Small caps to potentially double your money

In a riskier than usual selection this month, here follows three small cap companies which brokers believe could double in value or more over the next year.

“Elephants don’t gallop”. So said legendary but controversial investor Jim Slater, referring to the observation that small-cap companies can grow at a much faster rate than their blue-chip cousins. Writing in The Times he said, “Mammoth companies rarely double their market capitalisation in a year. By contrast, small companies often do this and more.”

It’s a nice soundbite from Slater but not strictly true. You might be surprised to learn that over the past year, ten FTSE 100 companies have doubled or more in value. Longer term, over the past five years 27 current constituents of the blue-chip index have doubled in value, with 48 up by 100% or more over 10 years. And while hardly any FTSE 100 companies have gone bust over the past few decades, countless small cap firms are currently taking up space in the corporate graveyard.

Where Slater was right however is that small caps can soar in value in a very short space of time and over the years can deliver returns in the four and even five figure percentage levels – something almost impossible for large stocks to do given their already vast size. For example, those investors shrewd enough to invest in AIM listed competition organiser Best of the Best (LON:BEST) a decade ago are currently sitting on gains of almost 15,000%!

In a riskier than usual selection this month, here follows three small cap companies which brokers believe could double in value or more over the next year.

SYNAIRGEN

While the pharma stocks rally seen last year has lost most of its fizz, investors are still excited about the prospects of many COVID-19 related stocks. One of them is respiratory drug discovery and development firm Synairgen (LON:SNG). In March last year the firm announced it would be starting a Phase II trial of its drug SNG001, designed to test its efficacy in hospitalised COVID-19 patients. SNG001 is a formulation of a naturally occurring protein which manages the body’s antiviral responses. It has been designed for direct delivery to the lungs via nebulisation, to treat and/or prevent lower respiratory tract illness caused by respiratory viruses.

The markets took very well to initial results of the 220 patient trial, which were released last July. The major headline was that the odds of developing severe disease during the treatment period were significantly reduced by 79% for patients receiving SNG001 compared to those who received the placebo. Also, patients who received SNG001 were more than twice as likely to recover over the course of the treatment period and the measure of breathlessness was markedly reduced. Following the news, shares in Synairgen galloped up from 38p to close the day at 190p.

A few months later and in October Synairgen took advantage of its share price surge to raise £87 million in order to progress SNG001 as a treatment for COVID-19 as rapidly as possible. The plan at the time was to begin a Phase III clinical trial of SNG001 in around 900 COVID-19 patients around the world (since reduced to 610), who require supplemental oxygen. This would provide the data to progress marketing authorisation applications in 2021. The money raised would also fund manufacturing and device scale up activities with the aim of producing c.100,000 treatment courses per month in 2021.

Viral updates

By the end of 2020 the first patients had been enrolled in the Phase III trial (known as SG018), which has been deemed an Urgent Public Health study by the UK’s National Institute for Health Research (NIHR), with dosing beginning in January 2021. In the US, Synairgen has had an Investigational New Drug application accepted by regulator the FDA, enabling it to initiate the trial in the country. Additionally, the FDA has awarded SNG001 Fast Track status, enhancing the ability of Synairgen to interact with the regulator and shorten review timelines. As I write, the trial is now approved by regulators in 11 additional countries, with further approvals expected in five more in the coming weeks.

Synairgen recently announced its results for the year to December 2020 and confirmed that the Phase III trial is ongoing, with initial results expected in H2 this year. After that, the near term plan is to gain the required regulatory approvals as soon as possible to treat patients with COVID-19 in hospitals, to treat those at home with significant breathlessness and to reduce the number of patients who develop ‘Long COVID’. The company looks well funded to take the trial to completion, with cash balances of £75 million at the end of the year.

Breath of fresh air

As well as vaccines, the world also needs treatments for the patients who will inevitably continue to catch and become ill with COVID-19. Assuming that the Phase III trials go well, Synairgen has an excellent opportunity here to sell its drug to healthcare operators around the world. In the longer term, further opportunities come from helping governments to prepare for future pandemics and applying SNG001’s antiviral activity to treat patients hospitalised on account of other severe viral lung infections. Of course, along with the trial outcome, significant risks remain including obtaining the required regulatory approvals and challenges associated with building the manufacturing and supply chains needed for launch.

