Power up your portfolio – AIM’s best video-game companies

If you’re thinking of buying a Playstation 5 this Christmas, you might need to have a backup plan.

Despite being released just over a year ago, the ninth-generation gaming console had already sold 13.4 million units by the end of September, making it the fastest-selling console in Sony’s history. These sales have been achieved despite a global semiconductor shortage and supply-chain issues stopping the consoles being shipped out. Sony expects supply to continue to be limited until at least early next year.

It’s not just supply issues affecting your chance of bagging a PS5, though. Demand for the latest console is through the roof, as video games have become big business − perhaps bigger than you think. A recent report from stockbrokers Arden Partners highlighted that the industry is now worth $170bn worldwide. Surprisingly, this is more than the music and film sectors combined. The report also highlighted that the global market recorded a deal flow of $60bn in gaming and e-sports combined in the first half of 2021, and is set for a long-term investment ‘explosion’.

The video-games industry saw a boost in 2020 as the effect of global lockdowns kept people at home, and needing to be entertained. While Arden Partners expects a consolidation in the second half of this year, it sees exponential growth over the long term, particularly due to the rapidly expanding virtual-reality (VR) segment.

VR is apparently the fastest-growing market segment. According to Arden Partners, UK revenues are up by nearly 32% in 2021, and are expected to increase at the same rate over the next five years. One other growth area is cloud gaming − playing video games using remote servers (without having to download or install them on a computer). While cloud gaming, worth an estimated $1bn in 2020, is still relatively young, it is forecast to be worth $30bn by the end of the decade.

Alex DeGroote, research director at Arden Partners, commented: “By 2025, it is predicted the industry will generate more than $260 billion in revenue as more technological breakthroughs occur, leading to further investment of capital.”

Small-cap investors already know the kind of returns that they can achieve from video-games companies. One big winner was games maker Codemasters, which listed on AIM in June 2018 at a price of 200p per share. Less than three years later it was taken over at 604p per share by US gaming giant Electronic Arts, valuing the business at almost £1bn. Meanwhile, the share price of technical and creative-services provider Keywords Studios (KWS) has risen from 123p in July 2013 to £26.65 (at the time of writing), after embarking on a highly successful acquisition strategy. Its market cap has gone from just under £50 million to around £2bn over that time – a fortyfold increase.

With all that in mind, let’s look at a few of the best small-cap video games companies looking to take advantage of the industry’s explosive growth.

FRONTIER DEVELOPMENTS

Several decades ago a video game could go from concept to the shop shelf within a matter of weeks – E.T. (reportedly one of the worst ever), was developed in just five. But with a significant increase in computer processing power, the creation of games has become a lot lengthier and more complex, with budgets often stretching into tens of millions of pounds. This isn’t surprising given the potential rewards on offer, with the best-selling games frequently shifting well into eight figures’ worth of units. There is also the promise of further revenues over the long term from in-game purchases and extra downloadable content. Take-Two Interactive’s best seller Grand Theft Auto V, for example, was recently reported as having made more than $6bn in revenues since release in 2013.

One AIM-listed company which has a range of popular titles is Frontier Developments (FDEV), an independent developer and publisher of video games founded in 1994 by chief executive and major shareholder, David Braben. Based in Cambridge, Frontier uses its proprietary Cobra game-development technology to create innovative genre-leading games, primarily for PCs and games consoles. Some of the most popular games include Planet Zoo, a zoo-management simulator; Elite Dangerous, a space-flight simulation; and Jurassic World Evolution, a prehistoric-theme-park simulator. As well as self-publishing internally developed games, Frontier also publishes games developed by partner studios under its Frontier Foundry games label.

Next level

Frontier has had a very successful time as a public company, joining AIM in July 2013 with a market cap of just £39m. The company is now valued at £676m and since then has grown revenues from £12m to £90.7m on an annual basis. From 2013 to 2021 profits have followed revenues, with earnings growing from 7.3p per share to 55.4p. While 2022 is expected to be another record year, Frontier has recently taken a hit.

The news that investors need to know is that in late November the company announced a reduction in revenue expectations for the current financial year. The main point was that its latest game, Jurassic World Evolution 2 (JWE 2), released on 9 November, had seen lower-than-expected sales on the PC platform. Combined with muted sales of its Elite Dangerous: Odyssey game, revenue guidance for the year to May 2022 is now£100m to £130m, down from £130m to £150m previously. The range provided is so wide because of the many possible outcomes across the whole games portfolio, as we head into the important Christmas season.

The stock market didn’t like the statement, sending Frontier shares down by almost 40% on the day of the news. Despite the revenue revision, which seems cautious, I think that the share-price fall looks harsh for a number of reasons. JWE 2 is still expected to be a big revenue earner, with Playstation and Xbox sales having been largely as expected and the PC effect coming during a crowded release ‘window’. What’s more, with the release of the Jurassic World Dominion film in June next year, sales of the game should get a boost.

