Takeover Time at Valeant?

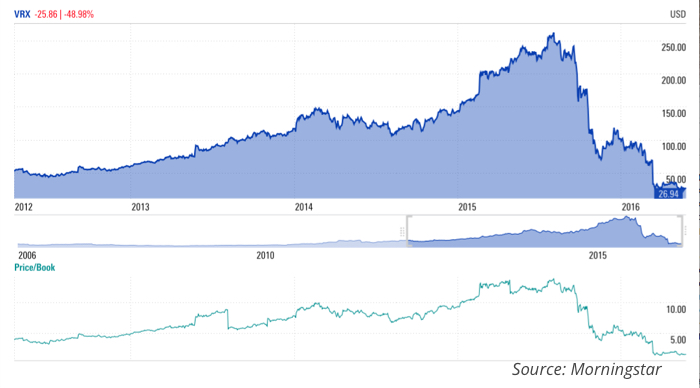

The last year has been tough for Valeant Pharmaceuticals, as the Canadian specialty drug maker has been involved in scandals, accounting misstatements and fraud, all of which battered down its share price from a 2015 high at $236.81 to the current price near $29. On April 7, I recommended a long position in this “troublemaker”, as I felt the worst was already behind and that investors had just overreacted. During the period from April 7 until today, the shares have not moved significantly in either way, even though they have been exposed to turbulence. But a few positive things have been happening and I believe price is about to take over.

Unlike Bill Ackman from Pershing Square who purchased Valeant’s shares at skyrocketing prices, when I first mentioned this stock to our readers its price had already been battered down by 90%. At the same time, I never suggested betting the house on this, as Ackman seems to have done, because no one can predict the future with such precision. Valeant seems well undervalued at current prices, but it still faces severe challenges that may or may not be overcome. Its debt load is around $30 billion, which translates into a huge drag on profits. Unless the company finds a way of reducing it, under less favourable economic conditions it may be knocked out by its creditors.

I’m writing this piece today not because I want to urge readers into investing in this stock, as Bill Ackman seems to have done when scheduling emergency conference calls; but rather because I feel there are a few new points to weigh. Last week, the WSJ published a piece claiming that Valeant was recently approached by Takeda with a takeover offer. In fact, it seems to have been a joint offer from the Japanese giant Takeda Pharmaceutical and the private equity firm TPG. Takeda is trying to get its hands on Xifaxan, a highly promising drug to treat Irritable Bowel Syndrome (IBS) – a disorder that may affect as much as 45 million Americans. In addition to that, TPG is eyeing up the rest of Valeant’s assets to add to its more than $70 billion of assets under management, which cover all sectors of healthcare. The offer was rejected by Valeant. The shares opened 8% higher on the day.

While Michael Pearson certainly left Valeant in a very sensitive financial situation due to the excessive leverage taken to acquire other companies, abusive treatment of inventory transactions as sales, overstatement of revenues, understatement of costs, and many other bad accounting practices (to say the least); he also left the company a notable portfolio of drugs and medical devices. Instead of spending time, effort, and resources in R&D, Pearson preferred to purchase what others had already developed and then simply raise the price of that output as much as possible. While questionable, the strategy allowed Valeant to build a well-diversified portfolio and become cost effective. An example of this diversification is the fact that its highest earning drug – Xifaxan – represents only 10% of revenues. The top 20 earners represent 30% of revenues. The company is not heavily dependent on any single product and is not dependent on unsuccessful, expensive R&D. While R&D is certainly the only way to develop new products, at this difficult point Valeant is lucky in not having much R&D dragging down its operating income. Maybe it can think about it in the future, but now all it needs is a simple and predictable cost structure. Pearson’s bet has been on marketing drugs and on building a cost effective corporation.

But Pearson went too far in terms of leverage and the company needs to find a solution to its $30 billion debt load. Nevertheless, while debt is there to be repaid, the acquired products and medical devices are available for disposal. Pearson had an eye for drugs that were selling at huge discounts and built a great portfolio for Valeant. If something goes wrong, the company may sell a few core assets. It is estimated that Xifaxan is worth north of $30 billion. That product alone could repay the company’s debt. Last week’s WSJ news on the takeover offer is proof there is interest in Valeant’s products.

Xifaxan is the product of Salix Pharmaceuticals, a company Valeant purchased one year ago. Xifaxan is one of the most promising drugs to treat IBS, which is expected to leverage the company’s sales in the near future. Such a product is a must for Takeda, as the pharmaceutical giant has a major focus on gastrointestinal disorders. The bid failed and no price was advanced, but other bids may well follow. This is a strong positive sign. Another even more positive sign is the fact Valeant rejected the bid, which to me demonstrates optimism about the future. The new CEO, Joseph Papa (ex-Perrigo), was appointed just a few days ago. He has already stated that Valeant “has a very good pipeline” of new drugs that hasn’t been fully appreciated.

After the scandals of the recent past, Valeant will face a tough future. Papa will need to sell the company’s non-core assets and eventually evaluate a potential sale of some core assets in order to reduce the debt load. At the same time, these scandals have scared many away, which will force Valeant into doing some drug rebates that will negatively impact its revenues. But while all these factors represent risks, we still know this company has an excellent portfolio of drugs, ranging from ophthalmology to gastrointestinal drugs, and has access to both the developed world and emerging markets. Apart from the impact its debt load has on net income, there is no complicated cost structure, which means Valeant has a cost structure that carries much less risk than its competitors. At current price, Valeant’s price-to-sales and price-to-book ratios are much below its competitors making it hugely undervalued. In my view, this company is worth $80 to $90 per share. What it now needs is time for the new CEO to articulate a plan and for the market to rebuild trust in the new management team.

A point in favour of investors is the fact there are a few drugs that are worth a lot of money, even if sold separately. It is estimated that the Xifaxan business may be worth at least $30 billion. In the meantime let’s monitor the actions of Novartis, Takeda, Allergan, J&J and Cooper, all of which have an interest in Valeant products. At a $10 billion market cap, Valeant looks cheap. There’s definitely upside potential here, but patience is needed. I would buy and forget about this company for a year and then re-evaluate.

Comments (0)