Following the annual results release analysts at broker FinnCap reiterated their near-term target price on Synairgen shares of 505p. This is based on a discounted cash flow model and assumes a 70% probability of SNG001 reaching the market in 2021. The broker believes that the targeted 100,000 treatment courses per month equates to peak potential monthly revenues of c.$300-350 million – a significant figure given the company’s current market cap of just over £200 million. With the shares having slipped back to a current level of 102.6p, FinnCap’s target implies potential upside of 392%.

WESTMINSTER GROUP

This next company has seen its fair share of problems from viruses over the years. But following a recent fundraising and healthy pipeline of business opportunities, the outlook seems promising. Founded in 1990, Westminster Group (LON:WSG) is a specialist security and services group which operates in over 50 countries via an extensive network of agents and offices. The company operates through two divisions, Technology and Services, and its high margin business model sees multiple revenue streams being earned from many sources around the world.

Its main activity is the design, supply and ongoing support of advanced technology security solutions including security equipment, installation and maintenance services, manned security operations and long-term operational management of security infrastructure at sites such as prisons, ports and airports. Clients include the likes of governments, government agencies and blue-chip commercial organisations. To give one example, a recent deal saw the company win a five-year contract to replace and maintain the security screening equipment at the Houses of Parliament. The project includes the removal of existing systems and the installation and maintenance of new advanced X-Ray Screening and associated systems to screen people and baggage.

Back in 2014 Westminster Group was negatively affected after flight restrictions in West Africa prompted by the Ebola virus impacted its airport operations. Fast forward to 2020 and COVID-19 had a similar impact due to travel restrictions and airport closures materially affecting its airport managed services, training and guarding businesses. There were also a number of contract delays as a result of the pandemic. However, supported by growth elsewhere, income from long-term managed services contracts and an easing of restrictions, the company came through the year well. While annual revenues slipped from £10.9 million to £10 million, net losses were reduced from £1.3 million to £0.7 million.

Inflection point

A key event came in December last year when Westminster Group completed a £5 million equity placing at a price of 4p per share. Just over half of the funds were used to fully redeem outstanding convertible loan notes and pay off other borrowings, saving some £0.3 million in annual interest and fees and leaving the business debt free. The remaining funds are being used as working capital to support the deployment of business prospects.

The placing announcement provided a lot of details about the future potential here, with the company stating that it is now at an inflection point in its growth trajectory. At the time, a long list of pipeline opportunities was provided, including some 16 Airports Managed Services deals. These included a number of long-term, multi-million pound, annual recurring revenue opportunities, some of which were at advanced stages of negotiation. Westminster believes that each of which, if secured, would lead to a significant step change in growth.

In the 2020 results, management updated on the outlook. While being wary of further COVID related delays, CEO Peter Fowler remained positive for 2021, with the easing of restrictions setting the stage for revenue growth to return to the double-digit levels seen pre-pandemic. Enquiries are said to remain at healthy levels, with a range of products and solutions provided to clients worldwide so far this year. The easing of lockdown restrictions has also enabled the progression of some delayed projects that slipped from 2020.

Secure the growth

The situation Westminster Group finds itself in is a perfect example of why Jim Slater was attracted to small caps. If any one of the substantial pipeline of opportunities is converted into a contract, combined with the relatively fixed operating costs, it could have a material impact on earnings and thus the company’s valuation. I see no shortage of further opportunities to those already announced, with the company having built up a strong reputation across the world over the past few years. What’s more, the recent winning of the Queen’s Award for Enterprise, in recognition of the company’s outstanding contribution to international trade, should attract further attention.

Analysts at broker Arden recently initiated coverage on Westminster Group shares, slapping on a target price of 19p. That values the company on a multiple of around 11 times the broker’s 2022 earnings forecasts, in line with listed global security industry peers. At the current price of 4.05p that implies upside potential of 368%.