Shares to dino-soar?

Shares in Frontier Developments had their worst ever day following the November profits warning. They tumbled from about £25 and have now settled at a shade over £17. While a number of analysts unsurprisingly cut their target prices following the update, they still see significant upside potential in the shares. Berenberg thinks that the sell-off was overdone and is confident that JWE 2 will prove to be the company’s most successful franchise ever. It believes the shares are worth £25.

House broker Liberum meanwhile is slightly more optimistic, having a £28.70 target price, implying 67% upside from current levels. That looks like a decent potential return, but more cautious investors might want to wait for the next trading update, due out early in the new year.

TEAM17 GROUP

Another aspect of the gaming world is the ’metaverse’. Put simply, this is an area which brings together many technologies, such as virtual reality, augmented reality, social media and even cryptocurrencies, to create an immersive virtual world where gamers can interact with each other. The term was first mentioned in author Neal Stephenson’s 1992 sci-fi book Snow Crash, in which humans are represented as virtual avatars and interact with each other in a 3D virtual space.

Mark Zuckerberg of Facebook believes that the metaverse could eventually replace the internet as we know it but thinks it could take five to 10 years before the main features become mainstream. What’s more, a recent report from Emergen Research suggested that the global metaverse market was worth $47.7bn in 2020 and is expected to grow at a CAGR of 43.3% up until 2028. All of this bodes well for this next company, which is well known for creating popular multiplayer titles.

AIM-listed Team17 (TM17) is a global games label, creative partner and developer of independent premium video games. It earns money by partnering with independent games makers around the world in the development and publishing of their content across the PC, console, mobile and tablet gaming markets. The company typically earns a fixed revenue share after games are launched but also earns higher margins from its own in-house-made games.

In contrast to some of its peers, Team17 focuses on premium, rather than free-to-play games. The portfolio currently contains over 100 titles, with back-catalogue sales delivering a strong residual income stream. The company is perhaps best known for its popular turn-based, strategy game Worms, which was developed in-house, first released in 1995 and has gone on to be a successful franchise. Other popular games include the multiplayer cooking game Overcooked! and prison-strategy title The Escapists. A recent move has also been made into educational entertainment apps for children via the $26.5m acquisition of StoryToys.

Extra lives

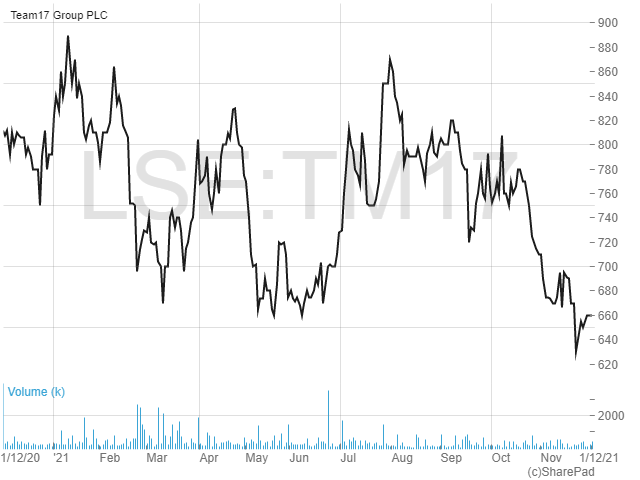

Team17 joined AIM in May 2018 at 165p per share and also completed a £107.5m placing described as “multiple times oversubscribed”. Since then, the shares have risen to 650p, with revenues up from £43.2m to £83m over three years. Pre-tax profits were up from £8.7m to £26.2m over the same period.

The six months to June 2021 saw another strong period of trading, with revenues up by 3% to a record £40.1m for the half year. It should be noted that this performance came following a 28% revenue rise in H1 last year after the company benefited from the increasing demand for games, as a result of lockdowns. Pre-tax profits also hit a record for the period, up by 5% at £14m. Team17 is a highly cash-generative company, with operating cash conversion of 108%, helping to take net cash at the period end to a healthy £66.6m.

Operating highlights of the half year included six new title releases across multiple platforms, 17 additional, new, downloadable, content packages released across nine titles and an increase in the content portfolio, to over 500 digital revenue lines spanning a broad range of genres and platforms. The outlook for the second half year is positive, with further game launches scheduled and the company due to benefit from a full, six-month contribution from the StoryToys acquisition.

Level up

Shares in Team17 hit an all-time high of 890p at the beginning of the year and on no real negative news have lost 27% of their value. While they trade on a ‘chunky’ historic earnings multiple of 35 times, I believe there is enough growth being delivered here to consider a ‘buy’.

Along with growth in the wider gaming industry, there is plenty of cash in the bank to make further acquisitions, even after the StoryToys transaction, and the company says it is on the lookout for more deals. What’s more, StoryToys has opened up a whole new growth market to take advantage of, with analysts at Technavio suggesting the global, educational apps market will grow by over $46bn between 2020 and 2024, at a CAGR of 26%.

