How to build a portfolio of value shares

Filipe R. Costa explains how to filter the market in order to help build a portfolio of value stocks.

Markets have retreated a little from the year’s highs as Europe seems to have entered a second wave of Covid-19 viral infections. We certainly don’t know to what extent things can deteriorate due to the impact of the virus. But we do know that markets have been rising for a prolonged period of time, which has stretched the valuations of growth stocks. At this point, the risk of investing in something relying on extreme growth forecasts is highly risky, as the slightest negative development could send highly valued stocks into reverse. However, I don’t think this is the time to hit the panic button yet. I believe in rotation: a replacement of highly valued growth stocks for discounted value stocks.

In my last magazine article, Rotating from growth to value, I explained in more detail the whole idea behind this rotation and how an investor can easily position a portfolio to get a proper exposure. Here, I argue from the same standpoint, but instead of relying on passive ETF investments I’m actually going to build a portfolio of stocks, and in this case FTSE stocks.

Deciding on the value proxies

The hardest task in building a value portfolio is to decide on the proxies to use to filter value. There is way too much research on this topic and an even higher number of resulting strategies. For the sake of simplicity, which is always a good starting point to build a strategy, and following in the footsteps of David Dreman, who amply demonstrates the power of price ratios (see, for example, his book Contrarian Investment Strategies: The Psychological Edge), I’m building a strategy out of five ratios. They are briefly explained below:

- Enterprise Value to EBIT – It’s a good alternative to the price-to-earnings ratio, which can usually been manipulated in several ways.

- Debt-adjusted price-to-earnings – While this ratio still suffers from many of the price-to-earnings ratio shortcomings, it adjusts for leverage.

- Enterprise Value to turnover – It has been shown several times that the relative turnover of a company is a good proxy for future performance.

- Price to net asset value – It is a very traditional way of finding value. The less you pay for the book value of assets, the better. After all, if the business fails, you still own its assets.

- Price to net tangible asset value – This ratio has the advantage of eliminating a few intangible assets that are often recorded as goodwill, only to later be revised down in the form of write-offs.

Filtering the stocks

Now that we have a strategy, it’s time to put it to work. Sharescope/Sharepad are very good tools to screen stocks from a list. Other software or web resources may be good as well, as far as they have a good database of stocks and offer proper filtering.

I’m choosing LSE stocks as my stock universe. Any other selection is valid. I start by imposing three filters on the data. First, I exclude financial stocks. In general, these stocks have a very high leverage and need different proxies to be properly selected. Second, I require the market cap to be at least £100m. Third, I require that all of the five proxies described above show values equal or greater than zero. This eliminates stocks without reported values on any of the proxies and eliminates negative numbers, which are usually difficult to interpret.

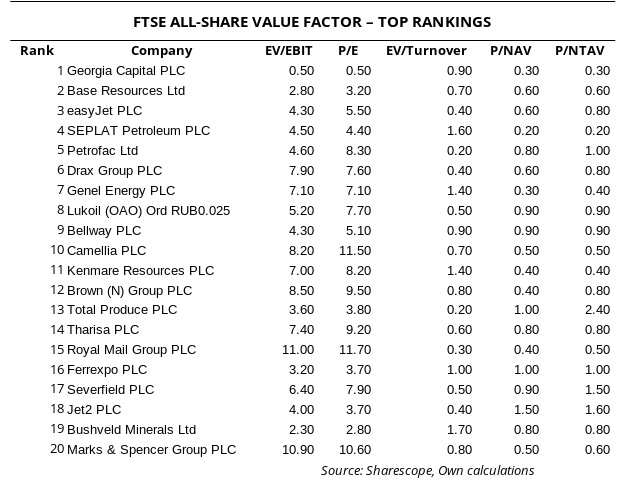

After running the three filters on a universe of 1,430 stocks, my list was shortened to 300 stocks. Up to this point, I have done nothing related to value selection. Many investors opt to limit values for the chosen proxies. For example, they often require the price-to-earnings ratio to be lower than a certain threshold, let’s say 10. I don’t like to set absolute parameters on the data. A price-to-earnings of 10x may be above the average under certain conditions and below the average under certain others. I prefer to build ranks or ratings. Thus, I collect the data for the 300 stocks and rank them for each of the five proxies. In this particular case, the lower the ratio the better, so I give the higher rating to the lowest ratio and the lower rating to the highest ratio. For example, I can attribute a rating between 1 to 300 to each stock on each proxy. After doing this, I sum the ratings for each stock to get an overall rating. In the end I just need to reorder the list by overall rating in descending order and then choose the top positioned stocks. This way of selecting stocks saves us from having to subjectively impose limits on the proxies and allows for a stock to be ranked high even if it ranks low for some of the proxies.

Value isn’t an objective definition so what we want is to discern a way of capturing a portion of the market that could fit the bill.

The top selections in my list are Georgia Capital (LON:CGEO), Base Resources (LON:BSE), EasyJet (LON:EZJ), Seplat Petroleum (LON:SEPL) and Petrofac (LON:PFC). Royal Mail (LON:RMG) and Marks & Spencer (LONMKS) are also some noticeable entries in the list.

Concluding Remarks

One particularly important point about a quantitative strategy like this one is the fact that we aren’t expected to just pick winners. Neither are we playing the role of an analyst, who scrutinises the financial statements of each of the companies. Instead, we are playing with numbers and statistics. We pick the companies that rank above the average for some measure and select a sufficient number of stocks to eliminate the unsystematic risk associated with each stock. Some companies trade on low price ratios for legitimate reasons. That’s why it is important to select more than just one or two stocks. But, in the end, we are refining our stock selection process for our portfolio to hold stocks that are expected to be better than the average, better than the broad market.

Comments (0)