The highest yielding share in London

As my colleague John Kingham recently wrote in the March edition of Master Investor Magazine, “high yield stocks do not always deliver the yield you were hoping for.” This refers to the dreaded “yield trap”, whereby companies which have seemingly large dividends relative to their share price then go on to disappoint investors by cutting or even suspending their distributions.

During my time in the financial markets I’ve learned that a yield of around 6% should be the starting point for suspicions over yield traps to be aroused – at that level investors could be set for a modest, or even substantial, dividend cut. Take Morrisons (MRW) for example. Back in 2014, when the Bradford based supermarket was experiencing difficult trading conditions, it yielded around 6-7% for much of the year. Subsequently, the dividend was slashed by 63%.

Any stock with a yield of 9% and over is pretty much guaranteed to be set for a markedly lower payment next time round. Or it could be a sign of something even worse. Back in June 2010 CD seller HMV Group announced a c.£24 million dividend to its shareholders, with the shares yielding 12% at the time. Two and a half years later the firm went bust!

While the area is often fraught with danger, high yielding companies can sometimes present interesting investment opportunities. This next stock, according to my analysis, is THE highest yielding stock in the whole of London. But is it a yield trap or worthy of investment?

Investment Underdog?

Founded in 1993 by a regional law firm, NAHL Group (NAH) describes itself as a consumer marketing business. Its critics might call it an “ambulance chaser”. A more balanced description of the business is that it helps consumers deal with personal injury claims, earning money by generating leads from people who have been in an accident and passing them on to lawyers who can assist injured parties with claiming compensation.

Personal injury is the core of NAHL’s operations, with it making up 59% of revenues and 87% of operating profits in the last financial year. Trading under the National Accident Helpline brand, the company has built up its reputation via a series of TV adverts featuring the “Underdog” mascot, a brown plasticine canine character typically seen on screen sporting several bandaged limbs.

In order to expand its operations and to diversify its mix of income, NAHL has made a handful of acquisitions outside of the personal injury sector during the past two years or so.

The first deal came in February 2015, NAHL buying the residential property marketing business Fitzalan for up to £4.3 million. The company earns income by generating conveyancing and RICS survey instructions directly from home buyers and sellers in England & Wales then offering them to law firms and surveyors. Expanding the new business line further, in January 2016 NAHL bought the Sussex based conveyancing search provider Searches UK for £2.01 million, with it contributing an impressive £0.6 million in operating profits in its first year as part of the group.

The largest deal was completed in October 2015, that of catastrophic injury market services provider Bush & Company Rehabilitation, for £25 million. The business specialises in undertaking assessments following accidents resulting in disabilities such as spinal cord injuries, acquired brain injuries, amputation, orthopaedic injuries and visual impairment. To part finance the deal NAHL completed a £14.2 million placing at a price of 355p per share.

Whiplash woes

While NAHL had a successful IPO on AIM in May 2014, the shares rising from 200p to a peak of 420p by October 2015, the company has seen a number of issues since then which have resulted in the shares falling back to the current 162.75p.

The first sign of trouble arose in November 2015, when then Chancellor George Osborne announced in his Autumn Statement that the government would be cracking down on fraud and the “claims culture” surrounding motor insurance. The government was looking to end the right to cash compensation for minor whiplash claims and proposed that personal injury claims of up to £5,000 would be transferred to the small claims court (which attracts lower fees). This was up from the current limit of £1,000, thereby reducing the potential size and value of the market for NAHL.

Following an industry consultation the above changes are now expected to take effect from October 2018, with compensation for sufferers of minor whiplash restricted to small pre-defined amounts dependent on the length of the injury. In addition, the small claims limit for all other types of personal injury claim will rise to £2,000. While less than 30% of enquiry volumes in NAHL’s personal injury business have historically been below the new small claim thresholds the firm has been forced to adapt its business model.

The new strategy will see future enquiries handled in three main ways.

