Momentum stocks in moribund markets

Richard Gill reveals at three smaller companies that have seen positive share-price momentum recently and look worthy of further research.

As a whole, small-cap stocks showed a lacklustre performance in June, with the FTSE AIM All Share Index inching up by just 0.62%. Of course, there have been worse periods so far in 2020, with the market crashing by some 38% in the four weeks from 21 February, so many investors will be grateful for at least not losing any money. Despite a flat month for the index, there were many notable performances from individual small-cap companies in June, with 11 doubling or more in value and 30 up by more than 50%.

The top performer was lottery and e-commerce business St. James House (SJH) which soared by 335% after announcing a positive trading update and new funding package. Next up was private-investor favourite Sound Energy (LON:SOU), with shares in the gas company ballooning by 203% after it entered into a gas sales and project funding agreement with a Moroccan conglomerate. Not far behind was China New Energy (LON:CNEL) −up by 186% after it advanced plans to list on the Hong Kong Stock Exchange and priced a global offering of shares far higher than its current AIM valuation.

Other notable risers included spot-the-ball competition organiser Best of the Best (LON:BOTB). Its shares almost doubled in value in June after the firm announced an almost doubling of annual profits and a 20p per share special dividend. With the shares now on an earnings multiple of 39 times, they are looking as expensive as the luxury cars it gives away as prizes. Meanwhile, shares in Goldstone Resources (LON:GRL) finished the month 155% higher, after they returned from suspension following the company being dissolved by the Jersey Registrar of Companies, due to an administrative error. Not only that, the gold explorer also finalised a $3m loan secured on 2,000 ounces of the yellow metal.

Making momentum

Rising share prices in companies like these are attractive for followers of momentum investing, a technique whereby investors look to make money based on the continuation of a trend. They typically look at a share that has consistently risen in price over a period of time, say at least three months, and invest in the hope of the momentum carrying on into the future. While this is mainly a technical-analysis-based investment strategy (which has its critics) I believe that looking at a rising share-price chart can be useful for flagging up a company which is potentially doing well operationally and consequently reaping the rewards via a higher share price.

The following three companies have seen positive share-price momentum recently and look worthy of further research. Given that most London-listed shares didn’t manage to weather the recent slump, I am focusing on stocks which have shown strong growth over the past three months.

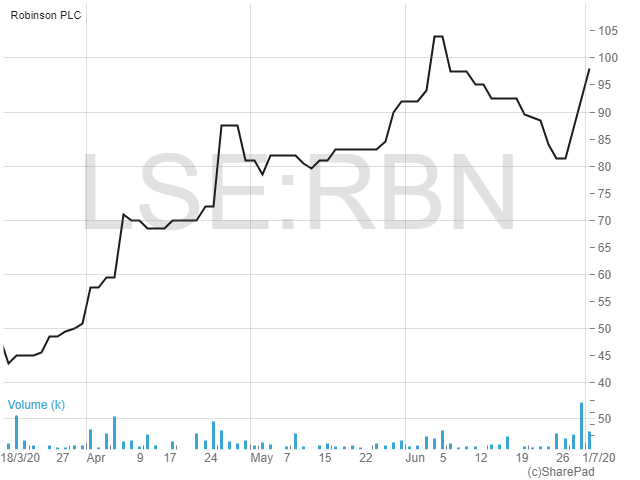

ROBINSON

In a recent Master Investor magazine article, I looked at a range of small-cap companies that, in the midst of the coronavirus pandemic, had decided to scrap or significantly reduce their dividend payments. As we slowly move out of the crisis, as trading conditions improve and as worst-case scenarios haven’t come to pass, companies such as Robinson (LON:RBN) are now returning to the dividend list.

Based in Chesterfield, Robinson is a custom manufacturer of plastic and paperboard packaging, mainly for the food, personal care and household sectors. With a history going back 180 years, when founder J B Robinson bought a box business, the company went public in 2004 and used that as a basis for growth both here and in eastern Europe. Since then, several acquisitions have been made, building up the plastic injection moulding side of the business. The group currently has two manufacturing facilities in the UK and two in Poland focused on the manufacture and sale of injection and blow moulded plastic packaging to mainly blue-chip customers including the likes of Proctor & Gamble, Reckitt Benckiser and Unilever.

Plastic fantastic

Growth at Robinson has been steady if unremarkable over the past few years, with 2019 a particularly good year for the business. While revenues grew by a modest 7% to £35.1m, operating profits doubled to £1.7m, mainly as a result of gross margins rising from 18% to 21%. More impressive, however, was the excellent cash-flow performance, with a net inflow of £4.52m from operations. This was ahead of the £1.2m reported net profits, largely due to the adding back of almost £2m of depreciation and £0.8m of amortisations costs, combined with good working-capital management.

