Has Sprue Aegis’s Fire Gone Out?

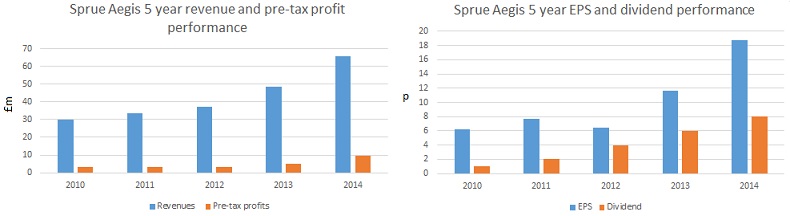

Sprue Aegis is a great British company which I have covered for many years, ever since it was listed on the old PLUS markets. The shares have been somewhat of a private investor favourite in recent times, having risen by more than 800% over the past five years. Over that time revenues have more than doubled, pre-tax profits more than tripled and the dividend increased eight-fold. Investors who bought the shares back in July 2010 have seen 56% of their initial investment covered by dividends alone. But are there further gains to come?

For those who are not familiar with the company, Sprue Aegis is a Coventry based supplier of home safety products, mainly smoke and carbon monoxide alarms – I have one in my kitchen (below). Selling across a number of brands, including the flagship FireAngel, the company has built up a strong presence in the UK retail and trade market, as a supplier to the UK Fire & Rescue Services and as a sole supplier to a number of major retailers.

Of note in the past few years has been the company’s rapidly growing business in Continental Europe, where it mainly sells through a network of independently owned third party distributors. Key to this is the firm’s distribution agreement with BRK Brands Europe (a subsidiary of consumer products giant Jarden Corporation), which it originally signed in 2010 and revised in 2014 under significantly better terms. Driven by safety legislation in France and Germany, sales growth from Continental Europe has been particularly strong in the past two years.

A trading update from Sprue last week was good overall but did contain both positive and negative comments.

For the first half of 2015 (to June) the firm saw yet another record period of trading, with sales expected to be up by around 137% at £56.5 million, with operating profits more than tripling to £9 million. The numbers were mainly driven by an increase in trade and retail sales into France, where legislation has been enacted for landlords to fit at least one working smoke alarm in each rented property. The deadline being extended by nine months to 31st December also drove sales. While this provides good visibility for the rest of the year, on the downside it has resulted in an expected softening in the order book from France beyond that.

Despite the strong sales growth, one of the main risks to the Sprue investment case – exposure to exchange rate movements – had a significant negative impact in the period. Sprue has been hurt by this before, notably in 2012 when negative forex movements saw £1.3 million wiped from operating profits and a halt to profit growth. It is estimated that a one cent adverse move in the currency rate hits revenue and profits by between £0.3 million to £0.4 million.

During the six months to June, sterling strengthened by around 13% against the Euro and once again significantly reduced the translation value of sales derived from Europe. This was unfortunate timing given the huge upsurge in sales from the region. In addition, the weakening of sterling against the US dollar increased the cost of US sourced products.

The overall result was that gross margins for the period (before the distribution fee paid to BRK) fell to around 29% from 37.4%. Operating profits would have been £6.1 million (or 68%) higher if exchange rates were the same as in H1 2014.

Despite this, subject to no further net adverse forex movements, trading was so strong that results for the full year are expected to be significantly ahead of market expectations.

On the balance sheet, net cash stood at £29 million as at 30th June, up from £11.7 million, helped by an extension in credit terms from smoke detector supplier DTL and good working capital management. Also, £2.9 million of cash was received from a West Midlands Fire and Rescue Services’ tender – the UK government is providing the fire and rescue services with £3.2 million of grant funding to provide free alarms to private landlords under new legislation expected in October, as if they needed any further monetary support!

Other key points in the statement noted that stock levels are expected to increase in the coming year due to the relocation of a supplier factory, a delay has been seen in the production of the firm’s new “SONA” branded mains powered range of products, and that the company is continuing to invest in “connected home” solutions products, with a trial to connect Sprue’s home safety products to the internet ongoing.

Have new investors missed the boat?

There is no doubt that Sprue Aegis is a solid and quality company. However, it looks unlikely that the shares will rise by as much over the next five years as they have over the previous five. The recent boost in sales from France can in some respect be seen as a one-off, and while the recent deadline extension provides good visibility for the rest of the current year there is less visibility going into 2016 and beyond.

Concerns over the company’s exposure to forex movements remain and I note that the Euro has continued to weaken against sterling since the company’s half year end, from around 1.408 to the current 1.432. However, with the current financial year expected to be heavily weighted to the first half (around 75% of market revenue forecast have already been met) we would expect that any negative effects will be less pronounced in the second half. Also, since 1st April Sprue began purchasing products in sterling (rather than US dollars) under the revised BRK distribution agreement, which lowers the forex exposure risk.

On the upside Sprue has further significant growth opportunities in Europe. In Germany, for example, the deadline for mandatory installation of smoke detectors in homes (both new and existing) in states containing more than two-thirds of the population has yet to come about. Opportunities also come from the fact that market penetration levels for carbon monoxide alarms remain low in France and Germany compared to the UK. Also, many European countries, including Spain and Italy, still do not have smoke alarm legislation.

Elsewhere, sales of AngelEye home safety products began to Sainsburys in June this year. Also, Sprue continues to invest in product innovation, with the SONA products providing new sales opportunities, as do the firm’s upcoming “connected home” range of products which provide internet connectivity and remote monitoring of wireless home safety products.

Recently joining as CEO is Neil Smith, a retail expert who has worked for the likes of B&Q, Halfords and Boots. Along with this a new management incentive plan was implemented. Under the scheme key management will be able to claim between 25% to 100% of certain share options if an equivalent total shareholder return is delivered over the three years to 3rd June 2018. Quite rightly however, the scheme has come under some criticism as the options come at nil cost to the directors.

Having been on a strong uptrend since April 2013 shares in Sprue Aegis have recently slipped back from their all time high of 355.25p (seen this March). Dipping to 265p in June they have however seen a strong recovery in recent weeks to now stand at 340p, capitalising the firm at £154.8 million.

Current market forecasts are for pre-tax profits to fall to £9.1 million in 2016 from an estimated £12 million in 2015 (due to the France effect) before a return to growth in 2017 with profits of £12.4 million. The shares trade on a multiple of 15.6 times full year earnings forecasts, rising to 19.9 times in 2016 but falling to 14.6 in 2017.

Then there is the cash on the balance sheet of £29 million, equivalent to 63.7p per share. That takes the 2017 ex-cash multiple down to a more attractive looking 11.9 times. Sprue has hinted however that it may use the cash to make acquisitions. If not, a special dividend could be a possibility.

The recent trading statement reconfirmed the progressive dividend policy, with the interim payment expected to be declared at 2.5p per share, up by 25%. For the full year I expect a payment of around 10p, implying a current year yield of 2.9% – reasonably attractive for a solid growth company. House broker Westhouse has a 400p target price, which suggests 18% upside to the current price.

Comments (0)