Make a mint with these marvellous microcaps

There is one sub-class of small cap stocks which offer the potential for substantial long-term gains – perhaps more than any other asset class in existence. Not just 100% or 200% gains but up to 100,000% or even 200,000%. The stocks I am talking about are microcaps, companies which have a very low market capitalisation compared to other listed peers.

The superior growth potential microcaps have compared to their blue-chip and mid-cap cousins comes from simple mathematics. Take a blue-chip like British American Tobacco (LON:BATS) for example. In the last financial year BAT made revenues of £14.75 billion. These have been growing at a steady rate for years at constant exchange rates – up by 6.9% in 2016. But given the company’s size, sales are unlikely to ever grow by double digits or higher unless a significant corporate transaction occurs.

In contrast, it is much easier for a business valued at only a few million pounds to double or even treble its income from just one contract win, and thus send its value soaring. Take AIM listed CCTV installer UniVision Engineering (LON:UVEL). In May this year shares in the company, then valued at c.£3.5 million, soared by 373% in one day. This was on the back of the business winning a contract in Hong Kong worth £38.1 million, around 10 times historic annual revenues, to be completed over the next six years.

There is no standardised classification of a microcap stock in the investment world. But to take a practitioners’ view, many UK focussed funds have a similar definition. For example, the Malborough UK Micro Cap Growth fund looks to mainly invest in companies with a sub £150 million market cap, as does the Liontrust UK Micro Cap Fund, along with Miton UK MicroCap Trust. However, the stocks I am talking about, more likely to be defined as nano-caps by the fund managers, are those with a market capitalisation of less than £30 million.

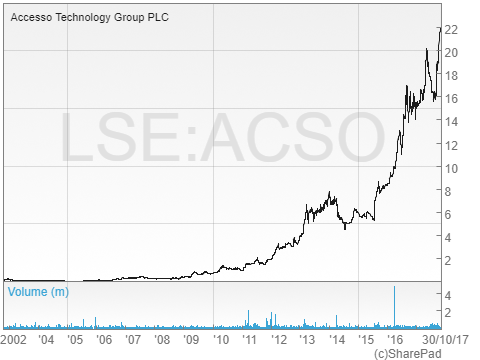

Some well-known AIM listed giants are former microcaps. Back in August 2003 online fashion retailer ASOS (ASC) was valued as low as £2 million and today is the largest company on the junior exchange, valued at £4.65 billion. If it was listed on the Main Market it would be eligible for inclusion in the FTSE 100. Accesso Technology (ACSO), the entertainment & leisure industry technology provider previously known as Lo-Q, was worth around £1 million back in 2005 and is now valued at £569 million. The respective capital gains from both companies, from their low point to today, are 171,346% and 71,900%!

Of course, microcaps come with a heightened risk profile. Their bid/ask spread can sometimes be up to 50%, which means if you want to sell immediately after you buy you’ll lose a lot of money instantly. They can be prone to large swings in value on a daily basis, exposed to the decision making of one or a few key indivuals, and find it difficult to access capital. So they are not for widows or orphans and investors need to take a long-term perspective. But just like with blue-chips, your maximum loss can only ever be 100%.

Here follows three London listed microcaps which are currently seeing a step change in their revenue growth and which I believe have the potential to show substantial capital gains in the coming years.

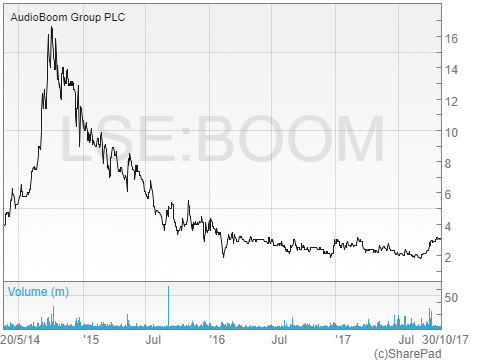

AUDIOBOOM

Sometimes referred to as the audio equivalent of YouTube, Audioboom (LON:BOOM) is an AIM listed global podcasting platform. For those unfamiliar with the concept, a podcast is a digital audio file made available for download from the internet to a computer or mobile device – a bit like radio for the 21st century.

While podcasts have been around in some form or another since the 1980s, it is only in the past decade they have really taken off as a form of popular entertainment. This has been on the back of growth in mobile devices such as iPods and smartphones. According to the 2017 Infinite Dial report from US firm Edison Research, 24% of interviewees had listened to a podcast in the past month, up from 9% in 2008, with 40% having ever listened to one, up from 18%.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

The great thing about podcasts for marketers is that they provide access to a thoroughly engaged audience who are highly interested in the (often niche) topics they are listening about – anything from sport, science, gaming, comedy and a range of others. That’s why, according to a report by the Interactive Advertising Bureau and PricewaterhouseCoopers, US podcast advertising revenues are on track to rise by 85% in 2017 to a record $220 million.