Investors were cheered at the end of June when Robinson announced a trading update containing many positive developments. At the top line, sales had grown by 5% in the first half of the year, with margins continuing the positive trend seen in H2 last year. All these were achieved despite challenging market conditions. On the balance sheet, net debt was £6m at the end of June, down by £1m over six months, despite capital expenditure of £2m, thus implying a further notable cash-flow performance.

Robinson is currently in the process of selling some surplus properties in Chesterfield, with the final sales previously expected in 2021. However, due to a lack of site inspections during lockdown, delays of six months are now expected on realising their value. But back to the good news. A decision to not declare a final dividend for 2019 has been effectively reversed, due to greater clarity on the impact on the business. An additional 3.5p per share payment is expected to be made at the end of July. A further interim payment should be declared with the interim results, assuming no further deterioration in trading conditions.

“Excellent value play”

Shares in Robinson have now more than doubled since bottoming out at 43.5p at the depths of the late winter sell-off. They are in fact trading higher than prior to the Covid-19-inspired panic, currently at 98p, a level last seen more than two years ago. On last year’s earnings figures, that puts the shares on a multiple of 13.4 times. That rating looks moderate but remember that cash flow here is excellent, with net cash from operations almost four times higher than reported net profits in 2019.

What’s more, with a current market cap of £16.3m, the shares trade at a discount of 29% to net assets of £22.9m as at 31 December 2019 – assets which mainly consist of tangible property, plant and equipment. Even if we strip out the intangible assets, the net tangible asset figure of £18.16m more than covers the current market cap. Also, annualising the dividend means that a 6p per share payment equates to a chunky yield of 6.1%.

Analysts at the house broker finnCap have a 130p target price on the shares, which is based on a six times EBITDA multiple plus £5 million for the surplus property. That implies 33% upside from the current price, with finnCap believing the shares are an “excellent value play”. Robinson’s chief executive, Helene Roberts, (appointed last August) seems to agree, buying 3,455 shares for her portfolio in mid-April.

CHARACTER GROUP

From value, we now move on to a recovery stock, one of many negatively affected by the closure of non-essential shops in the UK in March. Founded in 1991 and a public company since 1995, Character Group (LON:CCT) is the largest independent toy company based in the UK, with significant sales also in the Far East and Scandinavia. Toys are a big market, with a total of 337 million toys with a value of £3.2bn sold in the UK during 2019, according to analysts at research firm NPD Group.

Character designs, develops and distributes toys, games and giftware internationally, with many of these products produced under licence and based on well-known television, film and digital characters. The current portfolio includes the likes of Spiderman, Peppa Pig, Postman Pat, Pokémon and many other characters popular amongst children around the world. The company is neither a retailer nor a manufacturer, with most products made in China by subcontractors.

Rain stops play

Toys and games is a sector which is highly influenced by trends and fads, with toy sellers’ success reliant on their ability to predict these trends and provide relevant products. As such, Character Group aims to have a diverse range of products and to expand and refresh its existing successful core brands. There is also an exposure to seasonal sales (Christmas) and to falls in consumer spending. As such, Character Group’s results over the years have been somewhat up and down.

The most recent numbers, for the half year to 29 February 2020, were on the ’down’ side of things, reporting a tough period for the company. Several factors affected the numbers, including an overhang of stock from the administration of Toys R Us owner Top Toy in the Scandinavian markets, a decline in UK consumer spending, the weakness of sterling and the ubiquitous Brexit uncertainty ‘excuse’.

Overall, revenues for the period fell by 12% to £51.7m, with pre-tax profits more than halving, from £5.6m to £2.5m. However, following a reduction in stock levels and good working-capital management elsewhere, the net-cash inflow from operations for the half year was an impressive £14.5m. Net cash at the period end was a solid £16.8m, which added to unused bank facilities of at least £50m, puts the company in a solid position to face the rest of the year.

It’s no surprise that the second half is expected to be negatively affected by the coronavirus pandemic, due to supply issues, along with a more serious fall in demand from shop closures worldwide, although online channels have remained open. Despite these issues, the board expects to achieve a profit in the second half and for the current financial year as a whole. The numbers might just be boosted by the launch of a sustainable and environmentally friendly range of wooden Peppa Pig toys. Despite the popularity of the ‘porcine princess’, reflecting caution over trading in the second half, the interim dividend was cut from 13p to 2p per share.

