Make a premier league return from football finance

My first blog on Football & Economics, published just over two years ago, discussed how billions of pounds, euros and dollars have been poured into the beautiful game over the past few years. A number of recent reports and statistics have demonstrated that there are few signs of this trend reversing:

⚽ Driven by the £5.136 billion TV rights package agreed by FTSE 100 firms Sky (LON:SKY) and BT (LON:BT.A) in 2015, Premier League clubs once again spent a record amount of money on transfer fees this season. Spending on players in the summer transfer window hit £1.165 billion, with 13 teams breaking their individual player transfer records.

Further splurges in the January window took total spending up from the previous record of £1.045 billion last season to a new all-time high of £1.38 billion for 2016/17 – that’s round about the same as the total annual GDP of San Marino.

⚽ Deloitte’s recent Football Money League 2017 report showed aggregate revenue for the top 20 clubs worldwide up by 12% to €7.4 billion (£5.5 billion) in 2015/16, a new record, with three clubs breaking the €600 million revenue barrier. Manchester United topped the survey, making revenues of €689 million – the highest annual revenue posted by a football club in history.

⚽ Supported by the government and bankrolled by billionaire businessmen, the Chinese Super League has been spending silly sums on players recently. At the end of last year Shanghai Shenhua signed Argentinian international Carlos Tevez on a reported salary of £615,000 a week! That’s just over £1 every second.

⚽ Even in the lower leagues inflation is biting. As if having to cope with three relegations in the past seven seasons wasn’t enough to deal with, Portsmouth fans have seen the price of a match-day pie rise by 45%, from £2.20 to £3.20, according to the BBC’s latest Price of Football Survey.

One area, however, where spending growth looks to be slowing down is the record transfer fee.

In my first football blog I made one rather bold prediction – that by the year 2035 we could see the first billion pound transfer fee paid for a footballer. That was based upon the continuation of the 12.05% compound annual grow rate (CAGR), seen between 1893 and 2013, in the record transfer fee.

In August 2016 the transfer of Paul Pogba from Juventus to Manchester United set a new transfer fee record, with the Red Devils buying back the French midfielder (who they sold only four years earlier for just €800,000) for a reported £89.3 million. In sterling terms this was only a 4.7% rise on the previous record set in 2013 – the £85.3 million transfer of Gareth Bale from Tottenham to Real Madrid.

So record transfer fee inflation has now slowed to a CAGR of 11.78%, taking my forecast for the first billion pound player out to 2038 – with such big numbers involved even small changes in the growth rate have a large effect.

But overall, football remains awash with money. And where there is money there are opportunities for investors.

Buying shares in football clubs is often seen as an activity which should be limited to two kinds of people – fans who like the idea of owning some of their team and Russian/Saudi oligarchs who like the idea of owning all of a team. Investors looking for financial returns are often put off by the fact that most football clubs are run in the interests of trying to win trophies rather than with the goal of making shareholders richer.

Nevertheless, shares in quoted football clubs can go up (and down) just like any other company’s shares, so of course it’s possible to make money from them. I once heard star fund manager Nick Train say that his best ever investment was Manchester United (MANU), back in the 1990s when it was listed in London. Following the exponential rise in the value of TV rights he made a return of around 30 times his initial investment.

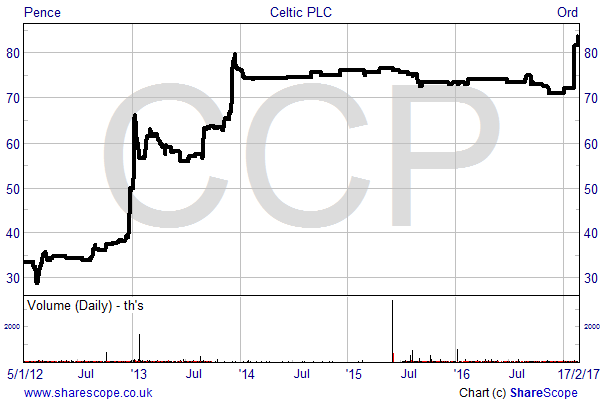

But quoted football clubs are something of a rarity in London these days, with the only two remaining being AIM listed Celtic (CCP) and NEX Exchange listed Arsenal Holdings (AFC). Buying equity in the latter will prove to be an expensive affair for most fans, with shares in the North London club currently priced at £18,250 each, capitalising the business at c. £1.1 billion. Celtic fans have a much cheaper offer, with the shares currently changing hands for 81.5p each and the business capitalised at just £76 million.

Given a closer look Celtic is an interesting proposition.

The company just released what could be considered a cracking set of results for any public company, never mind a football club. For the six months to December 2016 revenues were up by 95% at £61.2 million and pre-tax profits grew by 59% to £18.6 million. Net cash stood at a healthy £18.6 million at the period end (24% of the market cap), with net assets of £69.1 million covering 91% of the market cap.

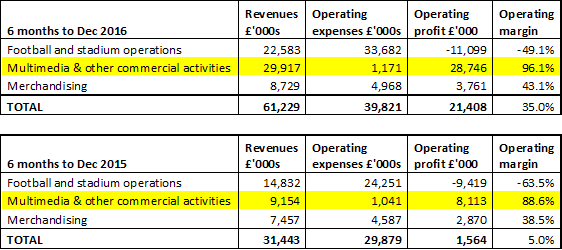

Unsurprisingly, an increase in income from TV rights was the main reason for the surge in revenues, coming after the club qualified for the money-spinning Champions League group stages for the first time since 2014. The following tables, which cover the six months to December for 2015 and 2016, demonstrate the importance of TV rights to the club’s financial performance.

In both periods Celtic’s football & stadium operations were actually loss making. Merchandising was a nice sideline but without a doubt the most significant impact on the accounts came from the highly profitable multimedia division where additional revenues from the Champions League campaign in 2016 resulted in the total operating profit margin surging from 5% to 35%.

The second half of the year/season will be more subdued from a financial perspective, with Celtic out of the Champions League after coming bottom of the group with no wins and being tonked 7-0 by Barcelona. But from a football perspective we should see the club’s 6th consecutive Scottish title win given its current 27 point lead at the top of the league. That puts it into the qualifying rounds for next season’s Champions League and provides a shot at another money-spinning year.

Investors looking for other football stocks need to either look abroad or search amongst London’s matched bargain facilities for unquoted shares – Millwall and Rangers trade on the JP Jenkins platform, Tottenham Hotspur is on Asset Match, and on Capita’s Matched Bargain Service (MBS) you can buy shares in Aberdeen Football Club and Sheffield United. Smaller clubs just might be worth a punt given the potential to break into the big time – Leicester City went from England’s third tier of football to being the 20th richest club in the world by revenues within just eight years.

Those with an even higher appetite for risk might want to head down the bookies, or take a look at the potential to diversify through a sports betting fund as recently suggested by my colleague Filipe Costa. Incidentally, I personally made my best ever financial return from football, raking in £734.84 for a 50p outlay on an accumulator – that’s a gain of 146,868%!

Comments (0)