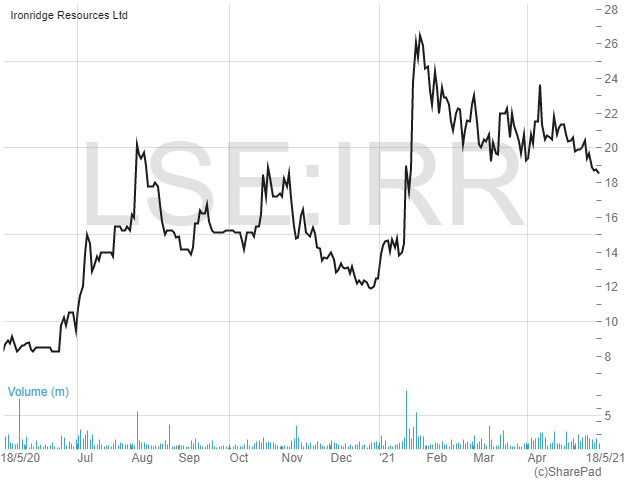

IRONRIDGE RESOURCES

I don’t often cover mining companies but this next one looks to have a compelling investment case in the context of the current global economic environment. IronRidge Resources (LON:IRR) is an Africa focussed minerals explorer with a range of assets including a lithium discovery in Ghana, a grassroots gold portfolio in Côte d’Ivoire and a potential new gold province discovery in Chad. In addition, there are legacy iron ore assets in Gabon and a bauxite resource in Australia.

There are two main projects being focussed on at the moment, the most advanced being the Ewoyaa Lithium Project. Located c.100 km southwest of Ghana’s capital city Accra, here IronRidge has a Mineral Resource estimated at 14.5 million tonnes of ore at a grade of 1.31% Li2O (lithium oxide). A scoping study in January this year supported the business case for a 2 million tonne per annum production operation with life of mine revenues exceeding $1.55 billion, average annual EBITDA of $105 million, a post-tax net present value of $345 million, with significant potential to extend the mine’s life. The results confirmed the company’s belief that Ewoyaa is an industry-leading asset and additional drilling is now underway to increase the resource scale and improve the project’s economics. Options are being explored to fast track the project to production.

Meanwhile in Côte d’Ivoire, IronRidge has access rights to highly prospective gold and lithium occurrences covering a combined 3,584km2 and 1,172km2 respectively. These are well located within access of an established road network and along strike from multi-million-ounce gold projects and mines. The most advanced asset is the Zaranou gold project where extensive drilling work has been completed within a broad 47km long gold anomalous structure. High-grade gold drilling intersections along an 8km strike have been reported including results up 25.8g/t gold. In March, ongoing results from the current drilling programme confirmed significant mineralisation potential, with the company believing Zaranou has the potential to become a large-scale, open pit gold mine.

Precious Metals

While being an early stage explorer, IronRidge looks well positioned to benefit from two prevailing global macro-trends. On one side, demand for lithium, due to its use in stored energy devices and electric vehicle batteries, is expected to soar in the coming years. According to analysts at GlobalData, demand for the metal is expected to rise from an estimated 47,300 tonnes in 2020 to 117,400 tonnes in 2024. This is expected to be driven by growth in electric vehicle sales, which use lithium-ion batteries, with GlobalData expecting annual production to grow from 3.4 million vehicles in 2020 to 12.7 million in 2024.

Meanwhile, concerns over rising global inflation, on the back of governments needing to magic away their pandemic related stimulus debts, has led to a resurgence of the gold price in recent months. Since March, the yellow metal has bounced off lows of c.$1,675 an ounce to c.$1,875 as I write. Many industry analysts are expecting the price to surge above $2,000 and beyond well before the year is out.

To accelerate its development prospects, in late April IronRidge raised a total of £12 million at a price of 20p per share. The money will be used to deliver an updated scoping study and pre-feasibility study for the Ewoyaa Lithium Project, a maiden mineral resource estimate and ongoing drill testing of exploration targets at the Zaranou Gold Project and for ongoing development of the other prospective gold projects in Côte d’Ivoire and Chad.

Good IRR

Analysts at broker SI Capital have a 57p target price on IronRidge shares. This is based on a discounted NPV analysis which mainly looks at the Ewoyaa lithium project and Zaranou gold project. That’s 208% ahead of the current price of 18.5p. The broker expects that the lithium mine will be fast tracked to development, with plenty of news coming out across the portfolio to interest investors in the coming months. Chairman Neil Herbert and CEO Vincent Mascolo see the value, both recently buying £30,000 worth of the shares.

I would like to add Wishbone (WSBN) to the list of small caps which will in 12-18 months return 6x or more on its current SP of 18.5P

This is a gold miner working out of WESTERN Australia where there is a gold rush currently underway

With only 169million shares in issue once the drilling starts and resources and the Gold grades are identified it is expected lucrative JV’s with Newcrest the big heavy weight gold producer in the area to be signed which would result in another GGP in making but with better prospects and much less shares in issue

I would strongly advise to get in now before the drill results are out

Sure Brucey boy, im gonna lump into that