Picking quality FTSE 250 stocks for a recovery

Investors just need to pick quality shares that can weather the short-term volatility and deliver increased profits over time, writes Filipe Costa.

What 2020 reserves for us in the end no one knows for sure. But spread-betting companies are certainly happy thus far, as the rollercoaster is attracting money into their market. A deep dive in February/March has been followed by panic buying, as Covid-19 fears have been replaced by improved odds in favour of a V-shaped economic recovery.

British shares have experienced the same volatility seen in Germany and in the US but are currently lagging in the recovery. With Covid-19 shutting down borders that were already partially closed with Brexit, the UK faces a tougher scenario than other developed countries. However, difficulties usually come with opportunities.

Investors just need to pick quality shares that can weather the short-term volatility and deliver increased profits over time. With this in mind, I’ve selected a pack of 10 stocks from the FTSE 250, which rank high on quality traits. I opted for the FTSE 250 because its components are more domestically oriented. At a time when borders are effectively closed, these companies may be better positioned for a recovery. In fact, the performance of the FTSE 100 over the last decade has been poor when compared with the FTSE 250. The fundamentals seem to favour a perpetuation of that trend.

My investment strategy is quantitative. I don’t hand-pick stocks based on an extensive analysis of corporate balance sheets. I don’t have the time and resources to go through the financial statements of 250 FTSE companies to then select the best. Even if I did, I wouldn’t be sure about its worth. As far as science goes, empirical evidence shows that analysts, as a group, have been historically unable to deliver better results than the market. So, for the sake of simplicity and profitability, the best you can do is to invest in a broad market ETF. However, if you want a little more action and flexibility, you can select a list of quality stocks on your own, applying a quantitative strategy. All you need is a list of proxies to help identify those quality stocks.

Choosing the Filters

There’s no definitive list of quality proxies, but I believe the following five ratios are good enough to capture the most important aspects of quality.

Return on Capital Employed (ROCE)

We want to select companies that make a lot of profits from the money they employ in the business. ROCE measures profits before interest and taxes and is more precise than return-on-assets (ROA) or return-on-equity (ROE), as it takes into account all money employed in generating profits. I’m using a trailing 12-month figure.

Cash Return on Capital Employed (CROCI)

While making a profit is great, not all companies are able to convert that profit into cash flow with ease. At the same time, it’s much more difficult to overstate cash than profits. To address this issue and just select the real cash-generating companies, I’m using a trailing 12-month CROCI figure.

Debt-to-Enterprise Value

If cash is king, debt is a thorn in investors’ side, as it accelerates the erosion of a company’s financial position, in particular during difficult times. To select companies with just a moderate leverage, I use the 12-month trailing ratio of debt-to-enterprise value.

Interest Cover

If a company is unable to pay interest, it will need to seek additional external financing or dilute the current shareholders’ position by issuing new equity. A high interest cover ratio puts a company in a more comfortable position in this regard. I’m once again using the trailing 12-month figure for this ratio.

EBIT Growth Volatility

A quality company makes consistent profits over time. Highly volatile profits are usually associated with nascent companies and with pro-cyclical businesses. Quality companies are more able than others to survive downturns. To measure growth volatility, I compute the standard deviations of the last five annual EBIT per share growth rates.

Selecting the Stocks

With the quality proxies now chosen, it’s time to run them on a FTSE 250 list. I additionally require:

- Debt-to-enterprise value and interest cover to be non-negative,

- Require all other proxies to be non-missing,

- Exclude Financials.

It’s now time to run the filters, which capture 110 stocks from the list of 250. This is in particular a consequence of missing values. Still I prefer to exclude a stock not reporting ROCE or EBIT growth on a particular year than to ignore the missing value.

A final step concerns the proper selection of a group of stocks from the list of 110. Many investors require the proxies to be greater or lower than some predefined threshold. An example would be to require ROCE to be greater than 10 and debt-to-enterprise value to be lower than 12. These two filters would shrink the list to 36 stocks. If we further imposed other restrictions, we would certainly come up with a very short list from which we could invest. While this is a common way of selecting stocks, my experience tells me that most of the time you end up with empty lists. That usually leads you to relax some values or to use discretion in selecting stocks.