Playing for time

Character Group shares have experienced good momentum since they hit a five-year low of 190p in mid-March. Since then they have risen by 79% to 340p but are still well off the 584p highs of almost exactly one year ago. Predicting earnings for the current full year is likely a thankless task given the general uncertainty. Indeed, broker Allenby Capital has suspended its own forecasts on the group. But we can get a sense of the potential here by looking at what Character Group has achieved in good years.

During the relatively stable 2015 to 2018 period, the company made average annual net profits of around £10.4m. Reasonably assuming that this figure could be achieved again in the coming two-three years, and with a current market cap of £72.7m, then the shares are being priced on a multiple of just seven times earnings. In my view, that is a good price to pay given the recovery potential and especially given that net cash covers almost a quarter of the market cap. Also, if dividends return to their 2019 level of 26p then a yield of 7.6% is implied at the current price.

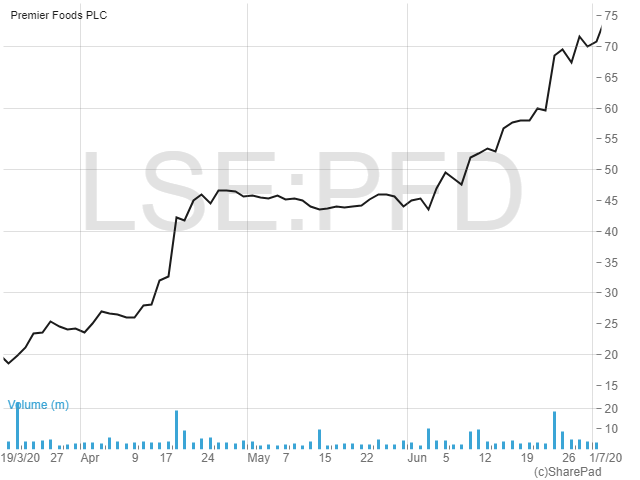

PREMIER FOODS

From value and recovery we now move on to something a bit more risky. Premier Foods (LON:PFD) is a FTSE Small Cap index listed company which 10 years ago was a constituent of the FTSE 250. Numerous issues over the years have seen the shares fall from highs of almost £22 in in 2007 to below 20p as recently as this March. But a strong set of financial results has recently supported a strong recovery.

Premier Foods is one of the UK’s largest food companies, producing a range of well-known brands from its 15 manufacturing sites and offices around the country. It operates via two divisions. The larger of these, the grocery business, makes a range of flavourings and seasonings, cooking sauces, quick meals, snacks, soups and desserts. Meanwhile, the ‘sweet treats’ business sells sweet food products including cakes, pies, tarts and other goodies. Some of the firm’s most popular brands include Mr Kipling, OXO, Lloyd Grossman cooking sauces, Homepride and Bisto.

On brand

Numbers for the 52 weeks to 28 March 2020 reported on a third consecutive year of growth in revenues and trading profits (effectively EBITDA) and a significant reduction in debt and other liabilities. At the top line, revenues grew by 2.8% to £847.1m, after a strong performance from both divisions. That helped the previous year’s £42.7m statutory pre-tax loss turn into a £53.6m profit. Operating highlights included Mr Kipling having its highest-ever annual sales and a cost-savings plan now expected to deliver ahead of its original £5m target over the next two years.

The balance sheet saw some significant improvements over the period, with net debt cut by over £40m to £429.6m, helped by an £86m inflow from operations. That took the net debt/EBITDA ratio (a measure of leverage) down to 2.7 times, better than the company’s target of three times. The company also revealed a landmark pensions agreement, with the potential for a significant reduction in annual contributions from £38m at present, with pensions administrative costs in FY20/21 expected to reduce by around £4m.

The outlook was highly positive, with Premier benefiting from operating in a key industry during the current pandemic. Revenues for the first quarter of FY20/21 were expected to be about 20% ahead of the same quarter a year ago, after a particularly strong performance from the grocery business. As a result, previous expectations are expected to be exceeded.

Tasty opportunity

Investors who bought Premier Foods shares at the recent all-time low of 18.45p would appear to have got an absolute bargain. With the shares currently changing hands for 71p, they have already made a gain of 284% in just over three months. But have the shares got further to go? Analysts Jeffries seem to think so, slapping a 100p target price on the shares following the recent results.

The valuation looks attractive, with the shares on a historic earnings multiple of eight times. Taking the large debt pile into account, the company has an enterprise value to EBITDA ratio of just under seven times. The debt is a concern here but looks to be falling rapidly, with cash interest costs last year covered 3.2 times by the cash generated from operations – which looks comfortable. Overall, for a business which operates in the defensive, fast-moving consumer-goods sector and which has good growth opportunities overseas, I believe the shares look reasonably priced.

Comments (0)