The traditional lead generation model will remain but this will be supplemented by NAHL offering deferred enquiry payment terms to selected law firm partners to support incremental volumes. The company will also invest in cases using so called Alternative Business Structures (ABS). These are a kind of joint-venture agreement with a company providing legal services which NAHL will fund and take a share of profits from.

Unfortunately these changes will have some short-term impact on the business. An exceptional investment of £1.7 million is being made to adapt to the new regulatory environment and, given the new ABS structure, an element of cash will now only be received when cases are settled – average case times can be c.18 months. As a result NAHL expects it will take some time to reach maturity for both profits and cash under this new arrangement. Overall, cash generation is expected to significantly reduce in 2017 and 2018 before returning to levels previously achieved as the new model beds in.

Crucially for income seeking investors, despite the increased investment and expectation of deferred profits, NAHL still intends to maintain its policy of paying out two-thirds of its earnings as a dividend.

Valuation

NAHL Group presents a special situation for investors, with the shares being very lowly valued for understandable reasons. Nevertheless, I believe they have the potential for a substantial recovery over the next few years.

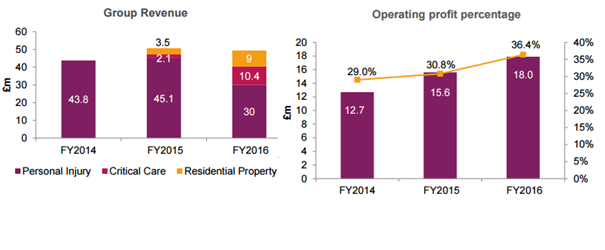

Management have already reacted well to the announced regulatory changes, with the two new divisions reducing exposure to the personal injury market and providing growth opportunities. And as the chart below shows they are doing a good job of growing margins. Also, NAHL’s market leading position in the personal injury business puts it in a good position to consolidate the sector – with adjusted net debt of £8.2 million as at 31st December 2016 the balance sheet is not over-stretched and interest payments are well covered by operating profits.

Source: NAHL Group 2016 results presentation

While NAHL shares are off lows of 119p seen earlier this year, they remain lowly valued by the markets. The current market cap of £73.8 million is a multiple of just 6 times net profits for 2016, although with profits expected to fall over the next two years, as NAHL adjusts to the new regulatory regime, the multiple rises to 6.9 times for 2017 if market forecasts are met. With 2018 likely to mark a nadir for earnings the forecast multiple of 8.5 times for the year looks cheap should growth continue upwards from there.

As alluded to above, with a forecast dividend payment of 16.15p for 2017 the expected yield of 9.9% is the highest offered by any company on the London markets right now. Of course there is uncertainty over whether that level of dividend will end up being paid but it is encouraging that management have committed to a substantial and sustainable level of dividend cover (1.5 times). I also note that investors who get on the shareholder register by 28th April will receive the 2016 final dividend of 12.7p, which in itself equates to a yield of 7.8%. On the downside the payment will likely fall in 2018 in line with the expected fall in earnings.

The risks here are clear but for long-term investors with a higher appetite for risk NAHL Group has its attractions. Broker Arden sees the potential for a short-term recovery bounce to 200p, with house broker Investec having a target of 300p.

I would have to agree with you, sir. I have been tracking this company for some time and findings based on my due diligence are very much in consonance with yours. When its share price plunged, I just had to swoop in. While the PI segment (even though it is primary value driver) would be challenged, the value generated by conveyancing and critical care are very promising and have further room for growth. Please feel free to contact me if there is anything about this company that you may wish to discuss.

Cheerio!

I still think yield of 9.9% is too high and not sustainable &investment is a bit risky. Would be grateful if you have any other suggestions for less risky shares offering a combination of stable growth and income. I will be happy with any dividend yield of 4-6% (but less risky)

I am a private investor (not professional) looking for good investment opportunities (low to medium risk). You seem to be quite experienced –can I know whether you are CFA , IFA or some such professional