Analysts at Peel Hunt have an 859p target price on the stock, with Berenberg going for a slightly higher 900p.

TINYBUILD INC.

Another games maker looking for growth by acquisition is the recently listed tinyBuild Inc. (TBLD). Based in Seattle in the US, the company is an indie video-games publisher and developer with global operations. The business model focuses on securing access to intellectual property, with the company partnering with a range of developers to establish a platform on which to build multi-game and multimedia franchises. Prior to a recent deal, tinyBuild had a portfolio of over 40 titles, with a pipeline including over 20 new titles in development.

Some of the firm’s popular titles include stealth-horror game Hello Neighbor, serial-killer-action title Party Hard, and Totally Reliable Delivery Service, a physics-based comedy about terrible delivery drivers. Interestingly, tinyBuild has developed a multimedia strategy for some of its best games, expanding the content IP into areas including books, TV, film and merchandise. This approach not only delivers more revenues, but also acts as a marketing and customer-engagement tool to extend the life of popular franchises. Hello Neighbor, for example, has sold over 1.6m books; has a pilot animation with over 40m YouTube views; and has released merchandise such as toys and clothing through licensing agreements.

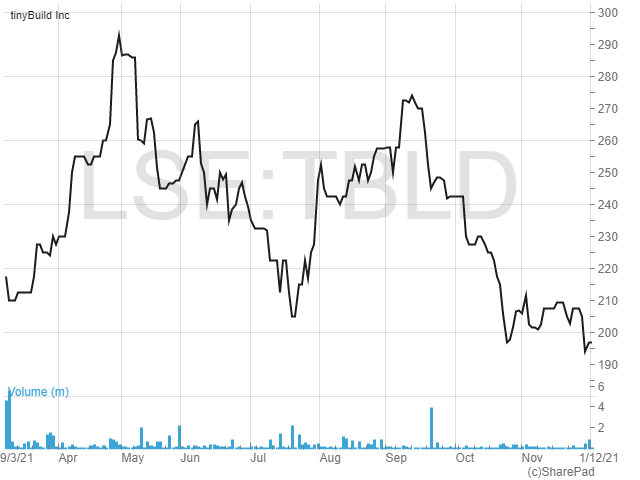

At the time of its AIM IPO in March this year, tinyBuild raised a total of £36.2m, with some of the proceeds expected to be used to make acquisitions and so-called ’acquihires’. An acquihire refers to buying out a company mainly for the skills and expertise of its employees rather than for the products it makes. The approach sees the company focus on existing partners where it has built a working relationship with the development team.

Building growth

tinyBuild came to market with a strong track record of growth, with revenues of $28m in 2019 and adjusted EBITDA of $7.7m, growing at a CAGR of 53.1% and 97.4% respectively. In the first full set of results as a public company (to December 2020) revenues of $37.6m were reported, with EBITDA almost doubling to $15.3m.

More recently, numbers for the six months to June 2021 showed revenues relatively flat at $18.6m, although this was in line with expectations following a second-half-weighted release schedule. Nevertheless, EBITDA grew by 18% to $7.9m, with margins increasing to 42% as the contribution to revenues from own-IP increased. Net cash at the period end stood at $61.6m, which included the proceeds of the IPO fundraise. The outlook was positive, with the company on track to deliver results at least in line with expectations, plus the effect of any accretive acquisitions.

tinyBuild has made a number of acquisitions/acquihires in the past few months. June saw the $6.5m purchase of DogHelm, developer of Streets of Rogue, the highest-rated title in tinyBuild’s portfolio, based on users on the Steam platform. August saw the $10.2m acquihire of development studio, Animal, developer of Rawmen, a light-hearted, multiplayer arena ‘shooter’ where players use food as a weapon to neutralise opponents. In September tinyBuild bought Bad Pixel, the development studio behind the popular open-world game Deadside, for up to $17.1m.

The latest and largest deal came in late November, with the company acquiring US-based Versus Evil (the video-game publisher behind titles such as The Banner Saga), as well as its Brazilian subsidiary, Red Cerberus. Versus Evil has published 32 titles on all major platforms, which will bring tinyBuild’s portfolio to over 70 games. Total consideration will be up to $31.3m, with the deal expected to be around 10% accretive at the EBITDA level in 2022, with greater potential for returns in the following years.

Bonus round

While shares in tinyBuild are up slightly from their IPO price of 169p, at the current 197p they are well off highs of 293p seen in April. I put the fall down to nothing more than profit taking, as trading has consistently been in line with expectations, with the company also executing on its acquisition strategy. There is a lot to like here, with plenty of cash for further deals and tinyBuild also having a solid base of predictable revenues. This was demonstrated in the interims when back-catalogue sales were 91% of total revenues, showing how the company is able to extend games’ life cycles, while adding new titles. Following the Versus Evil transaction, analysts at Berenberg upped their target price on the stock from 310p to 325p, implying upside potential of 65%.

Comments (0)