across the UK.

The largest division in the group is agriculture, which contributed 73% of revenues in the last financial year. Here, via a number of brands and businesses, the company manufactures and supplies a comprehensive range of agricultural products to customers across many parts of the UK. In the feed division, Wynnstay operates two multi-species compound-feed mills and one blending plant, offering a range of animal-nutrition products to the agricultural market in bulk or bags. Meanwhile, the group’s arable activities supply a wide range of products to arable and grassland farmers, including seed, fertiliser and agrochemicals. Also in agriculture, one of Wynnstay’s other brands, Glasson, is a producer of blended fertiliser, a supplier of feed raw materials and a manufacturer of added-value products to specialist animal-feed retailers.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Secondly, the specialist agricultural merchanting division is a specialist supplier of agricultural and associated sundry products. The group operates 55 depots across Wales, the Midlands, north-west and south-west England, supplying to farmers, smallholders and rural dwellers. Additionally, Youngs Animal Feeds, which is also part of the group, sells a range of equine and small-animal feeds to wholesalers and retailers in Wales and the Midlands.

Ewe won’t believe it

Wynnstay posted a record set of numbers for its 2018 financial year, growing revenues by 18.4% to £462.66 million and underlying pre-tax profits by 20.5% to £9.6 million for the 12 months to 31 October. However, the shares suffered following the company’s announcement in March last year, that trading had weakened significantly during its second quarter and that profits would now be behind the previous year. This was blamed on abnormally warm weather during the winter months, which reduced the requirement for feed and other weather-related products, along with a weakening in farm-gate prices, partly believed to be the result of Brexit/political uncertainties.

While the 2019 numbers were behind initial expectations, they weren’t actually that bad. The bottom line showed underlying pre-tax profits of £8 million, down by £1.6 million compared to the record 2019 levels, but still slightly ahead of those posted in 2017. Despite the difficulties, the total annual dividend was increased by 4.8% to 14p per share. Notable was a strong cash-flow performance, with a net £12.9 million flowing in from operating activities after good inventory management. Net cash at the period end was £3.84 million, with the company only having £6.76 million of borrowings.

The outlook was of interest, with Wynnstay commenting that the trading environment for the agricultural-supplies sector remains challenging. Farm-gate prices are generally lower than a year ago and uncertainty remains about the impact on the agriculture sector of exiting the EU. Additionally, a high level of forage stocks on farms has reduced feed demand, and wet weather conditions over recent months have decreased the acreage of winter cereals that farmers have been able to plant. Nevertheless, the company remains confident in its medium and long-term prospects, helped by its wide spread of activities and strong balance sheet.

Cheap as grain

At a current price of 282.5p, Wynnstay shares are now trading at well under half of highs seen as recently as March 2017. Despite the inherent cyclicality of the business, that drop looks unfair to me given that record numbers were posted barely a year ago and that the business remains decently profitable.

On an earnings basis, the shares trade on a multiple of just over nine times, putting them well into value territory. Value also comes from the company’s net assets, which as at 31 October amounted to 479p per share, 70% above the current price. Even stripping out intangible assets leaves a TNAV (tangible net asset value) of around 400p per share, representing 42% upside.

Regarding income, Wynnstay has an enviable dividend record, having increased its total annual payment every year since listing on AIM in 2004. With the shares now at a near 10-year low, the historic yield on offer is a shade under 5%. We can be reasonably assured that the payment will at least be maintained in 2020, barring any extreme change in trading conditions. This view is based on the strong balance sheet, long track record of dividend increases and comfortable earnings cover of 2.2 times. I note that investors who get on the shareholder register before 27 March will enjoy the 9.4p per share final dividend, which alone yields 3.3%.

Comments (0)