Audioboom itself has a number of aspects to its business. The core offering is a cloud-based content management platform which enables podcasters to create, broadcast and syndicate their content across a range of devices and countries. Working with third-party media agencies the company then secures advertising to place within the podcasts and shares the revenues with the content creator. Audioboom also creates its own original content under the brand name Audioboom Originals and has a premium podcast subscription service, which allows content creators to publish without advertising being built into their audio files.

Recent trading sounds good

Audioboom has a history of being loss making at the operating level but its revenues are now starting to take off as more advertisers embrace the podcast medium and the company exploits its vast range of content. In the year to November 2016 total sales were up from £0.2 million to £1.3 million, with these rising from £0.33 million to £1.84 million in the six months to May 2017 alone. However, the company remained loss making for the half, being £2.9 million in the red for the period.

The most recent numbers, for the three months to August this year, showed growth continuing at pace, with revenues up by 329% compared to Q3 2016 and up by 32% over the second quarter of 2017 to £1.49 million. In addition, record forward bookings have been received for the final quarter of the year. Other operational highlights of Q3 included monthly unique users rising by 11% to 90 million in August and available advertising impressions (in effect the inventory the company has available to sell) rising by 24% to 602 million for the quarter. While the total number of content channels fell by 4% to 11,424, this came as the premium subscription fee was introduced for smaller content partners, with a view to removing non-profitable accounts.

Audioboom’s key focus now is to increase revenue generation and expand its operating margins. In its 2016 annual report the company set the target of becoming cash-flow positive on a monthly basis during the final quarter of 2018 – that’s 10 months from now. But with cash of £3.25 million as at 31st May and cash operating losses running at an average of c.£0.44 million a month in the first half, there could be the possibility of another fundraise if current trends don’t continue.

Boom or bust?

Audioboom has been around for some time now, having listed on AIM in May 2014 following the reverse takeover of cash shell One Delta. Early investors could have bought the shares as cheaply as 4p shortly after listing, to see them rise to a peak of 16.625p within a matter of months. However, since then the shares have come back down to the current 3p per share, with the overriding issue in my opinion being concerns over the speed at which monetisation is progressing.

But Audioboom is now clearly making commercial progress, with revenues in the last quarter alone higher than in the whole of the last financial year. The key now is to reach cashflow break even as soon as possible to avoid tapping the market for further funds. Once that point is reached profits should start to grow rapidly.

While Audioboom is a risky stock, the long-term potential here is huge, with the company looking well placed to take advantage of the rise in podcast advertising income given its strong market position. The house broker Allenby has a 7.5p fair value price, which implies 150% upside from here.

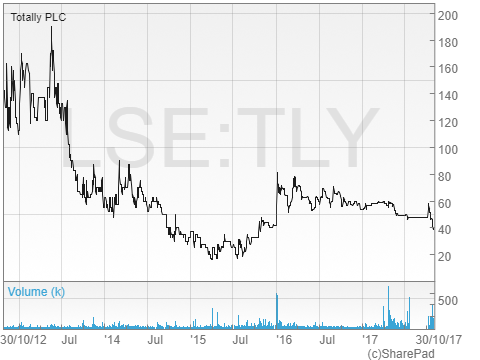

TOTALLY

Another company which has been around on the markets for some years but has not yet delivered on its full potential is Totally (LON:TLY), a provider of out-of-hospital services to the UK healthcare sector. Across several subsidiaries the company provides a range of services that aim to improve people’s health, keep patients out of hospital and, critically for the UK healthcare system, reduce the demand for emergency services.

Results from the company for 2015 showed revenues of just £0.58 million and a loss of £0.41 million. Hardly inspiring. But during the year the first pieces were put in place towards Totally progressing on an ambitious buy and build consolidation strategy within the fragmented UK outsourced healthcare market – one which is estimated to be worth over £20 billion per annum.

Holt at the helm

In September 2015 Totally made the key appointment of Bob Holt as Non-Executive Chairman. Holt, regarded in the City for being a turnaround specialist, is probably best known for being Non-Executive Chairman of social housing support services business Mears which he took from being worth £3.6 million at IPO in 1996 to a current market cap of £457 million.

Holt soon got to work on advancing the business from its low base, making three acquistions in 2016. The first was that of Premier Physical Healthcare, a specialist in musculoskeletal injuries and conditions, for £6.75 million. This was soon followed by the purchase of About Health, a leader in the provision of dermatology and patient referral management services, for up to £7.7 million. Then in November Totally bought Optimum Sports Performance Centre, a provider of physiotherapy services, for up to £0.65 million. All three companies have since been fully integrated into the wider business and have continued to deliver new contract wins.

For more insight and analysis like this, CLICK HERE to read Master Investor Magazine for FREE.

After a busy year in 2016, 2017 has seen even more corporate action take place. In February the company raised £18 million in an over-subscribed placing & open offer to provide further funds for its expansion plans. A substantial portion of those funds have since been put towards the most transformational deal to date, that of urgent care service provider Vocare Limited. The business, bought for up to £11 million, provides a range of services to the NHS throughout the UK including GP out-of-hours services, the 111 non-emergency phone service and urgent care centres, working in conjunction with NHS A&E departments.