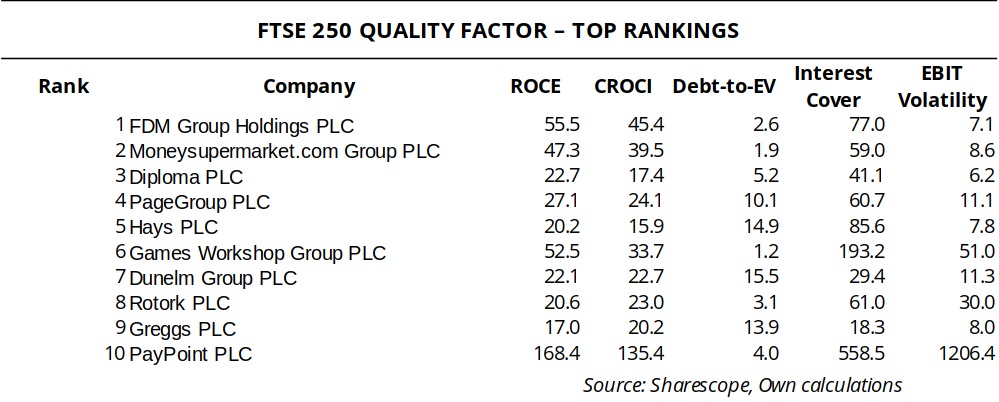

Alternatively, I prefer to apply a quantitative framework on the whole process and select the best stocks from a list. Quality and other traits vary across time. It’s not an absolute definition. A quality stock is a stock with better fundamentals than the average, the median or the broad market. With this in mind, I prefer to attribute ratings to all stocks on each of the five quality measures. As I have 110 stocks, I attribute a rating of 110 to the best ranking stock and a rating of 1 to the worst ranking one. The final rating is just the sum of the five ratings. Then I select the highest ranked stocks. The following table shows the list of the top 10 stocks.

My strategy selects FDM Group Holdings PLC (LON:FDM), Moneysupermarket.com Group PLC (LON:MONY), Diploma PLC (LON:DPLM), PageGroup PLC (LON:PAGE), Hays PLC (LON:HAS), Games Workshop Group PLC (LON:GAW), Dunelm Group PLC (LON:DNLM), Rotork PLC (LON:ROR), Greggs PLC (LON:GRG) and PayPoint PLC (LON:PAY).

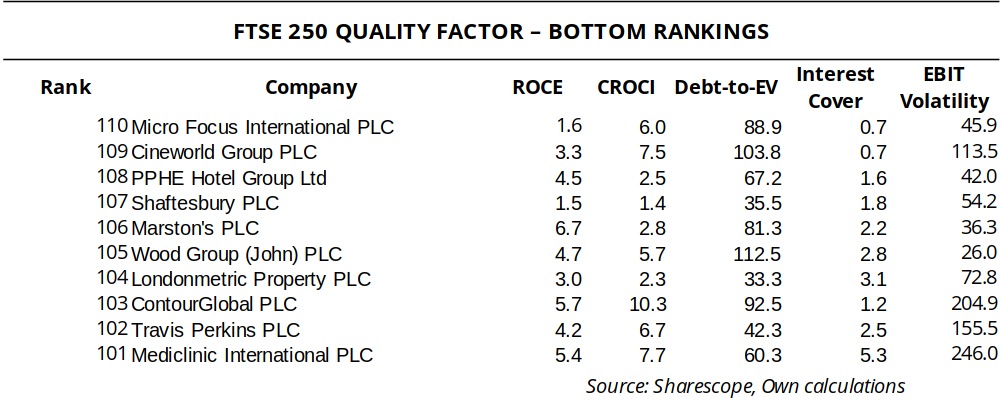

Out of curiosity, I’m also reporting below a list of the bottom ranked stocks.

This is a relatively simple way of building a strategy. All an individual investor needs is a good stock screener. The next step would be to choose a number of the top rankings to invest in and to give the stocks proper time to show their merits.

As a final note, let me just reinforce the idea that this is a quantitative strategy. If the quality proxies were properly chosen, then we’re expected to end with a list of stocks that are on average of better quality than the rest of the market. On average means there’s some potential deviation. Deviation from the mean means risk. To minimise this risk, it’s important to choose a sufficient large number of stocks. Choosing the top one to three is most likely inappropriate.

An interesting analysis that could have been improved by some backtesting for downside protection and upside growth over, say 3, 5 and 10 years

Also, what investment trusts or funds hold all or nearly all of these equities in their Top 10s? Is there any way to research this, and what’s the track record of these funds?

It would in general be great to have a search tool that allowed one to identify a set of individual shares and then find which managed funds come closest to a similar way of thinking about stock selection, if you don’t have the time and resources to monitor stock performance yourself over time.