Between 2015 and 2017 Vocare grew revenues by 137% to £76.8 million, that’s almost 20 times higher than Totally’s historic annual sales, so significantly expands the size of the business. Vocare’s pre-tax profits in 2017 were £0.28 million but in the five months to August a loss of £0.79 million was posted due to spending on quality improvement and seasonal trading losses. Profitability is expected to return in the remainder of the year.

Totally sees good opportunities for growth via the acquisition given a rising demand for urgent care services nationwide, a widened geographical footprint across the UK providing critical mass to the group, along with additional partnership and contract opportunities.

Totally Undervalued?

It’s still early days for Totally’s acquisition strategy, with investors having a long wait until they can see how the combined businesses perform together. The most recent numbers, for the six months to June, showed an almost fourfold rise in revenues to £3.68 million but a net loss of £0.96 million as the company remained in its buy and build phase and invested in infrastructure such as IT and staff. The first set of annual results showing a full contribution from the combined entities are not due for almost two years – the year end has also been changed from December to March following the Vocare deal.

Now capitalised at £24.7 million Totally trades on a historic price-to-sales multiple of 0.32 times, just considering revenues from Vocere alone. That looks very cheap, especially given the opportunities to realise cost saving synergies and economies of scale across the business and deliver a decent profit. Several directors seem to think the shares look attractive, with Bob Holt, CEO Wendy Lawrence and Finance Director Lisa Barter all increasing their holdings in October.

On balance, Totally is a risky bet. But with a big hitter on the board, ambitious expansion strategy and backing from major investment institutions, in five years’ time it could be significantly larger than it is today.

XPEDIATOR

Founded in 1988 by CEO Stephen Blyth, Xpediator (LON:XPD) is an international provider of freight management services operating in the supply chain logistics and fulfilment sectors. Headquartered in Braintree, Essex, and supported by a network of offices in Europe, the company provides regular and direct services linking Eastern Europe, the Balkans and the Baltics with Western Europe.

The three main areas of focus are: freight forwarding services, specialising in connecting Central & Eastern European countries and the UK; logistics & warehousing, which comprises distribution hubs in the UK and southern Europe providing over 39,000sqm of shared user space, pallet distribution and fashion logistics; and transport services, providing bundled fuel and toll cards, and financial and support services for hauliers in southern Europe. Xpediator is unique in that it operates an asset light business model – it does not own any warehousing facilities and has only 19 trucks – which reduces risks and fixed costs.

The company listed on AIM in August this year, raising a total of £5 million in the process to accelerate in its growth strategy. That strategy is twofold, firstly focussing on developing the existing activities but also looking to acquire complementary businesses which will add new territories, customers and services to the group. The freight forwarding and logistics markets are highly fragmented and the company believes that there are many smaller firms which would consider being acquired by a larger business.

Growing the fleet

Over the three years to December 2016 Xpediator grew revenues from £51.4 million to £76.4 million on a pro-forma basis, with pre-tax profits up from £3 million to £3.2 million – these illustrative figures assume a contribution from EMT, a fashion logistics business acquired in March this year. The maiden set of numbers as a public company revealed further growth, with revenues up by 56% to £49.1 million in the six months to June, with net profits up from £0.16 million to £0.53 million. Net debt at the period end was modest at £1.8 million, with total borrowings standing at £8.7 million – although I note the IPO proceeds have been received since the period end.

At the end of October Xpediator made its first acquisition as a public company, that of UK-based international freight forwarder, Benfleet Forwarding, for an initial £6.55 million (maximum £10.45 million based on future profits). Based in Basildon, Benfleet specialises in the movement of flooring, machinery, household goods and garments. In the year to March 2017 it made revenues of £21 million and net profits of £1.35 million, so with the initial consideration being just 4.9 times historic profits this looks like a good deal. On completion the enlarged group will operate from five sites in the UK together with 11 offices in Europe, and employ over 650 people, with the acquisition expected to offer immediate cross-selling opportunities, potential cost synergies and be immediately earnings enhancing.

Growth, value & income

Shares in Xpediator have done well since IPO, rising from 24p to the current 31p. The markets particularly liked the Benfleet acquisition, sending the shares up by almost 10% on the day of the announcement.

Now capitalised at just over £30 million I calculate that Xpediator shares trade on an annualised multiple of around 7.8 times historic profits (assuming a standard tax rate on the pro-forma figures, along with the contribution from Benfleet). That looks good value in my opinion for a growing business with ambitious growth plans. What’s more, the dividend policy is to pay out c.50% of annual net profits. With an interim payment of 0.347p per share already made, house broker Cantor Fitzgerald is looking for a total 1.4p payment for the full year, which equates to an attractive yield of 4.5%.

Comments (0)